tv Closing Bell CNBC March 28, 2024 3:00pm-4:00pm EDT

3:00 pm

it's no longer for sale. 40%, i believe i read sticking with the sports business team, keeping the wizards in the nation's capital in the district scratching a deal that would have them move over across the way into alexandra. >> it's been great to be here. thanks so much, tyler. here at the new york stock exchange, and another big month for stocks. the rally is at five months and counting. the last experts, where we are likely to go from here, in the meantime take a look at your scorecard, 60 minutes to go in regulation. looking to extend its best start since 2019. energy once again, we are watching tech closely. we always do. it's been down three in the past four weeks. look at those stocks, the big

3:01 pm

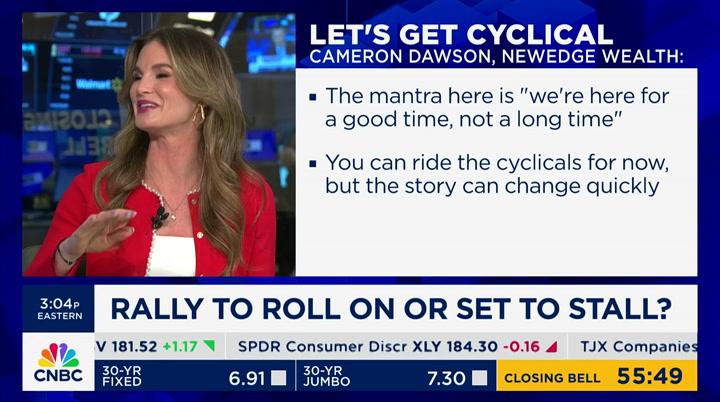

news of the week really coming tomorrow morning as you know the good friday release markets close but we will have that for you 8:15 a.m. eastern time at cnbc.com. interest rates are a touch higher than that as well. what is in store for this rally in the quarter ahead, let's ask cameron dawson. it's nice to see you again. so, as i said earlier it's coming down. we are going to turn the page to a new quarter. do we still have momentum to keep going? >> the market does have momentum but some of the market stocks have started to stall out a little bit. that's what you mentioned when talking about tech. they have started to lose a little bit of their momentum. the market is still able to go up because you are getting the

3:02 pm

benefit from things like energy, financials, all doing better. we are watching it really closely into the second quarter. that would be something that could be an issue for the markets. >> it could be an issue as you suggest. the broadening that we've been seeing lately, as tech has weakened, other sectors have picked up the slack. over the last month alone, technology is the seventh best performer. energy is the best. materials, financials, isn't that what we want? >> it is what we want. the important thing is that tech is still on an uptrend. it just means it is not doing as well as the other parts of the market. if tech actually flips out into out right weakness it is such a large part of the index. that's where it could have challenges. but it is really powerful. 85% of names are training above their 200 day. that is not something that you typically see. the weekends going into a top,

3:03 pm

you don't have a top and a top and bread at the same time. >> the numbers have come down, they are about half in terms of earnings growth where they were when this rally started in october. >> i think your plan don't have time is really interesting. you've seen this all be about multiple expansion. earnings estimates have gone up slightly for the full year mostly for 2025 but this is been all multiple expansion even in those cyclical parts of the economy or the parts of the market multiples have gone up by 30% for industrial send materials. you really do have to see earnings deliver in order to make sense about a lot of these multiples. the performance is going to continue. >> i think you are set up for better activity certainly. we think they are bottoming. early indicators are telling you that you are seeing a recovery which is success that

3:04 pm

earnings can do better. mostly now that you have lowered the bar for earnings. but if we are continuously seeing the trends in the out years, i think that is something we will have to watch closely >> are you spectacle -- skeptical that something that is in lead can continue to do it? are these one off anomalies or is this the start of something you think could be a new and positive broadening trend? >> they typically do well as you are starting to see activity bottom. the risk you have is once estimates go up, you are training at peak evaluation and peak earnings. there is still air left for this run to happen. you will have to watch once they get into the 53-54 territory, that's when you might want to take some chips off the table. >> how reliant are we off the fed? >> i don't think we've been that reliant because we've gone from six and half cut to three.

3:05 pm

if three becomes two, will the market really see an issue with that? we think that key reason why the market continues to do well is because the forecast continues to go up. they've gone from 1.2% to 2.2%. risk assets love that. the key thing to watch may not be the fed, and maybe the forecast in the expectations about the economy which would drive the market up or down. >> what about pce tomorrow? >> i think that if you get a hot pce, waller coming out and saying hey, there is no rush. if they move against, it might be that wall with he one cut this year looks to be running out. >> james, still of morgan stanley but not in the ceo role said maybe we don't get any of

3:06 pm

this year. >> i think we still have an expectation faked in to interest rate to parts of the market that you're going to get cuts. small caps have been trading better but you have to remember that they have a lot of floating rate debt, they have a lot of debt in aggregate in their 40% unprofitable. these are countries that do well in a high-growth falling rate environment. their strength to suggest that there is still expectation for rate cuts. >> it has matched the dow up 5%. it sticks out him so much of the focus has been on this because of the mega cast. it feels like it's ready, it just need some confirmation that they're going to be rate cuts sometime. >> there are a lot of catch-up trains. they had a significant discount

3:07 pm

so in a broad risk on tape, there is a lot of room to catch up. the question is, is that sustainable? if we start to see them sticky or longer or if growth slows down, that would be something to maybe take some off for the russell but for now it's interacting great in this moving average. it's an uptrend. >> are you pretty positive going into a new quarter? >> i think for the entirety of 2024, we've overcome so much in the first quarter if you think about it. they actually inverted even more. you have earnings revisions that have moved lower. we've had significant challenges. the market at eddie -- every reason to go down. as far as looking at technology, as long as semiconductors continue to perform well and they are the strength of technology right now, the dismiss is not doing

3:08 pm

well. and there is enough positioning that needs to be rebuilt in this broadening out theme in other sectors like the financials industrials, healthcare, energy, and materials. coming into the year, those sectors were not carried at a significant overweight. capital can still be treated really well. scott, i just have a hard time believing on any pullback. may be the market doesn't gallop higher at the pace it has in the first quarter, but on pullbacks there's going to be a lot of demand for equities. >> i worry, or wonder, if a lot is hinging on the semis, a lot of them have gone up a lot. they have already expended their multiples. their stock purses -- prices have gone up a lot. >> you look at q4 earnings

3:09 pm

recipe, the majority of margin expansion is coming from the semiconductors itself. and yes of course, we all know that this is leading that concentrate expansion, but the revenue growth is real. it's not just isolated, it's applied materials. they are benefiting from the capital spending from large technology companies like apple, like amazon. >> these are all so to speak, the tech a trade, when it has some kind of stumble. >> a lot of it would unwind. it is likely that there still is room to run. evenly see it lose a little bit of momentum, it is still in

3:10 pm

uptrend. i think the point is really important. tech is the only sector that has seen meaningful inflows. every other sector has seen outflows. it just means that they are under owned. the thing that gives us a little bit of pause is that the industrial materials, financials are already backup to near 20 your eyes. you are putting a lot already in those evaluations >> the 52-week high yet again today. are you a believer that this trait is going to continue to work? you thought it was, it didn't, will it continue? >> clearly the price of oil is breaking out toward the high of the year. i think it is more than that. at the end of 2023 it's telling you that management believes that they need to go out and find the production at this

3:11 pm

point that the organic growth and that makes a compelling case for the supply and demand balance being in the favor of a lot of these energy names. i think it continues and i think again, it is another sector that is indicative of where positioning can be rebuilt significantly. >> if i ask you both for a contrarian type idea, what would one of yours be in some ways it has been a contrarian type market, last ear not a lot of people were positioned to do what it did. now we've got the better performance and things like energy and materials. i don't know that there was a lot of great positioning for that. how would we assess that here? >> the most contrarian idea would be utilities. a lot of that is rates. rates moving higher, staying higher is harder for utilities, but if we look and say utilities are a risk off part of the market

3:12 pm

that would do well if growth forecasts were to fall, that says that that is even contrarian. look at growth forecasts which are now resoundingly soft landing. meaning that nobody is projecting any kind of economic stumble. if we were to have one, utilities being cheap would do well. >> it is difficult for me as a momentum player to look at contrarian plays, the momentum so well i would say this. i do think at some point we have already witnessed the nasdaq recover from a multi- quarter earnings recession. at some point the russell is going to follow suit. when it comes out of the recession i think the center of opportunity for that is going to be in large-cap regional banks. hear what i am saying. large-cap regional banks, not small caps. >> the financials kickoff earnings and they have done quite well in the quarter up

3:13 pm

almost 12% in the month of about 4 1/2. do you believe in that trade? >> the big ones, you are talking about super regionals. bigger than that. >> i think bank of america very quietly is having a very strong performance while everyone is talking about citigroup. so yes, i do believe that the five money center banks that we tend to focus on can continue their current crisis -- price continuation. >> the others that participate in both areas of big banking. are you positive on the financials? >> i think they have some pretty significant tailwinds which is that you have slightly less inverted yield curve. you have loan standards that are actually easing. loan standards are coming in.

3:14 pm

some of the stress in lending is going away. you have the recovery and capital markets business which is to suggest that there could be an earnings recovery ahead. there only training at 1.2 times book which is not at all history. >> as anything that would make you nervous, we are at 420 right now. there was a note earlier that said okay, if you go to 435, and then maybe you get a problem. they then said reasonably as of late. >> we are at 4.35. what is interesting about the correlation between yields and where i want to invest in the market. the beginning of the year, a lot of people liked real estate and utilities. they liked real estate and utilities that play in the release -- belief that rates were going to lower. the markets still moved higher and things were okay.

3:15 pm

i think it is important to understand that in the third quarter of 2023, we saw the yield make the move from 5%. it is the velocity of the yield that would trouble the market. if in fact we see a very fast rise in treasury yields, that's where equity investors are going to get very comfortable. i don't know if it is a particular price point but i think it is a velocity. >> i'm looking at headlines from an official that says they will probably start with moderate rate cuts. unimportant whether it starts in april or june, they should start in the spring. i bring it up because it just points to what is a pit it. a shift from global central banks that we are done with this tightening regime. there is enough confidence everywhere that inflation is coming back to the level that they wanted to be and that you

3:16 pm

are going to be in a global cutting rate environment for the foreseeable future. >> i think that is why, even giving the data that was higher inflation, the idea that the last one out is a rotten egg meaning that the last one to start cutting would have too strong of a currency. i think that is one of the reasons why the dollar has been so strong. imagine if it had not been at the meeting how strong with the dollar have been over the last couple of weeks. >> i wonder, we are at record high, i wonder if some of that is in response to these types of headlines moving signifying that the environment could be different. it's going to be different. >> yes, i believe you're absolutely correct, i also believe that we are at the end of the quarter and you will see some strength here of what has been a remarkably strong

3:17 pm

quarter in itself. >> guys, we will leave it there. tomorrow, you can watch cnbc.com, another reminder, it is the feds preferred measure. they are going to bring you full coverage of that report, it starts to 8:15 a.m. eastern time. i know you won't miss it because we are all going to e watching that. let's send it to christina now. thanks, scott. formally restoration hardware is soaring at 18% rhino after providing reassurance in the company's latest earnings report. they expect to accelerate through the rest of this year despite a sticky housing market and interest rate environment. the forecast was enough to offset the mess and other management comments that weren't of revenue lighting this year. take your pick. bank of america analyst

3:18 pm

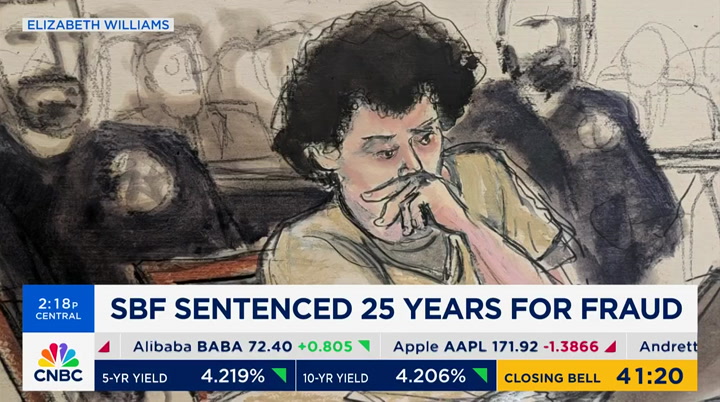

labeling estee lauder a, quote, cinderella story. they upgraded the company to the weaker chinese market, that is helping the recovery. shares are up about 6%. >> christina, we will be back to you in a moment. live outside the new york city court house. >> thanks, sentenced to 25 years in prison today for what prosecutors argue was one of the biggest financial frauds in u.s. history. the fall of one of the longtime crypto billionaire two years ago. he was leading a $30 million penthouse in the bahamas, he was really the face of the crypto industry at the time. today he took the stand in a beige prison jumpsuit pleading for the judges leniency.

3:19 pm

he was cross-examined back in the fall during his criminal trial. he said today that his actions quote, haunt him every day. he also said, i'm sorry. the judge asking him to forfeit $11 billion. the 32-year-old pointed to the, quote, and not harm he did, the brazenness of his actions. the exceptional flexibility of the truth and his apparent lack of any real remorse. he said he obstructed justice, committed perjury at least three times on the witness stand. they were at risk of committing crimes in the future. he said it is not a trivial risk at all that he comes i can commit another crime. judge kaplan also talked about his risk appetite. said his fraud was another example of this in his penchant for gambling. he was found guilty in november on seven counts of fraud and

3:20 pm

conspiracy. his family sang we are heartbroken and we will continue to fight for our son.'s defense team does plan to appeal, scott. >> thank you very much. of next, the s and p is heading to its best year since 2019. it is still, is still raising the red flags ready to come on and make his case. we will come on and do it after this break.

3:22 pm

the future is not just going to happen. you have to make it. and if you want a successful business, all it takes is an idea, and now becomes the future. a future where you grew a dream into a reality. it's waiting for you. mere minutes away. the future is nothing but power and it's all yours. the all new godaddy airo. get your business online in minutes with the power of ai. here's why you should switch fo to duckduckgo on all your devie duckduckgo comes with a built-n engine like google, but it's pi and doesn't spy on your searchs and duckduckgo lets you browse like chrome, but it blocks cooi and creepy ads that follow youa from google and other companie. and there's no catch. it's fre.

3:23 pm

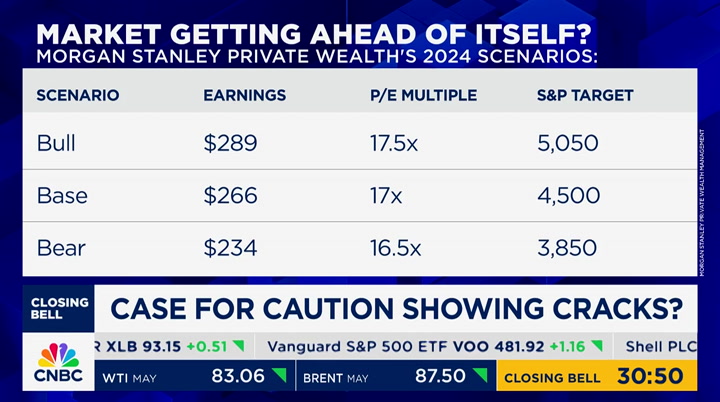

we make money from ads, but they don't follow you aroud join the millions of people taking back their privacy by downloading duckduckgo on all your devices today. welcome back, the s&p hitting a fresh record high as it has for its best first quarter in five years. our next guest predicting pain ahead for the market, he says

3:24 pm

it has gotten ahead of himself. one of the highest rated private health advisory teams in the country, he joins me here. your consistent, i will give you that. for why are you still negative? >> when i know you are coming on i was like, how my going to handle this interview? >> i have no choice. at some point, as this market as we just said is off to its best start in five years, you would think that your position would change. why hasn't it? >> i think it hasn't because while we have seen tremendous economic growth that we weren't expecting, we have seen inflation come down, we have seen a very strong labor market, the things that we are concerned about continued to be think that we are concerned about. if you look at the pace from

3:25 pm

october to now, we actually have not even seen a 2% correction and over that time period we haven't seen something like that in over six years. if you look at all of these sectors that are doing well, they're all either overbought or extremely overbought. in our mind, i think even on the short-term we would all agree that the market could probably take a breather. from a technical standpoint from where we have been, i think it wouldn't surprise us to see a pause or more importantly see a pullback given how far we've moved and how aggressive we've moved. >> that is all fair, and i think you are right in suggesting that nobody would be surprised if there was a pullback, some kind of a correction, however you were negative, you've been negative since before the market got into the conditions you suggest

3:26 pm

no make it right for a pullback. and let's talk about the underlining thesis behind the. the underlining thesis was the fed is not going to be as aggressive in cutting rates of the market was pricing and we saw 2023, instead of rate cuts, we saw rate hikes. instead of seven rate cuts, we are now potentially getting two. and then let's talk about earnings, earnings last year were flat. earnings this year even with the tone and economic growth that we are talking about are not really going all that much higher. if you look at the performance, 90% of the performance is the multiple expansion. at that point, are you looking at a situation where the equity risk premium standpoint is not giving you that bang from the book in our mind, yes, maybe you are right. >> the market is telling the story, not me.

3:27 pm

>> what is driving that market? even if you go deeper into earnings last year, you take out the market cap and you look at equally weighted, those are negative. you strip out the mag seven. you are talking about breath in the market for this quarter would you are starting to see particularly in february. if you look at the performance, the 10% performance, 30% of that is one. you are starting to get some breath particularly with some of the larger names in different parts of the sectors. it is still around two to 3% in each of those sectors. >> let me take a couple of those points off of what you said. we will debate this. >> so we went from an earnings recession, we were negative earnings for multiple quarters and then as you said, we got flat. but now we are going to grow again. so the trajectory from earnings

3:28 pm

looks like this, we went from negative to flat to know we are expected as we said for the first quarter, some 5%. may be down, was 10% but it's nonetheless, 5% versus negative. and you really want to be negative on the market into a global cutting cycle? we are going to have that. >> at some point. let's talk about what are the things that my effects that. so, growth has done well. we saw january, february, numbers that ran hotter and you can talk about owner equivalent rent and so forth. but i think some of the other things that are a concern are the fact that if you look at gasoline prices which was a tailwind last year, it's up 16% this year. is going down, concerns with regards to the quick race going down. >> wasn't consumer cellular good today?

3:29 pm

>> yes, but if there is a variety of different consumer cellular numbers. >> if consumer cellular is been good, the optimism still remains. >> it does, but what is going on underneath the scenes? you are in a situation where the consumer has over $1 trillion worth of debt. right now, nonmortgage debt is actually equivalent to mortgage debt. you are basically paying exactly what you were paying before. savings have come down. the issue is for me, is not just the fact that the rates have to come down, if rates stay higher for longer's, that is going to be a really big problem for a variety of different areas in the economy. >> don't you think that rates are going to continue to come down as i suggest not just here, but globally? when you have an official saying well, we have the option to cut it every meeting. we are not obliged but we could cut it every meeting. we could start in the spring.

3:30 pm

the inflation target within a site. if i told you that that was powell, suggesting that the inflation target insight, you would believe it. i mean they are all but telling you that cuts are coming. it may not be on the market's original schedule, but does that really matter if it is a trend, a major trend change? >> it does matter if it is not priced into the market. if markets are priced for perfection, we don't need something dramatic to happen in order to send them down fairly dramatically. if you are in a situation where multiples expanded so much, earnings do not, tear point are coming in and if no one is paying attention to the fact that we were in a situation where your pricing in seven cuts and you're only getting two now in the market continues to grind higher, then earnings better be good. if earnings aren't great, i

3:31 pm

don't necessarily mean that they have to be okay, i think they have to be good based on where we are priced right now. you could see that pullback having a really dramatic impact on the equity market. and then if you get hot inflation numbers tomorrow, we are not necessarily expecting a hot number but to my point, it's not priced into the marke . the potential for a hot number is not being priced into the market at all. so what happens if we get one? >> certainly you can't have a string, a continued string of hotter inflation numbers and expect the market is just going to be cozy with that. >> let me ask you one more question about evaluation. how can you make a comment that the multiple of the market is too high but then in the same light say well, it is just a small number of big stocks that have carried the load in those evaluations have gotten out of whack. you may take issue with the evaluations of microsoft and whoever else you want to lump

3:32 pm

into that, but does not also imply that the other parts of the market, the lagging sectors of the market multiples that are more attractive if not cheap, relative to what the mega caps have done? >> all of these other sectors that have not performed as well in the quarter as technology has an. they have picked up lately but those multiples are not the same as the microsoft. >> the idea that the market is going to spread outcome we are going to continue to get brett. it is happening in february. my concern is the earnings within those estimates are not necessarily rising to your earlier point in the show. the better question is, if quality is the place to be, and these companies are the ones that have balance sheets and continue to grow, like the earnings that they have that

3:33 pm

are driving the market and there are a huge part of the s&p 500 . >> you are insinuating that when you use the word quality that it only applies to those names. when you look at the number and names of stocks that have been at or near new highs over the last couple of months, as caterpillar quality? are some of these other industrial names, is that quality? is j.p. morgan quality? all of these stocks that i am naming have been at or near new highs. the quality spectrum has widened tremendously over the last couple of months. >> i would say, those have always been great companies. they've always continue to be great companies. in my mind if you look across the spectrum a look at the sectors in an environment like

3:34 pm

this -- >> they are getting really excited. the point is, markets have gotten ahead of themselves. prices are too high. stay cautious, don't get out of the equity market. if you have cash, let the market come to you. >> stay calm, be patient. >> i love the debate, i really do. i appreciate you coming back and your willingness to engage. >> up next, tech having a volatile month. poere should investors look for oprtunity? we will be joined after this break. coming right back. it into space? boring does. boring makes vacations happen, early retirements possible, and startups start up. because it's smart, dependable, and steady. all words you want from your bank. for nearly 160 years,

3:35 pm

3:36 pm

3:37 pm

3:38 pm

billion of assets under management. vomit, welcome. it's nice to see you. >> thank you for having me, scott. >> how would you articulate your market view here as we close a quarter. best start to a year in five and now we are wondering what happens next. >> it has certainly been a great start to the year, it is not just this year, the last six months of markets have been really moving up. a lot of that has been multiple, multiple expanded quite a bit. in particular around the so- called magnificat -- magnificent seven if you look for sustained growth beneath, there are pockets of value that you can find.

3:39 pm

they are tired of looking at the mag seven or wondering if there is going to be a continued rotation, where should we look? >> we are spending a lot of time in aerospace. deeper in the supply chain. the supply chain is ramping up production. there are some challenges in getting new things out. what that means is the existing fleet of planes is getting older and working harder. the implication is that the need for repairs, parts, maintenance is continuing to increase at a sustained rate. the service and aftermarket, the really well position in our view. >> before i let you go, i'm going to see you next week, i

3:40 pm

will get to you in a moment. you really are the epitome of the american dream. when i read through the notes, i did not want that part of the story to be overlooked and simply just talking about x's and o's in the market at large. you came to this country at 17 years old you had a full scholarship to franklin and marshall. how did you get to from there to where you are today >> i have been very lucky, life takes you in different directions. and just the opportunities that i've had here. the american dream. >> you just needed to come here

3:41 pm

get the education you did when you are 17 you really don't know much. in america, i've had the chance to see a lot more things. there possible. >> will make sure we shake hands. i will look forward to that. i'm going to be there live. he's going to join me live. we are tracking the biggest movers as we head into the close, we are standing by once again. insiders dumping shares of reddit. enough to move the stock.

3:42 pm

details next. they're waiting for you. hey, do you have a second? they're all expecting more. more efficiency. more benefits. more growth. when you realize you can give your people everything, and more. thank you very much. [applause] ask, "now what?" here's what. you go with prudential to protect, empower and grow. with everything you need to deliver, you guessed it... more. one more thing... who's your rock? learn more at prudential.com

3:45 pm

15 minutes from the closing bell, let's get back to christina with the stocks she is watching. christina. investor steering clear, the excessive evaluation, spotty execution and inconsistent government related contracts. they said, quote, the darkest days of the economic downturn are ahead of them. the shares are down 6%. and a change of course for

3:46 pm

reddit sharers. surging almost 15% on the first last week, we learn now that the ceo, cfo, chief operating officer also sold hundreds of thousands of shares with the public offering spooking some investors, that's why the stock is down 13%. >> christina, thank you. coming up, closing bell. coming right back. webcasts, a, courses, and more - all crafted just for traders. and with guided learning paths stacked with content curated to fit your unique goals, you can spend less time searching and more time learning. trade brilliantly with schwab.

3:48 pm

3:49 pm

3:50 pm

top technician jonathan krinsky lays out where he is forecasting the market in the new quarter. his take, next. boring makes vacatio. happen, early retirements possible, and startups start up. because it's smart, dependable, and steady. all words you want from your bank. taking chances is for skateboarding... and gas station sushi. not banking. that's why pnc bank strives to be boring with your money. the pragmatic, calculated kind of boring. moving to boca? boooring. that was a dolphin, right? it's simple really, for nearly 160 years, pnc bank has had one goal: to be brilliantly boring with your money so you can be happily fulfilled with your life... which is pretty un-boring if you think about it.

3:51 pm

thank you, boring. here's why you should switch fo to duckduckgo on all your devie duckduckgo comes with a built-n engine like google, but it's pi and doesn't spy on your searchs and duckduckgo lets you browse like chrome, but it blocks cooi and creepy ads that follow youa from google and other companie. and there's no catch. it's fre. we make money from ads, but they don't follow you aroud join the millions of people taking back their privacy by downloading duckduckgo on all your devices today.

3:53 pm

we are now in the closing bell markets. here to break down the crucial moments of this trading day. his technical name -- take on the names and losers. >> i will begin with you to see if we can extend this record high, it sure looks like we just might do that. >> this year, to date has really resembled, i mentioned this before. some of those years like 95- 2013, no downside volatility at all. you get this persistent strength and it gets overbought. it's very clear and yet it doesn't quit. and very mindful of saying okay, you have to step off

3:54 pm

here. those years did not quit off the first three months. being aware of how much had to go right in order for us to get here. obviously the potential being offset by how much stronger the economy is and the ai investment and earnings push that wasn't going to be there otherwise and therefore has animated people to essentially pay up the long-term stories. i think one of the most remarkable things is what could actually go wrong and we've still managed to be where we are. and we were able to withstand that. we were able to withstand going from seven to three and here we are going to have another record close. >> that's because the confidence in the macro picture underwrites the whole story and

3:55 pm

if you are confident about the and you do believe that the stocks that had been left behind last year were unduly cheap or at least not priced for a good earnings path over a couple of years i do think that is important to keep in mind it is not just like oh, we will have a couple of quarters, it's probably gotta continue for a while. it's been impressive. i think it is natural to sort of get a little bit itchy and say we are due for some kind of adverse. >> there is no smoking. >> how are we looking as we head into a new quarter? >> it's good to see you. the biggest risk that we had in april for us is the momentum factor unwind and it doesn't necessarily mean market negative but when you look at them in the factor depending on what you look at, we are coming off the best quarter in at

3:56 pm

least 20 years meaning the stocks that have been going on have been going up extremely strongly, if you want to kind of break that down, two potential areas that we could have some opportunity in their coming off the best five month return and interesting enough, april is a pretty weak month. i think you have stretched positioning. that is i think the biggest downside risk. the opportunity is an area like utilities which are just now starting to break out of an 18 month downtrend. breaking some resistance to the upside. very strong for utilities, they have been up pretty strongly on average about 2% the last few years of 80% of the time. we think those are two ways you can kind of play both sides of the market and we will see how

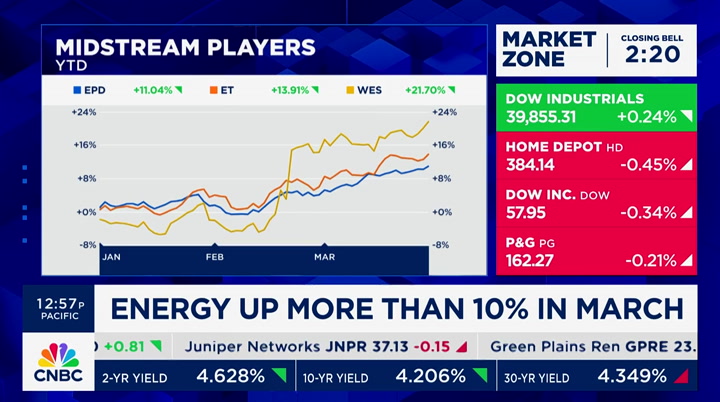

3:57 pm

that shakes out for the overall team. >> energy up 10% this month. is it going to continue? stephens has more on that for us. >> the stocks have actually lagged oil. it could continue. upgraded energy to overweight this week. the sector trade is at two times the historical discount. companies have paid down debt and free ash flow margins are well above the historical averages. across the sector, 40% of components are at their highest level in at least a year. the refiners leading the way. 66, all hitting records this week as they remain supportive. the busy string driving season is just kicking off and gasoline futures are already up in the last month.

3:58 pm

looking for the midstream could be the place to watch. there is a premium for existing infrastructure. key players there, including the energy transfer. >> all right, thank you very much. yesterday we had a new record close for the s&p . and we are little bit more han hundred points away now. >> this should be the 22nd new record high in the first quarter. if you annualize that, i think that is the record number. this market has run ahead in taking credit for a lot of good stuff but it is based on that like we were saying, many of the things we were so worried about back in september and october are really not coming true and reversing the huge risk aversion that we did see there. stuff to watch that i am watching that you can't really tell when it's going to run out

3:59 pm

is a lot of the retail investor speculative action that has started to flow again. i don't think it is make or break but you also at the same time have this very very active and growing area of just selling options to harvest the income to bet on low volatility. the market is this broad, and never just tops. it doesn't offer good, but we had a really broad rally the beginning of 2018. i don't agree have the makings of it right now in the same way but those are the things that ride along with a full market. when they get too extreme, they could be more stabilizing. it is not necessarily negative unless it knocks something loose in terms of the pricing and we are selling everything because the leading stops went down. that is not happening right now >> the 60 or so points, ahead of a new closing eye.

4:00 pm

it looks like we are going to notch that on this final day of an amazing quarter. there going to extend the record close. you have names like disney which have done incredibly well. going to mark all of that, don't forget 8:15 tomorrow morning. have a great one. i will see you then. >> indeed, the dow and s&p both closing at record highs as we wrap up the best quarter since 2019 . winners stay late. >> well, the s&p hosting is 22nd record close, not just stocks that are having a huge quarter either. bit coin, returning more than 60% coming up, the global

19 Views

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11