tv Bloomberg Daybreak Asia Bloomberg April 24, 2024 8:00pm-9:00pm EDT

8:00 pm

quarter. that will be keenly washed but also we are going to keep a close eye on the yen. we have a bank of japan meeting about to start today and the yen punching through numbers we have not seen in over three decades. avril: absolutely. and that is bringing those intervention jitters back to the fore. but as you say, it is also about earnings. just remember how tesla really helped to reinvigorate the markets with its plan. meta potentially spoiling the party. but we have the opening in korea. as you mentioned, those earnings from sk hynix seem to be working their way into the markets. it is not just about how the company seems to be doing well with their advantage because it is seen as a leader any high-end memory chip market compared to

8:01 pm

samsung. but also how it points to this bottoming out in the chip market and potentially the recovery for semiconductor demand. we're actually seeing sk hynix starting today on the back foot, sliding about 3% now is investors digest that scorecard. potentially what we got from med is bringing -- from meta is bringing the downdraft into the korean session. the outperformer among the asian currencies looks to be reversing some of that today. we also have the open in japan. one of the things we will be watching out for has been the japanese currency which has breached the 155 level. this has got to do with that yield gap as we saw the way u.s. treasuries were coming under pressure overnight. but now that we are watching the

8:02 pm

yen at the weakest level versus the greenback in about 30 years. consider how back in june 1990 when it breached 155, it was a matter of a couple of days before it reached the 160 level. though there is some skepticism as to whether we will actually see intervention by the finance ministry simply because of the timing. we do have the boj decision that is due tomorrow. and tokyo cpi numbers. so this does complicate the picture. japan stocks also under pressure after the recovery yesterday. that was thanks in large part to tesla's plan helping to reinvigorate the markets in asia. i want to take you to what we saw in u.s. treasuries. as i say, it was under pressure during the session. the idea coming through from australia's high inflation print that inflation is stickier than central banks might like. that really put pressure on global bonds.

8:03 pm

further out into the curve you go, the less demand you see. they seem to be reluctant to put on duration. we did see an ok five year option after a successful two year run. this is what we are seeing across the curve. really focusing on the earnings from south korea here. paul: thank you very much. let's get more detail on the sk hynix earnings from our asia stocks reporter from seoul. in the early going we are seeing a bit of a selloff in sk hynix, weaker by about 3% despite very impressive first quarter numbers and what appears to be a prettied decent outlook. are we seeing some profit taking? youkyung: sk hynix reported a lot higher than expected but we are seeing a drop in the share price. that is probably because the

8:04 pm

macro economic factors such as the geopolitical risk and the fx rates, things like that, are getting a bigger attention from investors now. they have been buying shares this year based on the ai boom. looks like earnings are really good. but investors are now seeing the macro factors as a bigger factor affecting companies like sk hynix than other chip stuff and south korea. so we will have to see how foreign and flash there is flow from now -- foreign investors flow from now on. and that answer may hinge on the macro economic and geopolitical risks, not just to earnings. in other news that may have shaken investor confidence in sk hynix is the company announced a plan for a new chip plan that is up to $15 billion in some

8:05 pm

investors might be worried about the new investment increasingly chip supply going forward. that could also pressure memory chip prices. paul: yes. that $14.6 billion expansion plan for a new plant in south korea was announced. we also have sk hynix saying plans to modestly increase this year. so is there potentially even more spending in the coming quarters? youkyung: sk hynix gave -- announced some positive news when it was releasing its earnings, such as its business has made a meaningful turnaround during the first quarter and it is seeing memory demand study. it sees prettied good dividend coming from conventional memory. so this investment announcement may be showing the confidence

8:06 pm

from the company that is prettied bullish on the demand coming from the ai investment from around the world. however, today's a selloff in the stock may be showing that investors are still prettied worried about the increasing supply of the chiefs -- the chips. i am pretty sure investors are waiting to hear about the sk hynix earnings going forward during the conference call underway. so we will have to see how the share price goes after the earnings conference call is over, when there will be more details about how the company views the sector and the ai demand and its own earnings for the next quarters. paul: asia stocks reporter youkyung lee there in seoul. let's look at how some chipmakers are performing. sk hynix off earlier session lows, still weaker by about 2.2%.

8:07 pm

samsung in its place, south korea's largest company also weaker by 1.6%. let's get over to our next guest , cheuk wan fan from hsbc. thank you so much for joining us. i want to start with you or calls on some asia tech names. when you see a pullback like what we are seeing now in sk hynix are you tempted to buy that dip? a previous guest said this would be sk hynix's best ever year. is this a good entry point? fan: we are remaining constructive on the asian technology sector. we think that the ai investment boom will continue to drive pretty strong demand for high-end memory and semiconductor products and asian technology leaders are well-positioned to ride on this

8:08 pm

global ai investment expansion. in this is going to bode well for the earnings outlook currently. we are overweight on the korean equity market. as consensus earnings continue to project around 64% gps growth. we think the latest announcement from companies to expand substantial, to expand the capacity on high-end memory chips. this is reflecting the very strong underlying demand observed by corporate management. so we think the fundamental outlook for asian tech stocks remain positive and we will take this as a buying the dip opportunity. paul: outside of tech, what other sectors do you like for diversification in asia? fan: within the asian equity

8:09 pm

market we adopt a diversification strategy, given the diverging fundamental and growth profile. currently we have overweight position in japan, south korea, india, and indonesia. within the china and equity hong kong market we hold a neutral and technical allocation position. we mainly focus on service consumption and high-end manufacturing and the telecom sector in china. so we look for companies with resilient earnings. we also focus on the beneficiary of corporate government reforms across the region as we actually see quite positive momentum in corporate reforms in japan, china, and now south korea also a view. more details about corporate

8:10 pm

governance reform that encourages listed companies to enhance shareholder values through dividend payout increase and share buyback. and these actually deliver quite attractive investment opportunities with strong fundamentals. paul: you're also overweight u.s. markets and you are not alone in that call. to what degree do you feel that the earnings story has taken over from fed easing as the major catalyst markets for now? fan: we actually see the main driver for global equity markets including the u.s. equity market has been shifted to corporate earnings expectation rather than rates, given that in the first four months we see heightened rate volatility driven by uncertainty surrounding the timing of the fed rate cut. but we see continued strength in

8:11 pm

the u.s. equity market mainly driven by improving macroeconomic outlook as a soft landing scenario continues to play out. in corporate guidance continues to point to pretty solid earnings recovery in 2024. and this is the key driver behind the u.s. equity rally. the tech company continues to deliver very solid earnings growth. we think that recent weakness in the tech stock reflects a technical pullback rather than a trend reversal. so we continue to see opportunities in the technology sector, but importantly, we expect the u.s. equity rally to broaden beyond just big tech. as we expect economic growth will continue to get momentum. this will continue to benefit consumer discretionary and

8:12 pm

financial stocks in the u.s. so we expect u.s. outperformance will continue to sustain. paul: we cannot let you go without getting your view on the yen, which we see weakening to levels we have not seen since way back in 1990. we do of course have a bank of japan meeting starting today. do you expect any sort of bold policy, maybe even a rate increase from the boj to defend the yen? fan: we expect the boj to stay on hold in this meeting. however, we do expect the boj will likely address the market concerns about the currency, volatility. however, we think the boj will remain pretty prudent in normalizing monetary policy. but given the strong u.s.

8:13 pm

dollar, and this is mainly driven by the aggressive market pricing for slower and later fed rate cuts, so this actually creates room for the boj to raise interest rates earlier. currently, we expect the boj will likely deliver another rate hike in the third quarter of this year. we anticipate a potential 15 bip rate hike in q3, given the continued strength in the u.s. dollar and this drives the yen to hit more than 30 year lows. so, with this goal for the boj to further adjust interest rates, we also project two more interest rate hikes in japan going into 2025. we expect one hike in q1 next year and another hike in q3 next year.

8:14 pm

taking into account our projected rate hike in q3, we anticipate that the upper target range for the japanese policy rate will go up to 0.75% by the end of next year. this would reflect a policy normalization in japan, and this is support some stabilization of the yen going into second half of the year. paul: all right. some aggressive moves coming from the boj. fan cheuk wan, hsbc global private banking and wealth. thank you so much for joining us. that is our bloomberg question of the day as well. will the boj or the fed move rates more in 2024? that is becoming a very live question indeed. still to come, the clock is ticking for tiktok in terms of its fight against the u.s. divest or banned bill. eurasia group we joining us to

8:15 pm

tell us what this means for digital diplomacy. that conversation coming up later this hour. first we're going to have more on the investor backlash to meadows earnings as it doubles down on its ai ambitions. this is bloomberg. ♪ thanks to avalara, we can calculate sales tax automatically. avalarahhhhhh what if tax rates change? ahhhhhh filing sales tax returns? ahhhhhh business license guidance? ahhhhhh -cross-border sales? -ahhhhhh -item classification? -ahhhhhh does it connect with acc...? ahhhhhh ahhhhhh ahhhhhh

8:16 pm

to me, harlem is home. but home is also your body. i asked myself, why doesn't pilates exist in harlem? so i started my own studio. getting a brick and mortar in new york is not easy. chase ink has supported us from studio one to studio three. when you start small, you need some big help. and chase ink was that for me. earn up to 5% cash back on business essentials with the chase ink business cash card from chase for business. make more of what's yours.

8:18 pm

challenge a law that would ban the app in the u.s. unless it's chinese owner bytedance sells its stake in the company. president biden signed that legislation wednesday as part of a larger foreign aid package. >> rest assured we are not going anywhere. we are confident and we will keep fighting for your rights in the courts. the facts and the constitution are on our side and we expect to prevail again. paul: let's bring in our tech reporter alex barinka for more now. we just heard from the tiktok ceo saying he is going to fight for american's constitutional rights, giving us a preview of what this legal battle will be about. alex: that is the message he has for users and employees internally that the fight is not yet over. tiktok and bytedance both expected take this to the courts, with the hopes of either delaying the enforcement of this bill, or getting it killed altogether. the first amendment argument is

8:19 pm

one that we very well could see, with them claiming the government is infringing on its user's rights. we could also look to some past legal battles for other clues on the arguments they might have. the state of montana had a bill that aimed to ban tiktok in that state, and tiktok sued, as did a group of users whose lawsuit tiktok funded. so we could see folks on the docket who are not just tiktok or bytedance, but perhaps some of the users, content creators, or the merchants selling on tiktok shop. paul: so, where do we place the odds of this legal challenge being successful, and how long could it potentially go for? i mentioned that in the context of a presidential election coming up in november. alex: of course. our bloomberg intelligence litigation analyst expects that if an appeal gets filed to the d.c. second circuit, which is a very likely choice for this, the legal battle could be expedited

8:20 pm

and be wrapped up as soon as the end of the year in the fourth quarter. he puts the chances of bytedance and tiktok succeeding and overturning the law at just 30%. the confidence the tiktok -- the context with the election is important. the u.s. will vote on the next presidential election in november. and this deadline for bytedance to sell or divest its stake in tiktok actually comes due the day before the presidential inauguration in january. so depending on who wins the presidential ticket next year, it could have a big impact on this. obviously president biden signed this bill into law on wednesday morning in the u.s. and if he ends up still being the president, he's leading the democratic party right now, he might very well see this out as a ban if bytedance is not able to offload its stake.

8:21 pm

but the republican front-runner is donald trump, who in recent weeks has said he thinks tiktok should stay in america. if donald trump wins the november election, tiktok and bytedance might be in front of a friendly audience as they make their audience -- their argument to stay. paul: tech reporter alex barinka on the ban tiktok bill. we are going to delve into how that could impact ties between washington and beijing. eurasia group's xiaomeng lu will be joining us later. plenty more to come on daybreak: asia. this is bloomberg. ♪

8:24 pm

the moment. iron ore continuing to put in a spirited recovery, better by another three quarters of 1%. i cannot tell you how iron ore miners are doing in australia because we are closed for public holiday today. that's pulling back from levels we saw earlier. it was getting close to $10,000. there has been some reluctance from some of copper's major consumers in terms of paying that much. we have blackrock however saying that copper needs to rise to $12,000 to incentivize large-scale mine investments. the willingness to pay these eye watering prices seems to be absent. let's talk a little more about the commodity space. we are hearing from bhp, the world's biggest miner. it is said to have approached

8:25 pm

anglo american to buy the company. it could be the biggest shakeup in the industry in more than a decade. for more we are joined by martin ritchie. what more do we know about this? martin: so far we have had confirmation from anglo american, which is bhp's target. as you said, this would be a really big mining deal and perhaps the biggest m&a deals this year. bhp is the world's biggest miner. it produces everything from iron ore to copper and nickel. and anglo has a similar profile, a lot of different commodities. but what is the key here i think is copper. anglo has a substantial production in copper and as anyone who watches the commodity space knows, there is a lot of interest in buying copper around the world because people think there's going to be a decade-

8:26 pm

plus a very rapid demand growth. we don't have any confirmation from bhp yet. as you said, it is a holiday in australia, we will see what happens. but this is a deal that will shakeup the mining space and could dominate the agenda this year. paul: yeah, it's been some time since we have seen such large-scale dema -- dealmaking from bhp. to what extent is this becoming a bit of a trademark of ceo mike henry's leadership, and have we heard in response from anglo about this reported bid? martin: i think everyone understands that the ceo probably wants to make it extent i -- a big stamp in his leadership. bhp already made a big deal in copper last year, a $6.4 billion deal. so, that expanded their portfolio there. they have already said -- anglo

8:27 pm

has already said that bhp's proposal will see anglo first spinoff its iron ore and platinum business in south africa, and that really emphasizes this focus on copper. rio tinto, bhp's rival in the number two iron ore miner, has also been looking to build up its copper business. and we saw glencore, the international trader and miner, try to take over these tech resources as well, principally for copper and zinc. so you can see how this is shaping up into a big battle for control of the world's copper resources. paul: all right. commodities reporter martin ritchie there. let's take a look at how we are doing in the fx space. of course we are very closely watching the yen. well, we are always watching the young closely these days, but especially so now. we are at levels we have not seen since june 1990. the yen weaker than 155 against

8:28 pm

the greenback. so, against that backdrop we have a jank -- bank of japan meeting starting today. the boj has pledged it is going to do something about the level of the currency. we have to wait and see what that is. still to come, u.s. secretary of state antony blinken touches down in china. the u.s. moving to force a sale or a ban of tiktok. we are going to discuss the impacts of that with eurasia group next. this is bloomberg. ♪

8:30 pm

8:31 pm

avril: absolutely. i think for tech stocks, what we got from earnings and their plans, the likes of tesla earlier in the week and now from meta is really throwing a span into the works of these asian equities that negative sentiment coming through, we are seeing the japanese benchmark as well as the kospi both lower in the first 30 minutes of trade. because dax index not doing as badly. concerned about rather -- whether tech can continue propping up a bull run and the broader market, especially as it talk about how they have to spend billions of dollars more for ai investments and its outlook really disappointing here. traders might also be reluctant to put risk-on at a time where we are waiting out today for data coming out from the u.s. including on gdp, consumption,

8:32 pm

and all of this could go along and shape the way the federal reserve is going to guide monetary policy. of course we have been seeing this higher for longer narrative coming through. all of this is coming as the backdrop on a day where we have sk hynix earnings. the stock still about 3% down today despite the big beat and operating profit. i think the investor assessment is how the macroeconomic environment shaping the broader markets. of course you say it is really about the japanese currency as well as we have seen it weaken to that three decade low. the real effective exchange rate. the question about whether we are going to see intervention. some skepticism as to whether we will see actual intervention simply because of the timing. we are waiting for the boj decision tomorrow. there are some corners of the

8:33 pm

market that think given how inflation is trending we might see some signals of quantitative tightening coming through. i will flip the board again and take a look at how china futures are pointing to a negative open. this is after we got earlier in the week the hong kong stocks really shining and coming back, outperforming global markets as chinese sentiment turns. sentiment towards chinese equities turns, i should say. we are watching out for the story that sources telling bloomberg news chinese officials have been telling brokerages to curb their exposure to the risky products, snowball derivatives among the things we are watching in the markets today. paul: thank you very much. let's turn now to geopolitics. the u.s. secretary of state has arrived in china. he is on a mission to press beijing on issues including it support for russia and

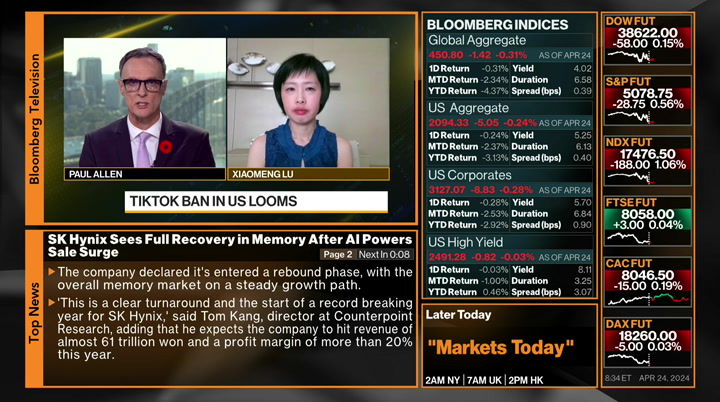

8:34 pm

industrial overcapacity. antony blinken will meet senior communist party officials in shanghai on thursday, and then he had to beijing for a possible face to face meeting with president xi jinping. a hawkish u.s. election campaign could be a test for the stabilization of ties that was brokered last year by xi and president biden. let's bring in our next guest right now. xiaomeng lu is director of geo technology at eurasia group. thanks for joining us. as i mentioned there, antony blinken heading to china with a message about overcapacity, support for russia. but following the passage of the tiktok ban or divest bill, do you think china will have a message for antony blinken? xiaomeng: i would expect this issue to be on antony blinken's meeting agenda with chinese officials. because i think a lot of the decision-makers in beijing are very frustrated about the way the u.s. treated tiktok.

8:35 pm

and we expect beijing's initial resistance to this ban to be symbolic and muted. but i definitely think there is a chance for them to talk about it over the negotiating table this week in beijing. paul: is this the sort of thing that can be negotiated out, though? particularly in the context of u.s. election season. xiaomeng: i am not sure either side will be in a position to negotiate at this point, because president biden just signed the bill into law yesterday. i think the next step is for tiktok, as they promised in public multiple times, to challenge this law in court. i think china will gauge the u.s. potential reaction, and also how things will play out in the future in order to put their

8:36 pm

plan together and think about how to respond when the eventual tiktok exit from the u.s. market happens. paul: it is shaping up to a -- to be a very interesting courtroom battle because tiktok already signaling it will fight us on constitutional grounds, a breach of the first amendment as well. how long do you see this dragging out for, and where you place tiktok's chances for success? xiaomeng: i think they will fight a legal battle as long as they can. i have no doubt they will use a lot of resources on the legal front. but in the meantime they have a year to deal with this divestiture order. then they are forced out of the u.s. market. at the moment, bytedance does not have a very high hope that they will be able to win the battle in court for tiktok. paul: so let's explore some of

8:37 pm

the potential outcomes here. if they lose that battle and tiktok is divested, what then happens to the data, the algorithm, both of which the? company is very protective about? ? and is there anything beijing can do to intervene? xiaomeng: there is a lot beijing can do to intervene. they will have to issue approval for the deal if tiktok were to sell its core algorithm to u.s. buyers, which is the most valuable asset of the platform. but they are unlikely to give that permission. so in that case, tiktok can basically sell the platform, the brand, to u.s. buyers if there's a deal interesting enough to u.s. stakeholders. or they will have to leave the u.s. market altogether. paul: for there is another potential option as well, and that would be potentially to suck up a ban, leave the u.s.

8:38 pm

market and try to return later. how appealing with that option be? xiaomeng: i am not sure they have much legal recourse at this point. they can choose to withdraw from the u.s. market altogether, just like other u.s. social media networks did in china 20 years ago. i think if that's the scenario, which i think is a likely possibility at this point, they will leave the u.s. market but they can still compete in other global markets. i think the u.s. is their biggest overseas user base and their most lucrative one as well. but maybe that's the eventual reality the platform has to face. paul: no doubt other western countries, allies of the u.s. will be watching this court case very carefully, regardless of

8:39 pm

the outcome. what are the implications for tiktok in other countries? xiaomeng: i think in the eu, which is another very big market for tiktok, the company is already being investigated for digital service act violations, and identified as a gatekeeper subject to additional scrutiny. i would expect european regulators to look at these matters independently, because they believe their legal and regulatory framework dealing with data security, antitrust concerns, on its own ground. they will see this u.s. episode of the tiktok saga, a reflection of the geopolitical context between the u.s. and china. and i think for the global south, a lot of the emerging market, they are likely trying to stay away from this spat. and in that case, tiktok can

8:40 pm

have a longer lifespan in the eu potentially, and they will probably put more investment in the emerging market. paul: all right. xiaomeng lu, director of geo technology at eurasia group. thank you so much for joining us with your analysis. still to come, boeing gets a credit rating downgrade from moody's, despite reporting strong first-quarter earnings. we will discuss what led to that downgrade, next. this is bloomberg. ♪

8:41 pm

8:42 pm

paul: the auto china show in beijing is kicking off today. the fair returning for the first time since 2019, bringing an array of unveiling's. our chief north asia correspondent is there and joins us now from the event. what are the key themes going to be? stephen: well, there are many key themes. look, we have not really been here in earnest in five years and the ev landscape for sure has changed dramatically since 2019. so many more chinese brands that dominate this local market. so that is probably theme number one, how the chinese ev makers over the last five years have created, i would not say a

8:43 pm

monopoly, but they dominate in the first quarter the top 10 brands of models that were sold in china. nine of them were domestically made chinese brands. only tesla cracked the top 10. also, again, these chinese makers are improving their quality and lowering their costs. so what do the legacy carmakers from europe, japan, and the u.s., who used to dominate here, how do they compete in this domestic space when the locals are engaged in a price war as well to bring the costs down? volkswagen for one, they are bringing their investor day here, they are bringing all of their top executives. they have 20% of the internal combustion market here in china but only about 2% of the ev market. have they lost this space because of the ev switch here in china? bmw and mini, they are bringing 15 models here testing the waters, as is mercedes.

8:44 pm

can they read grained -- can they regain ground when they had dominance here in the ev space ? that leads to theme number two and the price war. byd now has 33% of the ev market here in china. some of their models are priced at $11,000 were below. how do the europeans and americans and japanese compete in that space? third theme, exports. all of these brands have big export ambitions, including the stall we are out here, great wall motor. they have been exporting a number of cars and suv's abroad. but again, we are against the backdrop of rising protectionism around the world, with europeans and the americans talking about overcapacity and potential anti-dumping subsidies. it's a big theme, it's a very, very sensitive issue here. getting people to talk about it in earnest is going to be a challenge obviously, because

8:45 pm

that is the biggest export challenge for these automakers. finally, the big theme on technology is smart you ev's. we've already seen the launch of its new su-7. we have companies here moving to the smart ev space. huawei also has about four different partnerships, so there are huawei-backed partnerships as well making noise. so, a lot to talk about over the next couple days here as the beijing auto show kicks off in earnest today. paul: back for the first time in five years, so you have plenty of names joining you down there as well. who are you going to be talking to. stephen: we are here at great wall motor, gwm. we are going to be talking to the head of their international strategies coming up in the next hour on the china show at about 9:10 hong kong, beijing time. also bill russo, longtime china

8:46 pm

analyst, he will be with us in the 11:00 hour. later we will hopefully be talking to the byd german head of their design team. and that will be very interesting. you can probably tune into that tomorrow. a number of things, just juggling the different events today will be the biggest challenge, and getting as much coverage as possible. paul: all right. our chief north asia correspondent stephen engle down there at the auto china show in beijing. sticking with cars, ford has posted its first quarter results, beating expectations on saw -- strong sales of work trucks. they have dial back on aggressive electrification push. their ev division posted another quarterly loss. still the ceo told us the company is on track for a strong year. >> we had a really solid quarter. we did not expand our guidance range between $10 billion and

8:47 pm

$12 billion but our trajectory is towards the high-end of that guidance. looks like we are on track for a really solid track. romaine: i would be remiss not asking you about what is going on in the ev space. at fort it was the worst performing of the major businesses. we got earnings out of a couple of your competitors and at least on the ev side, things were not much better. do you see any hope of improvement in that business this year? john: we are segmented, so we are different than many of our competitors. so you have the transparency about where we are at with our electric vehicle business relative to our commercial business and our internal combustion engine business. so you have the transparency. look, we know we need to have the election business stand out on its own. you needs to be profitable, it needs to provide return on capital, and we are working diligently to get there. we have a lot of hopes and we

8:48 pm

know our second generation of vehicles that will be coming out in a couple of years are going to be a big step forward and bring us to the point where we will be profitable. so, we will not launch them if we are not profitable. so we have to make the best of it through this period here until we get to the second generation vehicles and we will continue to manage that and optimize across the country -- company. paul: that is the ford cfo john lawler speaking to bloomberg's romaine bostick. moody's rating has downgraded boeing's credit score one notch -- or to one notch, to junk. this is after they beat estimates for first-quarter earnings. the downgrade coming after boeing said it burned close to $4 billion in cash as quality issues plagued outlook. for more, george ferguson joins us. is that cash burn sloan -- showing any signs of slowing down, and what else did moody's have to say? george: on the earnings call

8:49 pm

today what we heard from boeing is they expect cash flow to be negative again in the second quarter. not as bad as the first quarter, not that $4 billion cash flow burn, but they still expect it to be sizable. that is a concern for investors. the plan at boeing is all about a turnaround in the second half as the increase production right now. production is pretty slow. they are trying to stabilize it, improve quality, and they are working on a plan with the faa for how they are going to maintain that higher-quality. again, they are going to turn it on in the second half, and they hope it will generate a lot of cash, but right now they are down about $7 billion, which is a pretty low point for this company. paul: we are going to hear from boeing's major competitor airbus pretty soon with its first quarter results. demand for aircraft, still

8:50 pm

pretty strong, but costs seem to be a focus for airbus. what are we expecting to hear? george: demand is strong for both boeing and airbus aircraft. it's got better fuel burn. but yeah, the industry coming out of the pandemic has just had challenges with supply chains. boeing's are especially bad. airbus has done a better job of keeping there's healthier. but they still have inflation and challenges in the supply chain where they have to take over a supplier. it's really led to a profit landscape that's harder to achieve pre-pandemic profitability than we all would have expected. but they are not at the levels of builds yet. as they step up into the 50 a

8:51 pm

month or so, they get better. but that pain inside the supply chain is not allowing that profit level to be reached yet. paul: all right. bloomberg intelligence senior aerospace analyst george ferguson. you can watch us live and see our past interviews on our interactive tv function, tv . there, you can also dive into any of the securities or bloomberg functions we talk about, and you can become part of the conversation and send us instant messages during our shows. this is for bloomberg's of drivers only. you can check it out at tv . this is bloomberg. ♪

8:52 pm

o coming in.. big orders!s starting a business is never easy, but starting it eight months pregnant.. that's a different story. i couldn't slow down. we were starting a business from the ground up. people were showing up left and right. and so did our business needs. the chase ink card made it easy. when you go for something big like this, your kids see that. and they believe they can do the same.

8:53 pm

earn unlimited 1.5% cash back on every purchase with the chase ink business unlimited card from chase for business. make more of what's yours. paul: meta shares plunged and extended trading after it announced it plans to spend billions of dollars more than it had previously anticipated when it comes to ai development. ed ludlow has more from san francisco. ed: mark zuckerberg outlined meta put itself in a position to be the leading ai company in the world and there is a commitment to spend on the infrastructure needed to build future generations of models on the back of the success of llama 3. the problem is investors are not buying it. the message that really hit them

8:54 pm

in the court is that it is going to take time for it to show up meaningfully on the top and bottom line. what we are talking about is meta ai, the current generation of the assistant. they are trying to scale that. smart investors, quote, would be able to see that even if revenue is not obvious from ai, you can see that ai products scaling and see the monetizable opportunity. but meta's business is still mostly advertising. they are seeing impressions growth. they are seeing the average ad price growth go up as well. and in some cases you could argue that is where ai is showing its value. meta's kind of damned if they do and damned if they don't. there have been segment of the market calling for some time, spend more on ai infrastructure, get going on this, and then some want to see the prudence. that is the message from mark zuckerberg, the patient, trust us.

8:55 pm

it is going to cost us billions of dollars to get there, but we will get there. when does this business he serious topline growth from ai? apparently it is coming. whether investors believe it, well, we will find out in the markets. this is ed ludlow for bloomberg news in san francisco. paul: let's take a look at some of the asian tech movers in the asia session at the moment. some reasonable declines going on here off the back of that meta earnings disappointment. rakuten off but almost 2% at the moment. the big name that moved today was sk hynix. south korea's second most valuable company really reporting blowout first-quarter numbers. net profits coming in at 2 trillion korean won. that turns around a big net loss for the same quarter the previous year. the company saying the results due to their high-bandwidth memory. other advanced chips for ai data

8:56 pm

servers as well. let's look at boeing suppliers as well. boeing, as we were just discussing, seeing its credit rating downgraded to one notch above junk by moody's. cash burn the issue, although boeing suggesting that burn will slow down next quarter. boeing suppliers having a bit of a rough ride in the early going in asia. markets coverage continues as we look ahead to the start of trade in hong kong, shanghai shenzhen. ♪ of bright ideas, that your customers need to know about. constant contact makes it easy. with everything from managing your social posts, and events, to email and sms marketing. constant contact delivers all the tools you need to help your business grow. get started today at constantcontact.com constant contact. helping the small stand tall.

9:00 pm

0 Views

IN COLLECTIONS

Bloomberg TV Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11