tv Bloomberg Markets Asia Bloomberg April 25, 2024 11:00pm-12:00am EDT

11:00 pm

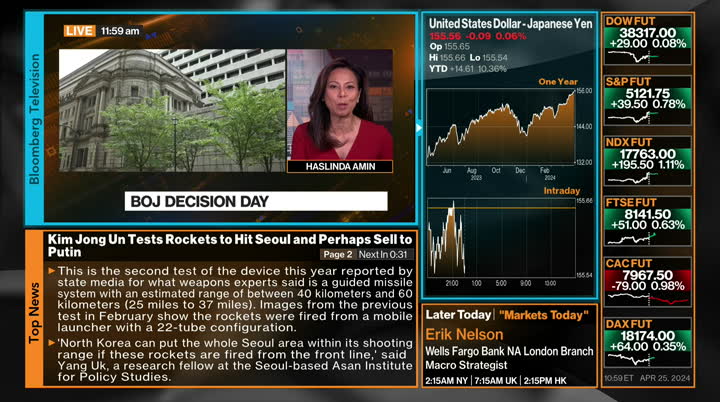

it's almost 11:00 a.m. in hong kong. 12:00 noon in tokyo. also coming up this hour, tech shares gain after beating expectations, but the limelight being stolen in asia. yields pushed to 2024 highs. sticky u.s. inflation eroding hopes for even a single set rate cut this year. china's top diplomat warns his u.s. counterpart that negative factors are ties between u.s. and beijing. avril, markets reacting to what we heard overnight. avril: from the u.s. on, the data we got the quarterly pc numbers, higher than expected

11:01 pm

but growth was soft. that's not something the fed wants to hear. similarly you take a look at data out of japan, tokyo cpi, even accounting for the start of education subsidies, something the boj might not want to hear, but we are still seeing stocks powering ahead today and this is six in large part to what we got on the earnings front, you had microsoft and alphabet. it really showed how ai is fueling growth. stocks are reversing, some of the softness from yesterday. we are seeing chinese tech, really stealing the limelight and hong kong markets headed for their best week since 2022. the yen is hovering flat against the dollar as we wait for what we get from the boj, let's take a look at stock market movers because i think that is what

11:02 pm

highlights how quickly sentiment can turn for some chip related names and how closely they are still tied to their u.s. peers and big tech names. yesterday, they slid and today recovering. let's look at jgb futures as well. as i said, we got data out of the u.s. overnight and that complicates things for the fed. it also puts pressure on treasuries that selloff, yields higher, reading into what we are seeing from japan, it's also about traders bracing potentially for the start of signals on quantitative tightening. we are anticipating hawkish signs because he has to keep the yen depreciation and check. haslinda: that's right, the

11:03 pm

anticipated conclusion coming up. let's dig in with mark cudmore. this on the back of the yen, at 34 year lows, but the weak yen is helping inflation in japan. the boj, a rock and a hard place . mark: you've raised an interesting point. i think all of the hoop law about a weaker yen is a little overhyped, don't think it's as problematic for the japanese economy as they think. the country still does not have high inflation, is not have runaway inflation. it is a problem in terms of it is the worst type of inflation so that is an issue and of course it is a major commodity importer. i think there probably won't be

11:04 pm

intervention. i expect the boj will probably attempt to be marginally hawkish but in typical fashion, they will mess it up. what the boj is good at is confusing and disappointing. [laughter] they will confuse and disappoint and after the press conference, dollar-yen will be higher. but it won't run away because the market is betting intervention. you have all of these hedge funds that will have downside puts in dollar-yen and i expect you get the pop in dollar-yen next week instead. haslinda: you say boj is confusing but he's been clear, he's data dependent and the data we got today was not pretty. tokyo inflation below expectation, below 2%, that makes it really complicated. mark: it does. i think the low inflation prints today -- morgan stanley did a

11:05 pm

great job of warning about this, there were some one-off adjustments, they were spot on and i only saw as the number came out so i didn't have much of a preview. it was a soft print. the fact is japan does have proper inflation now. is it really sustainable, is it entrenched? how much it disappears when you get a softening yen? what they don't want to do is enact a policy change that sees the yen surge across the next couple of years. they will worry if the yen keeps depreciating at the pace from the last couple of years, but there perfect world is probably to keep a cheap yen at this level. the rhetoric we've had has done its job easily but is not a sustainable management possibility. haslinda: is it true the yen

11:06 pm

intervention playbook is very different from 10 years ago? mark: absolutely. first of all we are talking about different ends of the spectrum. 10 years ago we were looking to weaken the yen as a currency. it's easy for a central bank to weaken its own currency. on a strict theory basis, just print infinite amounts and no one wants it anymore. but a central bank strengthening its own currency -- theory will tell you on an infinite basis that is a possible -- that is impossible. you can't keep printing other people's currencies to prop up your own. it's different when you are intervening to strengthen the inverses weakening. the bank of japan, everyone knows whatever they do it's only for a finite amount of time. they have to pick their moments well which is why i believe you don't get intervention until the

11:07 pm

year narrative changes in the u.s. and i don't think we are there yet. if they fire their bullets now, sure, dollar-yen turnaround for the short-term but you get the whole discretionary macro hedge fund community going brilliant, thank you, you are letting us sell yen, we appreciate that. [laughter] haslinda: thank you so much for your candor. the bank of japan is likely to make any revision in its inflation forecast. our next guest thinks the number will be above 2% for the next three years. why? >> thank you for having me. to the point on the possibility of boj revising its inflation forecast the next three years, i think it's likely the boj will put an inflation anchor around 2% given we are seeing more evidence of this virtuous cycle

11:08 pm

forming in japan. by putting inflation forecasts at a higher level compared to the previous outlook, it perhaps gives the market a signal that the boj is gathering more evidence and getting more confident and comfortable about japan's inflationary trajectory. haslinda: the thing is, it is not likely to be comfortable with the inflation print out of tokyo today, right? >> i think we have to put this in a broader scope. the japan economy has been de-anchoring from the deflationary impulse the past few quarters and now is on the path to increase inflation in a new print. the boj governor has been mentioning that the boj is not adopting a data dependent approach in terms of future rate policy decisions good we think the inflation finding path will continue and as we mentioned about wage growth being fairly optimistic, it's very likely --

11:09 pm

it is more likely than not that the boj inflationary trajectory is going to be on a gradual rise going forward. haslinda: what are you exactly looking for for the end of the year? 50 basis points for the next two years? >> i think the boj policy rate decision is not going to be conducted in isolation, it also depends on what the fed does going forward. the base case of a soft landing scenario where the fed will eventually start to cut rates, we think the boj will also likely hike its rates in a gradual manner. in the base case we think the boj is likely to hike its rate once this year, and again likely in q3 or q4. haslinda: we know the and is in

11:10 pm

focus, 155 and change, how much intervention do you think is needed and what is the level you think japan is comfortable with? is it below 150? >> i think for the japanese yen, it's not just a weakening yen in asia. we see weakening pressure across asia and fx. that is essentially driven by a stronger dollar momentum right now. in terms of intervention, i think the japanese authorities might focus much more on the pace of depreciation to make sure it is not disorderly compared to asian peers. i think there are no specific levels we are looking at but rather the pace of depreciation matches more to them. haslinda: fair to say if the yen depreciates steadily toward 160,

11:11 pm

the boj and ministry of finance would become for bowl with that? mark: -- >> it depends where the u.s. yield lands, it's accommodation of the boj allah see mix and what the fed does. haslinda: in terms of tucci -- qt, what do you see the boj doing? >> that will be the focus for the boj meeting this month. we will hear more on their plans to scale back qe, but we think the boj are likely to continue to adopt a gradualist approach which means once they are firming up, seeing more inflation gathering in the economy they will conduct cutie in a gradual manner as well. haslinda: are right, you are sticking around. you can turn to your bloomberg for more on today's boj decision. you can get commentary and analysis.

11:12 pm

ahead, we turn the spotlight on asean economies as they look to defend their economies. we will have more on the biggest risks later this hour. keep it here, this is bloomberg. ♪ when you automate sales tax with avalara, you don't have to worry about things like changing tax rates or filing returns. avalarahhh ahhh

11:14 pm

11:15 pm

dialogue, cooperation. this is welcomed by our peoples and the international community. at the same time, the negative factors are still increasing. the relationship is facing all kinds of disruptions. haslinda: our senior reporter joins us on the line with the latest. it's about balance, he says. what you make of those comments? ian: i think it's oscillating between stability on the one hand and volatility on the other. we are seeing a stabilization drive for the u.s. and china, but at the same time there is growing concern in the u.s., especially with the election, the rhetoric on the u.s. side is increasing when it comes to chinese economic support for

11:16 pm

russia, the china sea, there are things china has been doing the u.s. doesn't like despite pushes by biden to stabilize relationships. there is growing demand to make it clear to china and broadcast the u.s. isn't going to put up with some of this chinese behavior. on the chinese side, you have a very clear message today laying it out for blinken, saying this relationship can go in two directions and it's up to you guys. to some extant we are where we always are on u.s.-china relations. things seem to be moving steadily forward, there is no big blowout like when speaker pelosi went to taiwan. we are still in a situation

11:17 pm

where one of those incidents put the relationship from a steady path over into something more volatile. i think that was clear from a comment on both sides. there are factors on the chinese side and the domestic and economic challenges they have, ukraine facing a resurgent russian push. and the philippines and others seeing aggression in the south china sea, you have a potent mix. there is a stabilization drive like we've seen over the last six or seven months. haslinda: thank you for the update. let's bring back our guest from fidelity international. she believes china's outlook

11:18 pm

from -- four controlled optimization is supported by policy measures. talk about these targeted policy measures. >> for china's case, our base case for stabilization remains intact. we have seen support from sectors reflected by activities and supports and in terms of growth we are on a gradual recovery path. services, consumption and industry activities are on track and property sectors continue to face pressures. under this scenario i think the policy is determined on yield growth drivers, which means targeted easing policies will be rolled out to support these growth drivers, to stabilize the

11:19 pm

growth going forward. haslinda: those new drivers won't be kind, yes the target of 5% this year, what are we looking at in the coming years? peiqian: i think it is a balancing play in the short-term , where policymakers balance the negative or structural headwinds coming from the old growth drivers well continuing to nurture the new growth driver to become more important part of the gdp growth. going forward i think we are still in a re-anchoring process. it's probably more challenging to estimate china's potential growth rate going forward. as the new growth drivers become more important, it's hopeful china will continue to reestablish long term, medium to high growth rates. haslinda: we've been talking

11:20 pm

about antony blinken's visit to china and for the u.s., it is about overcapacity, an issue it's been ringing up to china. how do you view this issue? is it sector specific? peiqian: from an economics perspective i think china does face overcapacity in some sectors. by our evidence-based research, overcapacity is more evident in the property related industry and supply chains and that's partly because of china's long-term drive to shift its growth away from property driven growth models. that is inevitably creating overcapacity and deflationary concerns. other sectors, such as the manufacturing sector, we're not seeing excessive overcapacity on that front. recent performance is better than expected and a reflection

11:21 pm

that china is ramping up capacity in the manufacturing sector. haslinda: take a look at the new on -- yuan, it has been strong against a basket of asian currencies. does it reflect china's fundamentals right now where it is trading at? peiqian: i think from a fundamental perspective, the renminbi is establishing a relatively stable momentum right now, in line with our expectations of china's growth pattern being in a controlled stabilization scenario. even though we are facing more yuan weakness pressure against the dollar, that's in line with other asian effects also facing weakening pressure because of dollar strength. on that note i think the yuan is fairly stable and it's very likely policymakers will maintain such stability in the interim. haslinda: stable because of the

11:22 pm

fixes we've seen. in far -- as far as pboc policy, what are you seeing? peiqian: i think it's likely they will maintain stability because it acts as an anchor to asian effects to some extent. the monetary policy, we look out for gradual easing going word with a focus on providing liquidity as a fiscal easing has been taking the heavy lifting of stimulus in the coming quarters and we look for marginal rate cuts as well, which are likely to come in the second half of the year and when the fed rate path becomes clearer. haslinda: it all depends on the fed. we thank you so much for joining us. plenty more ahead, keep it with us. this is bloomberg. ♪

11:25 pm

haslinda: of course we have a breaking news out of the boj, something we've been anticipating. the boj keeping rates steady, a range of zero to 0.1%, that decision is unanimous. the risks to prices are skewed to the upside for fiscal 2024 is what they are saying. an overnight call rate at 0.1%. it has dropped. the wording on buying the same amount of bonds as before. the decision is unanimous, keeping rates unchanged at a range of zero to 0.1%. this was pretty much expected, the boj expected to hold rates after its first hike in march,

11:26 pm

its first since 2007. the focus now on the boj updated quarterly inflation and growth forecast, we are waiting for that presser at 2:30 local time. let's bring back our guest, she will be joining us shortly. let's get her reaction right now. as expected for the boj. peiqian: yeah, i think the boj decision is fairly in line with our expectations. the rate decision was unanimous and the boj definitely sees outside risk of inflation. it's likely the wage inflation virtuous cycle is gathering were evidence. haslinda: boj also seeing underlying inflation is expected to rise gradually, a sentiment you expressed earlier.

11:27 pm

peiqian: yes, i think from what we observed in this year's inflationary trajectory, we've been completely the anchored from deflationary expectations in japan, but we are still on a pathfinding trajectory to a new level. i think with more evidence on wage growth gathering pace, it's likely it will contribute eventually to a higher inflation trajectory, which is likely to anchor again around 2% in the long run. haslinda: if it is as expected, why are we seeing the kind of reaction in the yen right now? it is touching new 34 year lows. peiqian: i think that is the market expecting or hoping for hawkish rhetoric from the boj given where the yen is trading right now.

11:28 pm

the boj is being very patient and adopting a data-dependent approach and wait and see approach to see what is going on in the economy, especially on the inflationary front. haslinda: we are waiting for comments at the pressure -- the presser at 2:30, what you think the governor will address? peiqian: we are waiting for some key comments, firstly his view on fx development recently and the implications of domestic inflation and whether it will affect the boj policy mix going forward. also more important, we are hoping to hear from the governor on his assessment of inflationary development, whether or not he sees a fundamental change in japan's inflationary path. haslinda: any surprises for you? peiqian: so far the decision has been in line with expectations

11:29 pm

but again, i think the press conference in the afternoon is more important for us to seek any guidance from the boj going forward. haslinda: the boj says the risks to prices are skewed to the upside for fiscal 2024. what might drive that? peiqian: it's likely coming from the imported inflation as we mentioned earlier, the and is facing weakening pressure. as a result we will definitely see imported inflation picking up and it will affect the headline cpi's in the short-term. haslinda: hang tight, let's get analysis on the yen from our chief asia fx and rate analyst. we saw the yen falling to a fresh low, the market didn't get what it wanted to hear. >> i think the clear message is

11:30 pm

they are not going to start tapering. that's what you saw the yen weakening, the market didn't get what they want. play think what is interesting, the statement itself is very interesting. the format has changed, much shorter, more concise. there are lines saying they will do what they said in march. so, that is going to stay. but having a shorter statement actually is preparation for them to sort of fade out the kiwi going forward. -- the qed going forward. haslinda: what can you see the minister of finance doing with this? stephen: from ap's perspective, if you look at the last few weeks, the yen has dropped. the pace is alright, but if the yen drops further, 156 beyond that, probably they will have to be stand by. but the pressure with -- presser, we expect it will be

11:31 pm

hawkish. haslinda: it comes against the backdrop of higher for longer in the u.s.. now traders are expecting only one cut, perhaps none at all for the year. how much intervention is necessary to keep the yen at a level they are comfortable with? stephen: actually, until the fed cuts, we think there will be upside pressure. what happened two years ago, despite the interventions, it didn't help. the yen rebounded against the dollar temporarily but quickly dropped because the rate differential story is still the main driver. that is why it could not keep the yen from dropping. haslinda: in terms of intervention, what are you anticipating? peiqian: i think it is definitely on the radar, especially when the dollar-yen is trading at such elevated levels. and beyond what they will do, we have to watch out for any

11:32 pm

potential moves in asia impacts because at the same time we see the korean won and chinese yuan also facing weakening pressures. haslinda: we have been talking about dollar-yen. we should also be talking about yen-yuan. i think that is an interesting pair we should be looking at. stephen: the yuan-yen is at a record high, if i am correct. that is because the pboc is clearly holding onto the yuan. it is outperforming in asia because it is not dropping beyond 7.3. that will be the case in the near term, unless the dollar drops further. with the pboc holding the yuan, the yuan-yen will have to drive higher. haslinda: for japan, it is important because china is japan's biggest trading partner. peiqian: yes. in terms of trade, definitely a

11:33 pm

weaker yuan-yen. but given that both are under weakening momentum and also the final demand from the develop markets are increasing, so overall i think the weak currency is helping asia broadly. haslinda: you talk about how it is important for it to happen perhaps we can in a gradual manner. the yen has sunk further. let's take a look at where it is trading at this point in time, if i can get the yen up. 156.02. this 160 the next level we are looking at? stephen: if it goes to 157 or 158 today, that is too fast. but for now, the big level in the market haslinda: is 160. they may intervene with some actions. what actions are you anticipating if they do it today? stephen: it is small intervention. they will have to sell dollars. haslinda: peiqian, we have lines out of the boj. it call cpi at 2.8% versus 2.4% previously.

11:34 pm

is it overly optimistic in coming to these numbers? peiqian: i think it is fair, according to our assessment. it is very likely that inflation will continue to remain above 2% in the short-term. and in the long run, it is going above 2% for the long-term trajectory. so, i think this upward revision is somewhat in line with our expectations. based on this, i think the likelihood of further boj rate hikes later this year becomes firmer. haslinda: before we let you go, there are implications for the rest of the region as well. it is not just about the yuan and the yen. it is also about others. stephen: we saw them hike rates, surprisingly. compared to other asian central banks, indonesia targets the currencies. so, they have to hike. it is very hard for them to cut rates if they are not hiking further.

11:35 pm

haslinda: peiqian, we kicked off the year expecting asean central banks to start cutting rates. stephen talked about bank indonesia. who is next? who is under pressure to take action to defend their currency? peiqian: i think broadly if you look at the asian central banks, it is very likely that most central banks will now delay their rate decisions if they are on a rate cut path. but if you look at who will resume the hikes, it is likely we look out for economies where inflation, especially core inflation, especially core inflations, are relatively elevated levels. central banks including korea and taiwan are what we are looking for in terms of potential hawkish rhetoric from the central banks. haslinda: peiqian, thank you so much for that. stephen chiu and peiqian liu. bringing us up to speed on the latest from the boj. plenty more ahead.

11:37 pm

to me, harlem is home. but home is also your body. i asked myself, why doesn't pilates exist in harlem? so i started my own studio. getting a brick and mortar in new york is not easy. chase ink has supported us from studio one to studio three. when you start small, you need some big help. and chase ink was that for me. earn up to 5% cash back on business essentials with the chase ink business cash card from chase for business. make more of what's yours. haslinda: let's do a recap on the boj headlines. the boj as expected kept steady. it did tweak the bond buying language. the yen sliding to a fresh 34

11:38 pm

year low. let's check in on japanese markets again. avril hong is with us again. avril: you can really see the spike in dollar-yen after that decision, choosing to keep rates on hold, as expected. but i think what markets were bracing for was potentially those signals that we would see the curving of those bond purchases. that wasn't something that came through. no quantitative signals just yet. wait and see what we hear from ueda's presser a couple hours from now. the other thing that stood out was that firming of the inflation expectations for this year, and the expectation also that we will see potentially a bit softer groove. and as traders digest the data, the signals coming out from the boj, let's take a look at what we are seeing in some of the other currency pairs because they yen is not just weakening against the greenback.

11:39 pm

let's flip the board if we can. it is weakening against the aussie dollar. this is also a day where we got data out of the u.s. remember that stagflation chatter coming back to the fore with that quarterly pc number coming in hotter than expected and gdp coming in soft. that is feeding into the higher for longer narrative. even though the dollar is still sitting a bit mixed, we are seeing that pressure coming through on asian currencies, the rupiah. remember what bank indonesia did in defense of the currency. haslinda: that's right. something unexpected. bank indonesia actually wanted to cut rates starting the year. expect further dollars strain keeping settle backers in asia on the defensive. thank indonesia raised rates to

11:40 pm

a record high to guide the rupiah. our next guest sees continued downward pressure in asian currencies. let's bring in the economist from hbc global research. this is the dollar strength story. >> correct. this is very much the story we have been seeing and a lot of asean countries, which is this prolonged strength in dollar, and it is tied into the repricing of that rate cut expectations, which at the beginning of this year when the market pricing as many as 67 rate cuts, but that had been pushed further to the end -- to later this year with lesser magnitude. that is why we saw bi hiked its rate compared to market expectations on hold and very much the driver there was an urgency to support the rupiah. haslinda: is b.i. an outlier, or are you expecting others will do

11:41 pm

the same? who is under pressure? yun: for a lot of the asean countries here, it is a very mixed picture in terms of its monetary trajectory. we actually saw vietnam with the very first asian central bank to cut as early as last year, and this year, the rj hiked. if we look at the other five asean countries, for indonesia and the philippines, we still expect them to be the likely candidates to cut. it is just that we have pushed our cut expectations to later this year, to probably the last quarter of2024. you also have malaysia, thailand, singapore. these countries we put on the -- in the on hold camp. for singapore, inflation very much the concern. for thailand, the bot has made it clear that it wants to address the long-term issues. whereas for malaysia, they are more offside risks to inflation because of the uncertainty on

11:42 pm

rationalization. it is quite a mixed picture here. haslinda: give us the sense of how challenging it is for central banks in asean, given that inflation is driven by factors they don't really have control over, like high oil prices, high rice prices, for instance. and what are the options for them? yun: correct. i think for oil prices, for food prices, this is traditionally the supply side of inflation factors. that is why in theory that monetary policy has limited scope to address them. but i think increasingly we need to be concerned about the spillover effects to core inflation. especially in terms of the rice prices. it is the main staple in asia and matters a lot for the other countries. the policymakers and central banks in asean cannot ignore that. haslinda: no disinflation so

11:43 pm

far. so, it is kind of curious that asean central banks have maintained their inflation forecasts.why is that so? if you look at singapore, they expect inflation to subside later in the year? yun: if we actually look at singapore's inflation data, this week we saw a downside surprise here. but if we look at the breakdown, i think the story remains the same, which is we are seeing a lot of stickiness in core inflation, and do not forget that in the second quarter of this year we will also see higher electricity prices, higher water prices. what the mas made clear in its statement about two weeks ago is that -- it sounded slightly more optimistic that core inflation is indeed dissipating. but in terms of tone, at best, it was quite neutral. for mas, for singapore, high elevated and a sticky core

11:44 pm

inflation remain the concern here. that is why we don't expect them to move anytime soon this year. haslinda: we started the conversation talking about the strong dollar. as far as asean central banks are concerned, how much ammunition, how much capacity do they have to intervene in the markets to prop up their own currencies? yun: i think a lot of the central banks have been doing that through various different tools. but if we look at asean's fx reserves, a lot of them are facing the uppers despite trying to be creative to easing on the different tools, like what b.i. has been doing before the rate hike. for most of them, until we see a meaningful turn in the brown dollar or we see clear signs that the fed rate cuts are going to happen, we probably see a little respite for currencies. they will continue to have done your -- downward pressures for a lot of them.

11:45 pm

haslinda: what do you see is the biggest risk for asean economies right now? yun: inflation really is in terms of the stickiness inflation, and at the same time policymakers are so caught in this lower -- sticky inflation with a little bit subdued growth metrics here, especially in terms of growth, i think that prevents a lot of central banks from doing a rate hike because of the nascent recovery of the growth forecast. in terms of trade recovery, we are very much in the nascent stage yet. haslinda: yun liu, hsbc global research, thank you so much for joining us today. it is 11:45. india kicks off its trading day. we know asian markets are in the positive. in fact, asian markets having their best week this year, and it does seem like the benchmarks in india are joining in.

11:46 pm

sensex up. the nifty up 0.2%. we talk about the indian ruby, steady at 83.33. let's do a check on japanese assets as well as the boj cap rate, releasing a very brief statement which is unlike what we have seen in previous quarters. the yen slides to a fresh 34 year low after that decision. the boj sees risk skewed to upside for the fiscal year 2024. it expects easy financial conditions to continue for now. for now, the yen sliding further. take a look at that. still ahead, announcements on china's strong tech rally as etf inflows signal possible moves. keep it here with us. this is bloomberg. ♪

11:48 pm

11:49 pm

3.4% at this point in time. that is on the back of asian tech in a fitting from that stellar earnings we saw overnight in the u.s. turning now to another big market story we have been tracking all week. chinese tech stocks have been posting double-digit gains while the u.s. peers look set for monthly losses. but data from etf inflows have also signaled that the rally could fizzle out soon. for more on this, let's bring in robert lee and rebecca sin. my favorite people. rebecca, let's start with you. what are inflows saying? >> inflows have been positive this week. as you said, the tech rally in hong kong has been phenomenal, 8.5%. they hold names like jd.com, tencent, alibaba. we have seen huge inflows. the largest hung tech etf saw 71 million dollars in inflows just this week alone. but some of these people have a

11:50 pm

profit opportunity because it has rallied so much. we have seen up close. they saw 33 million in outflows. etf's sare roughly 43 million dollars in outflows. it is really positive sentiment across the board. haslinda: the question is whether it is sustainable. can fundamentals support the actions so far? robert: i don't think there is any debate about those stocks being at low valuations. and it downside news is priced in. take a company like $.10, which we have talked about before. it is solidly positioned. the fundamentals look intact. using that as an example, i think it is justified and understandable with the bond fishing going on, looking at asian stocks which have materially outperformed international peers for people looking for value plays within asia and hong kong in particular.

11:51 pm

haslinda: but it is susceptible to movements in volatility because it is dependent on sentiment as well. all it takes is a headline to send tech stocks in china crushing. robert: not wanting to tempt fate with that comment, haslinda. [laughter] but yes. one of the bigger overhangs that has impacted the market in recent years has been the regulatory issues. based on our view, we think the regulatory outlook is stabilizing. obviously, the chinese government wants to support its tech sector, given the economic challenges it has at the moment. these are stalwarts. i think on the regulatory front, we are more likely to see a more stable outlook going forward, and the likelihood of anything coming from left field is less at this point, and that should make for a more stable operating environment, which should ultimately help underpinning the earnings outlook. haslinda: you wonder in terms of the u.s.-china tech, because we are seeing gains at a time that

11:52 pm

people are reassessing their positions in u.s. tech, given where valuations are right now. rebecca: i think if we look at where the sentiment is right now, the hang seng is down 5.5% this year versus the nasdaq, which is up 3.3 percent. for a lot of investors, this week was a signal of hope for them. i think to rob's point, a lot of people are viewing this as buying the depth, or fundamentally the companies are still very strong. i think a lot of this is politics driven. last friday, the announced changes to the etf connect scheme, which is the majority where the hung saying etf sits. they have lowered the threshold for the etf's that are allowed. for example, they dropped from 217 million to $64 million. from a percentage point of hong kong equities, it used to be 90% and is now 60%. this was very positive for the market. it shows they are committed to the china market, and we may see

11:53 pm

as much as $10 billion worth of inflows on southbound alone. this allows for more opportunities. with valuations, china tech is cheaper than the u.s.. to rob's point, fundamentally they are still very strong. there's a lot of growth opportunities in china, especially if we look across ev. a lot of names have done well this year and i think that sector will continue to grow. haslinda: we saw how tencent helped drive the rally in chinese tech recently because of that new gain. it is the sector likely to drive chinese tech sector, versus ai, where there is a lot of pressure from the u.s.? robert: that's right. i think all respect to tencent, they are playing the long game, investing heavily, but they don't have significant cash flows, and they can afford to do that. any incremental changes is likely to reveal itself in a two to three year view, not this year. so gaining a significant portion of their revenues. there was a little wobble

11:54 pm

earlier in the year. but with this new gain released, things appear to be getting back on track. even if, not wanting to tempt fate, if we saw another wobble in the gaming site, the real drivers for a company like tencent is there fintech business and advertising business, which is just over 50% of their revenue, versus domestic gains, which is around 20%. the upsides in those areas should continue to outweigh any risks. haslinda: optimism this friday. robert lea and rebecca sin. by the way, they have been right in their productions. let's take you back to markets. take a look at where we are in terms of how asian stocks are doing. the best week for the year. asia grinding ever higher. almost all sectors are in the positive. tech front and center on the back of the results which we saw overnight in the u.s. take a look at that. we have the tech sector up by about one point.8%

11:55 pm

in asia industrials, health care, finance also in the positives. also keeping an eye on japanese assets on the back of the boj keeping steady as expected. it did release a very brief statement, which is quite different from what it is used to doing. the yen in particular is front and center, starting 34 year lows since that decision. past 156 and a change. the level we might be wanting to look at is 158, but they say the next level to keep an eye on is 160. in terms of the topix, it is up. nikkei futures also in positive territory, in line with the rest of the region. some of the lines from the boj, it did say that the risk to prices are skewed to the upside for fiscal 2024. we are waiting to hear from governor ueda. he has that presser at 2:30.

11:56 pm

perhaps we will get some guidance on when the next rate hike may be. that is it from bloomberg markets: asia. daybreak: middle east and africa is next. do keep it here with us. this is bloomberg. ♪ when you automate sales tax with avalara, you don't have to worry about things like changing tax rates, exemption certificates or filing returns. avalarahhh ahhh ahhh

12:00 am

0 Views

IN COLLECTIONS

Bloomberg TV Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11