tv Bloomberg Daybreak Asia Bloomberg April 18, 2024 8:00pm-9:00pm EDT

8:00 pm

there is quite a lot to be pouring cold water on asian equities in the session today, especially when you take a look at some of the hawkish fed speak that has been coming through. haidi: yep. a mixed picture when it comes to earnings. mixed even when the numbers are strong. netflix, you see how high investor expectations are. it will be interesting to see how that plays through some entertainment related stocks. also watching chip stocks in the open with muted commentary, the pullback from tsmc. likely to see every action from hynek's in this part of the world. annabelle: and asml earlier this week i'm great outlook sprint japan -- we are tracking the japanese yen, continuing to watch any levels or signals of intervention we get from japanese government officials. many of those in washington from the -- for the imf spring

8:01 pm

meeting. they are concerned but also what are the parameters they have to act in. we just had some numbers coming out in the last half an hour that showed a general trend of cooling a little weaker than what economists had been predicting. still tokyo inflation is another one to watch and that is coming up in a week. equities, the picture today. we are under pressure so far. really a lot for investors to be tracking today given the hawkish fed speak and the stronger u.s. eco-data up. let's look at korea coming online to start the day. it is that pitch of weakness. the kospi down 1.2%. netflix, you can see in after hours dropping 5%. it is that concern around the weaker forecast for the current quarter. they will be stopping the report subscription fees and that is

8:02 pm

spooking investors somewhat. korean won seeing weakness against the greenback. korean currency officials have been in washington and they are seeking stable fx at this point in time. haidi: take a look at how we are setting up here in sydney. in the first minute or so of the staggered open we are seeing some weakness across trading for the asx 200 we have seen this drag that has played out when it comes to australian mining stocks despite the rally we have seen across commodities more broadly and even resilience returning to iron ore. we have seen aussie miners underperforming global peers. falling in tandem with iron ore prices that continue to come under pressure despite the rallies we have seen in gold and copper. that has not had too much of an impact. we saw treasuries really getting

8:03 pm

ahead of the fed speak and aussie bonds in that reaction to the unexpected fall in employment numbers as well. we heard commentary from our conversation with the australian treasurer saying the treasury is on track for a second surplus despite these elevated concerns over chinese growth and how it affects australian demand. and look at crude oil. we are seeing brent a little smaller, set for that weekly drop, offsetting the continued risk we see across the middle east. of course they continue to release them. look at what we are watching when it comes to u.s. treasuries, stumbling on just more fed speak really the mention of a fed rate hike from the new york fed president did his work across pricing across treasuries. take a listen. >> it is not my baseline. my expectation is interest rates are in a good place. eventually at some point when what lower interest rates as the economy to the 2% inflation we

8:04 pm

are headed towards. if they are telling us we would need higher interest rates to achieve our goals, we would obviously want to do that. so it is not my base case. annabelle: let's bring in our next guest, herald van der linde , head of asian equity strategy at hsbc. let's start with what we just heard from williams. not saying that a rate hike is the base case, but still, there is a risk of it happening. is that something you are also looking at as a scenario that is very much in play? herald: look, we are not looking for rate hikes this year, still rate cuts. but clearly it has shifted. the risk is shifting. inflation numbers have ticked up a little bit. maybe something happens with oil. so far it is ok. but there is more inflation than we anticipated. so that story we had at the beginning of the year, seven

8:05 pm

rate cuts, from seven we have now gone to may be there will be one rate cut. i heard somebody saying some banks have already said they will be a rate hike. a very big shift. you see the bond market is pricing that in. higher bond yields coming through. the 10 year is trading at about 4.6%. that is a dramatic increase. that means your discount rate for us as analysts. that is a very important number. that shaves off quite some valuation. 10 year is up, equities down, currencies weaker, u.s. dollar stronger. it is all being priced in. annabelle: i am curious if you can react to this in the question of the day. we are taking a look at when will treasuries hit that 5% mark, the 10 year. is that something you are seeing, and what will be the effects from that? herald: it is difficult to say.

8:06 pm

sometimes the market is on the train. we were on the train of several rate cuts and now we are moving in a completely different direction. i don't look at the treasuries as much. so i don't think we are going to get -- if i look at equities, we are now getting to your 100 day moving averages. you are starting to get to important levels. because if that happens, we are breaking through, you are going to see another step down or so. if we go to five than the equities will have another good step lower across the world. annabelle: what do you make of what we are seeing in earnings so far? is that going to be another catalyst to drive markets higher, even against the backdrop of higher yields from commodity prices? herald: we are talking about the global macro and that is not helping asian equities we want. with the earnings numbers that come through out of the region

8:07 pm

are not so bad. chinese earnings have gone through reporting season, we have tallied them up. they look like last year, so we are still rearview mirror. last year people thought there was no growth at all. but it was close to 15%. not too bad across the region. china, this year the expectations are for a slight acceleration. but we are going to have decent growth across the region, particularly north asia. that in and of itself is not enough to support asian markets, but it provides us with a bit of grounding. if the bond yields go to 5%, that will step down. but at some point we say this does not make sense for the equities because there is good growth and then you see money start to come back but we are not there yet. haidi: how is the currency picture and the volatility we continue to see playing out when it comes to equity valuations and interests, particularly for the likes of japan?

8:08 pm

herald: at the beginning of the year we were thinking, hey, the yen could strengthen from here. dollar strength is over. and that would lead to all sorts of interesting changes in flow dynamics across the region because money would come out of japan and then go somewhere else. that story has been clearly moved into the future by at least a couple of months. the yen has weakened. that typically supports the japanese market. now we are seeing a selloff in global equities. that is why japanese equities are coming off as well. but that kind of flow we were initially anticipating from japan into the rest of the region, that is not going to happen anytime soon. what that also means by the way -- you go first. haidi: no no, continue. what are the global implications? herald: it means that we thought they would be money going from japan into the rest of the world. now it is really global money

8:09 pm

that he succumb in -- that needs to come in. if we see a sort of peak in the 10 year bond yield, maybe it is close to the 5% we were talking about earlier on. if we see a peak somewhere there, then maybe that money start succumb back into the region. global money needs to come back into the region because it is not the japanese money that will drive the markets as much as china or india. haidi: you have switched a from taiwan to korea, which i find quite compelling. is that because of the government's efforts, do you expect korea to get to where japan has finally gotten to? most people are saying that is a pretty long-term view. herald: i think it is a long-term view. there are two reasons why we switched a preference for korea and taiwan. first of all, we liked taiwan

8:10 pm

because there was good growth in some of the leading companies there. now, that is materializing and those stocks were up 35% at one point. so we thought that story has been priced in. while on the margin have that new story in korea on what they want to do similar to what the japanese have done, make changes to corporate governance. that is hopefully an interesting story unfolding in korea but we are really -- the japanese have been on this for almost a decade now. the of introduced a new index, the nikkei 400, all kinds of changes were made almost a decade now. so they have been working on this for quite some time and figured out what works vest for them. the koreans have just started. we don't have to work 10 years because they can implement that but it will probably take quite some time for these things to

8:11 pm

slowly change. but we see better dividend payments coming through. there are share buybacks in korea. it starts moving in the right direction, but slowly. haidi: herald van der linde, head of asia equity strategy at hsbc. taking a look at movers 10 minutes or so into the start of trading, chipmakers in focus after the muted commentary from tsmc and other companies reporting across the space, not super positive either. we are seeing quite a bit of downside. sk hynix down over 3%. tokyo electron probably the worst performer. tsmc scaling back its outlook. really the caution when it comes to the smartphone and pc markets remaining weak despite posting his first profit increase in a year and beating estimates in the second quarter sales guidance. that semi market growth

8:12 pm

expectation being cut. taking a look at some streaming names on the back of netflix, we saw some very robust numbers. 9.3 3 million customers, the best start of the year since 2020 for netflix, but also saying gaines will slow. shares following suit. annabelle: certainly a lot of weakness across the screen so far. still to come, we will talk about the world's biggest exercise in democracy getting underway, the indian election. it is the first of nearly one billion indian voters heading to the polls. we will have a live report later this hour. first, the imf managing director adds to voices urging china to address overcapacity issues. this is bloomberg. ♪

8:13 pm

wealth-changing question -- are you keeping as much of your investment gains as possible? high taxes can erode returns quickly, so you need a tax-optimized portfolio. at creative planning, our money managers and specialists work together to make sure your portfolio and wealth are managed in a tax-efficient manner. it's what you keep that really matters. why not give your wealth a second look? book your free meeting today at creativeplanning.com. creative planning -- a richer way to wealth. to me, harlem is home. but home is also your body. i asked myself, why doesn't pilates exist in harlem? so i started my own studio. getting a brick and mortar in new york is not easy. chase ink has supported us from studio one to studio three.

8:14 pm

when you start small, you need some big help. and chase ink was that for me. earn up to 5% cash back on business essentials with the chase ink business cash card from chase for business. make more of what's yours. you don't have to worry about things like changing tax rates or filing returns. avalarahhh ahhh

8:15 pm

8:16 pm

seriously address the problems of the property sector that have been handled somewhat, but not resolved. they need it for domestic consumer confidence because many chinese people think of their apartment as their saving for old-age. they also needit -- need it because a sector of that significance cannot be put on hold. the second thing i said as we are now starting our article four consultation. and it may be very useful for china if we do more analysis on how they can boost domestic amanda. how they can exercise their own decision for a dual circulation economy. and i was delighted that he sees value from the fund to get deeper in these issues and

8:17 pm

provide china with appropriate device. >> they are coming under politically not just from this administration, but potentially another trump administration. do you have any concerns they will just seek out a weaker currency? >> we have not seen signs of that. but what i do believe is that, yes, if china builds overcapacity and pushes export that creates reciprocity of action, and then we are in a world of more fragmentation, not less. that ultimately is not good for china. china wants an integrated global economy. therefore what i want to see china doing is to get serious about reforms. get serious about demand and domestic consumption. annabelle: that was the imf managing director in washington with bloomberg's jonathan ferro.

8:18 pm

let's get the latest in geopolitics, because the u.s. congress looks set to approve some $95 billion in long stalled aid to ukraine, israel, and taiwan. house democrats have lined up to back speaker mike johnson's proposal and overcome a plan to blockade attempt by republican conservatives. the house is expected to vote on saturday, with the senate taking it up as soon as next week. the plan largely mirrors a package that already passed the upper house in february. the u.s. has imposed fresh sanctions on iran over this month's strike on israel, targeting 16 people and to tease -- and entities. president biden said in a statement that the u.s. is committed to israel's security. at the same time, allied nations have been imploring israel to not retaliate against iran, fearing a wider regional war. and the u.s. has vetoed a bid to

8:19 pm

make palestine a full-fledged member of the united nations. 12 of 15 security council members voted in favor, while the u.k. and switzerland abstained. although the palestinian authority received enough support to have its bid referred to the general assembly, the negative vote for the u.s., which wields veto power, was enough to block it. we will have more ahead on daybreak asia. this is bloomberg. ♪ so, what are you thinking? i'm thinking... (speaking to self) about our honeymoon. what about africa? safari? hot air balloon ride? swim with elephants? wait, can we afford a safari? great question. like everything, it takes a little planning. or, put the money towards a down-payment... ...on a ranch ...in montana ...with horses let's take a look at those scenarios. j.p. morgan wealth management has advisors in chase branches and tools, like wealth plan to keep you on track. when you're planning for it all... the answer is j.p. morgan wealth management.

8:21 pm

8:22 pm

a person familiar with the matter. bloomberg intelligence believes a joint bid could assuage financing concerns paramount may have had with apollo. our senior media analyst joins us for more. give us your analysis in terms of the benefits of this potential tie up. >> i think it is really good news for paramount. paramount right now is in exclusive negotiations with sky dance media. they are in a due diligence process for about a 30 day period. but there was a lot of investor concern there, because there was concern the nonvoting shareholders would be diluted and somehow the controlling shareholder, the redstone family, would benefit at the expense of the nonvoting shareholders. so this would be a much cleaner deal and one that would be cheered by all the investors. the fact sony is coming in with apollo definitely puts to ease

8:23 pm

any concerns the management team at paramount or any other investor might have had in terms of financing concerns with apollo. just given sony's deep pockets. annabelle: another stock we are attracting is netflix following its earnings. so many positives to take away from the report but investors do seem to be focusing on the negatives. >> it was absolutely a blockbuster report card. you had a subscriber blowout. their revenue numbers were really good. operating margin, their upped their guidance. everything we were looking for they delivered. of course one could argue the revenue guidance for the second quarter as well as the full year maybe can in in line to slightly below consensus estimate which is what is kind of spooking investors. embedded in that guidance is the fact maybe subscriber growth

8:24 pm

through the rest of the year, especially the second half, will face tough comparisons it will be more muted versus the first half. i think what really rankled investors is the fact netflix is going to stop disclosing any subscriber metrics starting the first quarter of 2025. and that really makes it very hard to map out the growth story for netflix going forward. annabelle: geetha ranganathan, thank you for your time. taking a look at asian chipmakers, we're just under 25 minutes into the session and the selloff we are seeing is accelerating. this is the biggest laggard so far. we had tsmc of course scaling back its outlook for a chip market expansion. it is also cautioning the smartphone pc sectors remain week as well put let's get more on this and bring in our energy -- bring in edward chang.

8:25 pm

you put that against asml earlier this week. it doesn't look great right now. >> the picture is looking murky. they produced a really solid set of numbers. excuse me. i think the market is zeroing in on commentary erring the earnings call. they are looking at tsmc scaling back its expectations for market growth. what we are seeing is a bit of a dichotomy right now between ai demand growth, which will underpin longer-term business for tsmc and in the short-term the smart phone and pc market weakness. annabelle: take a moment to clear your throat. we can look at how stocks are faring again. really big losses so far for some asian chipmakers. a lot of weakness coming through . given what you said around tsmc

8:26 pm

and perhaps concerns around the outlook than of the outlook is looking better. what is the readthrough on this for other big tech names like apple and nvidia? edwin: in terms of the warning on smartphones, the news does not look that good for apple. still by far i think its biggest customer, about a quarter of revenue. the smartphone market remains depressed. with nvidia there are two things that work. yes, tsmc was very upbeat about demand going forward. but at the same time there is debate going on in the market as you know about whether ai chip shares have run ahead of themselves. some of that is playing into the selloff we are seeing. haidi: when you take a look at the longer-term demand dynamics, is generative ai and the demand

8:27 pm

we continue to see from that, even as we see that downside reaction from markets today, is that still ultimately the bigger tailwind? edwin: i think so. there's general consensus that this is a once in a generation kind of technology that is going to revolutionize the way we essentially interact with technology and the way we live. the question is, is the current development boom, the current creation boom, again, running ahead of itself? and how many of these large language models we are seeing built with these expensive nvidia chips are going to be viable and/or extensive platforms in the longer-term? there is no question when you talk about generative ai, about a year or two ago it took a lot of us by surprise, its capabilities and potential. and it continues to surprise.

8:28 pm

8:31 pm

z things are going to be slow enough this year that we will not be in a position to reduce rates until the end of the year. >> the fed will get positive data, but they will be patients so fewer cuts, more delays make sense. for investors rates will be coming down and that is positive. haidi: that was rafael bostic and jonathan gray on rate policy, one of the key drivers. hawkish fed speak telling us fed is not likely to cut rates. chance that we see a hike if inflation continues to be

8:32 pm

present. that impacts growth stocks. tech under pressure. you are seeing tech leading the drop for equities. nikkei is down 2%. we are tracking the currency reaction to a strong dollar playing out in the yen. en versus the greenback, you are overbought but trading above 75, it really plays into the story of yield divergence, but between the fed and the boj, the question is what is the path

8:33 pm

ahead for the bank of japan? inflation figures play into that and we had cpi easing in march, but still above the central bank inflation target. let's get more with a sure economy editor brian fowler. what is your take away from the numbers earlier? brian: keyword is divergence, so in japan we had inflation slower than expected but we don't think it will derail hiking rates. next week the boj meets and policymakers are expected to stand pat and revise their forecasted cpi and introduce new forecasts in 2026. most expect cpi revised to 2.6%,

8:34 pm

that reflects optimism about wages, much higher than expected wage hikes. that will probably encourage workers to spend more money. that could spur demand and keep price growth study. above the 2% target. annabelle: you talk about october as consensus, july as a risk. is an earlier move a possibility? we heard from finance minister suzuki in washington that it is divergence, but that is a factor driving moves.

8:35 pm

brian: the yen is at 834 year low against the dollar, putting pressure on imports and other risk factors. in the latest month, food price growth slowed and that holds the index down. we know from the databank that the number of companies announcing price hikes was low, that will shoot up in april, three times the number of increases from the previous month so food will pick up. is why commodity prices are shooting up. look at coco, japan is a big market for chocolate. risk factors will prompt boj to move faster than market consensus. annabelle: asia government

8:36 pm

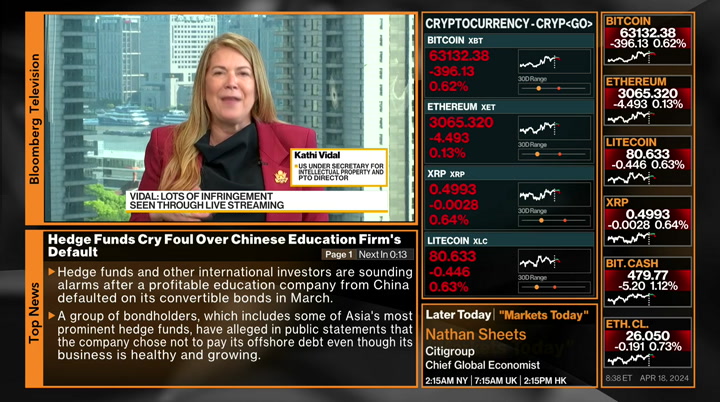

senior editor brian fowler in tokyo. china slammed the u.s. threat to impose restrictions on products. they say washington is undermining the security of the global supply chain. biden is proposing levies on products as part of a review. the steps would have minimal impact. ip protection is a key focus for officials amid tensions. kathy of the doll met with a top chinese official. we asked what message she delivered. >> we need strong protection in china. we spoke about innovation and u.s. company interest in being successful with a strong

8:37 pm

ecosystem. >> i've been covering china for more than 30 years and every year ip and the threat of theft has been a big issue. it seems to be not at the foreground of u.s. china relations but i'm guessing as head of ip protection that it is front and center of your attention. where are the biggest sticking points? kathy: one big issue is transparency, always at the forefront in terms of interest in u.s. companies. some improvements have been made when it comes to legislation, counterfeiting, but major issues with regard to transparency and new issues when it comes to counterfeit products and then secret trademark issues.

8:38 pm

stephen: this was had the forefront of the trump administration and addressed by xi jinping and joe biden in san francisco. the problem seems to be enforcement on the chinese side. it is not from discussion to real practice in china. kathy: correct, there have been legislative moves. since 2020 we have commented on 45 measures, so we are starting to see positive progress, but it comes down to implementation and enforcement is an issue. some improvements in enforcement for counterfeits, but a lot of issues with u.s. companies when it comes to online sales and protection was him in local communities. stephen: where are we seeing

8:39 pm

infringements? more sophisticated now than it was when dvds were pirated on the street corners. higher value items now. kathy: it is. one place where we are seeing infringement is livestreaming so for e-commerce issues were platform related. we are seeing new modalities including livestreaming where a product will be offered and then disappear, so it is hard to find out who is infringing. stephen: have you moved the needle? kathy: it will be a process of continued dialogue and making sure we are heard and that our counterparts and government understand the impact in china. i believe they do, it is pushing

8:40 pm

for progress which we will continue to do. annabelle: that was undersecretary for ip kathy fedele speaking with stephen engle. coming up, the first of indians one billion voters are heading to the polls. we are live in a city next, this is bloomberg. ♪ o coming in.. big orders!s starting a business is never easy,

8:41 pm

but starting it eight months pregnant.. that's a different story. i couldn't slow down. we were starting a business from the ground up. people were showing up left and right. and so did our business needs. the chase ink card made it easy. when you go for something big like this, your kids see that. and they believe they can do the same. earn unlimited 1.5% cash back on every purchase with the chase ink business unlimited card from chase for business. make more of what's yours.

8:42 pm

♪ >> india's six-week national elections begin on friday with the first voters casting their votes. bloomberg's haslinda breaks down the numbers. >> is the largest exercise in the world. 900 68 indians are eligible to cast a vote. 18 million would be first time voters with 190 7 million in their 20's. 15 million public agents will be deployed and 550 three constituencies, some holding as many as 3 million voters. that is equivalent to the population of jamaica.

8:43 pm

to keep the process safe 2 million security personnel were deployed in the 2019 polls which was the world's most expensive election. 8.7 billion dollars spent by candidates and political parties in india. 2020 force election runs from april 19 through june 1. bloomberg news. haidi: let's bring in bloomberg editor outside of the southern city of the capital. great to have you with us and this is the beginning of a marathon frost said's, what are we expecting, what is at stake and what is the atmosphere that you -- you -- you are feeling

8:44 pm

there? menaka: good morning. the atmosphere is quiet, but in 30 or 40 minutes you will see activity pick up. as the we do showed, this is the world's largest exercise, taking place in the world's fifth largest and fastest growing economy. domestic and international implications. this is iphone land, many apple vendors have facilities or are likely to build in the state of tumbled are who, but this will host one of the fiercest battles the fiercest battles this election as incumbent prime minister modi seeks to make inroads into southern india, a region that has resisted his charm. he is hoping that seats in india

8:45 pm

will help him go into that history books with a third term in more than four or 500 40 seats at stake. annabelle: the significance of india's election has major global implications, more than 50 countries are voting this year, but india's outcome will be the most closely watched perhaps. menaka: yes, it is. let me tell you why. we will have elon musk in the country. india has been courting elon musk for investment and it might come here. many stories are at play. there is the national story of india seeking its place in the international order and by rightful i mean proportionate to the size of economy and

8:46 pm

population, india seeking to grab shares from china, a very competitive space. there are economic considerations at stake and domestically whoever comes to power will determine the policies that will shape how competitive india is to take advantage of those opportunities. haidi: that was bloomberg news editor on the ground as india's voting gets underway, let's shift to indonesia. the finance ministers government is working to cushion the economy. she spoke to bloomberg at the world bank meetings in washington. >> the movement of the exchange rate will affect many of the economy. on the export, of course the revenue is better because they

8:47 pm

will receive a lot of currency. but we depend on some import and that will go higher. imported inflation can affect inflation in indonesia so we have to be very careful because of the movement coming from the united states. and the countries have to be very vigilant with this development, but what we have already done since the global financial crisis, and a lot of exercises have been done to improve resilience. economic point of view, we are actually having a very good structure. >> what else can you do?

8:48 pm

the speed of upside for the dollar is intense. what are some tools at your disposal to help the strong dollar and help the physical market? >> we have to make sure the stability in the economy is maintained and on the monetary and fiscal side, we work with the governor in order for us to adjust the macro spend. in order to adapt with pressure. for the central bank they have an interest rate, policy rate in terms of responding the currency. for us on the fiscal side, we have to make sure the budget can play a credible shock absorber. we had to make sure the deficit is within or below 3%. this is what indonesia fiscal

8:49 pm

prudence will do. we have to be more selective on expenditures and make sure revenue increases to the strong dollar, because some revenue is in for x denomination that can be used in the most optimal way. combination of monetary and fiscal two make monetary prudence will be very important. on the corporate side, they need to be really look at how exposure to for x and many of them is playing or in this case of doing the hedging policy at the corporate level. indonesia will be continue resilient in this kind of situation. annabelle: that was indonesian finance ministers speaking exclusively with bloomberg's alix steel.

8:50 pm

watch us live and see past interviews on tv or dive into securities or bloomberg functions we talk about. join in on the conversation, send instant messages for bloomberg subscribers only. it is at tv . this is bloomberg. ♪ when you automate sales tax with avalara, you don't have to worry about things like changing tax rates, exemption certificates or filing returns. avalarahhh

8:52 pm

haidi: china is seeking to end boom and bust trading. it's nine point includes dividend payments to improve stocks. let's bring in john chang. tell us more about this guideline and how it is different from previous rhetoric? john: so this is wants in a decade guidelines by chinese authorities that has been launched twice before in 2014. it improves the quality of stock listings, fresh listings, improving dividends for shareholders. while some measures are new, we have estate owned enterprise

8:53 pm

they've been in the works for years. it comes at a time when the chinese economy are facing challenges we see sentiment improving and this is adding more and this could be a long-term catalyst for sustainable rally in chinese stocks. haidi: there are investors comparing this to japan, korea. those are longer-term campaigns where japan is just starting to come to tuition, is this fair?

8:54 pm

john: this is john extra attention, we have the eb campaign tokyo launched by the tokyo stock exchange, followed by the value program in korea. although that progress has seen some uncertainty, given the recent parliamentary election results. china is falling on that, i think there are some similarities in this room in terms of improving etc..

8:55 pm

in the chinese stock market and korean stock market. haidi: asian stocks reporter john cheng with renewed efforts from chinese policymakers. take a look at how futures are shaping up. u.s. futures are looking like this, it is a down day, fed speak, consistently strong data compounding sentiment. an extension down steeply, expecting semiconductor names and weakness. annabelle: the imf function tells the story for privacy tsmc

8:56 pm

there is a focus on guidance and removing subscription figures from 2025. but broadly today, there's a lot of red across the screen. every sector in the red and it comes down to hawkish fed speak coming through on the outside risk. still a chance that we see a rate hike that was referenced by the fed as well. that is it from daybreak asia. it markets coverage continues as we look ahead to the start of trade in mainland china and hong kong. ♪ so, what are you thinking? i'm thinking... (speaking to self) about our honeymoon. what about africa? safari? hot air balloon ride? swim with elephants? wait, can we afford a safari? great question. like everything, it takes a little planning. or, put the money towards a down-payment...

8:57 pm

8:58 pm

her uncle's unhappy. the answer is i'm sensing an underlying issue. it's t-mobile. it started when we tried to get him under a new plan. but they they unexpectedly unraveled their “price lock” guarantee. which has made him, a bit... unruly. you called yourself the “un-carrier”. you sing about “price lock” on those commercials. “the price lock, the price lock...” so, if you could change the price, change the name! it's not a lock, i know a lock. so how can we undo the damage? we could all unsubscribe and switch to xfinity. their connection is unreal. and we could all un-experience this whole session. okay, that's uncalled for.

9:00 pm

11 Views

IN COLLECTIONS

Bloomberg TV Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11