tv Bloomberg Daybreak Europe Bloomberg April 26, 2024 1:00am-2:00am EDT

1:01 am

the yen hits a fresh 34 your low reaching 156 after the boj colds rates steady and tweaks its language on the bond buying. we bring you the latest reaction at head of the governor's press conference. wall street higher thanks to a boost from big tech, alphabet and microsoft shares surge on earnings beats as fuels demand. hopes of dampened as the u.s. economy slows well price pressures move higher, traders pare rate cut bets as the focus shifts to bce data out today. you put from the tech story certainly on the earnings front. we will break down the gun story as we lead up to the conference 7:30 u.k. time. the opitimism coming through,

1:02 am

alphabet coming through this first dividend ever and to share buyback as well, and it is proving both of these companies that their investments and i are now paying off. european stocks pointed up by .6 of 1%. ftse 100 futures as copper pops up higher on the session. s&p futures building on the optimism around the tech story looking to gains of .8 of 1% after closing the session lower yesterday. nasdaq futures looking to add more than 1%. let's flip the board in the process with scrutiny on the currency space with the japanese at 156. the key line is 157.60. getting details and analysis this hour. markets pricing the first full cut, 25 basis points from the fed not coming until december of

1:03 am

this year. are we approaching stagflationary territory with this economy? 107 on euro-dollar. brent just below $90 per barrel, 89.35. let's cross over to avril hong. what is standing up to across the asia session? avril: we are looking closely at the boj decision is the focus shifts to the words of the mouth of governor ueda about one hour from now, but also how tech is powering the asia stock recovery this friday. now we are seeing the nikkei, the topix extending gains, about .4 of 1% higher. they stood pat on the rates, but what was more important was how

1:04 am

they would keep the bond purchases in accordance with its march decision, and at the same time it dropped language about ¥6 trillion in bond purchases, and some had read this as a hawkish tweak to the language, but this is something ueda will need to clarify in his prayer for -- in his presser. let's flip the board because i want to show you what we are seeing among ship names as the big tech really comes through in's way as well. sk hynix slumped 5% despite beating on its own profit expectations. today seeing a nice recovery showing how for asia's tech names are so closely tied to their u.s. counterparts. we talk about how you weakness is driving the rally in japanese equities, and for the nikkei

1:05 am

this year it is responsible for about half of its performance, but something else to consider is if you were a foreign investor, then you look at this and your returns are seen it diminishing quite considerably. this varies depending on your base currency. i want to show you how the yen is not just weakening against the greenback. it is also weakening a lot against the aussie, the euro. we are brace for a bit more hawkishness, that this is tracking what we saw in u.s. treasuries overnight. tom: avril hong, thank you very much indeed. we will stay on the japan story and the details around this decision around the bank of japan, bloomberg economic saying this was a dovish hold. paul waul is standing by and tokyo. what are you looking ahead to

1:06 am

when it comes to the presser? >> it was a short statement. it was one sentence long, the shortest statement they put out in years. so in terms of moving forward with the idea of simplifying policy, we are seeing ueda moving in that direction, but what we did not get was a clear sign that they are returning to pare bond purchases despite local media reports just before the decision came out suggesting that there was going to be some discussion, perhaps an indication of that, so that has led to some disappointment. there was some confusion from this statement being so minimal, that certain statement on a buying as many bonds before was dropped, this reference to ¥6 trillion of monthly purchases

1:07 am

was not there, but there was a line saying that the stance was largely in with march, so no change there. with the financial conditions to continue, so all of this feeds into further yen weakness and keeps us on the watch for the possibility of intervention. tom: what is the latest we have been hearing from officials in tokyo around that potential intervention? do we have any clarity from traders if that does indeed happen? what line we might be looking at? >> if you ask me based on what we have seen in 2022, we have got two big pressure once coming up today. we have got governor ueda's press conference. he will want to play something for the hawks, something for the doves. i think it would be helpful if he gave some kind of hawkish

1:08 am

signal just to rein in they yen. if they yen -- the yen continues to weaken, we have the inflation data tonight. as the preferred indicator of growth, if that surprises on the upside there could be another surge in the yen and that is the time authorities would want to move in and intervene. it is also a holiday weekend. i think that is the timing, and i think the level is get to 157, i think intervention will come around then. tom: paul jackson with excellent analysis, thank you very much. let's get to the tech story, microsoft enough a bit shares soaring and late trade as first quarter expectations beat on strong ai demand.

1:09 am

here is what someone had to say about the results. >> we are very pleased with the financial results for the first quarter driven by strength in searching cloud as well as the ongoing efforts to durably reengineer our cost base. tom: let's bring in robert lea. what stood out from those results and the ai component that seemed to come through for both of those companies? >> absolutely, if i was going to great these results alphabet gets a solid grade star. -- a solid gold star. taking a step back from ai euphoria, alphabet is fundamentally an advertising driven business, and their advertising growth was the strongest in the quarter just

1:10 am

reported versus the last eight quarters, some across-the-board strength there. margins were ahead. happy days for investors. decent numbers across-the-board strength. the upper performance did not match the magnitude of the beat, but there is no great concern on that front, so we major contrast versus what we saw from that of -- from meta. tom: is there anything the market could be missing from both of these stories? >> it would be amiss of me not to inject a little bit of caution. the market is always short-term focus. i think a point i made previously is it is all about monetization. we are seeing early signs of monetization coming through for these companies. however numbers of alphabet were above expectations, free cash

1:11 am

flow generation was below expectations. the market is just focusing on the headlines, so the point i have made before is these companies are investing tens of billions of at a point where there monetization model and strategy is a relatively early, so the market does not seem to care at the moment, but that is something investors need to focus on through the rest of this year, because when you are interesting such high amounts on , you went to make a return. the risk is comes out to bite them on the bottom at some point. tom: continue to scrutinize the monetization of ai. thank you very much. to the macro, the federal reserve facing a dilemma, gary shilling soft first quarter growth and re-accelerating inflation.

1:12 am

later today the key inflation gauges released adding more nerves to a slightly jittery market. let's bring in our bloomberg mliv strategist. are we talking about a stagflationary environment now, a u.s. economy facing stagflation, or are we not there yet? >> i do not think we are quite there yet. we got a gdp reading yesterday, but around 6% it is around trend growth which is around 1.8%, so the fed is not going to be unduly bothered about the economy softness. they think of the economy is losing momentum. there is no question about it, but at the moment the fed's focus is on inflation, and the expectation is that we get it pce reading of 2.7% today.

1:13 am

the bulk of expectations were at .7% and 2.8 percent before yesterday's data, and after yesterday's upside and pricing indexes some of those numbers have been revised up to 2.9%. what does that mean? if we get an upside surprise that would be a big overshoot. if that happens the markets will complete the re-price fed. at the moment they are thinking one possible cut by the end of the year. they will price it out completely and that will send the two year yield to about 5.22% by my calculations within a week. if it is a downside surprise, rates have soared considerably in the last month and they may see a rally. tom: there is sensitivity in the markets to the data.

1:14 am

as we see the economic picture slowing. 2.5 percent was the date that they came through yesterday. ven ram, with the detail, thank you very much indeed. here is what else to think about today. 7:00 a.m. u.k. time, natwest earnings with a focus on interest income as market started to price and the expectations of a bank of england cut possibly as soon as june. those details come out at 7:00 a.m. u.k. time, so rounding up the story when it comes to the bank earnings picture, and when it comes to the liquor story we have remy conteui expected to benefit from a pickup in their chinese markets and potentially european market as well as the

1:15 am

u.s. market looks soft. year to date that stock is down 20%. we keep an eye on sale numbers from remy contreui. earnings coming up from exxon mobil later today after the run-up in oil prices. year to date that stock is up 21%. those earnings out later in the u.s.. get a roundup of the stories you need to know in today's edition of daybreak. terminal subscribers go to dayb. problems are mounting between economies even as the relationship shows some signs of stabilizing. more on that visit next. this is bloomberg. ♪

1:18 am

tom: welcome back to "bloomberg daybreak: europe." china's top diplomat warned antony blinken problems are mounting between the world's largest economies as the u.s. and threatens beijing with sanctions for the support of russia. blinken is expected to meet president xi jinping later today. >> there is no substitute in our

1:19 am

judgment for face to face diplomacy in order to move forward, but also to make sure we are as clear as possible about the areas where we have differences at the very least to avoid misunderstandings, to avoid miscalculations. that is a shared responsibility we have not only for our own people, but people around the world given the impact our relationship has around the world. tom: for more on this story let's bring in rebecca wilkins. what is to bend tone of the trip so far? it is a difficult line to thread for the secretary of state in this environment, but it seems particularly challenging this time around. >> it started pretty friendly when blinken touched down. he had softer less diplomatically charged events. he spoke to students at the campus there and took a stroll,

1:20 am

had dumplings for dinner. he has arrived in beijing and is speaking to the foreign minister. the rhetoric has slightly hardened. they pointed to the buildup of factors, some of the risks, and that reiterate some of the concerns we had in this is conference before blinken arrived, quite unusual for beijing to put on the event before an official arrives, so there has been a shift in that tone, and blinken is striking a tough balance here. we had the tiktok legislation come through and he will ask china to take a firmer hand when it comes to containing nuclear capability by north korea and ask beijing to take a firmer hand when it comes to influencing the middle east.

1:21 am

russia's war in ukraine is this big, continued obstacle, and there have been repeated threats of reprisal, so there are a lot of issues blinken is trying to thread the needle here. tom: you have long chart of the evolution of this relationship between china and the u.s. when it comes to efforts to stabilize the relationship, where are we on that front? >> there are two elements to watch. at the big trend is we continue to see both sides trying to stick by the commitments that were made between president xi and president biden in april of last year. a lot of discussions for example . lloyd austin spoke to his chinese counterpart for the first time after the chinese minister was put in place. meanwhile despite some of the developments like tiktok, china

1:22 am

has made a relatively muted tone including a response to things like the triple tariffs biden has proposed on chinese steel. when we think back to the response of xi jinping to the last trip by blinken, he described to meeting is very good. he was quite optimistic or at least praise the developments the two sides intimate. while it is positive we do have these conversations between lincoln -- blinken and his various counterparts, the backdrop in the u.s. has made things more hawkish, we have seen warm intimate policies aimed at potentially curbing china, and it is hard to see the more optimistic, more positive response from xi jinping this time around if they do meet as expected. tom: thank you very much for

1:23 am

breaking down the story around the u.s. and china. antony blinken meeting with his counterpart and potentially meeting with the chinese president later today. china's cleantech dominance is growing despite an all ensuring push from the west. our deep dive on the energy transition and those supply chains. that is next. this is bloomberg. ♪

1:25 am

1:26 am

companies looking to onshore cleantech. let's bring in the head of nef trade and supply chains team. we need more manufacturing capacity for green tech as we phase up to the competitive challenge from china? >> the energy transition, usually we are used to hearing things in a going fast enough, so this is an exception. when it comes to those watching -- the supply chain we have seen massive investment all the way up and down the value chain. it is unsurprising and unprecedented. right now when you look at solar panels, lithium ion batteries, china alone has enough manufacturing capacity to supply the world twice over today, and based on what is being planned we have got $460 billion plus

1:27 am

overcapacity spending. historically on is the dented and debate of an exception when it comes to decarbonization. tom: what does that mean for pricing? how does that challenge the economics around the all ensuring push? >> chinese manufacturers are under a lot of pressure, they are underperforming the general stock market index in shanghai. margins are squeezed, prices are going down. if you take a solar module, $11, things are falling off a cliff. it means deployment is going far faster than we expected. worse news when you were trying to justify manufacturing outside of china, so the u.s., eu, all these policy mechanisms. the economics of that is a lot more shaky.

1:28 am

right now the cost of the differential between chinese manufacturing cost at western manufacturing because has never been greater, so that could challenge onshore policies. tom: really fascinating and worth digging into in more detail. really fascinating. excess capacity of renewables, part of the ecosystem coming through in the consequences of that. there is plenty more coming up. we will check back in on the japanese yen, of course, her uncle's unhappy. i'm sensing an underlying issue. it's t-mobile. it started when we tried to get him under a new plan. but they they unexpectedly unraveled their “price lock” guarantee. which has made him, a bit... unruly. you called yourself the “un-carrier”. you sing about “price lock” on those commercials. “the price lock, the price lock...” so, if you could change the price, change the name! it's not a lock, i know a lock. so how can we undo the damage? we could all unsubscribe and switch to xfinity. their connection is unreal.

1:31 am

bloomberg daybreak: europe in london. these other stories that set your agenda. the yen hits a fresh low. 156 after the boj holds great steady and tweaks its language on bond buying. we will bring you the latest reaction ahead of governor ueda's press conference. stocks in asia falling higher thanks to a boost from big tech. microsoft shares surge on earnings as ai fuels cloud computing demand. plus, soft landing hopes down put, as the u.s. economy slows while price pressures move higher. rekha bets as the focus shifts to pce data out today. we remain in earnings season. we are getting lines crossing. it is a beat when it comes to sales. the chinese market doing some of the lifting for this french liquor maker. revenue coming in above the estimates, 230 7 million euros. the estimates had been for 232

1:32 am

million. quarterly basis revenue is a beat. they see in terms of margins they continue to hold their guidance for 2023-20 24 margin guidance. they are reconfirming that. sales out of china slightly better as the challenges in the u.s. market continue. organic growth in revenue from cognac coming in well above the estimates, so people are getting that at a rapid pace, up 15% versus the estimates of the contraction of 7%. organic revenue coming through from the cognac segment of this business. the revenue coming through broadly in terms of organic revenue for the fourth quarter contracting 0.7% with a contraction of 3.4%. a better salt -- a better part of results coming through with the chinese market turning around and taking the slack coming through from the u.s. we bring you the latest in terms of redhead crossing the terminal. we continue to bring you the latest on the earnings front.

1:33 am

we look ahead to the u.s. later today. we break down the tech story. the redhead crossing, the epc g is set to acquire 20% of steals unit. the details we will be hoping to get for more on bond. but again, the epc g group set to acquire 20% of the steel unit. we check into it at the market open 8:00 p.m. u.k. time. let's check in on the markets. we have to fold in the softer gdp data out of the u.s. and the fact that prices remain sticky. the question of stagflation on the lips of many when it comes to the u.s. story. the tech earnings propelled after hours. stocks higher around microsoft in alphabet. solid beats coming through. alphabet is your discipline -- dividend. pointing higher by 7/10 of a percent. ftse 100 adding 50 points. copper will get a lift. s&p future higher.

1:34 am

the nasdaq setting itself or a solid session this friday, looking to gain 1.1% on the beats that came through from alphabet and microsoft. cross asset, we are scrutinizing any moves around the japanese yen. 34 year low, and we are continuing to be on intervention watch. inflation data out of the u.s. could tie into any potential decision out of the ministry of finance in japan. 156 on the japanese yen. 157 60 according to bloomberg news in the analysis and the number crunching down versus the u.s. dollar in the session as the boj holds. the bloomberg economics team describing that as a dovish role. 499 on the two-year hold. euro-dollar out 107 and bread closing into $90 a barrel. up. let's get to the tech story, the detail around the ai component. strong ai demand has been cited as a key driver from positive

1:35 am

earnings from microsoft and alphabet. microsoft cfo says they are hope -- focus on continuing to achieve double-digit growth for the next quarter. >> fy 25 focus execution should lead to double-digit revenue and operating income growth. to scale to meet the growing demand signal for our cloud and ai product, we took fy 25 capital expenditures to be higher than fy 2024. tom: let's bring in rob from bloomberg intelligence. it has been a really fascinating week because metal was early in buying these gpu's, these nvidia chips. they were out ahead of their competitors. the cost is they've been punished. microsoft and alphabet are able to monetize some of this ai. talk to us about how the story is evolving and what these three tech giants are telling us about the direction of travel when it comes to artificial intelligence. >> sure, good question.

1:36 am

just cast your mind -- your mind back on alphabet or google. this made the headlines close to 10 years ago. made some early leads and progress on the ai side. a u.k. company called deep tech, if you remember that one. alphabet has been active or openly active in the ai space for well over a decade. ai algorithms underpin their core search business. it is sitting on a considerable amount of intellectual property and expertise. same is true for microsoft. obviously enhanced in the ai is enhanced by its stake in openai. compare and contrast with meta-is that meda is an earlier state in terms of its ai business and developments. i think that shows through on the numbers. arguably, meda is playing catch up. it's having to invest heavily in order to catch up its -- catch up to its peers. it's having a negative impact on

1:37 am

free cash flow. obviously, the higher amounts of capex has to put aim on that side is what the market took fright on a couple of days ago. compare and contrast with meta- -- sorry, without the bed and microsoft. both of these businesses are underpinned by a highly profitable cash cow businesses. alphabet is the search business whose quarterly growth hit in a quarter high, so that business is performing strongly at the moment, and underpinning the investments and ai. for microsoft, it's very well positioned within the pc software market. also, microsoft has a strong position on the cloud market. so there are, if that made sense. there are key differences between the two. basically, meda is playing catch up. tom: they are all spending heavily, billions of dollars in terms of building out that ai infrastructure. you have told us, and he flagged

1:38 am

it, we need to focus on how they are monetizing. what will you watch for in the months and quarters ahead in terms of how you get a better gauge of how the story is evolving? >> really, on the ai side, these companies appear to be monetizing it through the cloud business. again, that's a key strategic advantage that microsoft and alphabet have because they are much bigger cloud players. microsoft is the number two ranked in u.s. market for type -- behind amazon web services. meda has much smaller cloud business to its disadvantage, therefore that's why it's having to put extra investment on the capex side. again, ai has made huge headlines for the last 12 months. there's a lot of excitement and euphoria around it, but will we see the monetizing come through on a sustainable basis. we are in the very early stages of these business models still

1:39 am

being at an immature phase. i think the software companies are spending tens of billions of capex when their revenue that they are generating on the back of those investments are relatively low level at this point in time. tom: the keyword they came through a sustainable. whether or not the monetization and growth will be sustainable. really interesting. breaking down the consequences of the earnings that came through from microsoft, alphabet and tying it into the story around meda and how it informs our views on this ai story. let's switch focus to the airline manufacturers now because the airbus cfo set the plane makers ramping up production of its a350 wide-body jet. looking past weakness in its latest quarter. for more on the story let's bring in bloomberg's benedict who leads our aviation coverage. airbus and boeing both reporting earnings one day apart. what were the major differences between the two set of figures?

1:40 am

>> good morning, boeing came out on wednesday and have a relatively weak set of numbers as people would've expected. this is a company that has been in crisis for months. airbus coming out last night. the numbers weren't as strong as people had expected. they had a miss on the earnings. they had a cash outflow. we will see how the stock does this morning. it could be softer. some of the reason behind that for airbus is that they are investing heavily, as you say, they want to ramp up production of their a350 aircraft and they have to build up inventory and get the factories ready and that costs money. they also had an outflow because of employment programs. all these things contributed to slightly weaker numbers, but if you look at them side-by-side, obviously airbus is in a much stronger position than boeing is at the moment that -- at the moment. they reiterated the forecast and lifted the plan to build more

1:41 am

a350's. all in all, a fairly strong picture coming out of that european company. tom: airbus doesn't have the same challenges that boeing does in terms of these safety issues. in the regulatory scrutiny. they are not free from their own pain points. there are more so challenges for airbus. let's detail what those are and where we stand with those problems. >> the ceo spoke to guy johnson from bloomberg and he had a fairly cautious view on the road ahead. he said that we are still not out of the roads -- woods when it comes to supply chains. he pressed him and said many had the same problems during the pandemic. why is it that those issues are still kind of clinging to the airlines? and he said we are a highly specialized industry, we have a lot of people leave, as did others during the pandemic. we have to rehire and retrain people. this is taking longer than we thought. a lot of the supply chain issues

1:42 am

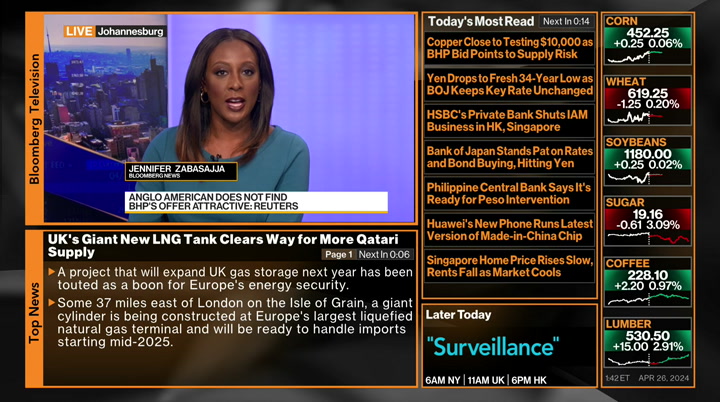

are lingering within the company. to some degree, as he said, they are a victim of their own success. they are building these planes at a record clip, and that's also very difficult to really get them out of the factory on time, the a320, the single airplane is hugely popular. they got a huge order yesterday for the a350. the demand side is strong but it's really a question of can they satisfy that demand with the factories that they have? tom: thank you very much on the airbus earnings and where that company stands versus its key competitor, boeing. he leads our aviation coverage. thank you very much. reuters is reporting the anglo american does not consider a proposed takeover from bhp attractive. the bid would have them at 39 billion dollars. if successful, the deal would create the world's largest copper miner. i'm joined by bloomberg's

1:43 am

jennifer zabasajja. let's get the view in terms of the south african take on this, because that is consequential as well. what is the view from south africa, what have we heard from officials and policymakers about this? jennifer: it's important to know how critical the mining industry is for south africa. not just that, anglo american has a long and storied history here in the country and also been the big contributor to jobs and to export, as we mentioned. but with this deal, the deal hinges on the fact that anglo american would need to spin off to south african listed companies, which is kuumba iron ore an angle -- anglo american platinum. these are important assets to the country, not just that, but anglo american is the fourth biggest on the ftse jsc. it's very critical to the industry and so the question is, if this deal were to actually go through, if the spinoff were to

1:44 am

happen, what does this mean for the mining industry, what does this mean for jobs. we saw angle this year announcing that they would have to restructure due to declining platinum prices. the big question people are asking is, what would these companies look like without their parent and what many people are saying, i was just reading the newspaper, that this is a lowball offer. the question is, will they go higher and may be value the company a little bit more? tom: jennifer zabasajja on the importance this deal has across the mining space in africa. an important angle to tie into the story. we continue to monitor the developments around that potential m&a. there's plenty more coming up. we get the take on this decision by the bank of japan to hold on rates. of course, we remain on intervention rock -- intervention watch. we bring you a guest with the insights after this. this is bloomberg.

1:47 am

tom: welcome back, the yen is at its weakest level against the u.s. dollar since 1990 on the heels of the bank of japan's decision to hold interest rates. the boj noting that it would continue its purchase of bonds in accordance with its previous guidelines. so that inflation will remain around or above target through 2026. i am showing now by senior research economist at aberdeen investments. top line, your take on what we will hear from the boj. the bloomberg economic seem suggesting this was a dovish old from the boj. >> i think going into this meeting there was an expectation of a more hawkish statement. in maybe those media leaks about change if purchases as well. in the wording around that was

1:48 am

very vague. a bit nuanced. it was up removing the reference but around the levels that we announced in the last meeting. so, all in all, so far, we do need to look at the economic outlook on the projections. it was motivation in 2024, fiscal year 2024, which is quite notable. it was .4 percentage points to 2.8. year on year. and so, the more important part would be the fiscal year 2020 six, which is a new forecast. and there, coming in at 1.9%. that's probably just showing that they do expect inflation to trend towards target over the medium term. now, there doesn't seem to be much focus on that. the yen is going through another cycle. tom: the 1.9% was not at the

1:49 am

target, it's within the hair of the 2% target. >> previously reroute 1.5%, so it is an improvement. however, i think the lack of qt, and the lack of further detail in the statement, it was a very short statement. i think that was a disappointment. so press conference will be really important. tom: the team said the markets are underestimating how many hikes are going to come through from the bank of japan. they expect three this year. where do you stand in terms of the sequencing of rate hikes that is expected from the central bank? >> by october or by the end of the year, timing is difficult with the boj. i do expect another couple of hikes, but very small increments. we are looking at another 10 beeps and another 10 beeps and that overall corridor around 25 basis points. the reason i have that, obviously it probably seems

1:50 am

dovish, but the reason i say that is because of the overall picture and that they are not in a position to really hike materially because that could be a policy mistake. let's look at what's happening with cpi. that is decelerating the headline in the core makers are decelerating. we had a disappointment on tokyo cpi. i would not look into that because it was a lowball regulatory issue. but, we do have some positives in that wage growth could pick up. we are not seeing realized wage growth pick up. the wage negotiations were strong this year compared to last year, but last year we did not see us feed through into realized earnings. we need to see that this year for them to really start hiking more materially. we've had a promising start. hopefully, in the april figures, we will start to see some pass-through. we had a few announcements that for the fiscal year some companies would come through and

1:51 am

hike prices. but we need to see that. tom: 150 612 in the japanese yen. you have a view they go gradually in small increments. that's a dovish forecast for the boj. can they really sequence and that in terms of the pressures coming through? to what extent does the softness of the yen strain that kind of policy action? >> i would say the risk for that few would be that they move a lot sooner and more aggressively. so you could go straight to 25 pips in july. so there are some risks. let's think about this, does an extra 10 basis points really make a meaningful difference to the carry trade or the rate differential? especially now, it's not just a yen story, it's the dollar side of the story we need to consider. look at the debate about when the fed will start the easing cycle. that has been shifted out by the money markets. it's a very challenging backdrop for the ministry of finance if they intervene in for the bank

1:52 am

of japan. that rate differential still stays quite higher. tom: does intervention happen, if it happens, does it have a material impact? >> so far they have been verbal intervention. material intervention, and this could happen a number of ways, it does seem that intervention the next 48 hours could be quite likely because the pace of the yen deceleration is going to be important. so far they have set it steady and they have allowed it to go through. remember when they have intervene and it starts as a psychological barrier for markets. we just haven't seen that recently. just a week ago there were discussions with japan and korea complaining about -- finance ministers complaining about the strength of the dollar. so there are spillovers from the's fed policy, was happening with fed growth and consumption. that's having spillovers.

1:53 am

tom: having at least soft approval for that thing. >> there could be a joint effort, potentially, that would be powerful, just on its own, japanese on its own is really difficult. tom: comprehensive for the bank of japan, consequences for the currency. senior research economist at aberdeen investments. plenty more coming up, stay with us. this is bloomberg. ♪

1:55 am

1:56 am

yesterday, the inflation story picked up. we get the core pc out later today. that may change the trajectory. for now, markets have gone from six cuts this year all the way to just one. that change in that repricing has been significant. let's flip the board and talk about the tech stories. higher rates ties in the what's happening with tech, valuations. the positive story came through for microsoft an alphabet. the fact they are able to monetize in the cloud business, the investments around ai. i want to give you a look at what's happening in terms of multiples and the valuation story. we know this is been a concern and investors are wringing their hands. look at tesla. it's at a challenging year. elon musk was able to sway those concerns and the earnings call. you are still down double digits for tesla and this is the 12 month blended pe, 59 times for tesla, despite the challenges it faces in the chinese market. all of that playing into the mix. meta-is looking cheap.

1:57 am

they had a challenging earning story in terms of the outlook. 20 times versus 59 times. that tells you a lot about how things are shaping up. let's have a look at the biggest story. i want to give you context in terms of softness. the japanese yen is down 40%. 40% versus the u.s. dollar. the bank of japan coming through with what bloomberg economic says was a dovish hole. that story continues to be in focus. more analysis on that through markets today. the team is going to join you in about eight seconds time period we go to break and they will be there with analysis and great guests. markets today is next. this is bloomberg. ♪

1:58 am

when i was your age, we never had anything like this. what? wifi? wifi that works all over the house, even the basement. the basement. so i can finally throw that party... and invite shannon barnes. dream do come true. xfinity gives you reliable wifi with wall-to-wall coverage on all your devices, even when everyone is online. maybe we'll even get married one day. i wonder what i will be doing? probably still living here with mom and dad. fast reliable speeds right where you need them. that's wall-to-wall wifi with xfinity.

2:00 am

7 Views

IN COLLECTIONS

Bloomberg TV Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11