tv The Exchange CNBC March 28, 2024 1:00pm-2:00pm EDT

1:00 pm

are going to start talking about that i'm long ido, the energy producers etf. >> we are green across the board and extending that record high for the s&p 500 by a few points or so. we had that record close yesterday. a few points higher than that. the dow is good for just shy of 20 we'll see how everything goes. i'll see you on "closing bell. "the exchange" is now. ♪ ♪ josh, thanks so much welcome to "the exchange." here is what is ahead on the show more hawkish fed speak to end the shortened trading week the market is okay with it, but is it out of indifference? there is plenty right to keep the rally going. and we have "3 buys and a bail" europe edition sadly, the uk stocks being dumped our trader has three names she likes. and the ai underdogs at the verge of an opportunity our analyst says he hasn't seen in a

1:01 pm

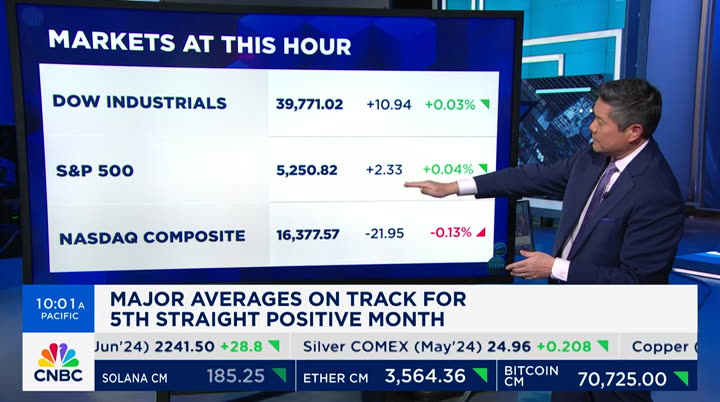

decade he brings the names to watch we begin with the markets with dom chu and the numbers. >> wilford, a modest close to the third quarter on pace right now, but it could be the best first quarter rather that the markets have seen in the s&p 500 since 2019 so as we talk about the moves that we're seeing, we're just a stone's throw away from record highs for all three of the major indexes, some of which have hit record highs this week the dow up about 11 points, about flat on the session, 39,771 5250 is the current s&p 500 level, up two points again, modest gains out. there and by the way, we we are up about eight points at the high, three at the low so a tight trading range for the s&p 500. the nasdaq at 16,377, down 21 points, so, again, very steady moves to try to close out this first quarter. that could be a pretty big one for the s&p overall. now, for that first quarter, year-to-date basis, you look at

1:02 pm

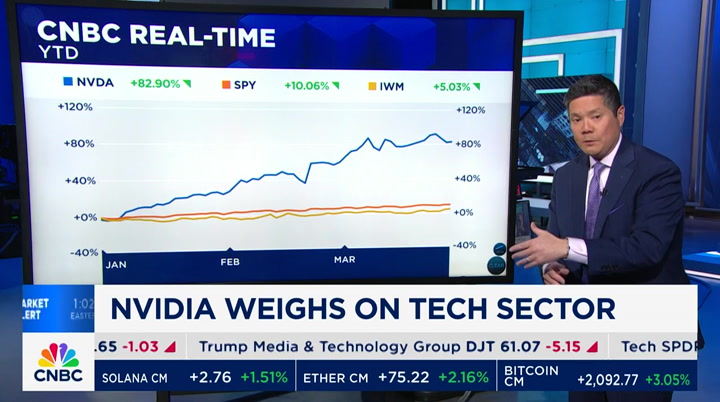

the real story lines developing. large caps versus small caps we've seen a rising tide for everybody. but the large cap is handily outperforming the small cap russell 2,000, and the stock that is driving a lot of that is nvidia, up 82% in just the first quarter year-to-date so far. is it growth or value? the large-cap outperformance tells you it's still about growth, but yes, we can put some numbers to it, as well if you look at the large-cap growth etf in the russell 1,000, you'll start to see something developing there, as well. we'll show you that. if not, we'll just not show that, as well. but then we cap it off with estee lauder the stock of the day, pretty much handily outperforming every other stock in the s&p 500 analysts of bank of america upgraded this to buy from a neutral. they think that the earnings

1:03 pm

trends are bottoming out for estee lauder, and they also look at this stock and say maybe there's some value to be had there, up 6% right now far and away the best performer in the s&p 500 today back over to you >> dom chu, thanks so much for that the dow and s&p flat lining as we stand the nasdaq just negative now we'll begin with the story of the day. sam bankman-fried sentenced to 25 years in prison for massive fraud. kate rooney is outside the courthouse with more for us. kate, 25 years is the number >> reporter: that's right. sam bankman-fried, the former ceo of ftx, seen as the legitimate face of the cryptocurrency industry, now sentenced to 25 years, capping off what prosecutors call one of the largest financial frauds in u.s. history, ordering him to forfeit $11 billion,

1:04 pm

recommending jail in the san francisco bay area the defense team, key lawyer, said there will be an appeal we also have a statement from sam bankman-fried's family saying we are heart broken and will continue to fight for our son. the judge today talked about the enormous harm sam bankman-fried did, and his exceptional flexibility with the truth and an apparent lack of any real remorse, which we got some of the reasoning behind his sentencing one of the key parts, perjury and lack of remorse played into the sentencing >> what was the emotion in the courtroom? you were outside as people were leaving, but what was the emotion from his parents >> reporter: from his parents, i was face to face with his parents as they walked out we were asking for a comment they said, please respect our space and our time here. they did kind of pause for a moment and face the camera, and his mother almost looked like a

1:05 pm

ghost. she looked just sxcompletely stc and devastated the parents throughout this entire criminal trial, in the courtroom, were bemt over at times. she was seen crying multiple times throughout this. so a really emotional day for the family their comments suggest they're still going to continue to support him. we have not seen his brother, gabe, who was part of the campaign finance conversation, but it was shocking to be face-to-face with the parents after it's been more than a year and a half of this >> kate rooney, thanks so much for that let's get more context and bring in danny cevellos. danny, thanks for joining us your initial reaction, 25 years? >> it's interesting, because under the u.s. sentencing guidelines, as calculated, sam bankman-fried's sentence range

1:06 pm

would be been so high, it was technically an illegal sentence. that's how high his expected sentence as calculated would have been. sam bankman-fried's attorneys challenged that by essentially arguing hey, there was no loss loss to the victims is the largest driver of these kinds of white collar crimes. and so the judge rejected that, but yet, even though the judge rejected the argument, the judge still went way below what the government was requesting, 40 to 50 years, and only 25 years which represents a substantial departure. here's the crazy thing about the sentencing guidelines, since the supreme court decision a couple decades ago, they're not even mandatory. a judge can go below the sentencing guidelines. so judges have considerable discretion in this area. this has been a very controversial area of sentencing, because the guidelines take a non-violent,

1:07 pm

non-gun, non-drug offender, and because of the loss amount, which admitted here here is so much, that it's beyond the highest level of the guidelines, which only goes up to $550 million. so in a case like this, the judge, in the judge's discretion, decided to go somewhere in the middle of what the government was asking. >> i mean, at the same time, the judge was criticizing sam bankman-fried for perjury and not taking things seriously, so why has he settled for a relatively low number, 25? is it because of this fact that crypto has rebounded, that the people that lost money initially might get some or all of it back, things like that >> that's probably a major factor, an argument the defense made that the loss here -- remember, the government and the probation department kind of arrive at their own number for loss. so loss can mean a lot of

1:08 pm

different things is it the amount that went into sbf's pocket is it the amount that disappeared? if it, is should he get credit for the money that some people are able to get back, especially if they get dollar for dollar, 100 cents on the dollar? so loss is never a concrete number, at least in one defense attorney's mind, that's me and, in fact, the law has changed considerably in the last couple of years. it used to be intended loss. now it's supposed to be actual loss, what is the actual loss? so the judge may have taken that into consideration either way, the sentence he gave was far below what the recommended sentencing guidelines were. the judge has the discretion to do that, but it's very interesting, because when a judge excoriates a defendant, as a defense attorney you're thinking, that means we're going to be on the high end of the range, and sam bankman-fried was definitely not on the high range. i know 25 years is a lot of time, but what he could have gotten was quite a bit more.

1:09 pm

>> when you look through the entire case, the entire trial, the evidence that the prosecution provided to get to this conviction, was it very clear to authorities, had we not seen crypto prices crash i guess i'm asking, that he might have gotten away with this, if we had seen bitcoin prices hold up throughout like they have now and bounced again. that's possible. look, this is just my take as a defense attorney, but federal prosecutors are prosecutors -- they're selected prosecutors with limited resources do they sometimes get their ideas from watching the news of who maybe to investigate yeah, that's possible. but the reality is that once you get the attention of federal investigators, nothing good can come of that, whether that attention comes from media, whether it comes from your company making an ill-advised stock move or business decision. no matter what, once investigators are onto you, bad things are possibly going to

1:10 pm

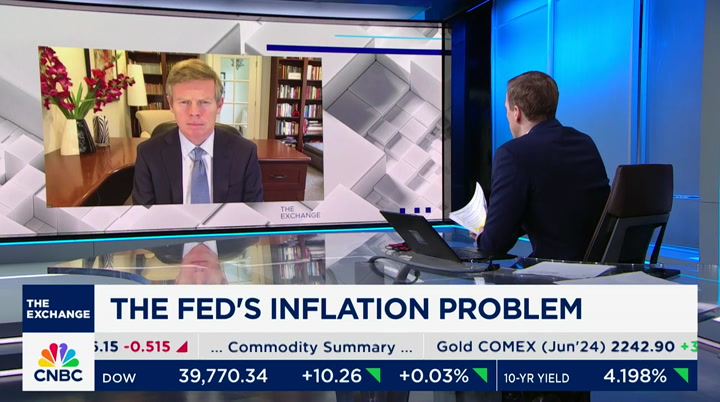

happen that's exactly -- this was a prosecution 101 government prosecution in a financial crime. they got to his cohorts, his co-defendants, got them to turn on sam bankman-fried, and from there, it was really smooth sailing for the government all the way. arguably, the only reason sam bankman-fried testified was either one of two reasons. either he insisted on it, or the defense team thought it's so hopeless, we might as well put him up there and try it out. >> danny, thanks for joining us. much appreciated turning back to the markets, a key piece of economic data on deck tomorrow, core pce, the fed's preferred gauge of inflation. in a speech in new york yesterday, christopher waller said there's a case to be made for holding off on cutting rates. >> i see economic output and the labor market showing continued strength, while progress in reducing inflation has slowed. because of these signs, i see no

1:11 pm

rush in taking the step of beginning to ease monetary policy >> my next guest says he expects one of the sticking points for the fed, wage inflation to ease in the months ahead. joining me now is a chief global strategist david, thanks for joining me before we get to the wage inflation point, what did you make of waller's comments earlier this week? we were talking to james gorman. he said he wouldn't be surprised if there are no rate cuts. your expectation of cuts and what happens to the market if we get none >> i think we will probably get three cuts the fed is clearly on the tight side of neutral. the economy is gradually slowing down, and it's prove than we can have good growth even as inflation comes down the most important thing to recognize here, which i feel the federal reserve has not recognized, they have distorted financial markets for many years by keeping rates much too low,

1:12 pm

then much too high so i don't think about a neutral federal funds rate in terms of the economy. the economy is looking after itself i look for a neutral rate for financial markets. they need to move back towards that neutral rate. as long as the economy is doing okay and inflation is gradually coming down, i think they should and will cut in june >> presuming you don't think at the moment that the rates are too tight for the financial markets. we're at record highs. gold just hit one, as well >> yes, but that's a relic of the liquidities in the market in recent years so we're clearly continuing the tightening, trying to mop up some of that liquidity but in general, there's been a disconnect between economic performance, earnings performance and markets. we have a lot of inequality in the country, so i can still see some of the reasons we have this booming stock market here. but nevertheless, i think the

1:13 pm

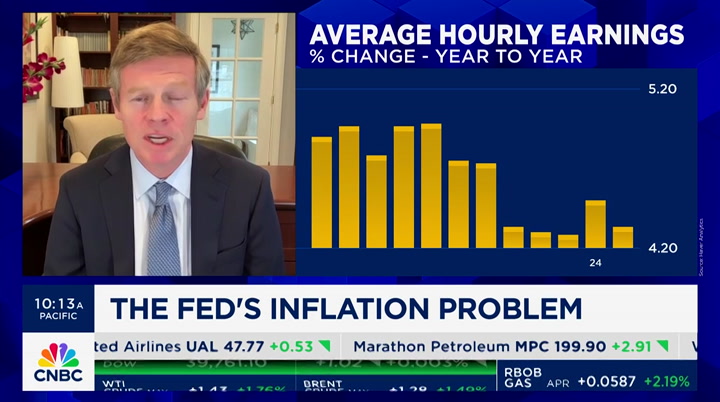

federal reserve ought to gradually move back towards a normal level of federal funds rate >> what fact you think will allow them to do that is wage inflation? >> yes, because what's going on, it's amazing we don't have more wage inflation everybody has known about the tight labor market for the last two to three years we still got 9 million job openings in this country, well above anything we saw before the pandemic yet wage growth is down 4.3% year over year what i'm seeing is only 6% of the private sector is in a union. there have been zero major strikes so far this year we've had -- we're seeing a lot of immigration coming into the country and filling low-wage jobs in places like retail and home care and so forth and day care so i think what you're going to see is pressure from low-wage workers holding down wage growth we're normally seeing that

1:14 pm

translate into higher consumer inflation. so i think we're still on pace for consumer inflation to come down and the fed should stop trying to micromanage the economy. >> give me the flip side what if james gorman was right, or mr. waller was right, and we didn't get any cuts at all, would that destabilize the equity market? >> it could. because what's going to happen, the equity market never stops at the limits of prudence, it stops at the limits of exuberance. if it grows higher, until it is very high, we were at 21 times forward earnings, which is rich. some of the biggest stocks are extremely expensive here but if we keep going, and the higher it goes before some shock occurs, the greater will be the -- so i do worry about that data people need to be diversified here but i don't think the fed should try to micromanage that either i don't think they're capable of doing it >> let's talk about regions

1:15 pm

where things are cheaper, and europe is one of them. sit cheap for a reason or, in fact, relatively attractive at the moment >> there are reasons for europe to be cheaper than the u.s the u.s. has got a much bigger technology sector and stock market in the case of the uk, commodities. but still, even if you account for that, even if you look sector by sector across the ten big sectors in the s&p, in every single sector europe is cheaper than the u.s. in the same sector so right now, the u.s. stocks are selling at 21 times forward pe, european stocks 14 times forward pe and they've got twice the dividend yield of u.s. stocks. this has been a great quarter and another after a very good year for the u.s. market but people are very overweight here as equities and global

1:16 pm

portfolios sooner or later, some shock will hit the market you'll get a tumble, and things that tumble the most are the things highly priced and that's where the risk in the u.s. is. >> the pullbacks in '22 and '23 did see a pullback alongside the u.s. in europe david, out of time thanks so much david kelly from jpmorgan asset management don't miss our coverage of tomorrow morning's key pce data. we'll have the numbers with analysis and reaction streaming on cnbc.com starting at 8:15 a.m. eastern time. still to come here on "the exchange," the investigation and recovery efforts at the port of baltimore are ongoing in the wake of this week's key bridge collapse up next, we'll speak with the heads of the virginia and new york/new jersey ports about how they're planning to handle the influx of extra ships and cargo. plus, we're wrapping up our around the world series with

1:17 pm

"three buys and a bail" in europe we teed it up there. we'll go into the individual stock names a little bit later this name rallied 70% at the start of the year, and our trader says it's time to get out. you might be able to guess which one that is, certainly if you are in the uk you would. it's the one tech success story of the last decade in the uk we'll discuss later.

1:18 pm

rylee! from rylee's realty! hi! this listing sounds incredible. let's check it out. says here it gets plenty of light. and this must be the ocean view? of aruba? huh. this listing is misleading. well, when at&t says we give businesses get our best deal, on the iphone 15 pro made with titanium. we mean it. amazing. all my agents want it. says here...“inviting pool”. come on over! too inviting. only at&t gives businesses our best deals on any iphone. get iphone 15 pro on us. (♪♪) business. get iphone 15 pro on us. it's not a nine-to-five proposition. it's all day and into the night. it's all the things that keep this world turning. the go-tos that keep us going. the places we cheer. and check in. they all choose the advanced network solutions and round the clock partnership from comcast business. see why comcast business powers more small businesses than anyone else. get started for $49.99 a month plus ask how to get up to an $800 prepaid card.

1:20 pm

welcome back to "the exchange." it's been two days since the fatal collapse of the francis scott key bridge in maryland with the port of baltimore closed for now, shipments are being diverted along the east coast, mainly to virginia and new york joining me now to discuss the impact is steven edwards the port of virginia ceo, and rick cotton, executive director of the new york and new jersey port authority. gentlemen, great to have you both on. of course, very sad circumstances as to the trigger for these bookings steven, i'll come to you first of all have you seen immediate pickup in traffic to your port as a result of this issue are you expecting it >> yes so first, i also say it's a terrible tragedy none of us want this to happen to any port. we know the port of baltimore well and we're thinking of them

1:21 pm

and thinking of the families with lost ones coming to the cargo, we break with the sectors, starting with the container sector the familiar one for consumers we are seeing cargo starting to discharge here as early as tuesday. but i think the key point here is nine of the ten services that go to the port of baltimore on a weekly basis call here of all ten, they call between new york, virginia, and philadelphia so it's not extra port calls or ships but more cargo coming on and off those ships. so we're in good shape, great shape to handle that cargo ocean carriers who are diverting that cargo to us, communicating exceptionally well on what their plans are. between new york and ourselves or virginia, new york and philadelphia, on a container sector we'll be seeing a relatively smooth operation. the cargo will have to be moved by motor carriers, and we're

1:22 pm

seeing motor carriers from baltimore register with us to come to our port and i think the same will be happening in other ports so i believe we'll be in very, very good shape. the roll on/roll off sector, baltimore is the number one port they have a great market share, and that's going to be more challenging for certain ports, ourselves included but we will see our first on friday discharge tractors and machinery. and in the car sector, we'll see cargo from rhode island through new york, delaware and ourselves as that sector gets spread a little wider but i expect the container sector to move quite smoothly. >> rick, is your take something similar, that it's not a big pickup of ships but more containers >> that's exactly what it is i also want to start by saying that this was obviously a

1:23 pm

tragedy in baltimore, and our hearts and thoughts are with the families of those who perished that's exactly what we expect to see. ships, what we don't expect to see is additional ships but we expect to see additional cargo coming off those ships right now, each though the volumes here are resilient, at the height of covid, we handled 20% more volume than we're handling right now so, we have the capacity to off load cargo that may have been intended to go directly to the port of baltimore. we have the capacity through making arrangements with truckers who might come up from baltimore, but also we understand that csx and norfolk southern are in the process of

1:24 pm

scheduling additional trains that will be able to transfer cargo that was intended for baltimore that we off load here. >> you both make it sound very smooth for your respective ports. rick, what level of preparation have you had for it to be hopefully as smooth as you're saying do you have to get more hours in, more equipment, or is there always this excess capacity? >> well, in the port of new york and new jersey, it's the second busiest in the nation. and there are monthly fluctuations, and we're able to adjust our marine terminals do have, as i said, extra capacity they surged it during covid, they can surge it now. it may require additional gate hours, depending on whether the cargo is departing here by truck or by train. but we are prepared to surge as

1:25 pm

necessary to handle the cargo. the car volume will be a little more challenging, because the cars need to be driven off of the -- off of the ships. but if the railroads step in, and provide additional capacity on car trains, we are registering truckers who are registered in baltimore, if they want to come pick up their containers here. we're certainly open to that >> steven, what was the reaction -- i guess not just your personal reaction, but everyone that works in and around the virginia port to the collision initially, and the worry that something similar could happen near you. >> well, i think the initial reaction was clearly shock our emergency response team were notified early of the incident i don't think we have seen a collision like it, not in my lifetime of working in the industry

1:26 pm

but i think when it comes to our port, we're fortunate. we don't have bridges in the port of virginia we are all tunnels, and the way tunnels work is that the channel itself goes across the channel at a safe point. and if a schiff diverted from a channel, it will run aground before it would hit a structure. so we don't face the risk that other ports face of bridges and bridge reinforcement in the harbor, so we are fortunate in that we have no air draft limit datis when it comes to ships coming in and out of the harbor. we handled as an industry, we have handled natural disasters before so when you think about the readiness of the east coast, we had superstorm sandy in the past, we have hurricane preparedness to the south. as an industry, we're used to surges some of them you will see in the normal course of business. that could be a nor'easter,

1:27 pm

closing for a hurricane for two days, it could be something like superstorm sandy on the east coast, all players know each other. from virginia through new york, baltimore, philadelphia, we all know each other. therefore, we can all work collaboratively quite well i think the other response we have seen to this is great in our overall community is both the coast guard and customs and border protection, stepping forward if we need to bring on surge capacity so if we're required to bring on more capacity, we'll do it very quickly. >> steven and rick, we'll have to leave it there. but we appreciate the time thank you both so much >> good to be with you we're going to continue this discussion and our next guest has several containers on the crashed cargo ship and is managing shipping diversions for many others. he says the economic impact of the key bridge collapse could total $4 billion the president of ceo of shipping logistics company joins us thank you very much for joining

1:28 pm

us, allen. give us that context, you have some client's containers on the ship itself. >> we do and let me just first echo the previous speakers and our condolences and thoughts go out to the families of those involved in this tragedy, as they said. we have several -- just to jump on the logistics side. we have several customers who have cargo on board the ship we're waiting for more news on that we have a lot of cargo actually enroute into baltimore we ship in and out of baltimore every week we have cargo sitting on the piers, waiting for other vessels that should have come in but won't now. so we are arranging to pick that up and move it, again, to some of the ports that will be used, like norfolk, virginia, new york, philadelphia, to get the

1:29 pm

supply chabsins up and running >> are we seeing an immediate jump in prices for this, or is has it not led to too much of an increase in cost >> basically from an ocean freight standpoint, not too much of a change in cost. you really will see that if you're a baltimore local importer/exporter and you now need to arrange to pick up your cargo in new york or philly. you'll have an increased inland freight. for the folks in the ohio valley, midwest, they have a number of alternatives again, they can rail it into norfolk, rail it into new york we also see cargo via the canadian gateway that longs to montreal and out to halifax as well and load ships there. so in that sense, i don't know that we'll see an increase in ocean cost more domestic freight for those e in and around baltimore. >> so when we say you think the

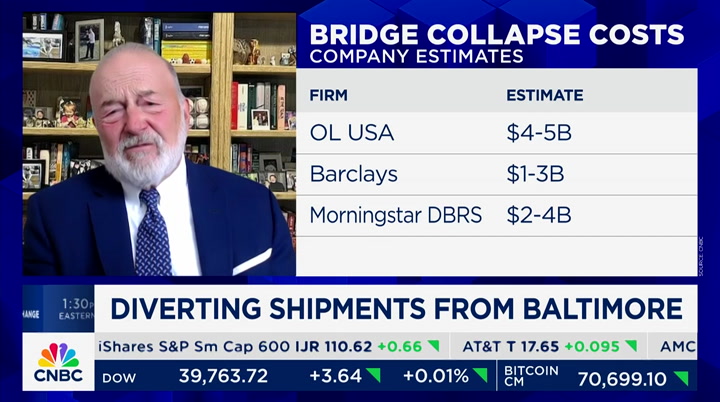

1:30 pm

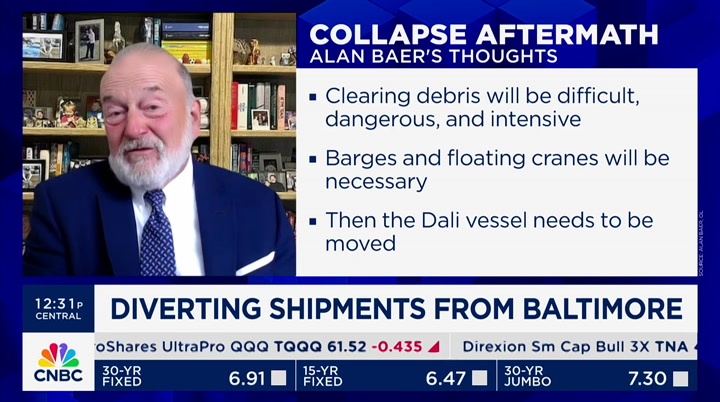

overall cost to the economy could be $4 billion, $5 billion, what are we talking about there? how do you get to that number and all things considered, are you considering things could have been quite a lot worse? >> well, you're looking there at an insurance estimate. so between the ships, the damages, replacement of infrastructure, things like that, that was an estimate provided by a couple of folks who follow the insurance industry they have looked at estimates to replace the bridge and ship costs, cargo relocations, business interruption. that was the total that they were coming up with at that point. >> and then just finally, what about those containers on board? when is your expectation that you might be able to get those off and when the ship might finally come to shore? >> yeah, that's the tricky thing, because as everybody has commented in and around

1:31 pm

baltimore, for sure, everybody is anxious to get the port back up and running there's somewhat of a snowball effect, because right now you can't book any cargo in and out of baltimore that starts to feed on itself, because you have ships with 30-day transits, so you're loading now for norfolk and new york when you look at the picture,tae dangling or hanging from the ship so that will be a feat to pick up that from the containers and not allow it to fall into the water, which could further exacerbate the issues. and then eventually, our estimate is that they have to return the ship to avert to take that cargo off while they assess the damage that the bow of the ship might have occurred i know the army corps of engineers is on site, and we are

1:32 pm

awaiting their estimate of those things, when can they move the ship, when can they create an opening in the channel and allow maritime traffic to resume >> allen beck, thank you for joining us >> thank you still ahead here on "the exchange," there's an underdog story playing out on wall street one firm says it's an overlooked group of stocks that will have major beneficiaries from the generative ai opportunity. we're back after a couple of minutes. they're waiting for you. hey, do you have a second?

1:33 pm

they're all expecting more. more efficiency. more benefits. more growth. when you realize you can give your people everything, and more. thank you very much. [applause] ask, "now what?" here's what. you go with prudential to protect, empower and grow. with everything you need to deliver, you guessed it... more. one more thing... who's your rock? learn more at prudential.com stevens dribbles up the court... he stops! ...for the championship! nice shot, marcus! sweet, turn simulation off. tssk, tssk, not so fast. what, why? did you forget marcus? forget what? your chem exam? uggh? flashcard time! the atomic weight of boron. the future isn't scary, not investing in it is. 100 innovative companies, one etf. before investing, carefully read and consider fund investment objectives, risks, charges expenses and more in prospectus at invesco.com.

1:35 pm

good afternoon welcome back to "the exchange. i'm tyler mathisen with your cnbc update this hour. joe biden's campaign will hold a star-studded campaign fund-raiser today at radio city music hall in new york stay out of that neighborhood. that will include two of his predecessors, president obama and clinton, as democrats set their sights on the general election later this year the fund-raiser is slated to bring in more than $25 million and will work to boost biden's re-election campaign as he faces

1:36 pm

concerns about his able and other things representative mikey cheryl says she will introduce a bill tomorrow that would keep any federal officials from accessing classified information the guard act targets senator bob menendez who faces 18 federal courts but also president donald trump, who will receive intelligence briefings pope francis appeared to look strong as he urged priests to treat worshippers with mercy during mass at the vatican this comes after a string of health issues over the past winter and a busy weekend ahead with of course, the easter holidays wolf, been great having you here this week. >> my pleasure thanks for the welcome still to come, here's one more look at our mystery chart we'll vehereal t name in the next "three buys and a bail. back after this.

1:39 pm

1:40 pm

europe edition we're here with gina sanchez, a cnbc contributor great to see you long time, no speak. great that you're picking out stocks in europe the first one is roche, which is the swiss pharma company, up about 6% this year it had modest guidance for the year ahead bank of america saying it's one of the most well-held stocks in your why do you like it here? >> finally, the sort of covid comps are starting to kind of become a thing of the past, so we're starting to sort of go into more positive outlook for the company. as they're continuing to grow revenues, also they're -- you know, their margins are expanding. so they're setting up to do well they're being cautious, but i do think that this is a company that continues to deliver. we'll see how the lung cancer data comes out in terms of their

1:41 pm

pipeline but on the whole, this is a company that is doing everything right and finally getting past those covid comps. >> next up, we have gone from totale energies, the french energy company, up 7% so far this month bank of america names it a top pick in the oil space earlier in the year, and it hasn't got a single sell rating, which might be a worry but you still like this one. talk to us about the valuation, as well. when you see valuation discounts, europe versus the u.s., you can kind of explain at times, but on energy companies, the companies are very similar it's not like tech, where u.s. tech is just a lot better. >> without a doubt, but if you look at what they're doing for the toucher, they really are fully embracing lng and have been making moves and diversifying their energy portfolio. it will take years, this is an energy company, not the thing

1:42 pm

that you can turn around on a dime but they are doing all of the things that you need to create a better energy and more diversified energy portfolio for the future so that long-run story is probably what's propel thing story, and it will take time for that to work out but they're still a solid energy player there's very little difference right now, but small moves now could mean very large moves in five or ten years time >> and like roche, both have good dividend yields the next one, another buy from you, anheuser-busch, embev they're up 13%, the u.s. shares since the company announced a $1 billion share buyback last fall. the stock is pretty popular, 13 buys, not a single sell rating gina, we have seen the industry as a whole come out with some profit warnings of late. talk us through why you like this one >> so this one has a tremendous move this is a company that had a

1:43 pm

massive social media boycott and still managed to grow revenues right now, most people who are looking at europe right now are looking for great companies that are cheaper than the u.s., because the outlook for europe is still a bit sluggish. this is a cheap company that shows that they can survive just about anything that was a pretty big hit. so i think for a sort of total value, there's a lot of unlocked value here >> and now for the one you think we should be sellers, a bail that's arm, which was our mystery chart. shares up 70% this year. mizzuho raised its price target by $60, citing an attractive long-term road map ahead i mean, arm is a great innovator with exposure to the ai theme, with you quite a few pointing to that all of a sudden jump in the chart, which we just showed, as being something that's unsustainable.

1:44 pm

>> you're absolutely right this is a great little stock it's not that i don't like the company. i think what they do is great. they make less powerful chips, but they're power efficient. so they're great in smartphones, they're moving into electric cars so there's a good story there. but 84 times earnings, i don't care how great you think the outlook is, there's no way -- they're not a huge, powerful chipmaker. they're going into a lot of smaller, you know, sort of smaller stories and expanding at the margins. so how they'll get over 84 times multiple is going to be a real challenge. >> arm holdings from cambridge, england, a sell according to gina sanchez thank you so much. >> thank you still to come, nvidia, there's less well-known names that could be at the new verge f major transformation that's next. ♪(artist: maria callas)♪ ♪(orchestra del teatro alla scala, milano)♪ ♪♪

1:45 pm

1:48 pm

welcome back to "the exchange." a look at markets right now, up but only slightly, just a handful of basis points for the dow and s&p, down for the nasdaq a handful of points. the russell is the leader today. the small-cap indecision up about half of 1% we are on track for the best first quarter in five years for the s&p 500. it's the outperformer, narrowly beating the nasdaq, as you can see for the quarter as a whole the s&p 500 up 10%, nasdaq up 9%, the dow and the russell lagging a little bit, up about 5% or so but it's been a very nice, strong first quarter for u.s. markets. still to come, there's one group of stocks that my next guest says stand to gain big from ai, but they may not be on your radar just yet. he'll make his case. that's up next meet ron. ron eats, sleeps and breathes hoops. and there's not a no look pass, double double,

1:49 pm

or buzzer beater he won't wax poetic on. ad nauseam. but oh how he can nail a software solution like the best high screen pick and roll you've ever seen. you need ron. ron needs a retirement plan. work with principal so we can help you help ron with a retirement and benefits plan that's right for him. let our expertise round out yours.

1:51 pm

here's why you should switch fo to duckduckgo on all your devie duckduckgo comes with a built-n engine like google, but it's pi and doesn't spy on your searchs and duckduckgo lets you browse like chrome, but it blocks cooi and creepy ads that follow youa from google and other companie. and there's no catch. it's fre. we make money from ads, but they don't follow you aroud join the millions of people taking back their privacy by downloading duckduckgo on all your devices today. welcome back while generative a.i. and big video games and technology in a different less talked about group of stocks. and that's webtool platform

1:52 pm

names initiating yelp on underdog thesis and other names including godaddy, a topic eamon javers has a report on is it a very good afternoon. it is. and personally what about these webtool names? why is a.i. a strong inventive >> thank you for having me on the show when you peel back the web ability space, i think the knee-jerk reaction from investors was, well, with these new tools, easy to create images it's easy to create text so the next line of thought was, well it must be easy to replicate a web presence and we don't think that's the case. we actually think these web-builder tools, particularly

1:53 pm

godaddy, are really well positioned to embed these genai tools into their own web stack and actually make it a lot easier for small businesses to create a web presence. i think the -- what gets lost a little bit in the fray is, it's pretty complex to host a website. there's security aspects to it there's just regular kind of cloud hosting. there's inventory management there's payments there's a lot that go into that and actually i think it's easier for these web development platforms to embed a.i. versus the opposite that's why we're constructive on the group and we see upside to about $150 at godaddy. >> so, talk us through what viewers in silicon valley, as to whether these webtool names of threatened by a.i. or not? >> a very, very different view here in silicon valley for instance, a new generation

1:54 pm

of kids using this tool in the future building websites will go to the chatgpt store generative a.i. native company, i.e., built in this area like a builder a.i. or one of em others versus a godaddy built in a different era more of an internet company than a generative a.i. company. josh, i wonder how you think that rolls out maybe a brief period where they're able to, you know, pull in apis and allow for this sort of loko no code a.i. rapper to some websites, but how is that sustainable? >> yeah. it's a great point, and i think this is a very common data line in silicon valley right now. obviously, if you look at the foundational model space, right? you have the incumbent, google, microsoft. right? you have labs. you have start-ups kind of all littered in the space, but i think one of the

1:55 pm

learnings from the foundational model layer is there are real advantages to scale. if you own these customers incorporate the tools, there's a large advantage. the other point probably more important for the web-builder market is, it has a little bit of a consumer element to it. like you said. but, you know, these companies really lean into that. they spend about a billion dollars annually on marketing so that when you go and say, hey, i want to create a website godaddy and one of these other platforms surfaces they're in some ways the gatekeeper, i would say, if you want a web presence. you have to have a doumaindomain they're making it very easy. website idea, here's a logo. let's use a.i. and a typical logo process could be leaked

1:56 pm

cost $200. in this case it's going to be a fraction of that in terms of cost and time. then they're going to say, okay. we'll take this logo and build you a website. what do you think? would you like to make the tone more playful more serious i really think it's a good point. a lot of new tools competing for this space, but i think only the domain makes it strategic for them. >> d., if someone was wanting to build a new website in the new era of coding and a.i. and you listened to all of the other names that i don't understand, but would you be going to the chatgpts microsofts a.i. tools, google or smaller start-up companies focusing specifically on website building >> yeah. certainly smaller start-ups up and coming opinion i mentioned one, builder a.i. that said making a website, making an app right now is as easy as ordering

1:57 pm

a pizza. still not like mainstream. hard to match an world in which you don't have a generation of a.i. companies that are native a.i. make this shift versus sort of some of the legacy names. like we saw in the mogul era led to lyft, airbnb, able to build for a mogul era. a lot of folks here in silicon valley say you need to be in it, start from scratch with that experience, those employees to be successful when seeing a platform shift this big. >> d., thanks to you both. much appreciated. leaving you here on "the exchange," just negative on the nasdaq just positive on the dow a strong month, very strong quarter so far s&p set to close the quarter up more than 10%. a real pleasure being here this week on "the exchange. "power lunch," up next. ♪ ♪ next. next.

1:58 pm

stop. we got it? no. keep going. aga... [ sigh ] next. next. if you don't pick one... oh, you have time. am i keeping you from your job. next. i don't even know where i am anymore. stop. do we finally have it? let's go back to the beginning. are you... your electric future. customized. the fully-electric audi q4 e-tron. ♪ ♪ it's odd how in an instant things can transform. slipping out of balance into freefall. i'm glad i found stability amidst it all. gold. standing the test of time. ontario has all the partners you need to make the electric vehicle of the future. with one of north america's largest i.t. clusters. 65,000 stem graduates per year. and all the critical minerals to make electric vehicle batteries. ontario. your innovation partner. at pgim, finding opportunity in fixed income today, helps secure tomorrow.

1:59 pm

our time-tested fixed income suite, backed by over 145 years of risk experience, helps investors meet their goals. pgim investments. shaping tomorrow today. rylee! from rylee's realty! hi! this listing sounds incredible. let's check it out. says here it gets plenty of light. and this must be the ocean view? of aruba? huh. this listing is misleading. well, when at&t says we give businesses get our best deal, on the iphone 15 pro made with titanium. we mean it. amazing. all my agents want it. says here...“inviting pool”. come on over! too inviting. only at&t gives businesses our best deals on any iphone. get iphone 15 pro on us. (♪♪)

2:00 pm

at pgim, finding opportunity in fixed income today, helps secure tomorrow. our time-tested fixed income suite, backed by over 145 years of risk experience, helps investors meet their goals. pgim investments. shaping tomorrow today. welcome to "power lunch," everybody. alongside julia boorstin i'm tyler mathisen glad you could join us on this thursday final trading day of the week and quarter for s&p 500. up 10% best in five years and we look at some of the quarter's winners and ask the all-important question can gains keep g

32 Views

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11