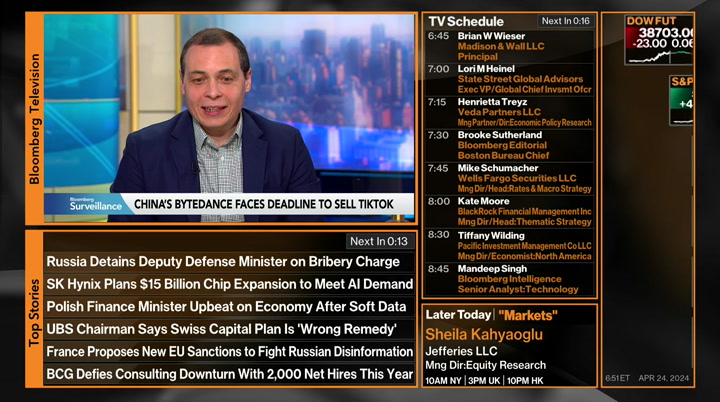

tv Bloomberg Surveillance Bloomberg April 24, 2024 6:00am-9:00am EDT

6:00 am

>> when you look at the relative earnings growth, it will decelerate for the mag seven and it will be overtaken by the forgotten 493. >> it's about the reaction of the stock to the earnings results. >> when we listens to earnings calls, we are to see a normalization and -- in consumer spending trends. >> you are hearing consumer demand that held a bowl lot better than people expected. >> we've got to get the engine going. >> this is bloomberg surveillance with jonathan ferro, lisa abramowicz and annmarie hordern. jonathan: live from new york city this morning, good morning, good morning, for our audience worldwide, this is bloomberg surveillance. when named to watch this morning and that's tesla, the stock is higher by more than 10%.

6:01 am

elon musk said all the right things on the call yesterday. more unless expensive models. lisa: we heard we will not get any details about if he can produce $25,000 tesla's on their current infrastructure, wait until august. what about robotaxis? wait for august. jonathan: i don't think you can look at this move without looking at it relative to the year to date loss. we were down by 4% and that we are up by 10. listen to this, 2.5 years ago, tesla was worth the same as the next 12 largest companies and that's how things have gone wrong in the last couple of years. annmarie: and the big issue is demand. they have very to different first-quarter results announcements. the numbers were bad and if you look at some of the rate at

6:02 am

which new cars are leaving deliveries, that is not promising for elon musk down the road but the words are dreamy and it's this idea of august we will get may be cheaper cars and a people model s and potentially a robotaxi. jonathan: jefferies says appeasing the market. how much of this was about appeasing the market after the concerns over the last few weeks? lisa: that a certain point, doesn't matter for elon musk what he promises if he can get a longer lease to fill those promises? we've been talking about a lot here, it -- is this a car company and or is is a tech company? he gave enough hope in the dreamy talk to put this back into something more than just a car company. jonathan: this is exactly what

6:03 am

investors wanted to see. let's talk about washington, d.c.. how many adults were in the room , 95 billion dollar aid package passed on the clock is starting to tick on tiktok, is that true? annmarie: they have 270 days to divest. this comes the day before the inauguration of the next president but the present has authority to kick this can down the road for another 90 days. does it get divested or banned? the issue will have to be dealt with in the next administration so it will either be trump 2.0 or biden 2.0. lisa: within the $95 billion aid package, there was also a provision about unlocking seized russian assets and giving that funding to ukraine. do they have to pass additional funding for ukraine or can they use that money in a different kind of way in coordination with europe? we will hear more about this.

6:04 am

jonathan: this accelerates the conversation about confiscated assets. the g7 meeting is just around the corner in italy in june. this poll came out this morning -- the biden bump looks over for now. annmarie: the previous month, this came after the state of the union and biden received a bit of a bump now he's pretty much back to where he was before the state of the union and the issue continues to be the economy. if you look at voters and ask them who is responsible for your concerns like inflation, they say biden is responsible or very responsible and then you asked them how do you feel about inflation in the future with interest rates coming down? it's a grim picture and that -- and this is what is weighing on his poll numbers. jonathan: equity futures right now on the s&p 500 are fading it touch, positive by 0.1%. we had the biggest one-day pop

6:05 am

in the s&p 500 in a while. german business confidence is a little better than expected but the euro is still negative by 0.1%. franklin templeton is coming up. tesla speeds up plans for a cheaper model with meta-earnings on deck. tech heavy weight lifting the s&p 500 to its best back-to-back rally in two months. katrina dudley says this -- katrina joins us around the table. >> good morning. jonathan: we've had tesla and gm and more later so what's the message from what we've heard from corporate america so far? >> we've had close to 20% of the s&p 500 reports a we have a reasonable sample but there is a lot over the next 10 days.

6:06 am

earnings matter. that's really clear. if you take a look at what we've seen over the first quarter, the returns to the s&p are in line with earnings growth so you had valuations flat-ish. that's where we come back to that and we think valuations are fair therefore for the s&p to work through the rest of the year, we need to continue to deliver on earnings growth. we really got to start digging into the details and understanding what is driving earnings. jonathan: let's go within the s&p 500, where do you believe there is greater scope for earnings growth this year? >> the easy one is the technology sector and we can talk about ai which is not news to anyone. we are looking at financials is another area where you see some good earnings momentum we can expect that to continue. some of the areas where were starting to see weakness are the health care sector which is typically been such a defensive area. i think the expectation there

6:07 am

for earnings have some degree of pressure and finally energy and materials. when a look at earnings and energy and materials, work -- i think about it in terms of their revenue is outside their control. they've got the ability to influence and they are using that as a barometer for earnings so that's a good guide to the future of the market. lisa: you expect earnings growth to come in big tech, more than the valuations priced in so far? >> i think the valuations priced and so far are actually pricing in the fact that this is the place you want to be in terms of technology. when we look at tech, we take a broader definition of where tech impacts. we are not just looking at the magnificent seven where the valuation probably are on the upper end of where we think is reasonable. we are looking at where the second derivative impacts of ai will come into effect. i look at our business and i look at how we are deploying it. we are deploying it not just in terms of our commentary but i'm

6:08 am

deploying it as i work with my team and looking at agendas how they have their review conversations, agenda planning for meetings. it's starting to use ai in a very blunt manner to make myself more efficient and effective. lisa: there is a question of hope versus dollars and cents. that's in terms of elon musk and tesla and it comes down to, do you invest in the hope of capital expenditures, promises, of shooting high or do you focus on the dollars and cents? how much money are they bringing in? >> you invest in credibility. that is what we have to do and that's why we go in and meet the ceo and look at them in the i and say what do you think you are going to deliver and what can i metric you on? that's something the ceo has the right to tell us. these are the things i'm focused on i will deliver. if you have longevity as a ceo

6:09 am

and longevity here is a relative term, i can use your history as a guide, did you deliver last time on the promises you made? it's not necessarily hope but it's about having that conversation with the people that matter and understanding what those metrics are in them we go out and try to inform that mosaic of those metrics and whether they can deliver. lisa: have earnings fully trump the bond market at a time when we're seeing with soap moves in yields appear to influence stocks even if you say they don't? >> when we have an environment where inflation is easily, we will see a decoupling of the bond market and the equity market. we are expecting rate cuts coming into the second part of the year but we are also focusing on the inflation number. as a look at what the expectation is on that's with drives the bond market, it was six cuts of the beginning of the

6:10 am

year. that's only four months ago, we were expecting six guns and now it's down to 2-3. annmarie: when you look at earnings come you talk about energy and materials and you expect them to drop 8% and 25% respectively but if we continue to see this commodities rally, would it be a good time now to buy into the sectors? >> the 8% drop is in terms of health care earnings. there are definite pressures there we are seeing in the health care system. as we look at energy and materials, that sector is a good barometer for what we are expecting in the macro environment. it is also kind of a second derivative play on emerging markets and what you expect to see in those environments. as we look at some of these emerging markets, there is a bit of a bifurcation because some of these emerging markets have got some really good strong trends but there is also a lot of geopolitical tensions. when we see a rise in

6:11 am

geopolitical tensions, the emerging markets cannot escape that. jonathan: let's finish on japan. we came into april worried and we sliced through 152, 153, 154 and we are looking at 155 this morning. what is it going to take for japanese officials to step in and change the trend? >> what they are looking at of the moment are things that are really within their control and that make a difference to the equity markets. we have not had a regulator in japan that is actually looking at capital allocation and how companies allocate capital. i understand the narrative and i know that everyone is focused on the boj and what's happening there but we are focusing on the ground and looking at the message that's been given to companies. i think that's got a much longer tail to it. i don't need to make a call on what is a binary decision. jonathan: you are not alone.

6:12 am

their two favorite sectors right now my talk about what's happening with tech or their favorite regions. it's the united states and japan . it's good to see you. katrina dudley from franklin templeton. the higher the session, 154.97. lisa: everyone is going to japan and every person who comes in is doing international travel and they say there's hope. at what point if you get a decreasing in -- yen does it become depressing for investors? jonathan: let's get to the bloomberg reef. shares of tesla surging in the premarket, accelerating the launch of less expensive cars in a bid to revive sagging demand. the news overshadowed with first-quarter earnings sales and margins lower and elon musk as he wants to start production of the cheaper models this year.

6:13 am

jamie dimon is on the cautious side for a soft landing buddies optimistic on the state of the consumer. >> if we go into a recession, the consumer is in good shape but that doesn't mean you can fight off the effects of the inflation. our worry it will be worse than before. deficits were half of what they were before in the 1970's. part of the reason we had the strong growth is the fiscal spending. jonathan: he stuck at the economic club of new york yesterday. the ftc voting to adopt a new total ban on noncompete provisions that prohibit workers from switching jobs within an industry. the chamber of commerce will challenge it in court and the legal showdown comes three years after president biden signed an executive order encouraging the ftc to limit noncompete agreements which affect roughly one in five americans. the rule does not apply to

6:14 am

existing noncompete executives who earn more than $150,000 per year. the execs are getting excited. i remember the late great alan krueger gave me an education on this and he talked about how important this was for fast food workers. i said what are you talking about any broke it down and it could not believe if you work at a fast food chain, you have to sign things in some cases come you can't work for the same chain at a different franchise. this is not about the bankers or the execs, it's about what happens in the lower paid jobs in america. lisa: that's the reason this is coming now. i saw this especially in tandem with the rule that would go into effect that would allow certain types of expansion in overtime payments. it raises the question, what are the knock on effects at a time the ftc has taken a more aggressive approach to monitoring business. the intent has a lot of residents in american society.

6:15 am

there is a question about a precedent being set but people will be compelled to discuss this. annmarie: a lot of the comments came from individuals in the health care space. some states have banned non-competes. the knock on effect will be a ton of legal action from the chamber of commerce and a political win for biden. 2.5 years ago, an executive order telling the ftc doing something about noncompete six month before the election. jonathan: this will get caught up an appeal after appeal. tesla doubling down next on cheaper cars. >> we know when elon says something, it often takes four years after the initial comments. i cannot rely on what he says as a time frame because those are usually his goals, not necessarily a reality. jonathan: some people have their doubts and we will talk about that next on the program. live from new york city this morning, good morning. ♪

6:16 am

to me, harlem is home. but home is also your body. i asked myself, why doesn't pilates exist in harlem? so i started my own studio. getting a brick and mortar in new york is not easy. chase ink has supported us from studio one to studio three. when you start small, you need some big help. and chase ink was that for me. earn up to 5% cash back on business essentials with the chase ink business cash card from chase for business. make more of what's yours.

6:18 am

6:19 am

after they just laid off 15,000 people and a lot of factories and a lot of high-quality individual just lost their jobs. i'm curious, we can say things but when elon says something, it often says four years after the initial comments. i can't rely on what he says as a time frame because those are usually his goals, not necessarily a reality. jonathan: shares of tesla jumping on his plans to speed up the launch of cheaper models. he also posted better-than-expected results despite a miss on earnings, sales and margins. pierre has a buy rating on the stock and joins us now. you have an original take on this, you think something bigger

6:20 am

is going on here. can you walk us through how big a change you expect from this company? >> [indiscernible] what's original is how the news came to us and how things got spun into a misunderstanding. a couple of week ago, they mentioned tesla was in trouble and there is no smoke without fire. there was something happening at tesla. we try to put airhead around what tesla could be doing but it didn't make sense. the reality was the exact opposite from the way reuters presented the situation was the initiatives they came across a something that needed to be

6:21 am

accelerated and not postponed or canceled. that's what elon musk told him in february. he said we are trying to sell 3 million units per year. at these price points, it's not going to happen. the demand is not large enough for that to happen. we need something like a model that comes in earlier to continue to grow and we plan for capacity for model 3 and model y that is too much because we will never sell 3 million units at that price point. let's take some of the project like the plans we have after the model -- next model generation and let's integrate innovations into the platform in order to be able to penetrate the market asap with less expensive cars. what i see coming through here,

6:22 am

let's see how fast it comes in elon musk tends to want things to happen fast and it takes longer to realize. it's going to happen soon because it's not going to be about building a new production chain and tooling a new manufacturing lab. it will be adapting the existing manufacturing lines. they will take some of the cost reduction initiatives and integrate them on the model 3 and model y platform is what i expect to see. it will come later once the existing production is adapted. lisa: i'm wondering whether it bothers you that we got note details that the line was wait for august and we will tell you more how we will do this. >> i think it makes a lot of sense before they present.

6:23 am

you have to remember that tesla is not running a car company. they have to be careful to talk about what they are doing with investors. they don't want to disrupt their business with too much information for shareholders. they are saying we are aiming a year from now to have the model three that will be 25% cheaper than what it is today. that might have a disastrous impact. it could impact sales for tesla so to me it makes sense to be vague and that's on guidance. on the robotaxi, elon musk is doing a couple of things but such details about his dream is something that's very much a moonshot.

6:24 am

you know how ai models are evolving. dig up a new model and you are facing avail of ignorance. you don't know what the model will do next. you just see that the technology is improving and they are building capabilities very rapidly but you don't know what will happen next so tesla is working on these new models and they have additional processing power and they are working on in-house models according to elon musk, very impressive, putting that into robotics and putting a robotaxi on the road is a process that will take another 3-10 years. i would be skeptical if it happened sooner. in august, they will talk about the platform and the robotaxi car and what it is and what it will look like and what the technology will look like and

6:25 am

how the technologies will differ from the mainstream car. once they have the platform, they need to develop test templates. it still qualifies as a moonshot. jonathan: it's great to get your view on things now. the name is up and double digits this morning. this could be a case study for the harvard business review. lisa: how you deal with expediting a cheaper model without building a whole new infrastructure. whether he can do it, it's interesting, the benefit of the doubt. you will not release details commits a car company even though it wants to be a tech company and you're going on faith. annmarie: elon musk set of someone doesn't believe that tesla is not about autonomy, they should not invest in the company. he is throwing his eggs in this

6:26 am

basket. he said don't worry, we will have a cheaper price point on the ev. jonathan: do they have a customer service department at tesla? lisa: i think that person jonathan: resigned yesterday. we will catch up with bloomberg's mario parker on the latest poll focusing on key swing states, the biden bump evaporating in that conversation is up next. ♪

6:28 am

you're probably not easily persuaded to switch mobile providers for your business. but what if we told you it's possible that comcast business mobile can save you up to 75% a year on your wireless bill versus the big three carriers? you can get two unlimited lines for just $30 each a month. all on the most reliable 5g mobile network—nationwide. wireless that works for you. for a limited time, ask how to save up to $830 off an eligible 5g phone when you switch to comcast business mobile. don't wait! call, click or visit an xfinity store today.

6:30 am

jonathan: coming off the back of two days of gains on the s&p 500. up zero point 1%, encouraged by moves elsewhere. we will talk about tesla in a moment off the back of the biggest one-day move on the s&p 500 in two months. in the bond market, decent auction at the front end of the curve supporting that. 463 on the 10 year. who would've thought pmi in america, were encouraged the economy that the economy was slowing down. lisa: is that how low the bar is for a sign of weakness that that will give a huge boost to bonds across the board? you got week p.m. in light data but people look at the internals of the s&p global pmi data

6:31 am

showing the weakest hiring levels and services going back to the height of the pandemic. this was enough to be the first punch and the second punch was the bump and that continued. jonathan: that was $69 billion of two-year notes. that's the bond market so let's talk about the euro briefly. the euro at the moment is negative about 0.1% staging a recovery. business confidence in germany is doing ok. the fireworks could come from dollar-yen at any point, getting closer to $1.55. remember where we were coming into april, looking at 1.52, go on. staring down the barrel of one dollar 55 cents and officials in the finance ministry have gotten quieter and not louder over the last few weeks. lisa: apparently because people have rejected their verbal intervention, it's less

6:32 am

credibility. will this come down to what they decide to do and when they decide to intervene or will it come down to what data comes out and maybe we will get another snp softer pmi print and that will be enough to bolster the and valuations? jonathan: perhaps they need a few more of those. our top story is tesla wrapping up plans to launch cheaper models hoping to start production as soon as this year. the announcement over shadowing a shortfall in margins in the stock is up by almost 12%. the luxury maker warning profit or plunge in the first half of the year as demand legs in china. we are down here by 8% on the morning. lisa: how much is this story about designers or their customer base.

6:33 am

how much is this truly a bifurcation between the ultra rich who are doing great and the lower class which are not doing well and if you tried to hit the middle, not so good and that's what they kept on pointing to is that the accessible fashion is not en vogue. jonathan: if you asked the ceo ofkering, they will say this is about the polarization of the luxury goods market that's either hyper luxury or low end. of course they would say that. if you ask other people about this, they point to the designs and how much the designs have changed over the last few years and ultimately they built out this consumer base with a particular design and they've changed it and the consumer base is not there anymore. annmarie: that's what i think because you had the creative director who did some wild things. he brought the new york link -- yankees logo to their loafers and they realized this is a younger audience.

6:34 am

they brought in another ceo and he is more classic. what you see them putting it is things like a handbag that was the style in the 50's and 60's. they just did all this work to bring in a younger generation so it will take some years for them to recalibrate to this new creative director and his design vision. jonathan: we need to get the ceo on the show. lisa: do you like loud fashion? jonathan: no. lisa: i was jonathan: asking the ceo. jonathan:i'm not big on logos and brands. lisa: if they want that crowd, they got that crowd and now they are ditching that crowd and they are wondering what happened. annmarie: they said they didn't want to rupture, they wanted a revolution. it's quite different to go from one designer to another. it's apples and oranges.

6:35 am

jonathan: the stock is down by almost 8%. president biden place to send a 95 billion -- to sign is $95 billion aid package to ukraine and other countries. also they want bytedance to divest tiktok. this was almost unthinkable a month ago that this would pass. the doubts were massive but later we will catch up with our guests and it's important to question the amount of influence the former president still has over the republican, but tickly on this issue. annmarie: i would go down to the vote cap. the senate passes is one bill but the boat counts in the house was for separate bills. you look at where it was in taiwan and israel, there were still bipartisan support for ukraine but you saw a lot of processed votes when it comes to

6:36 am

republicans which makes me wonder if this is the final aid package this congress can get through and what does this spell if we get a trump 2.0? lisa: some people might argue that trump gave his lessing in the form of not asking for mike johnson's ouster and maybe that was enough to give them the belief that republicans wouldn't get pilloried if they signed up on this. he wasn't aggressive in arguing against it so maybe he's not really against it anymore but you heard this kind of pretzel twisting in washington. jonathan: he was against the tiktok effort and is ready to blame president biden if it happens. lisa: he wants it to happen before he can talk about people getting rid of it. annmarie: it depends what year you're talking about. he also tried to bennett when he was in the presidency and had the white house but now he says if it gets been coming wants to blame it on biden. jonathan: it was oracle back in the day. lisa: there was a great article in the wall street journal about

6:37 am

jeffrey yass the billionaire has been the biggest republican donor during this political cycle who has almost all of his money tied up in tiktok. it gives color to the whole issue. jonathan: yesterday was the four year anniversary of the inject bleach speech. that's a four year anniversary, where has it gone? i remember watching that address in the press conference. those were weird times. equity futures right now are up 0.1% and equities are doing ok off the back of two days of gains. president biden is losing ground in key battleground states according to the latest bloomberg morning console pole. he's now leading in one of seven states with his match up with president trump. it's a fade from the post state of the union bumper the president. marriott parker joins us now. where was the bump coming from and why is it fading?

6:38 am

>> the main thing is the fact that americans remain pessimistic about the economy, namely inflation. one of the problems you talked about is the nostalgia from four years ago. one of the frustrations were present biden and democrats of the fact that americans remember the lower prices that were around during the pandemic but not some of the other stuff that happened with the trump administration during that time as well. it's been an albatross on his reelection prospects. annmarie: when you look at some of the other polling data we have, the issue of abortion continues to come up. is this where we can see the president lean into this november? >> that's the bet the president is making. you saw him earlier this week go down to tampa, florida which is essentially a move that suggests he's going on offense easement as polling shows him trailing in key battleground states.

6:39 am

he went down there carrying a message about abortion. he and the democrats are hoping that any time abortion has been on a referendum, it's been abortion rights have gone in favor of democrats. they are hoping to swing for the fences and put all our chips in the middle of the table and in november, we can galvanize turnout among independent suburban women and the democratic base. the problem is, it's not showing the potency of the economy. annmarie: the third rail of politics is entitlements. any politician that talks about potentially reforming social security or medicare, you pretty much no longer may have a job. our poll shows there is one provision potentially that could work to shore up social security that voters actually like. >> yes, that's taxing the rich

6:40 am

essentially, a billionaire tax. it is the third rail. you saw in the republican primary how potent an issue it was because you had former president donald trump waffling around the issue. he and nikki haley were on that. if you recall, older voters are a reliable block in november. no one wants to alienate that block at all but the overwhelming, 77% of the respondents to the poll were in favor of taxing billionaires in order to make sure the program remains solvent. lisa: we get to find out why michigan, georgia, arizona nevada and others have that much greater clout over all political decision-making than any other states in this country. we saw michigan with president biden gaining two percentage points but losing and the others. what types of proposals or

6:41 am

provisions or lip service can we expect from president biden to get the georgia, arizona and pennsylvania states on board? >> that's quite the list. you have seven months or so if you're the president to essentially blitz those states as much as possible. once that trip is done, he will give the commencement address at morehouse college, a historically black college and university. that's in georgia. what we know is that the black vote, the young male vote, georgia, all those things have been blinking red lights for the president. you will see the campaign find creative ways to visit some of those states to deliver messages tailor-made to some of those states as well in the coming months. annmarie: do you think biden can win without winning the blue wall? >> know, and i don't think the biden campaign, speaking with

6:42 am

them, they feel as though they have to absolutely keep that blue wall being michigan, wisconsin, pennsylvania. that's absolutely vital. you have to at list -- at least win two of the three for sure. ideally, you have to win all three in terms of getting back to the white house if you're president biden. jonathan: we appreciate your time this morning. that's the latest on the recent bloomberg pole. more than three quarters of poll respondents said the president is responsible for the current performance of the u.s. economy in nearly half said he was very responsible. if things improve, do they think him? the perception of the economy right now is different to what we talk about around this table. we talk about solid economic growth and jobs are plentiful. ultimately, the views around this table are very different to how things stack up in the polling across this country. lisa: i would take your question and say even though on paper

6:43 am

things look good, why are they not feeling it and why are they blaming him for the negativity they feel? this is a source of frustration for the white house and we can debate exactly why this is taking place. it speaks to the two speed economy that mike wilson was talking about and that we hear about in front of the bus in the back of the bus when it comes to airplanes. there is a kind of motley picture of the u.s. economy now. annmarie: it's hard to land this argument on voters minds. the rate of inflation is coming down, when they remember the price of goods before biden was inaugurated, i think the story will get even more worrisome for the biden administration. gasoline this morning averaged $3.66, close to four dollars and it's not even peak summer driving season. this will be a challenge. jonathan: if tk was here he would love the following story -- in london right now, at least two horses are on the loose in central london reportedly from the household cavalry which works in buckingham palace.

6:44 am

annmarie: i've seen that. lisa: is there a horse camp? annmarie: the trainers take them out in the hyde park and they can go running next to the horses, it's fantastic. jonathan: i love the back story of this. that's the latest from the united kingdom. let's get you updated on other stories. shares of these arising in the premarket after their earnings top wall street estimates done adjusting income for the fiscal second quarter rose 17%. in the u.s., credit card spending grew over 6% from a year earlier in the earnings following last months news that visa and mastercard are allowing u.s. merchants to charge consumers extra for using credit cards and retailers say it will save them at least $30 billion over five years. netflix is doubling down on

6:45 am

global ambitions. emily chang spoke to the companies she content officer about the strategy. >> latin america has a rich history of storytelling with so many great presentations and there is a great creative ecosystem there must been great is to see it continue to grow and continue to expand the variety and while it is what we do. they really have people on the ground in the culture and to work locally in that community. that's taking time to build and grow and have that maturity in the market that way for us. jonathan: you can watch more of that conversation on the circuit on bloomberg tv streaming at 6 p.m. eastern time at bloomberg originals. we hope you're enjoying the series. up next, earnings in full swing. >> the next few weeks, this is a get out the popcorn moment.

6:46 am

6:47 am

6:48 am

jonathan: stocks in the s&p 500 are lifted by zero point 1% with one single name dominating the conversation. it's tesla. we are up by 11 point 6%. later this afternoon, we will talk about meta. maggie seven earnings are in full swing this morning. >> it comes down to deterrence. i think the next few weeks, this is a get out the popcorn moment for tech. you will see chips, ai revolution, enterprise, consumers, google, meta and others, i think this will be a flex the muscles moment for tech.

6:49 am

my view is we sit here for-six weeks ago -- from now is a golden buying opportunity. jonathan: meta earnings after the bell today and microsoft reporting tomorrow. they had a stellar fourth quarter at meta. hi single or low double -- double digit rates of growth are likely to persist. let's start with that launch, how important is that? >> it's massive. jonathan: what is it? >> you have too many products. they went from nothing to attend billion-dollar run rate in the third quarter alone. it's a massive shift in terms of how much revenue they are

6:50 am

getting. jonathan: can you tell me what it does? >> it automates everything. lisa: how much are we looking at with the stripped down staff in addition to everything they have announced? >> i don't think that will happen. they collect more revenue and the money is there. it's about the advertisers willingness to spend. you spend more money into other forms of building ideas. ai still requires people to know how to use it. it's not like it's a massive labor change. lisa: with meta, people look at it as an advertising story but there is a question of how much share they are gaining and this year it will be very much about whether they want to bid for tiktok and what they expect to see in terms of ads from that. what do you expect to hear from that? >> i think people will wonder about tiktok but i don't think we will hear anything about it

6:51 am

yet. my bet is that the chinese government won't allow them to sell it so you are likely to see it exit the market but the lesson is what happens to the $6 billion last year in ad revenue that was going to tiktok, maybe eight this year? that money will get redistributed so some of it goes to meta and some go to youtube but they will look at how they can make products that capture the revenue. annmarie: is it met in the best place to bring in those users? that tiktok videos are hand-me-downs that live on instagram. >> so much of tiktok's video-based so youtube is in a good position as well as snap. when it comes to china, rbc is talking it can pet 10 chili wayne in china where they have incredible demand in terms of advertising. how difficult will that be? >> chinese marketers advertising abroad which has been happening

6:52 am

for a decade. it's hard to say. the weaker the chinese market gets, the more manufacture their focus on markets abroad. it's a negative correlation between economic activity in advertising and this flips the conventional view. jonathan: what does the death of tiktok look like? do they do this through the app store? >> this has happened already, one day is no longer available. jonathan: but people can still use it even though it's not available? >> that's my understanding. how do you get the app stores to stop supporting it? lisa: that raises the question of how they will capitalize on it and china getting some of the eyeballs. it's a macro call on how confident companies are about economic strength going forward. does that still apply? >> no, there are old rules of

6:53 am

thumb that were informed by a predecessor that was replaced. he basically taught everyone how to think about advertising. what he taught everyone in the 1950's was correct. there was a very direct relationship between economic activity and advertising but it's kind of falling apart because you have this cross-border activity for starters. the other thing people don't appreciate is e-commerce based marketers spend four dollars for every dollar of revenue, more than average retailers. e-commerce spends four times as much of the economy is digital. there is greater intensity and that's another factor that distorts this relationship. lisa: mark zuckerberg's chain, it goes to the -- he's trying it out and it has a prayer message written on it that he wants to pass along that he reads to his

6:54 am

kids at night. the cult of personality is the point in the questions around personality and some of the founders of these companies and whether that's an attribute or a deficit or a detriment going forward. >> attribute. lisa: even from mark zuckerberg. there might be people who see the chain and one in some say it's strange. >> whether it's politics or advertising, especially advertising, you will not get a better ai driven advertising campaign because mark zuckerberg has more fashion sense but keep in mind what really matters back to the what do people do in the advertising world, there is still a subjective choice about why you allocate more money to metaverse than google? jonathan: mark zuckerberg will not fail if donald trump goes back to the white house. he can't stand the guy.

6:55 am

>> i don't think it will really impact advertising in a meaningful way. jonathan: does he have the power to reverse the tiktok decision? i'm trying to work this out as to what this looks like? >> i think the bigger issue will be what happens to the rest of the advertising industry. tv network owners, what kind of regulatory latitude do they get? they've almost given up but they haven't done anything as far as aggressive moves to become more powerful players with respect to advertising in this world. they be loosened up? lina conn stays in the ftc. lisa: even if trump wins? jonathan: a lot of republicans agree with what she's doing. thank you. meta coming a little later following tesla yesterday afternoon. coming up next, we will catch up

6:56 am

with lori eitel from state street. mike schumacher has him strong bots on his bond market. the fed is easing soon playbook, he says remove it from your desk. you don't -- she doesn't think the cuts are coming anytime soon. lisa: that's why it takes one weaker than expected pmi print to go back to the rate cutting story so does that reverse when we get something else? jonathan: let's talk about supply as well. more supply coming later with bond yields higher by three basis points. the two-year is up by three. from new york, ♪ ♪ this is bloomberg.

7:00 am

>> all the things we look at are just not there. >> the big driver here i think does inflation come down as much as we anticipate? >> i'm pretty convinced that inflation is not returning to 2% in a safe and reliable way. >> inflation will just get more elevated than thought. >> is the big question for the market, is what we've seen come inflation that sticky or is it truly react seller? >> this is bloomberg surveillance with jonathan ferro, lisa abramowicz and annmarie hordern. jonathan: big tech earnings underway with tesla behind us but meta in front of us. next week amazon and on apple

7:01 am

and nvidia later in may. good morning, good morning, your equity market is posited by 0.1% with tesla flying, up by more than 12% in earnings, up by $17. a bit of a price target cut. he said in a much needed call, they just elon musk lisa: stepped up at a time when people are saying tone matters for someone who is thought of a somewhat of a genius but also pretty unpredictable when it comes to performance. how much debt is -- does it set up the earnings time as tell rather than show me. it seems like tellme is good enough for him. jonathan: is it a mirage? the low-cost ev is apparently coming to you at some point in 2025. annmarie: elon musk continue to brush out these questions and said more on that august 8 and i

7:02 am

thought he was obfuscating. this is what the market wants and he wasn't prepared to go in on details because he had a hail mary idea of a robotaxi. if you have an iphone and you're prepared to launch it, why would you spill the beans? potentially, we will learn a lot on august 8 which is why the likes of dan iser saying dark days potentially behind us and we are looking forward. jonathan: we will see because the stock has had a terrible year so far. it is down by more than 40%. in washington, d.c., it was almost unthinkable boyd come to an agreement on foreign aid for ukraine, israel and taiwan. the number is $95 billion aid package getting through washington. annmarie: when the president signs it today, he insinuated that he will make a speech of the american people and what we've heard from officials as they been preparing especially for ukraine to get that ammunition and weapons out the door. right now, ukraine is suffering deeply.

7:03 am

they are suffering on the battlefield and they think the next aid package can change things. lisa: it opens the door to what's next in terms of the discussion heading into the election. this is important to come together and do something. they got that done and now you have to fill six months of rhetoric. we have to figure out what will be the leading story because that's the way of the moment in washington, d.c. annmarie: everything they potentially have to do before the election will be kicked the can down the road and iti will be a lot of electionng. jonathan: lots of electioning coming to a tv set near you over the next six months, equity futures in the s&p 500 are posited by 0.1%. going into meta earnings later with yields higher by three or four basis points. coming up this hour, we will catch up with lori heidel from state street. brooke sutherland will react to

7:04 am

boeing earnings out earlier. mike schumacher of wells fargo not expecting rate cuts any time soon. we begin with our top story, stocks bouncing back in tech driving the s&p 500 to its best day in two months. lori joins us now for more. is this a scream to buy bonds now? >> hardly. we still think there is room to run in equities particularly u.s. equities. earnings are continuing to be pretty good but it means we are holding elevated levels of cash because we think there is value there when you have interest rates where they are but also we want to retain some dry powders we can capitalize if we get more pullbacks. jonathan: we got a sense of

7:05 am

economic weakness yesterday but it was enough to push into a bid into the bond market. is the pmi worthy of a double take? >> our view has been that we think the inflation bogeyman is contained. that doesn't mean we will see consistent 2% levels of inflation anytime soon but we are concerned about the fact that the fed remains so focused on data by data and there is a lot of noise in the data now and markets are having the same sort of reaction. we are not hanging our hats too much in any one point of data but it's about trendlines. where do we see the trajectory going? lisa: you said you have higher than normal cash holdings now at a time where you have a relatively high rate for that investment. are you worried about reinvestment risk and the idea that if that weakness that makes

7:06 am

you less optimistic about risk assets comes true that the fed would cut rates and that would make it less attractive? >> certainly reinvestment risk is always on her mind. our forecast is that the fed will cut this year and they may cut as many as three times or perhaps 100 basis points. we also believe is that it will be more elongated than what market participants thought six months ago. we've seen the number of rate cuts come down dramatically. we've seen rate expectations rise. you're getting paid to hold cash. we don't think the amount of cash we are holding is particularly high. 7% is a nice position but it's hardly going to take away from the court -- core portfolio. we think we will have more time to reinvest that cash more than the beginning of this year. lisa: how much of a pullback in equities before you see that as attractive?

7:07 am

>> we would like to see another five or 10%, those of the levels that give you encouragement. we don't expect to see that in the near term partly because of the earnings that will come through well but there is a lot of volatility out there. equity volatility has been heightened recently and we paired are overweight to equities as recently as early this week. annmarie: you hold a modest position in gold. what would it take for you to want to sell that? >> some of the volatility needs to come down. one of the interesting parts about our position and goals it's not necessarily driven by the typical reasons you allocate to goal. you normally think about deflationary environments, those are good places to hold gold as a diversifier. part of our positioning now is that gold is one of those diversifiers and it's still zigging when other things are. gold is one of those positions that gives us an anchor. what we would look for is more

7:08 am

normalization of the correlation between equities and fixed income. annmarie: what about the rally we've seen in this asset? >> interestingly enough, one of the biggest purchasers of gold has been central bankers. there is kind of another dynamic that's going on now. we see it's a bit of a momentum trades we think it has a further run. in the context of what's going to move differently from other parts of your portfolio, gold gives you an interesting ballast. jonathan: we had a guest on yesterday from morgan stanley talk about concerns about the deficit. connecting the dots on that to gold so how much weight would you put on that? >> it's less about the deficit per and mores about the idea that thee dollar likely will go lower at some point in time. typically come you don't see the kind of gold run we've seen when you have a strong dollar environment but people including us are skeptical of that

7:09 am

continuing. in the short-term, there is a great bid on the dollar in the short-term, economic uncertainty creates that, concerns about volatility because of two wars we have going on, concerns about other central bankers moving quicker than the fed so that puts a bid under the dollars longer-term, the next trend in the dollar is definitely lower and that will lift gold. jonathan: you think there are limits to that central bank divergence story? >> it's not that there are limits but it's a question of sequencing. historically, the fed has been one of the first movers from a developed market standpoint in terms of reducing rates and is likely this time around that won't be the case. that gives you a bit of a dollar bid because you have higher interest rates compared to other parts of the world. lisa: there was a report about

7:10 am

some of the industry analysts and how 73 percent of those in united states think the u.s. election in november will be relevant to their industries. how are you figuring out some sort of thesis, investing thesis at a time where there is this degree of uncertainty headed to markets later this year? >> that's the $10,000 question. you go back to first principles, earnings growth drives equities so where are the earnings that are likely to come through? where will they be met? the u.s. continues to be the best looking house on a fairly bleak looking street. the second thing is hold higher levels of cash with helps you with diversification. look for diversifiers like gold and industry by industry, there will be potential repercussions depending upon which candidate ultimately becomes president. if you look at things that have been sweet spots come inflation reduction act spending, chips

7:11 am

expended, some of those things may be scrutinized by the next administration. i think you have to look industry by industry but the problem is, it's early for that because we don't know how this thing will play out. jonathan: let's finish on tech. we get meta later today. a lot of people have filed in seven names into one name and the story worked last year and a big way and then this year, things started to break down. what is the best way to think about the big tech names? >> you have to take them one at a time, you can't lump it all together and by the seven stocks and call it a day. we have always been more in the camp that we thought you don't want to chase those names even collectively. having a more diversified portfolio, we think is the market continues to see broadening in the market, that will benefit investors. jonathan: we appreciate your time this morning. later this afternoon, we will hear from meta and you will get google and microsoft next week

7:12 am

and amazon and apple near the end of may. i think may 22. then we will hear from nvidia. let's schedule an update on stories elsewhere this morning. michael o'leary weighing in on the boeing management crisis saying plane maker needs to focus on leadership, continuity as it seeks to stabilize its business. >> we are seeing optimistic signs. we've seen aircraft moved from wichita to seattle without any defects being carried over. that's a good sign, it will speed up the manufacturing process in seattle i think we are now getting with them new management team in place and we will see the end of these production challenges abroad. jonathan: boeing will report earnings and 30 minutes time. that stuck it -- that stock is up in the premarket. stand up between pro-palestinian demonstrators in columbia university officials have been extended after deadline expired

7:13 am

at midnight. the columbia spectator reporting today extension came out with just significant progress in student representatives agreed to four commitments including coming down on tents in their camp. house speaker mike johnson will speak with jewish students at the university later today. kering shares following to their lowest level after the luxury group plunged in the first part of the year. slumping sales are attributed to gucci. lvmh is up like 10%. an absolute clinic on what gucci is going through. do you want to repeat that clinic? annmarie: there is a lot to dissect here. jonathan: annmarie: the design problems? annmarie:a different creative director to jonathan: a new vision. jonathan:what is annmarie: annmarie: the new vision now? it's more sleek. his first runway show was a great overcoat and it wasn't

7:14 am

extravagant. it was more sleek, think vintage gucci in the consumer base is different. they need to shore up new clients. jonathan: sales of gucci down 18% in the first quarter, held back by china. less on gucci in the next hour in the senate passing the foreign aid bill. >> after more than six months of hard work, many twists and turns in the road, america sends a message to the entire world -- we will not turn our back on you. jonathan: that conversation is around the corner. live from new york city this morning, good morning. ♪ how am i going to find a doctor when i'm hallucinating? what about zocdoc?

7:15 am

so many options. yeah, and dr. xichun even takes your sketchy insurance. xi-chun, xi-chun, xi-chun! you've got more options than you know. book now. every second counts. 120 seconds to add the finishing touches. 900 seconds to arrange the displays. if you're short on time for marketing constant contact's powerful tools can help. you can automate email and sms messages so customers get the right message at the right time. save time marketing with constant contact. because all it takes is 30 seconds to make someone's day. get started today at constantcontact.com. helping the small stand tall.

7:17 am

♪ jonathan: the bounce continues with two days of gains on the s&p 500. yields are drifting higher once again. the senate passing the foreign aid bill. >> after more than six months of hard work, many twists and turns in the road, america sends a message to the entire world -- we will not turn our back on you . failure to pass the supplemental aid would give power to vladimir putin and others. jonathan: president biden is set to sign and 95 billion dollar

7:18 am

aid package for ukraine, israel and taiwan after the senate passed a bill last night. biden signature will start a countdown on tiktok, the social media facing a possible ban in the u.s. parent company divest within 270 days. we break this down now. i want to sit on this for a moment. we talked so much about the division in washington, only a few months ago, people but the prospect of this happening was all most unthinkable. how united did washington become on this issue in the last few months? >> they gained eight votes since february from the republican party who had been so opposed providing aid to ukraine, israel and taiwan. this is a case of members wanting to be on the right side of history. when speaker johnson said last week, go into the room and look at all of the foreign intel and look at the data we have backing this up, we need america to be strong again against vladimir

7:19 am

putin and x and i rani and that's with the members decided to alternately deliver. this is a testament to the foreign policy arm of joe biden's career in the senate. in no small count, it's mitch mcconnell who wants this to be his legacy which we been hearing from his staff or seven months since the october 7 attacks in israel and well before that in ukraine. annmarie: this got through without border policy which republicans were basically promising their caucus that we would make sure we would do. where does that leave the potential legislation or this is an election issue and no one in congress will work on it until be maybe next year? >> congress will not be able to do anything on the border. republicans had their chance and decided it wasn't good enough and they let the perfect be enemy of the good. we haven't passed immigration reform in decades. i remember 2013 when we came close and they don't have the

7:20 am

ability to get to yes on immigration. the administration is planning a series of executive orders on border policy which will potentially we will see as early as next week so i expect that to the bulk of what we do on foreign policy. annmarie: and that's going into the election. we have a new pullout this mowing that shows the biden bum following the state of the union has evaporated. it really only has control of michigan and it continuously comes back to the economy especially inflation. what is the messaging from the white house going to be? it's not landing on voters. >> the economy has been a weak point for everybody for many years. your polls have an incredible margin of error of just 1%. it was big to the testament of how thorough your polls are of the swing state. michigan is interesting and present dish and present bun is made huge efforts to get with the union groups and got another and wiseman today but kennedy

7:21 am

got on the ballot michigan which could potentially be a problem for the biden and the trump team. when it comes to the economy, the president has been underwater with women voters specifically because of their exposure to inflation and the cost of household goods and gas prices which are disproportionate share of where money is spent in america from the women of the households. that delta is potentially being superseded by the abortion issue which for the first time in your pole is now major issue, a very important majority of voters in the swing states which includes democrats and independents. we want to learn from something beyond the polls, the actual boots on the ground in an issue has a history of superseding even the economic issues and inflation as we so in 2022 when inflation was higher. i think it's going to be a situation where biden keeps having to tout the state of the

7:22 am

u.s. economy which is by all accounts strong which is why the fed is struggling to cool it enough to bring inflation down but getting that message across is something that they are trying to to step it with abortion. i would like to see where immigration comes up in the polls. that something republicans want to see but the economy continues to be paramount. lisa: now that the $95 billion bill was passed, there is a question of what next? what gets done before the election? electioning will probably get done and you tucked at the potential of single executive actions on the border issues. what about tariffs? what about other issues that might come to the fore including from the ftc that very much are in line with what biden has been talking about? >> i'm finally expecting tariffs and trade to be front and center. on the senate side, there were

7:23 am

major announcements, three times higher steel tariffs which is only 2% of u.s. imports of that won't be a major mover for steel but directionally and from a messaging standpoint on china. the new section 30 one investigation into shipbuilding which is near the united states is way behind on and china dominate. and coordinate effort with mexico and potentially canada which the ambassador was integral getting pats in the last administration could be used to look into electric vehicles and their import from china on the component side and preemptively getting in front of that entire sector. i think a lot of activity on trade and then we are eagerly awaiting the inclusion of the section 301 review which covers the 370 billions worth of tariffs in place. the investor will announce whether any exclusions that were agreed to in the last year will be extended. lots of movement on the trade

7:24 am

front but to your point in congress, don't expect anything. they will be campaigning for the rest of the year. annmarie: you mentioned steel and you mentioned potential tariffs on chinese ev's. what lever could biden pull to ensure votes in wisconsin if he caps -- if he has to keep the blue wall >> >>? you really want to see the data for the biden team in your pole. it's michigan where he continues to maintain his lead even though he's underwater everywhere else. the primarvote in pennsylvania last night is interesting. nikki haley who hasn't been on the ticket for months got 17% of the vote. what biden will do is try to continue moving forward with the steelworkers, the three times higher steel tariff is something he is calling for and that speaks directly to the steelworkers. what we know about the unions and all those groups is that

7:25 am

they will go to the mat to get there 250,000 members to vote in the direction they advocate for. i think biden is taking that labor message to heart which is integral in pennsylvania, wisconsin, michigan and the whole rust belt. jonathan: it's great to catch up with you. breaking down the situation in the senate. this is something henrietta has done a good job of, how deep is that pool of people who have not decided what they will annmarie: annmarie: do in november? there are a lot of them and something else that is striking is the fact that the biden six-point deficit across the swing state is wider than that of democratic congressional candidates. some split ticket people might not vote for biden. when it comes to double haters, where do they go or do they split their ticket and potentially give the other side there presidential vote?

7:26 am

jonathan: equity futures now in the s&p 500 are positive by 0.2% and tesla doing nicely in the premarket with more earnings coming later with meta after the bell. before the opening bell, you will hear from boeing. we will catch up with brooke sutherland who joins us next to react. from new york city, this is bloomberg. ♪

7:27 am

[busy hospital background sounds] this healthcare network uses crowdstrike to defend against cyber attacks and protect patient information. but what if they didn't? [ominous background sounds] this is what it feels like when cyber criminals breach your network. don't risk the health of your business. crowdstrike. we stop breaches. starting a business is never easy, but starting it eight months pregnant.. that's a different story. i couldn't slow down. we were starting a business from the ground up. people were showing up left and right. and so did our business needs. the chase ink card made it easy. when you go for something big like this, your kids see that. and they believe they can do the same. earn unlimited 1.5% cash back on every purchase with the chase ink business unlimited card from chase for business. make more of what's yours.

7:30 am

♪ jonathan: coming off the back of the biggest one day gain, two days of gains into today and equity futures are let's talk that the bond market. a lot to discuss. the front end of the curve. later, huge numbers. the five-year notes coming to market. going into it by a single basis point. what was interesting was how encouraged people were about the softer pmi. lisa: it confirms the belief.

7:31 am

exhibit -- this is what people were worried about. what was interesting is that basically what you have is ready to value. there is still a bias. jonathan: clearer picture of what he is telling us this morning. the dollar-yen came really close to 155 overnight. by 0.05%. can you make the argument when we went through 152, 150 three

7:32 am

and approached 155 in a few weeks? lisa: they are questioning the ability to interfere. the bar has gotten reset so many times. a potential for intervention. this is a story. jonathan quan a little bit more yen weakness. the company accelerating plans for an ev model. the announcement overshadowing worse than expected revenue. elsewhere in washington, president biden sent to sign in a package. biden's approval also started -- starting a countdown to divest the social media platform within 270 days.

7:33 am

i have done my bit. first quarter revenue beating wall street estimates. the company is likely to deliver by year-end. initial reaction, up by 3%. broke, you have had some time to go over this one. brooke: it speaks to how slow boeing is going as it tries to get its arms around a franchise make sure that they are satisfied. that is why you are ending up with about 3.9 billion. it is talking about -- it remains a bit of a prove it

7:34 am

stories. it needs an ultimatum, to come up with some sort of plan to put an end to these issues. jonathan: demand is not a problem. demand has not been a problem. it is quality control. has it interested year that demand has not fallen off any material way, given how much they have been in deep water over the last few months? brooke: it is losing. airbus has built up a substantial lead. in terms of that competitive dynamic, it is lopsided, but you have a wobbly. if you are operating in europe,

7:35 am

or the u.s., your only choice is billing or airbus. in terms of pricing dynamics and airplanes. they are sold out well into the next decade. if you look at analysts, a lot of them are still positive. just because the reality of the aerospace market is. the demand will be there for billing. they are not allowed to fail. they are the biggest exporter and much of the world depends on the company to figure out what is going on and hand over airplanes that are up to standard. lisa: it looks significant, but in the scheme of things, maybe not so much. what optimism can you glean? is there something else like a

7:36 am

nasa contract or sit ins of safety patrol that you have been hearing about with certain employees? look: i do not know if that is the right question. i do not think investors want to hear that. the best way to be billed profitability is to get to the bottom of these quality control issues. being meticulous, figuring out where the problem points are and solving them one by one. boeing seems to finally understand that. they should have understood that after the 737 max crises. they announced that they are sent. they are at least saying the right things right now, which is progress.

7:37 am

lisa: basically the two laggards came out and send the right thing, which was enough for people to buy into the story. is it enough that this is a leadership team that understands that he needs to be saying that safety is first come even though everybody has been saying that for the past three to five months? >> the bar is rather low. it is good that they are saying the right things because they have not always been doing that. it is not some sort of comprehensive issue. acknowledging that is a first step. can you build up a track record where airlines and receiving the quality of orders and on time? that will take a couple months.

7:38 am

anne-marie: where are they when it comes to what they used to own? brooke: there is an urgency to get this done and bring spirit back into the fold. it is taking a little bit longer. they are helping to stabilize operations. not the first cash advance that they have made. it has a lot of its own staff. i am skeptical that this is going to do all of that to rectify the issues with spirit. at this point in time, they are still working on that deal. anne-marie: they have airbus as one of their customers. brooke: this would have been easier if boeing had purchased a

7:39 am

decade or two ago. it was not healthy to be so dependent on billing. not entirely profitable, but they do exist. they will not be keen for some kind of arrangement that does not satisfy their interests. just because this is not an easy deal to get done. jonathan: the estimate is 16.25. something like 4%. it kind of rhymes with tesla for a few reasons. if you look at it relative to

7:40 am

where stock has been the last few months. lisa: are you looking at a bar that is lowered substantially? you can get a little bit of a rebound. highlights come with the overarching narrative. even though we are trying to find those themes. keep nimble and keep working on each story and figure out which -- write each one will go. jonathan: you can learn how the market will react. how low is the bar? warning after warning indochina. coming out with how weak burning desire.

7:41 am

lisa: that is why they are expecting some kind of pop. is it just rhetoric? what kind of advertisement campaigns? jonathan: futures are positive. let's get an update on stories elsewhere. we can do that with the bloomberg brief. the answer may live in china. helping to boost prices. a long-standing history. a second story, the ftc voting to adopt a been. from switching jobs within an

7:42 am

industry. the legal showdown comes three years after president biden signed an executive order to limit agreements. the rule does not apply for executives who earn more than hundred 51,000 600 -- 150 1000 -- how did they come up with a number like that? the exclusive negotiating period with disney and warner bros. has ended. the least current nine year deal is with the nba, looking to -- this time around. lisa: you want it to go back to the future.

7:43 am

you just want a search function? jonathan:. farmer's wife. excuse me. a good show. they go. -- there you go. she likes chills. this is how she chills. videos? true story. a fiery morning. lisa is next to me watching dog videos. lisa: also resurrection videos of dogs that are found and then kept up. jonathan: lisa is kind of losing it a little bit. ok. bracing for a hawkish fed.

7:44 am

7:45 am

they're already there. they wear business sneakers and pad their keyboards with something that makes their clickety-clacking... clickety-clackier. but no one loves logistics as much as they do. you need tamra, izzy, and emma. they need a retirement plan. work with principal so we can help you with a retirement and benefits plan that's right for your team. let our expertise round out yours.

7:46 am

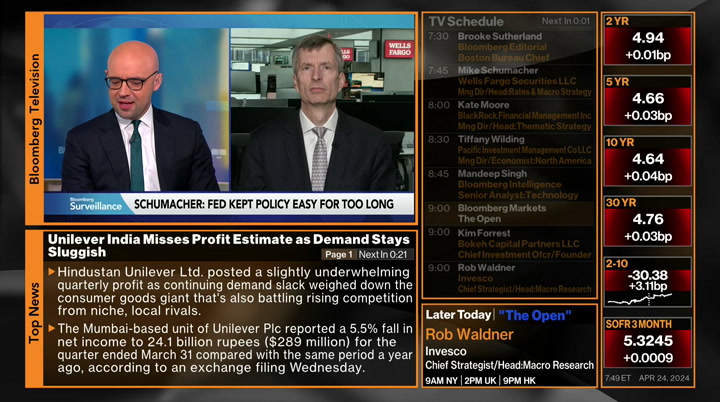

jonathan: no more of that. we are done. bracing for a hawkish fed. >> with growth and expensive as it is, there is no reason for a full cutting cycle at this time. i think the fed will be a little more reluctant to cut rates. it will take a while to rebuild that confidence. jonathan: mike shoemaker writing this.

7:47 am

from your desk to a distant bookshelf. they need to more before cac considering a rate cut. one day the market will price in additional easing. joining us for more. certainly enjoyed it. we have been very focused on this table. do you think the supply, the firing side in the rearview mirror? >> you have the announcement coming out next week. it is probably done for the balance of this year and into next year as well. lisa: i think it is telling that yesterday we such -- saw such a

7:48 am

big move. how much does not give you a sense that the playbook needs to be on the bookshelf of having a permanent place in your repertoire? >> it is interesting when you look at what has been driving rate and currency markets. the fed and the ecb, take your pick. you can do regressions until the cows come home. we can talk to people in the markets and that is what they will say, but to me, it is not a signal event. i focus on the amount that we have seen. i agree with the point. lisa: it does not begin this

7:49 am

wholesale decline in short -- bench rate? >> i expect the fed to have a tough time doing that. when those committee members sign up, they have to assume there will be cuts to fall. it has not changed. they will price a lot more easing. it is probably four to five at a minimum. lisa: do you think the bar has gotten much higher for the fed to really embark in a rate cutting cycle? >> it is pretty clear.

7:50 am

it was too early, to p2. what it means is i think the fed needs to wait. lastly on that point, jay powell once that first moved to be unanimous, but he has nowhere year enough votes. the buyer is quite high right now. jonathan: we had darrell on the program not too long ago. when we talk about some of those levels, the five year yield is very there is a 10 year risk. if you are investing, you need to make a choice. got people screaming about levels. where do i want to buy across the curve?

7:51 am

>> why should i take that extra risk? the reason is if the fed is going to cut soon, i am not going to get that much longer. pretty soon is not anytime soon. not going out all the way. too soon. jonathan: what is your credit call? >> i was in asia not long ago. very little yield. any incremental yield is attractive.

7:52 am

i suspect that is why people are so keen. relative to what i can get in terms of yield curve, credit looks pretty good. lisa: seven to 8% on average is anathema given the fact we software percent to 5% for 70 years. there is a question about what we are going back to. it suggests that policy is not necessarily restricted. there is more strength and inflation the most people had previously thought. can you give us a sense of how that evolves? >> their house does a terrific job.

7:53 am

cpi is running amok. it will come down gradually. it focuses on pce and not cpi. the thing is that the market needs to see a couple of good print. you need to see two to three good prints. i would say it takes another three to four months,. annmarie: the senate overnight defending to the less allies. what does that mean versus the u.s.? >> the idea of defense spending going up is interesting.

7:54 am

if i were to take a look at a couple of good years, probably all the developed countries. the u.s. gets a lot of attention. if you think about france, maybe 2% gdp. you put it altogether and what you get is a lot of bond issuance. yields have to be higher than in the past. a really topical point. jonathan: they have said the same thing. confronted with heightened geopolitical tensions. if you believe the consequences,

7:55 am

are you thinking maybe that trade is not going to work an -- not going to work? >> it will probably impact longer yields to a high degree. a secular steepening. it will be a big shift. longer-term, higher yields on the backend. jonathan: we appreciate it. lisa: we ask people how much of the deficit is being priced into it. you see that with every option. it is a valid point.

7:56 am

7:57 am

to me, harlem is home. but home is also your body. i asked myself, why doesn't pilates exist in harlem? so i started my own studio. getting a brick and mortar in new york is not easy. chase ink has supported us from studio one to studio three. when you start small, you need some big help. and chase ink was that for me. earn up to 5% cash back on business essentials with the chase ink business cash card from chase for business. make more of what's yours.

7:58 am

i don't want you to move. from chase for business. i'm gonna miss you so much. you realize we'll have internet waiting for us at the new place, right? oh, we know. we just like making a scene. transferring your services has never been easier. get connected on the day of your move with the xfinity app. can i sleep over at your new place? can katie sleep over tonight? sure, honey! this generation is so dramatic! people couldn't see my potential.y. so i had to show them. i've run this place for 20 years, but i still need to prove that i'm more than what you see on paper. today i'm the ceo of my own company.

7:59 am

8:00 am

8:01 am

better than a lot of people expected. >> we have to go. >> this is bloomberg surveillance. jonathan: live from new york city this morning. positive by .25%. we heard from tesla. later we hear from meta-. before this week is out, you will hear from the likes of google and microsoft. lisa: the reaction to the response from the earnings reports. is the buyer set to low or too high at a time where they had been outperforming? jonathan: they are a perfect example of that.

8:02 am

on the morning, taking a sneak peek of this. off the back -- i will not even say it is off the back of the numbers but off the back of the commitment potentially. that is where this market once the company to be. annmarie: everyone was asking, tell us about the robotaxi or this $25,000 car you are promising. that seems to be when shares were skyrocketing. a cheaper tesla model, but he said, we will have more information on august 8. is he up to skating for a reason? they made a good point. not too much away before. lisa: those shares are up 40%.

8:03 am

almost up as much as tesla is down. how much are earnings going to have to be? jonathan: a tangible amount of conviction. lisa: they come up with a thesis and it is kind of halfhearted on how they are going to edify it. people are talking about the earnings and specific companies because it is much more comfortable. jonathan: get the second call right. positive by 0.2%. higher by three to four basis points. the euro is a little softer. not supporting the currency. it is softer by .1%.

8:04 am

people catch up on my this earnings season is crucial for investor optimism. pimco ahead of next week's meeting. black wrought -- blackrock's kate moore thing this. the pressure on earnings is especially high. earnings come in -- let's talk about the upside potential. how great is it? >> the big thing is we wanted to see some monetization and guidance, but i think it will be the tone for management.

8:05 am

turning the stock price there. it sounds like there is a plan. there has been a lot of good news. what does the rest of 2024 look like? what do customer demands look like? we need to see constructive, happy faces from all these leaders. we always went to hear from ceos, but it is also really important to listen to the cfos who get down into the dirt. i think we have taken some pressure off of stocks throughout the weeks. we have seen growth as a factor for getting a little bit. that said, they do need to

8:06 am

deliver. they are well loved names. through the rest of the cycle. i think it is possible to get people excited, but we recognize that they are well owned. lisa: we get better than expected data. a lot of bullish sentiment right now. >> i want everyone to have confidence. continuing to manage labor force, thinking really long and hard. so that they can really deliver on earnings. revenue growth is ok.

8:07 am

it is the bottom line that i want to see. we saw this focus on cost control and focus on delivering earnings has been front and center. i do not think we want a screaming hot economy. we want solid demand and rates to be stable. they do well on. what we are not mentioning is the election year and what that might mean for policy. if we have stability in these other areas, i think it gives them confidence to manage margins. annmarie: how are ceos dealing with the election?

8:08 am

you have to walk a very five line. >> they are being deliberately evasive. there are a lot of outcomes depending on november. they do not want the bank too much one way or the other on challenges. they are just trying to manage over the next few quarters. they had basic -- annmarie: does it help executives plan for the future? >> it is really hard to say what the details will be. i will go back to the congress point. there is a limit to how much an executive could get done. i will be watching the senate and house races going into the

8:09 am

fall. lisa: they are looking for a split. i'm curious about what you said about stable rates. if the fed holds maids, is that -- we'll not be enough to fuel a significant rally in equities? >> we know that 80% as fixed. what we do want to be able to incorporate is expectations for the next couple of quarters. will they be cutting or will they not? it holds back some decisions which would be supportive for growth. stability is better than any outcome, i would say.

8:10 am

lisa: we are talking about geopolitical risk. how much does that give you pause? where are you looking to hedge? >> particularly if companies go down regular maintenance and hold off on expansionary. the election is all over the world. u.s. companies, mostly they are dispersed. policies and each of those regions will affect their decisions. i they wait -- are they waiting to get more?

8:11 am