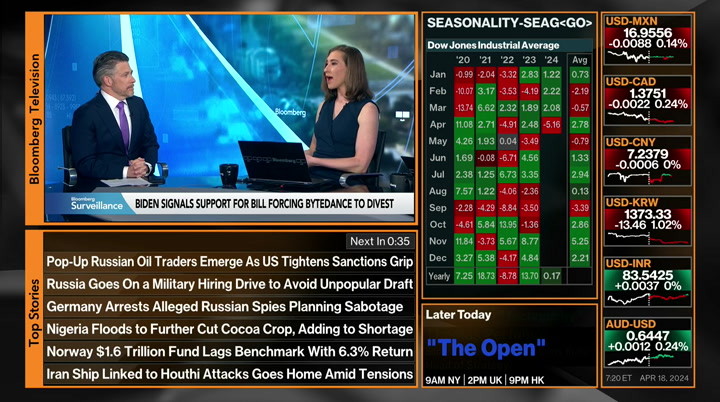

tv Bloomberg Surveillance Bloomberg April 18, 2024 6:00am-9:00am EDT

6:00 am

>> 5050 use higher for longer -- if the fed keeps i've above longer, we will see that under the markets. >> they are about to embark on a series of breakups. >> you will see inflation pressure and upward pressure on rates. >> you still need to see softness come through and we are not seeing it across the metrics. >> the longer the fed holds, the risk in the equity market is increasing rather than going down. >> this is "bloomberg surveillance" with jonathan ferro, lisa abramowicz, and annmarie hordern. jonathan: good morning.

6:01 am

this is "bloomberg surveillance" alongside lisa abramowicz and annmarie hordern. the two of the issues under the global economy right now, right here in washington, d.c. the sustainability of the deficit in the u.s. and mr. risch toward industrial policy. front and center. every conversation you have read outcome all roads lead back to that. lisa: especially given that it seems to be sovereign debt that is able to issue, not necessarily corporate debt when you talk about geopolitics and china and the u.s., it will be fascinating to see how that is filled with given china is a member of the imf and is trying to create a global coalition. what is a global coalition look like in a fractured world? jonathan: it is the united states and japan, the united states and korea, the united states and malaysia. malaysia stepping into the

6:02 am

effects market. japan and south korea turning to do the same. what you saw with yesterday is interesting. a meeting between secretary on, japanese, and south korea. foreign-exchange is going to become a big issue the next few days. annmarie: they put up his statement, we will continue to consult closely on the market changed its within our existing g20 commitment while acknowledging serious concerns at japan and the republic of korea. it is almost an implication the u.s. is aware of what japan is doing with and they are not afraid to intervene. the rest of the world is delivered u.s. exceptionalism. lisa: what can they do? this is the policy response that is uncertain. you have the currency had over the bank of japan saying we are concerned this could have a better in our economy. janet yellen saying we

6:03 am

acknowledge the worry. what are they going to do if it is differentials and growth? jonathan: the answer is nothing. the next question is for how much longer can they take it? ultimately they will want a. rate cut from the federal reserve. is not just the equity market that wants to see rate cuts, it is the global economy. the policymakers would like to say the same thing. lisa: how much does that going to factor into the fed's decision-making? what happens if they cannot cut rates because inflation remains too high or the accused of political interference? that we see the dollar breaking things. annmarie: they need to know what is going to happen postelection. we already have this loose fiscal policy. they like to spend more on

6:04 am

election years. that means the hangover after november is going to be for the rest of the world. jonathan: what does it feel like to come home? annmarie: it is hot. it is warm in busy. jonathan: equity futures shipping up as follows on the s&p, a bit of a bounce. up nine points of his 500. posited by .2%. yields are lower a single basis point. prude pulling back by 1%. back down to 81.82. if you are worried about higher yield, they have pulled back. lisa: it is a tense pause. i cannot get a lot of signal from this. we got a 20 year auction. right now very difficult to say there is a calm or innocence of cabazon see. what happens if you do get a surge in prices?

6:05 am

you cannot plan for something that has not happened yet. jonathan: we will have to have that discussion. we look at up with tony dwyer -- we will catch up with tony dwyer. leland miller of china beige book and tiffany wilding of pimco where is the path to 2% is beginning to stall. the s&p 500 looking for its first gain in five days as re-freezes continued to ease. tony dwyer singh we expect both the interest backup at eps contribution metrics to improve lid this year following a period of market indigestion. can we talk about market indigestion? is that a 5% move lower, 2% move lower -- a 10% move lower? tony: it depends on what you're looking at. we so focus on isn't the 500 i stopped giving a target because i don't know how to evaluate

6:06 am

tense stocks. can is be 500 go down? it could. the equal weighted s&p 500 and the russell 2000, the troops versus the generals have already seen corlett to performance. i don't think you're going to get as much pullback in the broader market then you could in the s&p 500. jonathan: what are you advocating for? tony: what i missed last year is if you remove the magnificent seven stocks from the s&p 500 operating earnings, you would have had a negative earnings year for the mag7 for the s&p 500 operating earnings. the same is true for this quarter. it is no suppressing of the market concentration have got.

6:07 am

the market indigestion is doing what it is doing now. you pullback, create fear, this be targets come down. people start calling for a correction, people-there ratio gets -- the bull-bear ratio gets out. the higher it is now, the more likely they are to be lower later this year because it will have a dampening effect on the economy. the talking of lower rates and looser financial conditions got us into the reef solution, once the opposite happened talking of not lower rates has tightened financial conditions? that sets the stage for a recovery in the second half. lisa: it is getting harder and harder to see what happens best to. i've chris pappas it the federal reserve cannot cut rates in june -- i am curious what happens if the federal reserve cannot cut rates in june. you see the dollar becoming

6:08 am

stronger and stronger. are you worried about something breaking and this becoming less orderly than the immaculate inflation? tony: i am worried about it. you are in delivered system when you look at the debt to gdp. every area of the universe in finance needs lower rates right now, whether it is m&a, wall street with capital markets, the federal government. it is a very tumultuous time. that is what is showing up here. that is why the dollar is rallying. you are under the situation where -- think about jerome powell at the end of the officiated at the end of december last year. the market is looking for seven rate cuts and now saying be not. we are looking at somebody who keeps telling us information that changes its within three

6:09 am

months. to make this option we know it jerome powell and the fed is going to do i don't think makes a lot of sense. financial conditions -- that sets the stage for a lower federated cut environment -- lower said cut rate environment. lisa: how much is this federal reserve leading and not following? how much did they cause the stickiness of the inflation by the less you? -- inflation by the end of last year? is that what we're looking at, that essentially they're going on a deficient shade of the -- a dovish. tony: they got it right once tightening without creating recession.

6:10 am

the immaculate 1995 scenario is with everyone is open for but the fed is managing by talking versus acting. money markets but still over 5%. until they actually change -- i will leave you with this main not. what could lead to a broader market recovery versus concentrated market? two things, number one, you have to have the fed cut rates. until then -- that is the indigestion. number two, you need a broader distribution of her next contribution. you cannot have seven stocks contributing all of the growth on a year-over-year basis. the good news is both of those are set up as we exit the year.

6:11 am

in the fourth quarter, it would be a much more even earnings contribution. they way the fed is talking about rates now creating 10 of financial conditions, that is going to end up as lower rates by the end of the year. annmarie: we would love to get your thoughts on where you see oil as is going in the sense of how difficult it is going to be for the ec that -- the ecb and the fed to combat. tony: the commodity call is under momentum. as everyone is talking about energy and oil prices, you see it could go over $100 per barrel. ultimately energy goes to supply and demand. the currency situation we have is because there is no. the problem globally is you need to growth, you need to demand to pick up. i am not a commodity analyst and i don't want to pretend to be.

6:12 am

what is it just is when everybody starts to get excited and trade the momentum of a commodity, it typically tends to reverse, especially if the supply and demand dynamics reinforce that. higher rates are not great for economic activity and that is showing up in currency and should show up in commodities. jonathan: wonderful to catch up with you. tony dwyer, always humble about what he doesn't know. if a key part of the year ahead is what happens to the price of crude, what do we say about the prince of crude? if you want to make a full summer, ask them for their forecast for crude by the end of the year. it is difficult to do and we are saying that is going to be the future of a whole set of decisions by the end of the year. lisa: especially when so much is determined by something else you cannot predict which is a crisis in the middle east. since when have you been able to

6:13 am

predict how this is going to transpire? and yet if there is some protracted -- you could get the closure of the straits of remove's -- closure of the straits and that could lead to a pop in all prices. annmarie: it is a geopolitical risk premium we are buying into when everything was heightened now coming off of the table. what happens when that is back on the table? you have the u.s. the setting with an israeli they are not going to extend some of these contracts. it is not affecting physical supply but you can seize up and corners of the world where supply might be hit and how difficult that is going to be if you have a crisis on top. jonathan: crude is down 81.79. here is your bloomberg brief with dani burger. dani: taiwan semiconductor any fracturing better than expected outlook and plans to spend as much as $32 billion this year. the upbeat outlook follows the chipmaker's first profit

6:14 am

increase in a year. ai demand boosting their growth. it also comes at a time of a chip correction. maybe this is the thing they didn't -- thing they needed to direct. the biggest looking to trim headcount as part of its integration with credit suisse. it is more than 100 positions across banking markets and wealth management will be cut. doha's airport has been a named the world's best airport. it edged out singapore's airport. do they even have a wonderful? tokyo took the fourth and fifth spots, and hong kong saw a boost moving to 11th place. jonathan: still waiting for jfk to break into the top five.

6:15 am

lisa: laguardia is actually beautiful. jonathan: beautiful is not the word i would use for that airport. annmarie: that is not a real waterfall if you ask anyone in the deal ha -- doha airport. jonathan: next, speaker johnson's moment of truth. >> i have a job to do and i am to do the job. regardless of consequences, that is what we are supposed to do. dave marjorie taylor greene brings the motion, she will bring the motion. jonathan: that is coming up next. this is bloomberg. ♪

6:17 am

it's a pillow with a speaker in it! that's right craig. a team that's highly competent. i'm just here for the internets. at&t it's super-fast. reliable. you locked us out?! arrggghh! ahhhh! solution-oriented. [jenna screams] and most importantly... is the internet out? don't worry, we have at&t internet back-up. the next level network. i sold a pillow! should i? normally i'd hold. but... taking the gains is smart here, right? feel more confident with stock ratings from j.p. morgan analysts in the chase app. when you've got a decision to make... the answer is j.p. morgan wealth management.

6:19 am

-- johnson planning a series of votes on saturday despite two house republicans from interest and raymond james writing this. if house republicans stick together and add provisions poison to democrats, speaker johnson has been tilted up and but he has about. ed mills joins us now. how narrow is that path? ed: i think it is okay. speaker johnson called for degree and aid -- ukraine aid. what is on the table this

6:20 am

weekend is what past the senate couple of months ago. they will separately on israel, ukraine, taiwan. there is a fourth bill on tiktok and russia-related provisions and a border security bill. i think the border security bill falls off but the others move over to descendant and when the senate comes back, this gets since pretty president, signed into law early may. annmarie: we saw david cameron go to mar-a-lago and now we see, trump sitting down with andrzej duda. how much is the international community having to put pressure on the former president for him to say yes or no to his heart remembers on whether or not they can vote on these packages? ed: i think his meetings are good to diligence. there is high probability donald trump could be president again this year so if you are a foreign leader and you have any

6:21 am

opportunity to meet with the future president, you have that. as it with its two these defense bills, his influence has been shown in the act that the house is not passed his bills yet. now that we had the attacks from iran against israel, the pressure really is there for congress to act and congress is going to pass what the senate did months ago, send it to biden's desk with additional provisions. annmarie: given we have separate individual bills, when they hook they could be one huge. i would love to ask about tiktok. does that mean tiktok has a chance to make it through? ed: the time is numbered because this bill, senator cantwell who is the chair on the senate commerce committee has come out and endorsed the provision added to the house bill. this house bill is going to pass. it overwhelmingly passed

6:22 am

previously so we bills -- four bills are going to be combined, passed the senate, and sometime next year tiktok is going to have to divest chinese ownership shut down in the u.s.. my bet is shut down because i'm not sure the chinese communist is going to allow that investment to take this and that algorithm coming to the u.s. and for us to understand what tiktok is collecting and how tiktok is influencing the conversation in the u.s.. the reason we are passing it is national security concerns. china is not going to want to let us know what they're doing. lisa: they came out and said they're not going to allow them to dentist. i think that is why people would agree with you. can you tell me why this got attached to aid in ukraine? ed: the reason is getting attached to because is the only thing moving.

6:23 am

republicans want to get some victories. -- this is a political a political offer for them to say it is not just the senate passed bill, we got some priorities in there and speaker johnson, when he put something on the floor against china, it is the only bipartisan thing idc -- bipartisan thing in d.c. that is also in this bill. the house ways and means is passing a bill that would impact the knew an almond retailers trying to remove that. those are the questions i am getting the most at raymond james, all of this anti-china bills. lisa: this is a way to make

6:24 am

everyone feel little better as the past age, get them on the same page which raises the question how much of the democrats going to back johnson publicans fade away? -- republicans fade away? ed: if marjorie taylor greene except the motion to vacate, there are going to be enough democrats on board to make sure johnson remains speaker. if the reason republicans are going to try to remove speaker johnson is because he brought up the senate passed defense bill, their to back them. the reason democrats didn't back mccarthy is his role in rehabilitating trump after dinner we sixth. his role making generally six partisan -- generally six partisan. johnson didn't have a similar bad feeling among democrats. democrats want some level of keeping house in order. jonathan: we are in town for the imf meetings, we are trying to

6:25 am

figure out how long is the line and is it filled with people from japan? by day complaining about ethics and be stronger dollar? by the european still complaining? how many complaints is this administration receiving? ed: the complaints may be long but i don't think a lot is going to be done with this. six months ago i was on with you all the concern has been the strong dollar or higher yields and in the u.s. was going to cause a lot of albums in the u.s. -- problems in the u.s.. that was a fusion between the treasury department and the federal reserve supporting the industrialization. a lot of folks may want a rate cut but there are folks who love getting yield out of their money market account. we talked about a trillion dollars debt service burden but that is a fiscal stimulus to the economy, especially among wealthy individuals.

6:26 am

monday this week they sent 40% of that back to treasury. i don't think a sent out with a thank you note -- they sent that out with a thank you note. jonathan: very well framed. ed mills of raymond james. our currency is your problem since to be the message. lisa: we understand and acknowledge, what else are they going to do? nothing. jonathan: the conversation continues. we will catch up with leland miller. this is bloomberg. ♪

6:27 am

(upbeat music) there's more to business than the business you're in. if you use data, that's the privacy business. manufacturing on demand? you're talking cloud business. got a few million hyper-connected customers? digital experience business. that was fast. that's where deloitte comes in. with the right combination of talent and technology to help advance and connect all that it takes to excel in business ... to the business i'm in. deloitte. her uncle's unhappy. i'm sensing an underlying issue. it's t-mobile. it started when we tried to get him under a new plan. but they they unexpectedly unraveled their

6:28 am

“price lock” guarantee. which has made him, a bit... unruly. you called yourself the “un-carrier”. you sing about “price lock” on those commercials. “the price lock, the price lock...” so, if you could change the price, change the name! it's not a lock, i know a lock. so how can we undo the damage? we could all unsubscribe and switch to xfinity. their connection is unreal. and we could all un-experience this whole session. okay, that's uncalled for.

6:30 am

jonathan: equities on the s&p 500 pushing higher. your equity for shipping up as follows the s&p 500 okay. the nasdaq up point -- up widepoint 3%. the russell was hammered. a four day losing streak on the s&p 500, the longest stretch since the week of 2024. if you get to the bond market, yesterday was different. notes pulled him back. it's down again. 4.57 on a 10 year, the two year pulling back, 4.9220. lisa: whether it is pension that

6:31 am

have bought stocks and are now going to sell them and move into bonds or where this idea we are to get higher, use it in a 20 year option. today vanguard was saying if you get to 4.75 on the 10 year, that will trigger a real problem. jonathan: this fx market is crying for dollar can is. let's get to foreign-exchange. we started the currency pairs as we kickoff coverage of the imf will meetings talking about the pushback from places like japan and south korea threatening to intervene in the fx market. they should have had to step in -- malaysia has had to step in. what are you fighting? fighting fundamentals and that is the problem. how difficult is it to intervene? lisa: use it right there. that is what intervention got you, nothing. if you are the bank of japan,

6:32 am

the only thing you can do is hike rates aggressively. even that is not going to get you along with what you want. the market is calling their hand. jonathan: that meeting between the treasury secretary and were presented is from japan, this is an issue in washington, d.c. annmarie: absolutely. how many people are letting up outside the treasury's door for meetings because of issues they have? whether that is asian countries dealing with the stronger dollar or the beginning of their own currency. also in europe, there is still tension. the u.s. was to see harsher sanctions on iran. it is a difficult position. they have to give a little to get a little when it comes like -- places like russia and iran. jonathan: u.s. is spending time complaining about policy in china but the rest of the world

6:33 am

seems to be complaining about policy in the u.s. this week we hear those complaints on repeat. lisa: especially given the u.s. continues to grow and people say that is because you borrowed so much to fuel your fiscal spending. how much is there some sort of coalition of lead minded peers at a time when there is so much disagreement? the iran issue is tied to china. iran has been accelerating its output of world. who is insulting to? annmarie: china, 80%. this is what is the first training you speak to the administration and they said they have sanctions on iran. that is one thing. enforcing them is another story. jonathan: it is a conversation they will not entertain. i had that conversation this week. it did not go well. annmarie: they continue to say iran is isolated. it is hard to see iran isolated when they are exporting will to

6:34 am

china, weapons to russia, and the foreign minister in the -- in new york. jonathan: cleveland then-president loretta mester and michelle berman urging patients. by rinsing "progress may have stalled and only time will tell if rates are sufficiently restrictive." the conversation market participants are having, the labors of having it is governor nikki bowman. very few others are having the composition she is having about whether we are true the restrictive -- truly restrictive. lisa: they don't want to put rate hikes on the table. they want to take them off the table which is the reason i am interested in speaking with ebs who talks about the potential for 6.2% fed funds rate if you don't get deceleration. jonathan: two hours away.

6:35 am

house speaker mike johnson putting his job on the line to passe for israel, ukraine, and taiwan. johnson is planning a series of votes for the aid package. president johnson urging the decision and urging congress to act quickly. . can he pass this and keep his job? annmarie: he dixie get past all of these packages and keep his job. like we have seen everything else that comes out of the house of representatives, the republicans have is the majority. democrats have to be there for the foods. there is potentially not the relationship former speaker mccarthy had with donald trump. it is not as intense as mike johnson has. some democrats make it in line and vote for him. after these bills is off to the races and it becomes all about november. jonathan: let's talk about the complaints we are hearing from president biden taking aim at

6:36 am

china surrounded by japan steelworkers. he called the country xenophobic. been a miller saying this, the narrative of china's collapsing manufacturer was a full street conditions on the ground. are these complaints from united states justified when they are talking about the prospect of overcapacity and dumping in global trade? leland: there is a fascinating academic debate going on if we are overcapacity or about to be overcapacity. it is compelling enough that europe is paying attention and the u.s. is preparing its fun response. i think the key is not where you see the flood of chinese cars. this is about 2025, 2026. chinese cars have been in a protective cocoon about 10 years. massive subsidies within --

6:37 am

inside the home market. the domestic market is getting closer to being saturated and they are the blessing the laws and regulations. there too many companies that have to go somewhere. next year, saying it could be romantic -- problematic. jonathan:'s conversations about dumping barb again sold. the goods have changed. i remember this was not one to be in issue. china would move away from this menu fracturing base compass about exports and more about consumption. what does it tell you about the trajectory of the chinese economy and where they are that we are still having this conversation in america? leland: it hammers home the idea that you need to always see what they are doing, not what they are saying. we heard there was a shift going on from investment to consumption.

6:38 am

they downshifted investment, consumption isn't going and. recently, they took xi jinping's new mantra about productive forces and then announced that is going to be the government's economic program. it is going to help these companies in green sectors will bless -- sectors globalize. this is production, production, production. this is why you see exports high and imports low. these are going to get bigger and bigger. annmarie: we are on the edge of the cvs becoming infrastructure weak. everyone is talking about going to china and talking about it. is there a disagreement in white house? leland: the white house disagrees with itself on everything when it comes to

6:39 am

thing some of the sea in place. you had some of the trade talks in administration wanting to do this not weeks or months but years and nobody in the white house is willing to give the green light. now it is getting political. we are talking not about solar which is existential talking about cars. cars are political and this is campaign season. some of the resistance you have seen within the white house to moving forward on these trade actions is starting to dissipate. annmarie: is the relationship washington needs to worry about less washington-aging and mexico-beijing? leland: the worry is you have this 2% tariff. a lot of chinese companies are already starting to plan and build plants in mexico so they can produce them in mexico and drive them across the border.

6:40 am

you miss the whole china trade were part of this unless you deal with shipment and the blood of factories. that will be part of the policy response. that is a lot more to admit that thinking suddenly waves of chinese cars are going to appear. lisa: there has been speculation china is deliberately allowing currency to weaken to -- their import of goods. do you believe that? leland: i don't think so. china's sweet spot is stability on the currency and that an exhibit thing else go better. they would want a stronger economy if they could have it. you have a supercharged u.s. dollar. do you want is soft -- the tuan is -- yuan is soft pegged to the u.s. dollar. lisa: is it fiction that china

6:41 am

is an equally engaged member at the imf eating given the fact we are seeing poisonous rhetoric about china? leland: i think it has become more acceptable to be walkable about china. the issue has been building production, the exports, the acts that everyone calls china a global growth driver but you are not if you are producing exports and minimizing imports. i think that has really gotten of the skin of a lot of people and that negativity on china is not american, not european. lisa: the last time we were at the spring meetings, we talked about if the imf come up with something to counter the belt and road initiative's. do you see that happening more actively at a time when people are big orval wanted their criticism? leland: no.

6:42 am

i am never of the belief that international bureaucracy is going to get together and do something productive. i think people are worried about belt and road but the chinese look at belt and road and they cannot afford what they have planned out. they are being more specific about what they are putting money into. there are a lot of issues. belt and road is not front and center on what we need to be worrying about. jonathan: have the complaints come too late from these institutions in washington? the hope was china would become more like the west and his institutions would help institute that. china has not become more like the west and in many ways china has been a leech on the international global trade system for the. -- for a long time. we sit here conversations and behold that will change, that china will move away from this growth come become a more like us, that would open up and

6:43 am

continue. that has not happened. the reason you are getting complaints now is because they lost and they cannot fix it. what you are seeing with the u.s. is them slide back into industrial policy. with the europeans are realizing is they have to do the same thing. all the hopes and dreams of having this globalization continue and china being that is over. what institutions have to figure out is how they find relevance in that world, how they shape some of these decisions being made. it is becoming increasingly difficult. they lost, it is done, it is over, it is not going to happen. industrial policy in the u.s., this is the future. we can disagree over a lot of things in d.c.. i can have my own view on the free markets. in washington where there is agreement, it is things like this, industrial policy and iteris and going against china

6:44 am

-- and hopes and dreams of going against china. lisa: there is this idea that maybe the u.s. was not head and very far behind. industrial policy is getting -- one of the u.s. has any upperhand in being able to re-create industrial policy with ai, different technologies without disrupting millions of people employed by that sector? there are ways to play that -- play this. jonathan: it was fantastic to get your thoughts. leland miller there. let's get your update on some stories. let's get you the bloomberg brief with dani burger. dani: donald trump's camp and wants other republicans to pay if they use the former president's name, image, or likeness in fundraising according to an campaign memo. all committees who use chubb in their fundraising must give a minimum of 5% of the money they earn to trump's political operation.

6:45 am

shares of micron up 1.87% and is poised to get one six $1 billion in grants to help pay for the missing projects. all part of an effort to get some conductor production back to american soil. google has fired 28 employees for protests against a $1.2 billion joint contract with amazon. it provides the is really government with cloud and ai services. the protest took place in a number of google offices. protesters in new york and california staged a nearly 10 hours sit in with others by committing the action -- documenting the action. jonathan: up next, the path to 2%. >> what we have seen over the first few months of 2024 is

6:46 am

progress on inflation has slowed. i expect it has even stalled at this point. jonathan: that conversation coming up next. from the nation's capital, this is bloomberg. ♪ your body. i asked myself, why doesn't pilates exist in harlem? so i started my own studio. getting a brick and mortar in new york is not easy. chase ink has supported us from studio one to studio three. when you start small, you need some big help. and chase ink was that for me. earn up to 5% cash back on business essentials with the chase ink business cash card from chase for business. make more of what's yours.

6:48 am

jonathan: welcome to the program. in the nation's capital for the imf spring meetings. equity futures positive, trying to bounce 5.3%. yields are lower. the 10 year, 4.5711. the path to 2%. >> what we have seen over the past few months of 2024 is progress on inflation has slowed. i expect it has stalled. we have seen lowering inflation.

6:49 am

i think it is restrictive and time will tell if it is sufficiently restrictive or binding. jonathan: loretta mester saying the central bank should not rush to cut rates adding i'm expecting inflation to come down but i think we need to be watching and getting more information. more fed speak on deck with michelle berman, john williams, and raphael bostic. here in studio, tiffany wilding of pimco -- why she's a lonely? tiffany: it is funny you have not had more people talking about this. you can look at the growth numbers and know we are running 3%. core growth, it looks like you're going to run that in the first quarter, maybe second.

6:50 am

we have not had four quarters of that growth since 2000's. that is nothing like an economy that has your trichet policy. in that environment you'd expect -- jonathan: we have had some big changes, deutsche bank say december. some banks are say no cuts this year, including the likes of apollo. where are you now on that issue? tiffany: we agree. we think ultimately they're not going to be cutting in the middle of the year as they had previously been telling us they're going to do. they will show us their new -- and we would get clear guidance on when exactly did explict a cut -- when exactly they expect

6:51 am

a cut. we needed to see two consecutive quarters of point something efficient. our own forecast as it will be three at the second quarter. if they still interested two quarters of two point something, that suggests december might be the first time they're looking to potentially cut. they have wiggle room. i think there is a clear message coming from them they're not going to be cutting. lisa: if nikki bowman has lunch with chair powell and talks about it being restrictive, that puts the idea of a rate hike back on the table. if you look at inflation running hot, as jonathan engel says, that raises the spectrum next year of additional rate hikes that he's is going to 6.4% --

6:52 am

that he sees going to 6.5% if we don't get inflation below 2.5%. do you agree? tiffany: we think that 3% threshold is a big number. if they are seeing inflation re-accelerating above three and looking like it is going to hang there, i certainly think that will be a problem for them. in terms of how they message it, it has to be a message of policy is not as rich or give as we thought. the underlying neutral rate is maybe higher than we thought. that is a longer-term issue. they have a longer-term review of their monetary policy. going to the exercise of reviewing these models and thinking about that is an opportune time. if the economy is behaving like that, inflation is above three, to talk about negative interest rates. lisa: especially when the relationship between stocks and

6:53 am

bonds has gotten using. do you believe eventually we will see a going back to the older normal of bonds and stocks moving inversely? how long will it take to get there given be don't understand what restrictive means? if you get higher yields, that might not be positive or negative for stocks. >> we are getting closer to -- tiffany: rating closer to that environment. we are talking about are we going to get 2. point something. we don't think that acceleration really accelerates. the fed can be reactive to implement rate increases and additional evidence of potential economic downturn as they are to inflation. it is that balance of risks being more balanced this gives you negative correlation.

6:54 am

we think bonds are going to be a good hedge. annmarie: do you think the fed needs to start thinking about targeting 2% to 3% instead of about to a measured percentage 2% -- laser measured 2%? tiffany: i don't think deliver say that. powell, it seems like, has taken that off of the table. they were right about a credibility issue with raising the inflation target which is understandable. if you take a step back, there is not a lot of academic is gushing around what are the cost benefits of two versus zero versus three? there is some wiggle room here. what could play out as they're willing to tolerate above target inflation for a while. i think that threshold is three. they always forecast getting to 2% but we will realize higher inflation. when we look at the market, and vision rates have increased a

6:55 am

little bit book that does not seem to be present in. annmarie: when you look at the language coming out of the fed and we heard from public this week, he is a must implant the latest trends are not bombs. you are saying this is the new trend? tiffany: yeah. in our minds it has always been you will probably need to see more easing in deliver markets, some higher unemployment. the fed is think we can achieve all of this without higher unemployment. we have been skeptical of that. what we are seeing plant in the economy is you are getting a hop economy and that is putting upward pressure on inflation. you are sing it at the core services like shelter, the shipper core measure. you are also seeing it in shelter. shelter has stalled. part of that is because we have the supply of houses. we have under billed last 10 years. the fact that we have a price

6:56 am

level adjustment that has happened in the rental market. you are just not going to see a vast deceleration. all of that suggests we are in this prolonged period of higher than target. jonathan: it is great to see you here in washington. tiffany wilding there. the fed became enamored with the combination of strong and benign inflation. lisa, they were looking for that to continue through 2024 and the is clearly a challenge to that based on the data? lisa: one of the more compelling arguments is their embrace of that narrative is what allowed him to remain stickier because of the verbal intervention. jonathan: coming up, we will catch up with police and our follow, michael sheppard, john lipsky, and tim adams. this bloomberg. -- this is bloomberg. ♪

6:57 am

so, what are you thinking? i'm thinking... (speaking to self) about our honeymoon. what about africa? safari? hot air balloon ride? swim with elephants? wait, can we afford a safari? great question. like everything, it takes a little planning. or, put the money towards a down-payment... ...on a ranch ...in montana ...with horses let's take a look at those scenarios. j.p. morgan wealth management has advisors in chase branches and tools, like wealth plan to keep you on track. when you're planning for it all...

6:58 am

the answer is j.p. morgan wealth management. her uncle's unhappy. the answer is i'm sensing an underlying issue. it's t-mobile. it started when we tried to get him under a new plan. but they they unexpectedly unraveled their “price lock” guarantee. which has made him, a bit... unruly. you called yourself the “un-carrier”. you sing about “price lock” on those commercials. “the price lock, the price lock...” so, if you could change the price, change the name! it's not a lock, i know a lock. so how can we undo the damage? we could all unsubscribe and switch to xfinity. their connection is unreal. and we could all un-experience this whole session.

6:59 am

life's daily battles are not meant to be fought alone. - we're not powerless. so long as we don't lose sight of what's important. don't be afraid to seize that moment to talk to your friends. - cloud, you okay? because checking in on a friend can create a safe space. - the first step on our new journey. you coming? reach out to a friend about their mental health. seize the awkward. it's totally worth it.

7:00 am

>> the restrictive policy the fed put in place to bring inflation down is going to swing back the other way. >> i don't think we are out of the woods with inflation pressure. >> it is not just that the rate cuts are less than later, but is inflation higher? >> a lot of what is keeping inflation sticky is supply-side factors. >> inflation has to move back up again. >> this is "bloomberg surveillance" with jonathan ferro, lisa abramowicz, and annmarie hordern.

7:01 am

jonathan: yesterday, you got everything you wanted, lower prices, oil down, weaker dollar, yields lower. it could not buy you a day of gains in equity market, four days of losses on the s&p 500. live from washington, d.c., good morning, good morning, this is " bloomberg surveillance," covering the imf world bank spring meetings. we are going to talk about the complaints from one side to the other, the complaints from the u.s. on policy coming out of china and from everyone else about policy coming out of the u.s.. that frames the meeting in washington, d.c. lisa: and donald trump coming back to the office, and how much that is included in the geopolitical risks. it is multilateral world, what are the lateral aspects of it? is it going to be china, iran,

7:02 am

russia, and the u.s. and who? the u.s., japan, south korea and western nations? what they are having issues with u.s. industrial policy. jonathan: the strength of the dollar is a consequence, causing problems. going back to the meeting between secretary yellen and officials from japan and south korea, the dollar and the epicenter of some of the concerns. annmarie: you saw all three finance ministers get together and agree the currencies are too weak, and it felt like it was the u.s.' response to say, we understand if you have to intervene, but what does that mean? do they have to intervene? and if they do, does it matter because how will they fight the fed? that is why you hear about the u.s. exceptionalism due to u.s. possibly coming making it harder to get back to 2% u.s. inflation target and what does that mean in terms of bond yields entire dollar on the rest of the world? jonathan: read through this with

7:03 am

me, excessive volatility, disorderly movements can have a diverse implications for economic and finance stability, is there anything excessive, excessive volatility, and disorderly about the movements we've seen? isn't this based on policy fundamentals in america? lisa: it creates a problem for the central banks and other countries to adhere what is best for their economy, so a lot of people would say it is disorderly because it crosses certain thresholds and they don't like it. it's difficult to know as an investor what can be done, if it is logical. you say disorderly, but this is a direct derivative of the fact that we are talking about u.s. exceptionalism, and a weaker economic growth than the rest of the world. that is explict to what you get in terms of currency. annmarie:annmarie: if you are concerned about fiscal policy, the imf says they don't see a

7:04 am

short-term fix because president\\ -- former president donald trump is in the mix, and during election years, you spend more in tax less, so that fiscal policy continues. jonathan: so plenty of complaints abroad but everything great here. they have talked about tempered growth for the next decade or so if we don't address big issues of the moment. lisa: are we talking liz truss? is this where we are going with this? the talk about the physical overhang. jonathan: we are not talking liz truss. lisa: hold on a second. if you look at the charts coming out of the imf, u.s. debt to gdp ranks with china and india, above where brazil is at. they are talking about this as the major risk. crises usually happen in areas perceived as the safest, and that is what people are looking at with the treasury market. what is that happened? this is pie-in-the-sky for people who would like to invest in treasuries today, and that's

7:05 am

what people haven't talked about it more. jonathan: you know the former prime minister is on a book talk at the moment if we wanted to get her on the program. lisa: i would love to speak with liz truss. let's make that happen. jonathan: equities on the s&p 500 positive .25%. bond market, yields lower by several basis points. and there is the move. 81, 84 on wti. lisa: how price in geopolitical risk? we could talk about the what if's, it didn't come to fruition, then it is a buy because if you don't have 13 million barrels of oil produced out of the u.s. every day, at a point, it's difficult to get right until you are staring in the face of what could transpire. jonathan: coming up this hour, we will catch up with rock creek with u.s. stocks coming up after four days of losses. we will talk to john lipsky on

7:06 am

the fed's path forward, and tim adams on the headwinds facing financials. begin with our top story, the s&p 500 looking to bounce back from its worst ounce back after the start of the year. it is still too soon to say if the time has come to be all and on small caps, and alifia joins us around the table. let's start with small caps. everybody wanted them at the end of q1, and now we are down off 70% after the losses of yesterday. why isn't this working in the way people hoped it would? alifia: it's coming down to the fed, if you looked at the beginning of the year, we had over a 60% probability the fed would cut rates in june and now it is at 15% with 95% probability. the markets are all over the place and they finally realized higher rates for longer is what they said and what will happen and inflation remains high maybe

7:07 am

for good reasons because economic growth -- prospects are strong in the u.s. and relatively to the rest of the world continues to be strong, even if there are downside risks. i do think investors that jumped into small caps, as a category, were probably too early. i think there's an opportunity for stock pickers. jonathan: key phrase, for good reasons. when you see high yields, is that for good reasons, growth, or bad reasons, inflation, or both? if it is for good reasons, isn't that a good reason to keep buying stocks? alifia: are we in a new regime where inflation will never get to 2%? so we are waiting for 2% and it never happens? for the next 10, 15 years, is inflation at 2.5% or 3%? can the is fine with that and can continue to grow, and we will have to see what other central banks are doing around the world because they are in

7:08 am

different edition than the u.s. in terms of the economic growth process. lisa: when jon talked about the broadening out of the rally, i think about all the stocks europeans wanted to buy, talking about luxury getting skinny, and then what you have got, people are not brian hennessey as much, you get the feature of a smr, and people are not buying as much of their chip technology, and that was part of what keyed the selloff yesterday in big tech in the u.s., and torpedoed what we are seeing in europe. how do you play that? alifia: europe is a good case of why this is a good active management environment. it is down 11% from in the cpi numbers came out and 27% down from the beginning of the year, a different case from last year. the same goes for europe. granollas might have strong

7:09 am

prospects, but i think that is probably where you would not picture marginal dollar if you are planning on growth across different regions. lisa: are you worried about the u.s. deficit? alifia: yes, but everyone has been for the last 10 years and for the next 10 years. lisa: so we have been begging the drum, and i remember my grandfather coming into his house saying the deficit is too big. this is like 30 years ago. at what point does this become real? alifia: when somebody puts a solution on the table. pain will only come with any solution, and nobody like to see that. lisa: you are based in washington. annmarie: what's the catalyst, them saying, look at this, this is unsustainable and we need to fix this in congress or is it going until the market forces them to? alifia: i think the market will force them, but i don't think it will be near-term. annmarie: are you so concerned about the u.s. deficit that you like gold? alifia: gold is a diversified

7:10 am

part of our portfolio. there are opportunities everywhere, but we also need to be mindful of downside risk, as much as there are pockets of opportunity in the u.s. and equity, that is a whole other area. we look at gold as a diversifier and it has worked until now. jonathan: what do you think it is about the regime leading gold to multiple highs the last three months? alifia: about this particular? a realization of investors that we are in a higher interest rate for longer and inflation is here to stay. how do i look at my portfolio and play a defensive type of risk? how do i make my portfolio more resilient? things like gold, not just gold but other state assets will be a part of investor portfolios. i think there are investors looking for short-term momentum commodity, and those who are looking on how to protect your portfolio. jonathan: do treasuries not work

7:11 am

anymore? is that what you are saying? go to gold? alifia: no, i think you need treasuries and gold. annmarie: that is what doctors do, they do not want to prescribe certain drugs, so -- lisa: why don't you sing it? jonathan: i will leave it there, a good time. alifia doriwala, let's hear an update on stories elsewhere. this go over to dani burger. >> advisors are pushing to keep cap the state and local tax induction treats even more and arthur laufer say they are opposed to any increase to the $10,000 right off cap, imposed in trump's 2017 tax law and will expire at the end of 25. shares of alaska air are higher with the airline expecting second quarter profit above analyst estimates.

7:12 am

they cut, citing a surge in travel by tech companies and increased demand for premium tickets. the company is bouncing back following the temporary grounding of one of their boeing aircrafts after the fuselage panel blew off on an alaska air flight in january. elon musk says some of the severance packages sent to former tesla employees as part of its biggest ever workforce reduction or too low. he apologized and email and said it was corrected immediately. he announced that tesla would cut the bull headcount by more than 10% as the carmaker struggles with slowing demand. i spoke to wedbush this morning and there were strong words to say about tesla and elon musk. >> this is the time for elon musk, late it out, walk the walk because the benefit of the doubt is not there, and this has gone from a cinderella story to friday the 13th. >> you can watch bloomberg brief every morning at 5:00 a.m.

7:13 am

jonathan: as he still got a buy on the stock? >> yes, he still has an outperform on the stock and has not given up yet. jonathan: even saying those things, still on outperform. what is going to change it for him? lisa: i'm not sure because ultimately this comes down to you have got to believe. you are either in it with elon musk and believe he is an innovator outside of cars, batteries, tunnels, or else you don't. jonathan: he certainly is an innovator, but the stock has not performed at all this year. futures on the s&p, positive by 0.2%. next, the clock is ticking on tiktok. >> sometime next year, tiktok will either have to divest its chinese ownership or shut down in the u.s. my bet is probably shut down. jonathan: we will talk about that but in a moment. did you find the stock on spotify?

7:14 am

i don't think you can buy at. annmarie:. jonathan: it is. lisa: so is the deficit. ♪ o coming in.. big orders!s starting a business is never easy, but starting it eight months pregnant.. that's a different story. i couldn't slow down. we were starting a business from the ground up. people were showing up left and right. and so did our business needs. the chase ink card made it easy. when you go for something big like this, your kids see that. and they believe they can do the same. earn unlimited 1.5% cash back on every purchase with the chase ink business unlimited card from chase for business. make more of what's yours.

7:16 am

jonathan: fantastic feedback. that song is just an english thing apparently. i thought it was global. not a thing, not at all. lisa: not on this side of the table. jonathan: let's leave that there. equity futures on the s&p positive by 0.2%. yields pulling back a little bit , down one basis point, 4.5792. under surveillance this morning, the clock is ticking on the tiktok bill. >> tiktok -- you know, the time is numbered. this house bill is going to overwhelmingly pass, so those four bills are going to be

7:17 am

combined, they are going to pass the senate, and sometime next year, tiktok is either going have to divest its chinese ownership or shut down in the u.s. my bet is probably shut down because i'm not quite sure the chinese communist party is going to allow the divestment to take place. jonathan: congress moving forward with a bill that would force tiktok's chinese parent company to divest its ownership of the platform. speaker mike johnson tied the legislation to foreign aid package for ukraine and israel. the bill is set to clear the house saturday with the senate expected to take up the measure and president biden promising to sign it immediately. michael shepard joins us now. lisa asked the question of the morning, why are we linking tiktok for eight or israel and ukraine? michael: strategy-wise, if you are a member of congress, you have something you would like to see past, if you see something else that is definitely going to

7:18 am

get through, what do you do? you try to attach it to that piece of legislation. we saw this with something else, there is also another measure, and iranian oil's insurance measure that was also attached to this, so this is a fairly convoluted just laid of strategy. the issue is that the house had overwhelmingly passed the measure initially about a moment ago, and the senate was slow walking and there were objections in the chamber, concerned about whether it would infringe on free speech, and others were concerned about a possible loss that it could get blocked in court, and singling out one company was also something. jonathan: do you think they will sidewalk this? michael: no because it is attached to the ukraine-israel-taiwan aid package. it is written that this will get through barring some last-minute

7:19 am

drastic change. annmarie: so it might not slough walk on congress, but in the executive branch, it could? couldn't he campaign on tiktok through november? isn't that what it comes down to? michael: great point, and the bill is currently written that it gives the company up to one year to divest bytedance -- bytedance to divest tiktok platform, so it would take a beat on the 2024 election timeframe and well into the new administration, and whether it is biden or trump, they could make a decision about how fast to proceed and whether to actually force it. annmarie: having these big votes, ukraine, taiwan, israel, sales of iran oil, there was something for everyone in the house, so then you have to think, why would his own party get rid of him and have this

7:20 am

motion to vacate? there has to be something there for every member of the house of representatives given the long list of provisions that will be voted on. michael: the power dynamic that we are seeing in the house right now, there is one word that could best describe it, entropy. we are seeing disorder, and it is hard for anyone, be it mike johnson, his most recent predecessor, kevin mccarthy, it is increasingly difficult for them to bring the republican caucus into line, and one reason is that a lot of these members are less concerned about a broader agenda, the agenda they have is often unique to them. so someone like marjorie taylor greene, so what they are looking for is it is easier for them to go after mike johnson then it is to try and rally the troops to

7:21 am

hold together. lisa: i will be optimistic here -- michael: wow. jonathan: he is in stock. lisa: i think you are in shock. i will optimistic and say it deals like people are getting sick of the dysfunction of people on both sides of the aisle would like to make it stop. i got that sense from the fact that the number of democrats were saying, you know what? we are going to vote along with this, and we will speak on the vote for you, house speaker, to preserve a sense of order. this firm ford representative jared moskowitz, i will not stand by and watch, i have a bucket of water. is that true or lipservice? michael: you raise a good point about how congress is facing a reckoning for tiktok. congress is facing reckoning on the question of whether it can govern, and we see these crucial bills on foreign aid to hotspots like ukraine, the mideast, and taiwan, which may in washington

7:22 am

could be a future hotspot. they are beginning to see the weight of that, and as the saying goes, heavy lies to head who wears the crown, and mike johnson is feeling that these days because does he want his legacy as a speaker to be that he could not govern or get his coalition over the house to pass anything? he is willing to accept democratic votes and support to get some of these things through. lisa: why aren't we talking about the way ukraine funding is being proposed instead of just. ? this is an odd to what -- instead of just aid? this is anod to what donald trump was saying. does it have pushback or is this anything the u.s. can give ukraine, let's go? michael: there at the point where they cannot be too picky. they have to take what they can get and get whatever support, additional support, they can to ukraine now. the situation on the battlefield is so urgent, and ukrainian

7:23 am

officials have made that abundantly clear during many visits to washington, including meetings in the office with their own bloomberg colleagues and journalists, it is urgent for them to get this aid so that they can stave off this intensifying russian front\\\ of -- russian offensive. annmarie: is trump still wielding his influence? i was struck that david cameron spent hours with him, individuals who are staunchly supportive of ukraine. michael: it is interesting that trump is reaching out to the foreign leaders, including the polish president. they do have a history there, but the question of how it connects to his sway over congress, i think they are parallel things. these leaders recognize that trump very well could be the

7:24 am

next president based on polling, including bloomberg's own poll, which shows him ahead in key swing states, and they have to make this outreach and build the bridge now rather than wait to at least understand what the former and potential future president may be planning. annmarie: when it comes to china, they will not be a lot of difference between biden and trump. we are hearing so much about china db on tap, -- china ev's on tap. michael: between trump and biden on china, there is not a lot of daylight, and where you see differences will be in different areas of policy. yesterday, we saw biden calling for 25% tariffs on certain chinese steel and aluminum products. he made the pitch in pittsburgh as he was defending u.s. steel

7:25 am

being an american hands, so that does sound like something donald trump would say. would he write the policy the same way? not totally sure, but it doesn't seem too much distance. jonathan: how dependent are we on chinese steel? lisa: the demand last year was 1.8 billion. annmarie: it is .6%? not even a percentage. jonathan: i'm not talking about our stories at bloomberg, but every story outside of bloomberg needs to have that quote. it needs to because this is about political measuring, not economic consequences or anything like it. annmarie: absolutely, and if it was bigger, you think they would have done this prior. the one place when i talk to officials the past few days, they are concerned about mexico, and that is what miller was talking about, if china dumps on mexico, how does that leak into the u.s.?

7:26 am

jonathan: fantastic, michael shepard here in washington, d.c. we will catch up with the first imf deputy director, jonathan lipsky. in the bond market, yields can be called a staple. -- can be called stable. lisa: remember yesterday? we started a little bit up and then we got the earnings and concerns about other things. jonathan: 4.5792 on the 10-year. live from bloomberg -- live from washington, this is bloomberg. ♪

7:29 am

7:30 am

then you don't stop. the idea that we have saved five million people's lives, it's overwhelming. it's everything. jonathan: things are steady, equity futures positive by zero point 2% on the s&p 500. the move in bond yields shifted lower, s&p 500 of .15%, the nasdaq up by .28%, the two-year, 10-year and 30-year down a little bit. we are talking about 4.58 on the 10-year, and the two-year back to 4.9348. crisis over in the bond market rate would you go that far? lisa: you know i would not go that far. you are setting me up to wind me

7:31 am

up. we have seen these moves every single day. if nothing happens, maybe you meander around the same place, you have headlines like today, and guard coming out, saying it just takes the 4.75% on the 10-year and then all the buyers get pushed out of the water and you get to 5%, end my god, armageddon for everything. -- oh my god, armageddon for everything. jonathan: no armageddon now but potentially on foreign exchange. the dollar is weaker, everybody outside the u.s. hoping for dollar weakness. that is what you have at the moment, just a little bit against the korean yuan. south korea and japan have threatened to interfere, and the stronger dollar story, they cannot do much about it. lisa: they cannot, especially if they need to cut rates.

7:32 am

especially they need a looser monetary policy. the question is, if the u.s. is truly exceptional in terms of growth and inflation does not come down, what else does it to without responding from some sort of policy level? annmarie: the japanese prime minister said, i hope you will read the statement as it is, it is serious concerns rather than ordinary. jonathan: serious, not ordinary. more serious that 153? let's go to our top stories. president biden turning up the heat, calling the country xenophobic and highlighting the economic problems during a campaign stop in pennsylvania. that is strong stuffed accused china of being, xenophobic. annmarie: you heard similar rhetoric from the former president. there was a lot of pushback. jonathan: average.

7:33 am

annmarie: this is what beijing said early this morning. i would like to ask kim -- beijing's foreign affairs spokesperson -- to biden, are you talking about china or the u.s. itself? so what they are talking about is basically, how do you say we are xenophobic when the language continues to come out of the u.s.? jonathan: that is going down a messy path. we will do our best to focus on trade and economics. taiwan semiconductor enjoys its first quarterly profit increase in the year, reviving growth for asia's biggest company. tsmc also better than, up more than 35% this year. decent news on the earnings front. lisa: yesterday, we got asml, and it came out low expectations. they said it was a corrective cycle. which is it? yesterday, nvidia down, today, it goes up, so i think that that

7:34 am

might take away from this. it is unclear what this means for apple in the semiconductor super cycle. annmarie: we just went from talking about the increased rhetoric in washington and beijing, and now we are talking about how tsmc is nailing it. there are long-term concerns, not just about the pathway for ai and how long the rally can go but how safe the taiwan strait can be. every time i think of the tsmc, i come back to the constant friction between these two countries, china and washington. this is a company that is in the middle. jonathan: dominating meetings in washington this week. we will hear from goldman, williams and bostic as sticky inflation traders reconsidering the path to rate cuts. they describe the u.s. economy is "overheated." john lipsky writing, "despite the first quarter, cpi data, it

7:35 am

is not clear that it is accelerating, calling into question the claim of overheating. john joins us. good morning. we have a lot to talk about. you are the ideal person to talk about the issues here in washington. it strikes me as interesting that we are lacking an institution that is coming out swinging and fighting against the drift toward policy and protectionism the last few years. how can an institution like yours regain that relevance so they can help shape and guide us toward more optimum outcomes? john: good question. the institutional response to the global financial crisis was to create g20 leaders, and they ticket on themselves to take a leadership role in these issues, and what you see is the inability of the g20 structurally to deal with controversial issues like this. they cannot even agree at the ministerial level.

7:36 am

the fund is going to have to keep working. there is no easy way because there are so much politics and geopolitics involved in the policy. or this move toward more protectionist policies. despite that, global trade is growing this year, so there is still a gap between reality than rhetoric. the difficult prospect is that this trend will continue and protection will become more embedded through industrial policy or other protectionist measures. jonathan: what do you think is the epicenter of global instability? a few years ago, we might have said china, but could it be the u.s. and the policy now? john: as the world economic pointed out, the question is is that sustainable or temporary?

7:37 am

as you said a few minutes ago, the imf called it overheating, but that is not so obvious in the data, and the imf silly figures point to an easy in growth in the u.s. year, so it seems to me that it will be more important to look at the underlying causes of stronger growth in the u.s. why is growth in the advanced economies continue as weak, and in the emerging developing economies, falling far behind? has the imf pointed out, only the u.s. has gdp output at this time above what had been expected before the pandemic. everywhere else is behind. for the poorest countries, they are the furthest behind. in other words, scarring has been important, and more important for less-developed countries. this is going to require not just rhetoric but thought and

7:38 am

action on how to boost productivity and growth in these countries. lisa: it's fascinating that in the memo and statement, they talk about fiscal debt in the u.s. debt in particular as being problematic when some might argue that's the reason why the u.s. doesn't bear the scars of the pandemic. what did you make of that? john: they themselves saved exceptional growth was due in large part to more expansionary fiscal policies. it seems to me that we are going to have to look and think about, is it labor market flexibility differences that have produced some of the results? in europe, the response to the pandemic was to provide a boost that tied workers to their job. so it meant after the pandemic, everybody went back to the same place it was before. and you have seen much more scrambling of the economy in terms of which sectors have

7:39 am

surged forward, and more flexible adaptation of technology here than elsewhere, so there is much more to it than just fiscal policy. lisa: to bring you back to what jon talked about how nobody is beating the drum right now about free trade and the concept of what that can do to the global economy, do you think this is an imf that can survive? john: absolutely. it has shown the importance of multilateral institutions as the place of dialogue. we are going through a difficult time, and i think back to my time at the imf during the global financial crisis, there was a sense if we do not hang together, we will hang separately, and you didn't have the sense of great power conflict in trying to figure out how to move forward. what we are seeing now is an environment of conflict of still

7:40 am

uncertain degree and that the global economy is not slowing, and it will take a return to effective multilateral action, open markets, open financial markets and trade markets ticket global growth going again. so these institutions are going to be critical, but it is not easy for obvious reasons. annmarie: how is it possible when the current administration is talking more tariffs on china and the potential next administration if trump got back in, 10% wall on all imports, 60% on chinese imports? john: first of all, it is not obvious that good policy will produce good results. it is not obvious that protection will produce better economic results but higher inflation. if there is the risk that markets and investors perceive, if we turn towards higher

7:41 am

inflation over the medium-term, people have based their own personal financial situation on an expectation of continued low inflation in the future. if that isn't the case, there will be a reassessment, a profound one, of the outlook that could produce pressures on fiscal policy because that means higher interest rates, higher debt service cost, and it will start eating up budgets and put governments in a more difficult position, so all this talk about protection, industrial production, continuing substantial deficits really could -- it is going to likely eventually undermine the median turnout. annmarie: if the world stays on that path, were are consequent is going to be felt most acutely? john: so far, the poorest countries have suffered the most from global inflation, disruption, etc.

7:42 am

they are the ones who have suffered and they are the ones least sponsor the for what is going on. the multilateral institution still exists for dialogue in which these issues can be dealt with. not solved quickly, but if these institutions went away, we would feel their loss intensely. jonathan: we started the week with mohamed el-erian, and he said he was hopeful. are you hopeful about addressing these issues or confident? john: hopeful. jonathan: i thought so, john lipsky, thank you. john: always a pleasure. jonathan: john lipsky, the former first deputy, managing director of the imf. elsewhere this morning, here is your bloomberg brief. >> jury selection resumes today in the manhattan hush money trial of donald trump trade seven jurors have been sworn in and the first-ever criminal case against a. selected jurors include four men, three women, and six

7:43 am

alternatives still need to be filled. the trial is expected to last between six weeks and eight weeks. donald trump is required to attend every single day. do ha qatar international has been announced best airport. asia had a strong showing and seoul took the fourth spot. the world health organization is waiting into the world of ai but not always with the best results. a new chatbot was unveiled that is available 24/7 to provide health information in eight languages, but they warned some responses might not be accurate. the robot occasionally provides weird answers. jonathan: based on the pandemic,

7:44 am

i'm not sure if i'm more concerned about the w.h.o. or the robot that comes out of it. annmarie: my advice, and i should not give anyone medical advice -- don't use this and see a doctor. jonathan: good advice. lisa: all of us have used google, dr. google? jonathan: i have pretty much every single symptom. lisa: 100% you have cancer. jonathan: next, thanks navigating through uncertainty. >> there are still big macro risks in the marketplace. strengthened stability seems to be a bigger presence in the boardroom of the banks. they are building them to make sure they can withstand any challenge. jonathan: this show has become depressing today. lisa: i'm sorry. i will try to get more optimistic. jonathan: take your pick. from washington, this is bloomberg. ♪

7:45 am

7:46 am

like everything, it takes a little planning. or, put the money towards a down-payment... ...on a ranch ...in montana ...with horses let's take a look at those scenarios. j.p. morgan wealth management has advisors in chase branches and tools, like wealth plan to keep you on track. when you're planning for it all... the answer is j.p. morgan wealth management. get your business online in minutes with the power of ai... ...with a perfect name, a great logo, and a beautiful website. just start with a domain, a few clicks, and you're in business. make now the future at godaddy.com/airo

7:47 am

lisa: was it me? jon left. annmarie: i think it was. lisa: welcome back. this is "bloomberg surveillance." a dark and stormy day. actually, it is a very energetic morning. we see a in markets, but it is the imf meetings that is front and center, s&p trying to climb, euro-dollar basically flat. people are worried about a strong dollar. 10-year yield doing nothing as we try to parse out how we think about the fiscal deficit, inflation, and the fact that you are still getting 4.6% on the 10-year yield looks good and people are buying. under surveillance, banks navigating through uncertainty. >> there are still big macro risks in the marketplace, and i will tell you, when i talked to bank management teams, i feel

7:48 am

like i'm having the credit animals discussion more than an equity analyst discussion. they are focused on their own balance sheet. i think strength and stability seems to be a bigger presence in the strategic boardroom of the banks. they are building the banks to make sure they can withstand any challenge. lisa: the imf lifting expectations for global growth, but morning financial institutions of headwinds, including rising political geo political tensions, including the u.s. tim adams writing, "instead of talking about lexical exchange rates, we're talking about preparing for a world that is getting more and more dangerous." "for the first time, geopolitical risks are the number one focus, especially the u.s. election." good to see you. when i was reading your notes, you talk about how it is somewhat of a sleepy affair, bureaucratic hubbub, but this is

7:49 am

different, why? tim: geopolitical risk is a concern that it will grow. tensions in the asia-pacific. it feels like a dangerous world. people are alluding to the 1930's, something overdone but something to consider. lisa: part of the problem with the discussions is it is hard to know how to prepare for something where it is a bipolar outcome. our people hedging that kind of risk? particularly with respect of the areas that might get hit hardest in the economy as a result? tim: everyone is preparing because the uncertainty overwhelms calculations. growth is exceeding what was expected, the u.s. economy is humming along, so from a growth perspective, we are exceeding expectations. but people are still nervous. annmarie: is the u.s. economy to good in terms that it is so good here that it is dealing with fraught consequences around the world? tim: i think you can ever be too good, that i do think some countries are same, why aren't we doing with the u.s. is doing?

7:50 am

the u.s. consumer powers ahead. maybe lessons can be drawn from the u.s. annmarie: the u.s. is doing more industrial and fiscal policy, the imf report talked about this. do you hear other countries saying, if we are not going to have as robust mobile free trade, that's the direction we need to lean into? tim: we have to go back to robust global free trade. that's the right answer. the fiscal deficit is not sustainable. debt and deficits are a part of the conversation. right now, it is providing a real pulse to the economy. lisa: take a step back and talk about the main issues, financial firms are trying to hedge against as they prepare for a more dangerous world. you point to oil and say it could surge 40% globally. this year or next year, if you see a protracted conflict to the middle east, do you see firms

7:51 am

preparing for that or do you see them as vulnerable to a situation like that? tim: our firms are all looking at different scenarios and they have for some time. it is not a surprise that oil prices could surge, and that goes back to national policy, if you would like to support manufacturing, energy is one of the most important, so it is not just throwing more physical dollars but it is how do you get energy prices that are appropriate? lisa: you talk about the risk mitigation business, is that mean that you don't see the likelihood of some kind of banking crisis or kerfuffle? akin to what we saw last march, simply because they are prepared for higher prices and a potential slowdown. tim: system is highly capitalized with a tremendous amount of liquidity. what we saw a year ago was idiosyncratic, so i feel good

7:52 am

where the industry is but every day we spent day week looking at different risks, so we do try to figure out the outcomes. lisa: when you talked about geopolitics, you talked about the u.s. election and that was one of the geopolitical risks that a lot of people looked at. what are people expecting from a trump presidency 2.0 in terms of de-regulation, is that the case? tim: i just today nine-city, 17 day tour and the first question was, it is going to happen november 5, 201 days from today? i think it will be business friendly. i think there will be protectionism, and i don't think we will see deregulation for the industry. i think there is a lot of potential chaotic outcomes. on what a trump 2.0 would look like. annmarie: what kind of tariffs do you potentially see happening? they talk about 10% on imports

7:53 am

to the u.s. and 60% on chinese. tim: i think that is the opening bid, but i do think there is a proclivity to believe that the biggest challenge we have in the u.s. is global and external imbalances, and we need to stop that. i think you could end up doing really bad policy in pursuit of the objective which is of secondary nature. annmarie: do you see the direction of travel the same when it comes to potentially more tariffs? tim: certainly on china, china is on the ballot irrespective of who is elected or running. lisa: the question for banks, if you are an international bank, do you get into china? do you expand your presence? or do you curtail it? morgan stanley pulled out a couple of the bankers from the region. tim: it depends on the institution. some are doubling down and it

7:54 am