tv Bloomberg Surveillance Bloomberg April 25, 2024 6:00am-9:00am EDT

6:00 am

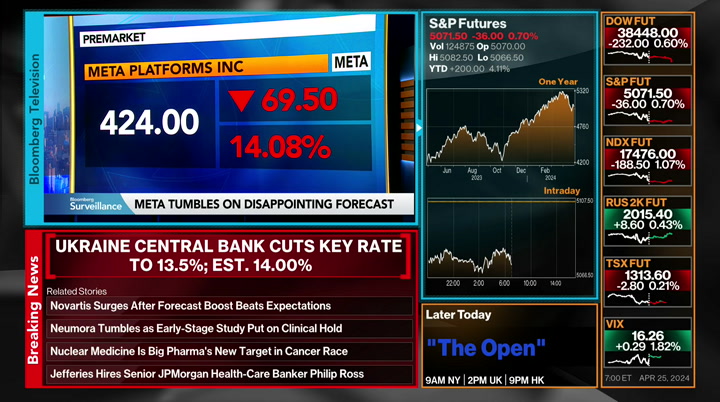

>> earnings matter. that's really clear. >> a lot of big news, but that said, tech companies need to deliver. >> from a valuation perspective, equities are somewhat rich here. >> we still think that there is room to run with equities. >> this is "bloomberg surveillance." jonathan: let's get your morning started. this is "bloomberg surveillance ." let's get meta on the screen, down by 13%.

6:01 am

it was down even harder overnight. it's the year of efficiency coming to a close over at facebook. they have come to invest aggressively. a very big change over at meta. lisa: i had the great high for looting words from tesla, the reaction was the opposite. they didn't want to see this in terms of investors. they wanted to see dollars and cents. the year of efficiency was different from what people expected. jonathan: i think that profit more than doubled. the focus was firmly elsewhere. annmarie: what with the stock trading at if they hadn't talked about reality labs and were softer when it comes to capex spending. he was watching the share price in real time.

6:02 am

the product of scaling was the clear monetize of opportunity. lisa: all i can say is that this is a fickle bunch. investors are taking back what they gave, they enjoy the idea of efficiency. now they are rightsizing it. it was a lot lower for the likes of tesla and boeing. here is a company that wants to invest in artificial intelligence. remember when that used to mean something? people are not having it. they had the increase of 27% revenue from a year ago. jonathan: it certainly meant something to nvidia. to lisa's point, tesla was down by 40% when you look at the earnings. meta was up by 30%. this is a lot to talk about. later, microsoft and alphabet after the close, jobless claims, one of the last big data points,

6:03 am

pce tomorrow morning, going into the fed next week. jonathan: how much -- lisa: how much did immigration support the base and how much of it is fueled by government spending? that will be an ongoing discussion as we hope head into the seven year options. jonathan: the five-year was soft. lisa: setting up that idea of being further out on the curve giving you a harder time. jonathan: equity futures are softer, but turning to the bond market, dirty $4 billion. we will repeat that all morning for you. happening this afternoon, unchanged, but coming up on the program, we catch up with ben as meta weighs in on u.s. equities.

6:04 am

bloomberg, microsoft, alphabet, with judy coronado head of u.s. gdp a little bit later this morning. top story, big tech equity futures, ben saying this -- " profits growth is slowly rebalancing away from big tech, but they continue to do the heavy lifting." you say don't fear the recent selloff. should i fear the selloff in meta this morning? ben: i think so. 80% of companies are beaten. all sectors are running well ahead of expectations. the problem is guidance. it helped with tesla, it hurt with meta. there is a message there. tells us to look for more macro uncertainty out there.

6:05 am

i take that with the territory, given the set up that we had coming into earnings. but big tech is important. magnificent seven, s&p 500, growing earnings something like something like 40% this quarter. everyone else is struggling to keep flat. this is important. i think there is still a lot to play for. jonathan: even what we have learned, what does it mean for the big names this afternoon? ben: markets telling us they are more concerned about costs, guidance, margins. that's going to absolutely be the focus. both of these companies have a lot of levers to pull.

6:06 am

expectations are clearly important. something like alphabet looks slightly better set up with expectations lower, valuations a lot lower than microsoft. again, what are we, we have had two reports so far with a couple of the big ones tonight and then into next week we have apple. lisa: do you buy aggressively into the selloff? do you love it? ben: definitions are important here. we have barely seen a 5% pullback, from that perspective. over three per year. forget about 10% duration. the average entry of drawdown on the s&p 500 is 14%. this is barely a ripple. the reason we are talking about it is low volatility, the rally

6:07 am

since october. but to answer your question, absolutely. the pillars of the bull market are in place. earnings recovery with rate cuts in the u.s., in the rest of the world, there's all that cash sitting on the sidelines and maybe we have begun to see it already. the average bull market, i think we are barely getting started. annmarie: you said something that we were ahead of, the fed put before everyone else, we laughed and everyone came around to the idea with a pivot party. yesterday speaking with pimco, they said the pivot party is over and that seems to be what the market is suggesting. how is that still your base case? the market saying. jonathan: we have pushed back

6:08 am

the magnitude and the timing for rate cuts. to your point, we are making money different ways. growth has been stronger. earnings expectations have been tested here in the earnings season and it is really important. i still don't think it we can assume the fed is going to pay interest rates. maybe the tariff has changed, that's a recipe for volatility that we have seen across asset classes a recipe for commodities forming better. that's the market looking at the tail risk. we are a long way from that being the base case. as long as rates stay restrictive and as long as this productivity boom continues. productivity running at twice the average levels, that's the secret sauce, here. if that continues we can throw the needle of strong growth on the inflation. annmarie: can you talk about the geopolitical risks?

6:09 am

ben: that's a head fake. the tail risk is the fed cutting interest rates. that's the rally, the second figure. the market is not pricing in higher interest rates, here. it's got a risk chance but we are a long way from that being the base case and if it came the base case, that would be negative for markets. annmarie: not the base case, but what about the probability of a hike? ben: call it 10%. the change was from zero and that is what has been the fundamental driver of the pullback we have had. that is why volatilities are, especially bonds, with an fx following. jonathan: let's talk about cash on the sidelines.

6:10 am

people in fixed income are trying to get in from elsewhere further along the curve. if it's not lower rates, it's higher rates. i'm trying to work out why that is a supporting factor now. ben: it's an incremental support. markets on fundamentals are important. i still think that whether you look at the numbers, your money market funds, or anecdotally, the feedback we are getting from investors, a lot of money missed the rally on the october lows. they are very technically looking at the pullback here, even if it's only the 5% we have seen so far. annmarie: can you characterize how bullish you are compared to six months ago when you were ahead of the game, talking about recessions that never materialized? ben: less bullish since then.

6:11 am

we are not looking for rate cuts anymore. valuations are above average. earnings expectations are higher . the outlook in the u.s. is less growth, but i don't think it's bad. they made money in the u.s. and the real opportunity is everywhere else, where valuations are lower, where you will get rate cuts. economies are already week. i think the real opportunity here is in the rest of the world with sectors outside of big tech. that is where you have lower valuations going wrong. crucially, profit margins are low. there are two ways to make money with other assets. i think that tech is well supported, but high earnings are high. jonathan: sounds like you like europe. is that right? ben: yeah.

6:12 am

emerging markets, cyclicals, europe, absolutely. ben bearish on europe as long as i can remarry at -- remember. profit margins are depressed, you've got a cyclical indices. the ecb is cutting interest rates in june. maybe not dramatically ahead of -- much more than in the u.s.. that's a combination that gives you real money in stocks. jonathan: can you point to the examples in the last 10 years? ben: there are some of them. europe has always been cheap. deserves to be cheap. apart from the ftse valuations

6:13 am

today, they are 20%, 20 percentage points cheaper than the 10 year average. i would make a version of that argument at any point. it's the catalyst. the ecb is going to cut. it has more profit margins and is more sensitive to these catalysts. jonathan: great to catch up, buddy. let's talk about things international for a moment. people talking about intervention, 100 5560. lisa: the obvious intervention is a rate hike. there's a pot -- policy monetary perspective. inconceivable for them to do that, but i'm curious to know why. jonathan: snapback from the u.s. administration, isn't this what

6:14 am

you would say to the japanese? annmarie: they would say you have the tools you can use yourself to get the currency where you want it to be. it was interesting, janet yellen met with the finance minister and the finance minister of south korea and implied that they understand the complaint but the administration behind the scenes is probably telling them that you can deal with it yourself. jonathan: we will see what we get from the japanese. here is your bloomberg brief this morning. that's checkup with dani burger. dani: the biden campaign said that they would continue to use their tiktok account, the irony being day said bytedance must force a sale. they say the band will not kick in for another 270 days. a transformational deal is in

6:15 am

the works the likes of which we have never seen that haven't seen in a decade for the mining industry. bhp made a takeover bid for anglo american, creating the world's biggest copper miner, though passing governmental approval is a different story. best story of the day, the jeffries ceo has sold 65 million shares to get himself a got. in a statement he said that the sale was a gift to himself and his family and he doesn't intend to sell further shares and that he remains oldish and committed to building a full-service investment bank. it's the first stock sale he's made and 35 years at the investment bank and if we are ok with bezos selling his shares in florida, what is a yacht between friends? jonathan: love that story. i think so many other people

6:16 am

did, too. commenting on anglo american, copper, the new diamonds, the journal is reporting they might spin it off before they complete the sale. lisa: and it raises the question of the domicile around the company and what london is going to do in terms of serving as headquarters for these me -- major mining companies. jonathan: up next on the program, the big spender from meta. >> the expectation was that we were going to keep the costs in check. jonathan: meta down hard this morning. live from new york city, good morning. ♪

6:17 am

6:19 am

lisa: jonathan: -- jonathan: squeezing out a third day of gains on the s&p 500, but under surveillance, meta has a big spend. >> the actual quarter looks pretty good. looking at the top line growth, 27% is a good number. outgrowing everybody else on the digital side. the expectation from most was that they would keep the costs in check. the fact that we are not seeing that is spooking a lot of investors out there. jonathan: investing billions

6:20 am

more than expected in artificial intelligence, the facebook parent revenue forecast fell short of s emits, looking ahead to microsoft and google after the close later. mandeep singh joins us now. if i said to you at this time yesterday they would deliver topline growth below 20%, but would you have said to me? mandeep: the only caveat would be that if they lost $4 billion on reality labs. even yesterday, they called out air glasses and wrote down inventory in lapsing vr, putting into question that there are no investment markers in reality labs and no path modernization. ai is being monetized across all products. it's making the recommendation

6:21 am

better for targeting. you can see it. why not get more clarity? jonathan: what about the capex figures that we saw yesterday? mandeep: i think that what you are going to see is the numbers are going to go sideways? all the capex will be reflected in the gross margin over time. microsoft will come up with the prophets in the market will probably cheer that. that is what meta needs to do. they need to separate the reality labs component versus the ai component. lisa: this is where i wanted to go mandeep: we know that the

6:22 am

glasses for reality labs are going to be 15 billion this year. take into that is the write offs for the vr devices that weren't sold. in terms of capex, you could argue that some of it has overlap. you can be used -- it can be used for developing infrastructure. i just question, how do you monetize a rvr? are you going to show that to the people who are using devices? what's the path to monetization? hardware is a low gross margin business. they are subsidizing the hardware. negative gross margins. you don't have a path to monetization in terms of advertising. why are they investing so much?

6:23 am

lisa: at the same time, they are minting money and if you are buying a stock to buy growth, with respect to tiktok and getting potential users, the idea that they grew the revenue year-over-year is substantial. why is that not more meaningful? it could get a room from the ai investments. mandeep: they have got a lot of drivers that look solid in terms of revenue growth. it's a market of their own within the social media platform. they want investors to be focused on the ai opportunity as opposed to ar, because they have so many things they could do. it's all in the service of monetizing ads. annmarie: let's talk about chinese advertisers getting in front of american consumers.

6:24 am

they are uncertain about the future. why? jonathan: it's reflected -- mandeep: it's reflected in the wide guidance. it's where the spending could come back. advertisements are auctioned driven mechanisms. there are other advertisers where the ad pricing could take a hit. in the end, this is the company that has the attention of 3 billion users, globally. where else are you going to vote? annmarie: the cfo had said that it was too early to assess the impact, but the countdown is already done. when could they potentially say how they feel about this? mandeep: next quarter. the creators will have to find another home.

6:25 am

they will move either to youtube or to the meta place with their property. you will start to see that migration and i expect the tailwind to be there. jonathan: short videos have become massive. reelz makes up 50% of the time people spend on instagram. isn't that a guide to the kind of world we are moving towards? mandeep: the recommendation is powered by ai. all of the capex is being utilized in an effective way. the recommendation is getting better and they are making it easier for advertisers to create the campaigns using ai. meta is the biggest use case out there in terms of what ai can do and they are deploying it very effectively. jonathan: coming up shortly, we

6:26 am

will catch up with michael at 22 v research as sanctions possibly loom over the latest trip from antony blinken to china. in the bond market, the 10-year is 464. things are stable going into that auction a bit later. lisa: it was a weak auction, with fires -- buyers that want to buy. jonathan: initial jobless claims with the u.s. gdp, a few hours away. live in new york, this is bloomberg. ♪

6:27 am

(upbeat music) there's more to business than the business you're in. if you use data, that's the privacy business. manufacturing on demand? you're talking cloud business. got a few million hyper-connected customers? digital experience business. that was fast. that's where deloitte comes in. with the right combination of talent and technology to help advance and connect all that it takes to excel in business ... to the business i'm in. deloitte. to finally lose 80 pounds and keep it off with golo is amazing. i've been maintaining. the weight is gone

6:28 am

and it's never coming back. with golo, i've not only kept off the weight but i'm happier, i'm healthier, and i have a new lease on life. golo is the only thing that will let you lose weight and keep it off. who loses 138 pounds in nine months? i did! golo's a lifestyle change and you make the change and it stays off. (soft music) her uncle's unhappy. i'm sensing an underlying issue. it's t-mobile. it started when we tried to get him under a new plan. but they they unexpectedly unraveled their “price lock” guarantee. which has made him, a bit... unruly. you called yourself the “un-carrier”. you sing about “price lock” on those commercials. “the price lock, the price lock...” so, if you could change the price, change the name! it's not a lock, i know a lock. so how can we undo the damage? we could all unsubscribe and switch to xfinity. their connection is unreal. and we could all un-experience this whole session. okay, that's uncalled for.

6:30 am

jonathan: three days of gains on the s&p, just about yesterday, the longest winning streak in a month so far on the s&p 500. equity futures taking some of it back, off by .9%. meta laying on that time, 5% on the nasdaq 100. there's lots to talk about in the bond market through the belly of the curve. earlier this week supply was taken down well. data was soft encouraging the bid. further along the curve, things are softer in the five-year auction with a seven year this afternoon. the 10 year, just about unchanged. going back to data leaks, maybe

6:31 am

it's what comes out in about two hours time. lisa: which do you think will be more interesting? i'm not sure, given that we have a sense of the government fueling the gains we saw and how much growth can be spent in the u.s. jonathan: any claims on the deviation that we've seen in the last several months? i think it's like 212 on repeat for weeks and weeks with very little movement on either side, encouraging people to think you are getting a job sprint that's just a week away. lisa: the reason why it isn't the data point that people have been looking at because it has been flatlining in terms of change. an interesting moment because we don't know the data that's going to matter. s&p global was probably the most important data point of the week. jonathan: is the s&p carrying for soft data in america? i think you know where i'm going. the japanese need safe data.

6:32 am

not in japan, but in america, the dollar-yen positive by .2%, it's been relentless through the year. much more so through this month. lisa: we were heading towards intervention level a month ago. this raises the question, what is the threshold and are they going to move without you just said? weaker data making it easy to throw money at it. at this point, why is it inconceivable that the bank of japan will hike rates if they are so concerned about depreciation in the end? annmarie: i wonder how much this is weighing on japanese executives. they said that 130 is what they would like, they go out and they use the yen to purchase boeing, airbus, and they said that this is a problem, a big problem right now. you have to imagine that they are calling off -- calling up the finance ministry and airing the complaints. the way the finance ministry came to washington, d.c. to air

6:33 am

their complaints. jonathan: shares of meta plunging on a week of revenue forecast as they plan to spend billions on artificial intelligence with microsoft and alphabet set to report. 20%, but we have come back since then. i wonder if it moves through the day. lisa: i agree, a lot of this is a knee-jerk because the bar is high. the year of efficiency, as you said, seems to be over. i think that mandeep nailed it, how much is throwing good money after bad and how much is investment in artificial intelligence? annmarie: exactly. he's talking about microsoft and apple when it comes to spending they don't like reality labs and the subsidizing these sunglasses. how do you monetizing it -- monetize it in the future?

6:34 am

it helps to improve the core business of these companies and if they came out and talked about the capex spending, very little goes to reality labs more to ai. jonathan: southwest, look at this headline, limited hiring with voluntary time off programs as well. they are in very different places in this country at the moment. lisa: especially if it is a domestic lower costs. wider than people had expected after the 31% loss. the revenue for passengers was lower than expected. again, the two speed airline industry of people traveling overseas, and first class, able to pay a lot more with people going on vacations with their families feeling pinched? jonathan: let's talk about that initial data. expected to confirm a booming

6:35 am

economy with a median estimate seeing a rise of 2.5%. personal consumption jobless claims are due out. pc data at the consumer sentiment survey comes out tomorrow going into the weekend. turning to the secretary of state, raising concerns over trade support for russia on the latest trip to china, meeting with communist party officials before heading to beijing, he's expected to invoke the threat of sanctions on supporting the war machine in russia. michael, good morning to you. let's get into this. i heard it from janet yellen, we will hear it from antony blinken, when do we start to see the policy? michael: a sanctions push is not something that will take likely -- lightly. chinese banks are taking this seriously as well. i would guess that the move is not imminent, but the threat has to be taken seriously. lisa: is it enough for the banks

6:36 am

to change course? michael: for the large banks, beijing is likely to let them manage their own risk, but in terms of a large bank and absolute terms, with iran and north korea, the sanctions risk has really embedded that institution. annmarie: there's questions around china bringing iranian crude or china supporting russia, if not outright, it could help them with the materials that they need. tiktok, south china sea, what's their main request overcapacity? when do you go in there and say that you need to sort this immediately? michael: it's a long list and i don't think that blinken is going to carry water on trade. clearly, he's going to make that point, but higher on his agenda will be the chinese support for russia, iran, and access to the

6:37 am

israel gaza conflict. south china sea is a flashpoint that people sometimes sleep on. tensions between china and the philippines, that could bring the u.s. in quite easily in the sense that they are a treaty ally with the philippines, so if there is an accidental collision , the issue moves to the front burner. lisa: how much you think the conversation is going to sound like this -- we are so much better than the other guy will be, so work with us? michael: i don't think that will be an explicit part of the conversation, but the election is certainly on the minds of the chinese. they don't want to see china become more of the center of the u.s. election and they already are with issues like tiktok, so it is incentive for beijing not to let the issues flare up too much. at the same time, it somewhat limits the biden negotiating

6:38 am

leverage, because the chinese don't know who will be president a year from now. it's so -- it's going to be on everyone's mind but not raised in the conversation. lisa: you said that trade will not really be the main issue, they will be talking about support and trade with russia and the global interference around geopolitics. how do you do more around trade in these issues where economics is increasingly determining geopolitics? michael: they can't be divorced, especially when you think about the excess capacity issue that is tied to the strategic competition over to clean energy. if you look at the export controls, which are a trade issue, right, it links directly back to national security. it is definitely going to be a part of the conversation and the chinese will be pushing back forcefully on u.s. tech restrictions. they have been characterizing this as an obstacle to chinese development and it is getting

6:39 am

closer to a core redline issue for china. it's absolutely going to be a part of the conversation. jonathan: japan will be watching carefully. how do you think countries like the united states will maintain national security cooperation with japan at a time when this cooperation is tested. when we talk about tested, looking at the fx market, how do you maintain cooperation in one when cooperation with the other is more fragile right now? michael: the u.s. japan relationship is very solid. there is a mutual interest of their with enough time spent on the relationship to be able to see through issues like nippon steel. the exchange rate isn't an issue. -- is the issue. it the same one on the chinese side. you have the prospect of geopolitics seeping in.

6:40 am

jonathan: what did you make of what happened last week in washington, d.c.? the relationship that they had with the secretary? michael: clearly, it's showing interest on both side in managing these. it's a complicated task. when and how do they intervene? we have seen the conventions so far and frankly they are fighting against a pretty strong fundamentals in terms of the strength of the u.s. economy and the prospect of the fed being higher for longer, so there are limits to how much intervene -- intervention can do. lisa: -- annmarie: how much is secretary blinken going to rely on allies like the european union and the fact that the biden administration is a post of the trump administration has taken a multilateral approach saying it's a group of us that you will have to contend with? michael: it's a big part of the

6:41 am

conversation and the biden administration once in needs europeans to step up on these flashpoint capacity, this for countries like germany than it is necessarily for the u.s. economy. it's an even more existential threat to european security than it is to the u.s., so the u.s. is counting on the europeans to do more. whether they will remains to be seen. president xi will be visiting france next month and that will be an interesting test in terms of how they are going to push back. annmarie: how nervous -- lisa: have nervous is tim cook around of the businesses that rely on china? michael: if i were tim cook i would be more nervous around the macro situation and the consumer

6:42 am

remaining week with rising competition then from the political risk. he's got to manage that. we are thinking about the outgrowth around tesla. those are bellwether chinese companies. beijing has to be careful about over retaliation. this is a time when china is trying to revive confidence in the economy. a strike environment us are less of the brand name marquee names. it more closely tied to technology competition, areas where you know, those companies are more at risk, but frankly beijing does not have great options in a time when they are trying to revive the economy. jonathan: thank you, michael. updating you on the bloomberg brief, dani burger. dani: the u.s. chips act announced this morning and this time it is macron getting up to

6:43 am

$13.6 billion in grants and loans, confirming our own reporting from last week, used to build out new american factories but the expansion comes with risk for micron given the memory chips that can cause rapid swings between shortages in gluts. the columbia university governing body is still backing the president as calls for her resignation grow. they say that they support her amid the ongoing protests in the world -- the war of israel hamas. they have shifted to hybrid classes after 100 pro-palestinian protesters were arrested for violating police orders. u.s. births declining to their lowest level in 40 years. the new data comes from the national center for health statistics. this trend has been happening for two decades. the drivers behind it will come as a surprise -- no surprise with things like family leave, student debt, and a pandemic.

6:44 am

the data underscores the importance of immigration to sustain u.s. population levels. that is your bloomberg reef. jonathan: a level not seen since 1979, wealthy nations facing the same issues. up next, booming u.s. economy. >> the core issue of demand growth will be incredibly strong. it's a hot economy and it is not really consistent with inflationary pressures. jonathan: that conversation is around the corner at 8:30 eastern time. starti is never easy, but starting it eight months pregnant, that's a different story. with the chase ink card, we got up and running in no time. earn unlimited 1.5% cash back on every purchase with the

6:45 am

6:46 am

6:47 am

morning. jobless claims with gdp for q1, a booming u.s. economy. >> the core measure of gdp will be incredibly strong. that will be the third quarter in a row we have gotten core gdp growth above three, something we haven't seen since 2014, absent pandemic related rebounds. it's a hot economy that isn't consistent with inflationary pressures. jonathan: the latest this morning, first quarter gdp is due with an increase of two point 5%. judy coronado wrote this, that it appears that q1 will feature a solid gain in productivity that is particularly encouraging and meets robust growth that is less inflationary. nonetheless, it's adding to the sense from the fed that they can take their time. going into this, judy, let's start with gdp and then we can

6:48 am

talk about the labor market more broadly as well. what are you and the team focused on when you get the q1 release? judy: we are of course focusing on the u.s. consumer, as tiffany had just mentioned. running very strong around 3%. the overall pace is expected to step down with consensus at 2.5% , reflecting trade taking a bigger bite. highlighting that the u.s. is the outperformer and therefore imports are outstripping exports and trade will take a bigger bite than it did in the second half of last year. again, i think that overall the picture is going to be robust. we already know that it worked for the quarter and we are moderate, 1% aggregate hours worked growth. implying with a strong topline

6:49 am

that productivity is going to remain very strong. not as strong as the second half of last year. still at or above what we think of as a long-run trend. that is the secret sauce of a soft landing. it's really key, productivity continuing to be the driver of these strong prints and not the labor market tightening again. jonathan: when you identify the sources of u.s. growth underpinning the boom, does that tell you that this could be more durable than people think? michael: i -- julia: i do think so. i've been encouraged by a lot of things that are different this cycle from last cycle. we have seen a lot more business dynamism, something that had been lacking the entire expansion following. to see that kind of strong

6:50 am

dynamic business formation with a hot labor market yielding dividends form a better productivity and matches between employers and what he's, strong productivity gains. i think it's got some legs here. that is one key driver. another key driver is immigration. we know that there are just more people. the labor supply backdrop has been incredibly strong, allowing the labor market to cool off despite strong gdp numbers. there is no sign that that is going to slow down this year. it would take some policy that would bring it down over time, but the flow that we are tracking, we have monthly flow workforce visa granting, legal workers coming here to work and it is across the earnings

6:51 am

spectrum and across a professional spectrum, from low-wage to high wage workers. we are still playing catch-up from pandemic. people want to come to the u.s. and work, so that has been a great driver of resilience and strength and allowed inflation to come down, despite the outperformance. jonathan: you alluded to the end of it via policy shift, are you saying it's harder than policies let on? julia: it takes time. these are not just switches you can flip. one of the reasons we have been talking to the government officials about why the workforce visa granting has been so strong in the last two years, part of it is just these agencies have been re-staffed. some of the processes have been

6:52 am

streamlined. there has always been demand and we have been seeing increasing delays in processing of allocations for workforce visas and green cards. that process is now working more smoothly. you know, these things, these things take time to build up, that infrastructure, the infrastructure is humming right now and that is again yielding a very flexible backdrop or the labor supply. lisa: government spending, how much do you think that will feature into the strong gdp print that we are expecting and about 90 minutes? julia: it's an excellent question and has been a big source of strength. we have seen full evidence of the infrastructure bill and the chips act. ira, boosting spending from the federal government and through state and local governments. that is one element that looks

6:53 am

to be tracking cooler in the second half of last year. a still robust gain, 2.5% at the state, local, and federal level, but it is something we will be watching closely, because that race is down -- pace is down from a 5% pace in the second half of last year at the state and local level. government spending has been an important ingredient through all of these bills that were meant to increase investment across a range of areas, including infrastructure. it has been an important source of growth and hiring. state and local government hiring has been one of the bed rocks of job gains over the last year. really, running much stronger, and if you look at it in a variety of ways, state and local government were so cash-strapped after the housing crash, historically they are at low

6:54 am

levels of employment. they have room to run. not only are federal bills boosting state and local spending, but state and local governments are flush with cash. property tax and sales tax revenues have been pretty strong . they are kind of rebuilding a bit. that has been a source of resiliency. this is a noncyclical less interest rate sensitive sector providing a foundation of resilience. despite other sectors struggling. lisa: how durable do you think the government spending is at a time when there is increasing concern over government deficit? julia: it's not going to last forever. the bills that were legislated, they don't have a tail for long years. it's not deployed overnight, but in our forecast the government added half of 1% of the gdp for about three to four years reflecting the bills that were

6:55 am

passed. if someone goes on to play catch up, the delta on the revenues will be positive. we will see it slow down. i don't expect the performance from the second half of last year to persist. we are likely to see in the first quarter that it would be close to the run rate this year. julia: -- jonathan: julia, thank you for the breakdown. going into first quarter gdp, the read is 2.5 percent, previous number, previous quarter, 3.4% with jobless claims important as well. that is going into payrolls about a week away.

6:56 am

lisa: raising questions over what job growth could look like. it's shocking. there was an increase projection of 128 percent in terms of immigrants from 2025 to 2027 coming in. annmarie: it was projected to be 1 million and is now 3.3 and what they have done with the recent uptick in immigration in the united states, they said that this could add to roast a mystic product $7 trillion over the next decade. jonathan: amazing. payroll is next week. 246 is the estimate so far. pretty punchy, isn't it? near 50. chris harvey, tobin markets, catching up with greg peters. why this bond market is still in the bison. lisa: what's that mean?

6:57 am

6:58 am

when i was your age, we never had anything like this. what? wifi? wifi that works all over the house, even the basement. the basement. so i can finally throw that party... and invite shannon barnes. dream do come true. xfinity gives you reliable wifi with wall-to-wall coverage on all your devices, even when everyone is online. maybe we'll even get married one day. i wonder what i will be doing? probably still living here with mom and dad. fast reliable speeds right where you need them. that's wall-to-wall wifi with xfinity.

7:00 am

>> i think the fed needs to weigh in. the bar has become pretty high. >> our forecast is that the fed is going to cut this year. >> we are expecting rate cuts in the second part of the year. >> we want rates to be stable and we want certainty. >> seems like the pivot party is over. >> this is "bloomberg surveillance." jonathan: live from new york city, good morning, good

7:01 am

morning. the second round of surveillance begins right now. i'm jonathan ferro. checking out meta, we are on top of that stock this morning. down by 14%, it had been close -- lower by close to 20. the numbers weren't bad. if you woke up this morning and thought it must've been terrible, revenue was up 27% from a year ago, profit doubled. a solid first quarter. but when you talk about the outlook around capex, that is when people start to get upset. lisa: they believe it will be 35 billion dollars to $45 billion. it doesn't sound so bad. it depends on what they are investing in. if it is ray bans that give you access to virtual reality, not so much. that is what mandeep singh laid out for us. jonathan: you can't talk about where the name is now without discussing where the mood has been over the last year or so, it had been up aggressively

7:02 am

compared to tesla. like a mirror image of the tesla story. lisa: it highlights, i don't want to use this word but i have to, idiosyncratic how companies are. happy talk was better for boeing. meta, not so much. the hopefulness is met with consternation from people who want the year of efficiency and a feeling of stripping back to focus on add revenue and a focus on market share. annmarie: i think that one of our reporters last night on the earnings call said that investors like everything ai, you can monetize it and it comes back to the core business of better advertising. what they don't like is the metaverse, reality labs. how do you make money off of the sunglasses? you buy the hardware but what is the service attached? jonathan: the year of

7:03 am

efficiency, coming to a close. alphabet and microsoft, later after the closing bell. numbers, u.s. gdp jobless claims this morning, the last big data site going into the fed next week. lisa: i don't even know what to do with it. a lot of people seem to have expectations around pce, but how big is the surprise one way or the other to move a needle in the market? i keep going back to the idea of s&p global composite pmi data. did that move the needle? just a bit of weakness? is that where the bias is right now, people responding to weakness just to justify a fed? jonathan: you said this, no conviction in the market. broader equities, down three quarters of 1% on the s&p 500 with a bond market going into auction a little later. that's where the 10 year is. unchanged on the day.

7:04 am

coming up, chris harvey of wells fargo. kit jukes and greg peters, talking about rate hikes. the meta outlook is tracking futures lower with more big tech on deck. wells fargo, the most bullish target on the street, midterm choppiness related to outlooks and rising rates. the target is 5535 but when will we focus on a return quote -- profile? chris is with us now. good morning to you. 5535 up from 4635. what changed? it's a big change. chris: we knew that we were moving numbers higher, but i didn't know how much higher. we look at things last year and we expected the market to be up 10%, maybe 15%.

7:05 am

that was pretty good at the time, but we missed by 10% and what we figured out was the market was being a lot more aggressive on how it's discounted. it discounted a lot further into the future and is using a much more progressive forward multiple. taken into consideration, we realize we could get to 270 and could use the 2021 multiple getting us over 5500. that's really how we got there. what we think will happen is not that the economy will be strong, but it's the mission of the winners winning and more probable companies will make up a bigger percentage of the s&p 500. within this is a corbat on mega cap tech? chris: most are those, but it's not every single mega cap tech being a profitable company. but yes. lisa: is there anything in the earnings that you see from those companies that make you concerned? chris: what makes me concerned

7:06 am

is we haven't learned anything new at this point in time. the consumer is still value-oriented and selective. we kind of knew that. people like to travel. services over goods, those kinds of things. we knew that as well. what we are waiting for, looking for, and what we think is ai spend is not discretionary. maybe we see that going forward and it is a part of what we saw last night. we think that there will be a separation between the winners and the losers with a separation getting bigger and bigger. lisa: the separation has been in returns but also earnings, like southwest coming out with underperforming losses. people liking to travel, there are signs that that is being challenged on the margins. american air, a similar disappointment. how much does this make you shift the companies that you like? does this mean that the ai

7:07 am

darling cash winners can keep going but that the broadening isn't going to happen? jonathan: delta -- chris: delta is different from southwest, higher end consumer, more business-oriented. what's going to change? the biggest question is two trains in the marketplace. the winners keep winning. as far as positioning what we have been doing for the last year and a half, barbell communications with something more defensive. health care, utilities, we want balance and protection in the portfolio but want to participate on the upside. lisa: if the fed only cuts once, how do you change your target? chris: don't change it at all. if you go back to 2021 when the fed was set -- two aggressive

7:08 am

cycle. the continuity is going to help. what else is backing it up? secular ai trade is not going anywhere. it's broadening to powered electrification. the m&a story keeps getting better. one cut, to cuts, three cuts, we don't care, it's the start of a bigger cycle. annmarie: it's not base case, but what if there was a hike? chris: that would be good. [laughter] annmarie: but isn't there a risk of increased u.s. exceptionalism? chris: i don't know about that, but i tell people that if this was your first day on the job, you would not come to the conclusion that the fed's to cut. the economy is stronger than expected. we are in a bull market. credit squeeze of less than 90

7:09 am

basis points, the consumer is fine and while the fed says things are tight, i see the parts where it's tight, but people don't have to tell you, you feel it in you know. i'm surprised the fed is telegraphing easing as much as it has. to me that is very surprising. jonathan: my favorite line of yours over the last few years, brace yourself. [laughter] coming out of pandemic you said it would be spring break for adults. did you expect it to last this long? chris: i did not. it's too early in the cycle, it's hard to tell. it's a long spring break. jonathan: wish i could work out what to do with discretionary based on that. discretionary, discretionary, go go go. what is it now show mark chris: i think it's more producers over consumers. consumers, again, they spent

7:10 am

what they needed to spend. they are being more selective. i'm not going to spend a lot for that. if i can jump on a plane and travel, i will, but in terms of data, it's been soft. the ai trade, that's the secular trade. discretionary spending is not ai, it's nondiscretionary and it begins to build out, right? secondary and tertiary trends. the data set power surrounding that. the electrification. i think that if you are looking for a narrative, consumers, producers over consumers, its eai trade, the momentum trade, so i hard growth market. lisa: you mentioned m&a, that is something we have been talking about a lot, how much it can happen given the recent ftc action. chris: that's a great question

7:11 am

and one thing that we keep saying that we think will happen -- people ask how you handicap elections and what you do. what we look at is who is going to control the senate, right? that's very important. if the gop takes over, it's better for equity markets and i think that this time around, the regulatory environment is very different. if you see the change in the senate, it helps to accelerate longer-term in the m&a cycle. lisa: aside from a rate hike in the reserve, what could crack your confidence as we parse through the data that matters most? chris: how long do you have? [laughter] right now, rates. i'm worried about rates. equity rates there's something where i buy strengthened isil week is. -- strength and i sell weakness. we could see for, 5% 10, 5%

7:12 am

break are we just seeing people manage expectations or are they telling us something different? i purchase strength, i sell weakness. a downturn of 3%, 4%, 5%, that could turn to a selloff very quickly and those are the things we are worried about. jonathan: chris, been great. good to see you, mate. equity markets are little bit softer, driven by earnings yesterday, going into microsoft at alphabet after the close later. updating stories elsewhere, here's the bird brief with dani: dani burger. because we -- dani burger. dani: because we have not talked about it enough, that revenue forecast suggests additional prospects are not as strong as some had expected and potentially there is a sense of

7:13 am

disappointment for alphabet earnings today. we were told earlier this morning that they were worried about the digital ad backdrop. >> in the north american, the global picture, tech companies, things are looking more challenging than before. dani: southwest shares are getting hit premarket. lisa, you mentioned that. the statement this morning, it showed how big of a toll the boeing crisis is having on the industry as a whole. they said that group slowing would end the service at four different airports and they will have to and hiring around of voluntary need and southwest is only set to get 20 of those back -- those max airplanes. david calhoun says they are

7:14 am

making progress to fix manufacturing issues and that boeing will meet the annual free cash flow goal six months later than anticipated. as for the earnings themselves, they burn through 3.39 billion dollars with shares higher in the post market because, as an analyst put it, it could have been worse. jonathan: that is how low dani, thank you. up next, the president signing the foreign aid l. >> products made by american companies here in america. jonathan: that conversation is up next. good morning. good morning.

7:17 am

jonathan: stocks down by .6%, squeezing out the gains from yesterday on the s&p 500. softer this morning off of the back of meta numbers this afternoon, the outlook disappointing you, you being the people selling the stock. the 10-year at the moment, the euro is stronger by .2%. did that feel personal? jonathan: yeah -- lisa: yeah, it fell personal. were you disappointed? jonathan: i couldn't care less. lisa: carry on.

7:18 am

[laughter] jonathan: the president, signing the foreign aid bill. >> these are products made here in america, including $1 billion for additional humanitarian aid in gaza. israel must make sure all the aid reaches the palestinians in gaza without delay. jonathan: a $95 billion package including aid and language that would ban tiktok unless its chinese based parent company divests, writing that we continue to believe that this will become an effective ban based on the expectation that beijing will block divestiture. that we expect the prevention of the tiktok algorithm will be a big part of the transaction. tobin joins us for more. i have been going through this for the last few weeks and asking this question repeatedly.

7:19 am

it's clear as the tension and rhetoric started to build from the united states towards china, what's clear from our perspective is the policy initiatives that will be deployed going into november. what are you expecting to see? for the most part -- tobin: for the most part, we are seeing the biggest things we are going to see, like this tiktok and, probably the last big thing that congress will do before they head into the traditional pre-election inactivity. there will be more conversations about inactivity in the future, but nothing will get done. from the administrative perspective, from the biden perspective, semi conductors, the biggest swings we have seen so far. secretary blinken is evidently in china right now threatening financial institutions if they don't start -- stop sending dual use goods to support the russian war machine.

7:20 am

i don't think that is going to come through, though it is a serious threat. those are the biggest, most confrontational moves on tap. last place, so finally getting the long awaited reorientation of the section one tariffs we have on chinese imports, the administration has been talking about this for literally years, but it seems they are on the verge of raising tariffs on ev's, solar panels, and other things, like lower value goods. overall we are locked into confrontational policy, despite attempts to take down the tone. lisa: the clock has stashed annmarie: the clock -- annmarie: the clock has started on tiktok. what did we learn from montana when they had their band? tobin: i don't think that precedent is usually relevant to the federal level. montana had a state level ban last may.

7:21 am

it was preliminarily enjoined by a district court is being appealed. the cases underway, but the big rationale for blocking it is that states don't have jurisdiction over foreign policy and that this was clearly a china measure, not fontana consumer protection, not the providence of states. that doesn't apply here, they say that if anyone makes policy about what we as a country want to allow in terms of ownership, its commerce. they will be afforded a lot more discretion -- discretion by courts than the state. i don't think that really is much of a positive signal for the company. annmarie: but do you think that it survives litigation in the courts? tobin: i think it does, i think it does. they all made first amendment arguments, but in a national security council, courts tend to

7:22 am

defer substantially to congress and the presidency. it's important that this is a newly passed law explicitly for this purpose. the other precedent people .2, trump try to ban tiktok in 2020 using executive action under a long-standing law. in that case, there were specific carveouts covering informational materials that tiktok fell under, but it is now a different situation where congress says they have can temporarily asked you to do this thing, it's different from others you have seen from both biden and trump where they reach for some obscure provision to do what they want to do because they cannot get congress to act. here, congress has acted. lisa: do you -- annmarie: do you expect a response from beijing? tobin: it's an interesting

7:23 am

question. i'm certain we will see something, but i don't necessarily think it will be substantive. this question came up a lot around semiconductor export controls. there were a lot of questions. i think the judgment from beijing at this time was that we have at least as much to lose from the u.s., from any retaliation, so we saw these kind of token efforts around restrictions of chemicals that were important for semiconductor manufacture. in this case you could come up with symbolic italia tory moves they could make targeting american companies, but of course chinese rules already prohibit comparable companies from operating within china, so it is not as though they have a direct conversation that is germane, since they have long band u.s. platforms from operating in china.

7:24 am

people pointed to u.s. moves against apple and other companies as signs of things to come, but i don't think that we will see dramatic retaliation here. the opponents of unilateralism, telling the u.s. not to let ostensible concerns get in the way of free commerce, and i do think that that -- that's how the lisa: what are they asking you more about, retaliation or lena con? tobin: that's been a long-standing conversation and it comes up in a lot of contexts, relevant work to a broader swath of investors since the ideal activity across every possible sector is indicated by with the ftc is doing whereas these sanctions affect some much

7:25 am

more than others. semi conductors being the foremost example. lots of questions over the course of the last three years over what the ftc would do and what they are up to, and we have been thinking a lot about what that looks like as we feel what trump wins would mean for antitrust. we tend to think that he would steer antitrust more towards a pro-business direction, but it's not totally obvious, because there are a think pressures within the populist wing conservative coalition of the party that have been supportive of what the doj has been doing, so at a minimum i think there will be a tug-of-war over that. jonathan: in some ways, looks like they are on the same page. thank you, sir. can you get anything done in this country now? annmarie: this is the reason why

7:26 am

when we hear from people like chris harvey looking from the m&a wave, where does it come from if you see a lot of them and sling before they get off the ground? a lot of questions, they are doing some really interesting stuff. lisa: the highest number of merger challenges since they have en route hired in 1976. j.d. vance, potentially avp pick , the only person he agrees with is lena con. jonathan: impressive stuff. lisa has been looking forward to kick jeeps -- kit juckes all morning. ♪ hey you, with the small business... ...whoa... you've got all kinds of bright ideas,

7:27 am

that your customers need to know about. constant contact makes it easy. with everything from managing your social posts, and events, to email and sms marketing. constant contact delivers all the tools you need to help your business grow. get started today at constantcontact.com constant contact. helping the small stand tall. at enterprise mobility, our experts always see another road. because when there's no limit to how far mobility can go, there's no limit to how far businesses can go. (♪♪) i don't want you to move. there's no limit ti'm gonna miss you so much..

7:28 am

you realize we'll have internet waiting for us at the new place, right? oh, we know. we just like making a scene. transferring your services has never been easier. get connected on the day of your move with the xfinity app. can i sleep over at your new place? can katie sleep over tonight? sure, honey! this generation is so dramatic! move with xfinity.

7:30 am

♪ >> session lows on the nasdaq 100, we are down 1% at the moment. meta accounting for 5% of that and they are down pretty hard. lots to talk about in terms of the earnings. in an hour from now, you will get u.s. gdp and jobless claims as well. here are the scores for the bond market on the two-year, 10 year and 30 year. the two-year at the front end of the curve, 4.9248. lisa, later, we get the seven year. lisa: $44 billion.

7:31 am

it is more interesting to watch the longer duration bonds. that is the uncertainty. are we looking at higher inflation and a higher term premium based on a higher deficit and an exceptional u.s. economy? this is a key question. i am wondering how we respond to this data. what's going to move the needle? will it be week data that moves the needle more than strong did that -- stated that people have baked in? jonathan: i want to talk about risk litigation. i want to reflect on a conversation we had yesterday. michael shoemaker of wells fargo, echoing comments we have had that perhaps treasuries won't work and called fixed income won't work as a haven. if you face increased geopolitical risk, heightened risk and the response to that is

7:32 am

increased defense spending, particularly in places like europe, does not put more cracks into the fiscal picture in certain countries that need to spend more money and does that prevent that bid from coming into the market -- bond market in the same way? lisa: you can broaden that out. any kind of downturn, what kind of ammunition do you have two fuel it with fiscal spending? do you get that same kind of flight to safety into treasuries and into booms and guilds if you are restricted without seriously weakening your fiscal profile? annemarie: it feels very acute in germany. they did a complete 180. the fact that they are talking up -- about ramping up their defense spending is a big deal. jonathan: a sizable move with bond yields. on the dollar against the end, 1.5 -- 155.51. looking at the euro, 1.0727,

7:33 am

some recent commentary on the government counsel of the european central bank, suggesting they will go in june. we will not agree to a follow-up anytime soon. >> you've seen that consistently. the hawks are coming out but the doves are less confident about some sort of rate cutting cycle. it is this persistent inflation that is challenging the pivot that all of the central banks are going against. jonathan: the economists went with that, the pivot to the pivot. annmarie: they are watching. lisa: is it two apostraphe pivot? jonathan: did they reach out? lisa: let's move on. jonathan: you never know. you can find out. shading. under surveillance, metas efficiency in doubt. they said they would spend millions more expect -- than

7:34 am

expected on ai. mark zuckerberg asking investors for patients. will they give it to him? annmarie: potential they are not giving it to him today. we will see if the stock makes a turnaround. i'm looking forward to microsoft in alphabet. they are expecting to have updates on their ai efforts. maybe it is just for ai when you don't have these reality labs and metaverse, if that is set aside and it's just ai, how much would the stock be up? lisa: i feel bad for mark zuckerberg, he doesn't have the same call to personality that elon musk has. jonathan: he's cultivating. lisa: i'm wondering if he had -- he's gotten jack. at what point can he say something and people get excited about it the same way elon musk does? annmarie: fourth richest person in the world. jonathan: and lisa feel sorry

7:35 am

for him. annmarie: i have the tiniest violin for mark zuckerberg. jonathan: let's talk about the data in an hour. u.s. first-quarter gdp data is due in 60 minutes. the bloomberg survey calling for a 2.5 percent rise over the previous quarter. we are looking at jobless claims and personal consumption data going into the next week. we will have pca, i federal reserve decision and we will be talking about payrolls next friday. if it took a soft pmi earlier this week to drive a decent bid into bonds, i just wonder how soft the number needs to be to reintroduce a conversation about a rate cut going into summer. lisa: the implication from the response to that pmi is the threshold is low. i'm sorry to do this, maybe it isn't the pivot to the pivot and we are actually looking at a fed that still wants to cut and they will look for any excuse possible. i think you have been on this and it is a smart point, which is immigration is allowing the

7:36 am

sort of immaculate disinflation and growth, if federal spending is allow this -- allowing this, how durable is that if we could get significant policy shifts? i think it is a great point. jonathan: it's a question we have to keep asking. elsewhere, the doj -- thank you, that was kind of you -- the doj is watching for possible intervention. the most dangerous pivot right now is the repricing of fed expectations after the break of a big psychological level. if i'm going to see 170, i will have seen it by the july fed meeting. kit juckes joins us for more per lisa has been looking forward to this. we went through 150 and 151, 152, 153, 1 54 and 155. we have people saying intervention risk, intervention risk. what do you think is guiding the

7:37 am

ministry of finance at -- at ministry of finance at the moment? kit: they are fighting a battle they can't really win. the correlation is of certainly strong. u.s. yields are moving higher if the fed is not going to cut rates. if the u.s. economy is going to be strong and data is released shortly, if we will continue down that way, do they feel super brave about coming in and revising it? they have been trying to say no, we are watching it. the trouble is low volatility grind higher. the people who are buying dollar-yen are extremely comfortable. they are knocking squeezed out at all. the people who are sending dollar-yen are being frustrated and losing money the whole way. the cheapness of the yen is evident for anybody who stands in front of cherry blossom and has their photo taken or maybe goes skiing. but it does not show up in

7:38 am

export numbers and the wider economy in a big enough way. they are nervous, i think, about going into earning. but as long as they do that at this point, that just risks the market eating the bit and taking us to absurd levels. because in the end, the extremes of these big dollar-yen cycles have done that time and time again. jonathan: extremes, absurd, is there anything obsessive or disorderly about 155? kit: i don't think so. the first one i thought about was the one in 1995. and then we went down from 100 to 80, extremely quickly and came back from 80 to 100 almost as fast. we have had a bunch of those since then. but, that is disorderly. at that point, you feel as if this will blow itself up and correct itself and will push volatility up. at the moment, it is a low volatility grind.

7:39 am

there is not much stopping it. the message is not changing. the central bank is not being aggressive enough. lisa: this is a reason why you suggested we could see this cross go to 170 if this continues as it is without some sort of intervention, which raises the question, why do you think it's inconceivable that the bank of japan will hike rates at the meeting tomorrow? kit: because the argument they have used in terms of their rate policy was to say having moved once, we want to see now what's going to happen when we get the full set of spring labor market data. it makes vastly more sense on that basis than in the next forecasting meeting in october. then they can say we have won the fight on the labor market and we are going in the right direction. it's hard for them to do it now except as a knee-jerk reaction to what's happening in france. i'm not sure how that's the bank of japan -- i'm not sure that's

7:40 am

how the bank of japan thinks. i don't have a base case in the world where this is out of control. 170 is literally having broken 150. plywood and we go 20 figures higher because i've seen it half a dozen times in my career. lisa: one of the biggest surprises has been the dollar strength. a lot of people were expecting dollar weakness. at what point does it become concerning or stifling in growth economically on a global level if we see the strength continue in the dollar? kit: i think it becomes a concern when it hurts the u.s. economy, for sure. when the u.s. thinks inflation is back under control and they don't feel the need to be fighting inflation. a rate cutting federal reserve would be happy to see a weaker dollar. if it causes disorderly moves elsewhere, it causes a problem. we had a really big dollar rally through the 1990's and the great

7:41 am

moderation. as the fed raised rates, cut rates and then raised them again. we had the crisis blowing up a lot of things along the way. that caused a really big problem. that dollar was not the strongest. that move was a longer move up from this one. you do get to a point where you create really genuinely big distortions of damage. i think from a u.s. perspective, we have not quite reached those. from a far eastern perspective, the japanese would say we don't like what the dollar is doing. jonathan: there are plenty of complaints and washington, d.c. we heard them. we heard the reports and the meetings that took place with secretary yellen. we know the origins of these complaints, u.s. exceptionalism and a market that has taken the view of central-bank divergence. a fed that has to hold and consider another hike and central banks like the ecb that are going to go through some

7:42 am

kind of cutting cycle. when i listen to policymakers, that's not what i hear. i hear they are going to cut rates potentially in june. after that, i don't know. can you walk me through this? the economies, i understand the divergence. u.s. is really good, europe struggled. might we see recovery begin? people are taking that, pushing it through central banks and saying what you are about to see is big policy divergence. do you think we will? kit: no, i think you get less rate cutting in europe, the stronger the dollar is and the less the fed cuts raise. i think from where we are now, apart from anything else, we are at the point where the market shock of strong european data is bigger than the market shock of strong u.s. data. you want to surprise someone, show them some signs of life in the german economy. and you will get the bigger market reaction. i think you will get a bigger

7:43 am

reaction out of the ecb. the ecb is nervous of the way this is playing out. it would not take much for the hawks at the ecb to turn around and say hang on a second. let's go one rate cut at a time and see how much we need. i think this can play itself out in several ways. from a currency perspective, the dollar is going up. it's not going up forever. from a policy perspective, there is some divergence because the situations are different between the two sides of the atlantic. but it's not going to go on indefinitely. we don't get huge divergence. jonathan: here is the appearance fee. i'm happy to pay it. arsenal football club, top of the leak. do we get it done? kit: i hope so. i'm watching it like everyone else and loving the ride. jonathan: congratulations. kit, thank you, in the stadium watching chelsea get decimated and liverpool fall apart as well. lisa: really? annmarie: arsenal-chelsea,

7:44 am

unbelievable. 5-0. lisa: let's just move on. jonathan: if you are wondering why things like it more bearish in the weeks to come. lisa: they are looking for a loan for a let's talk about that. jonathan: not my cup of tea. equity futures right now on the s&p, negative by 0.7%. it's get to your bloomberg brief with dani burger. >> let me add go blues and then i will move on. american airlines are expecting strong second quarter profit even though they are coping with high fuel costs. american has been leaning in, especially in their sunbelt hubs. they issued a higher-than-expected outlook. an early sign that the back barrier strategy is paying off because consumer demand for travel is there and they can find domestic and international routes. work trucks enjoyed a white-hot demand as the ceo put it.

7:45 am

they managed to keep their ev costs in check. they are on track to achieve a feat that would be the end be the in the of any tesla shareholder. affordable ev's priced between 25,000 dollars and $30,000 that can turn a profit. in the first quarter, ford relied on the good old fashion business of gas-filled trucks. the ceo of the world's largest sovereign wealth fund pulled the -- told the financial times he thinks europeans are less ambitious and don't work as hard as americans. probably hard for a european to admit. he made the comments in the contexts of -- he said americans are more willing to accept the stakes and take risks, saying you go bust in america and you get another chance. in europe, you are dead. that is your bloomberg brief. jonathan: we have to introduce him to some college grants in america and see if he changes his opinion. can we just say every time he

7:46 am

comes on with us, he wants to talk about the numbers and we invest in everything. and then he says things like this. he's tremendous. fantastic. we will get into that the next time he makes a bloomberg appearance. lisa: please come on and talk to us about the divide in the culture. jonathan: tell us what you really think. lisa: we will give him a half hour. jonathan: about europeans. lisa: we are just not very ambitious. jonathan: apparently the europeans are not ambitious. we have the worklife balance that americans don't. lisa: he address that. americans work harder at the expense of some other aspects. jonathan: my age group, i think it is changing -- by age group, i think it is changing in this country. lisa: what about european graduates? jonathan: i think it's changing in this country. european graduates are 30 years old. stayed at university for 10 years and live at home. lisa: that's the way to do it? jonathan: without a doubt.

7:47 am

lisa: that's not happening, i would get kicked out. jonathan: up next, the risk of a rate hike. >> as long as there is no urgency, you can have these discussions about are we restrictive enough and how long do we need to stay restrictive? jonathan: that conversation is next. live from new york, this is bloomberg. ♪

7:49 am

jonathan: equity futures are down 6/10 of 1% on the s&p 500. yields just about unchanged. 4.64 81. under surveillance this morning, the risk of a rate hike. >> it probably doesn't push the height rake and to move more restrictive in terms of policy rates. it reduces any kind of urgency. as long as there is no urgency around cutting, you can have these escutcheon's about are we restrictive enough, how long do we need to stay restrictive and

7:50 am

do we need to wait for the data to show you something? jonathan: trade is continuing to push back rate cut with some suggesting the fed could make another rate hike. greg says i think it is completely appropriate to factor a rate increase in. i feel much better about the market pricing that in, versus the start of this year. greg joins us. you talked about the market being in the strategic by zone. is it still there? >> i think so. if you rewind the clock for january or november of last year, there was so much around rate cuts and i thought that was the worst thing from the bond market perspective as i think ultimately, at the end of the day, the yield is what matters. the yield is what wins.

7:51 am

yield remaining high i think really continues to have a tailor for the bond market. jonathan: i think people have been conditioned by that, the pre-pandemic bond market that went on for the best part of a decade and that conditioning is sticky. do you see clients shaking off that psychology? if they got rid of the and they moved on, do they understand the opportunities in front of them with fixed income? greg: i think they have but there is definitely a recency bias. investors have been jaded by this extreme central-bank dominance that we have lived under for the past decade or so. i think it is washing away. what holds investors back ultimately is the volatility. so, as you see voluntarily -- volatility in yields and markets probably, it's hard to alter your asset allocation scheme meaningfully. what you need to see is less

7:52 am

fall in order to attract much more in the way of investment flow. lisa: what's the thesis? is it carry trade in a way that people had not experienced during monetary oppression or is this something you can get behind the idea of rate cuts eventually and have a bid into treasuries into some sort of downturn? greg: i think it is a twofold benefit. the first is you are earning more in yield. that income in the door matters and matters a lot. that's the first thing. the second is that if we do in fact hit some kind of economic speed bump, there is scope for rate cuts. i'm not calling cuts back to zero or what we have seen before. but at 5% level, there is room. and having duration in the portfolio that was missing the

7:53 am

past several years, pre-pandemic and immediately post-pandemic. lisa: i understand that for the five year. but the 10 year and the 30 year, i wonder about the argument we keep hearing from the likes of peter scheer, saying how much more can the united states borrow to help the economy, physically, during a time of difficulty? does that kind of lever get pulled and make treasuries less of a haven bid and they have been in the past? what would your response be to that? greg: i think that is a narrow focus of the world. if you look at death levels, they have increased globally. post-pandemic, you have seen, you know, a country -- you have seen countries start to spend. there is this isolation type of examination here. i think it misses the bigger picture. that's the first thing. the second thing is, i mean, i

7:54 am

think the u.s. is winning here. there is higher growth. inflation has come down meaningfully. i think there is a real strong story for the u.s. no doubt, what investors are looking for is an offramp on spending. and we are not seeing it. so, there is a lot of talk, a lot of chatter around the deficit. i think ultimately, the u.s. and u.s. rate market is the place to be, particularly in a time of crisis. i think you will see this perverse outcome, where you do -- if you do have this global swoon, you will see more demand for u.s. treasuries and not less. jonathan: let's see you get the economic downturn, what's the deficit look like in that world? if we are running something with a seven handle with gdp growth like this that we will see at 8:30 eastern time, what numbers will we be talking about?

7:55 am

greg: that's the challenge, ultimately. you don't have the same kind of fiscal room to spend in the time of a recession. that puts more pressure on central banks, which i think helps out treasuries a little more. but you are quite right. the way i think about it is it actually means the recession probably is not going to be as shallow as what many predict. you don't have that fiscal lift, which is so crucial to helping the economy find the bottom. in my mind, you will see a slightly harsher credit cycle. a longer duration type of recession and overall partial recession, i would say. jonathan: really interesting thoughts. greg peters. the last one, fascinating on the depth and duration of a downturn

7:56 am

given how constrained fiscal might be. lisa: this is an argument people have been making. because the united states incurred so much debt during good times, how much does this constrict their hands in bad times? if there is a downturn and the fed cuts aggressively, that could make the deficit a lot cheaper. that might be what you need to lower the rates. this is the difficulty in understanding how this percolates out. it isn't just a clear line that it would be for personal finance. jonathan: you get the growth and the inflation and the higher rates with it. lisa: it's hard to lay this out. jonathan: coming up, bob dull, -- doll, george ferguson, and ronald.

7:58 am

the future is not just going to happen. you have to make it. and if you want a successful business, all it takes is an idea, and now becomes the future where you grew a dream into a reality. the all new godaddy airo. put your business online in minutes with the power of ai. food isn't just fuel to live. it's fuel to grow. my family relied on public assistance to help provide meals for us. these meals fueled my involvement in theater

7:59 am

and the arts as a child, which fostered my love for acting. the feeding america network of food banks helps millions of people put food on the table. when people are fed, futures are nourished. join the movement to end hunger and together we can open endless possibilities for people to thrive. visit feedingamerica.org/actnow

8:00 am

it's an amazing thing when you show generosity of spirit to someone. and you want people to be saved and to have a better life, then you don't stop. the idea that we have saved five million people's lives, it's overwhelming. it's everything. >> earnings matter. and that is really clear. >> there's been a lot of good news priced into the big tech companies. that said, they need to deliver. >> it's not all one trade

8:01 am

anymore. it's th megsone -- the magnificent three or four. >> there is room to run equities. >> this is bloomberg surveillance with jonathan ferro, lisa abramowicz and and reordering. jonathan: we were up 40% on meta-going into the earnings and we are down 15% going into the premarket. how does this set us up for next week? lisa: i wasn't sure you would go there, the higher you go, the harder you fall, the way the morning is going. you could do that. meta-had the most to fall if you want to go through that. we can talk about how sorry we all feel for mark zuckerberg and the lack of star power elon musk has when it comes to his prognostications. for microsoft and google, it

8:02 am

seems like the bar is equal weight. you have had gains but these have been the darlings of the ai trade and they have the chance to really deliver on that and show the application. jonathan: meda has been the darling since the back in -- meta has been the darling since the backend of 2022. invest aggressively in ai research and product development efforts. that didn't go down well yesterday. i wonder if we learned to love that a little more in the days to come. lisa: here's the interesting thing about this earnings cycle. every earnings report is different and the bar is different for every company. you hear this efficiency discussion from certain companies that are talking about reducing costs in order to support revenues that are coming in lower. when it comes to elon musk, they are spending on taxes and the promise of it is just fine. with google and with microsoft, the problem is investment is

8:03 am