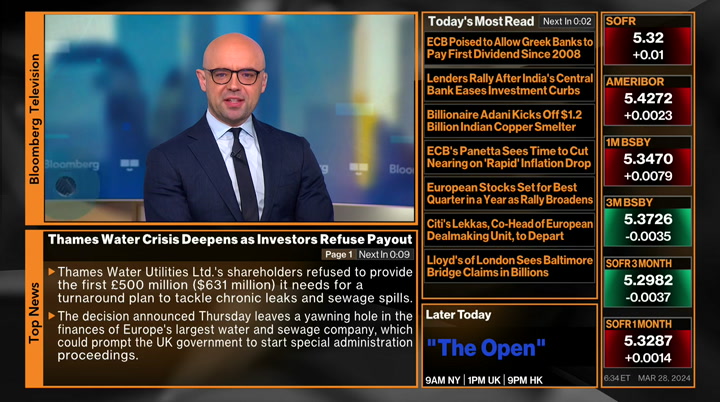

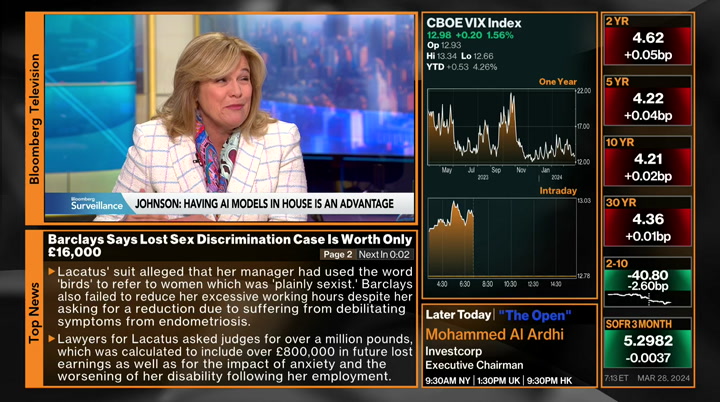

tv Bloomberg Surveillance Bloomberg March 28, 2024 6:00am-8:00am EDT

6:00 am

6:01 am

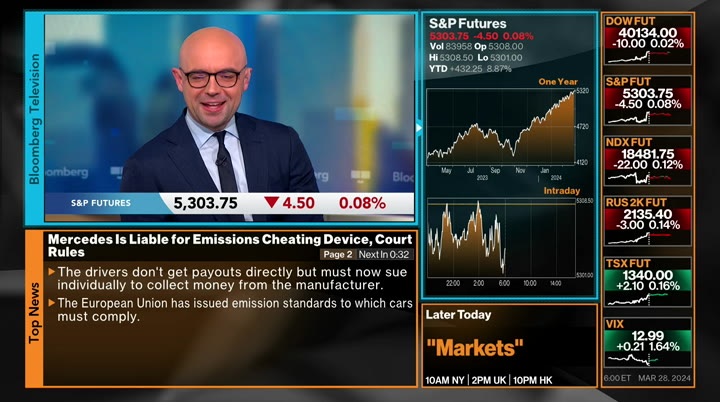

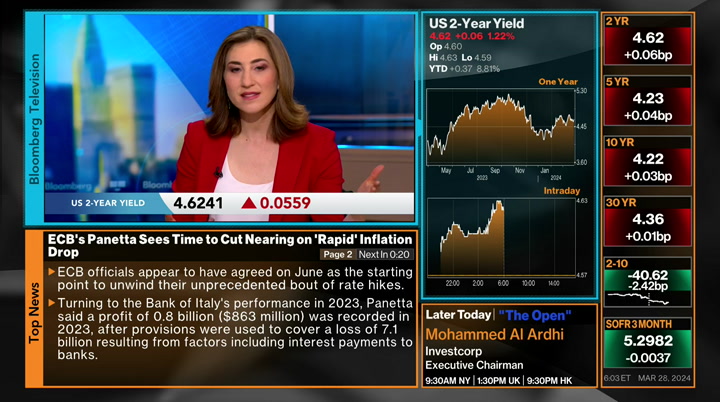

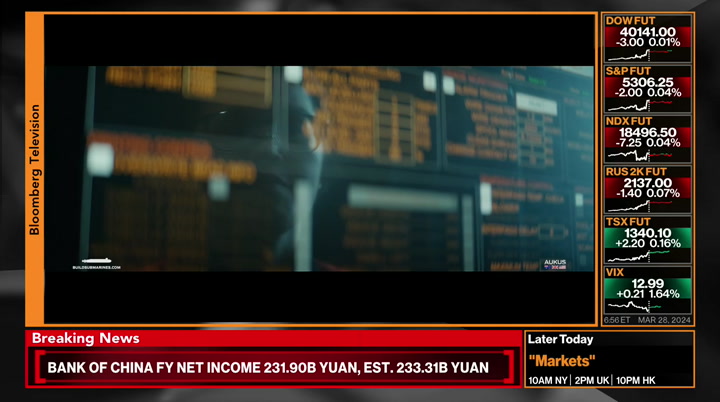

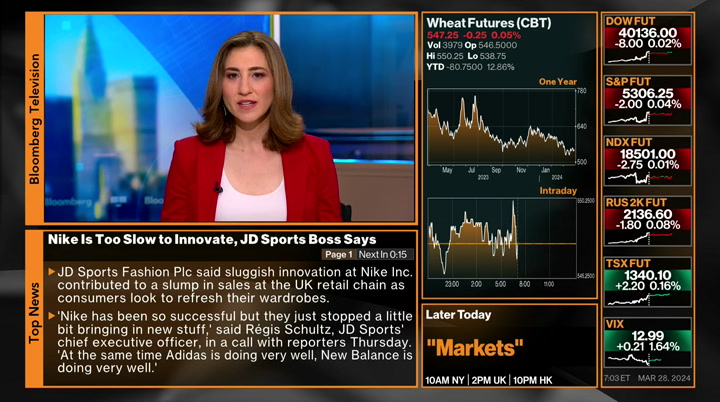

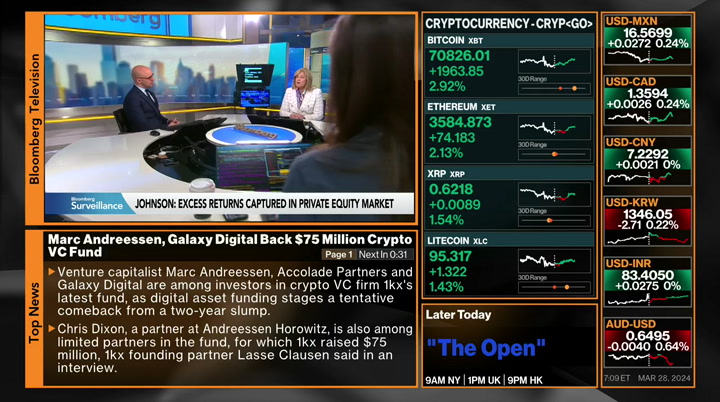

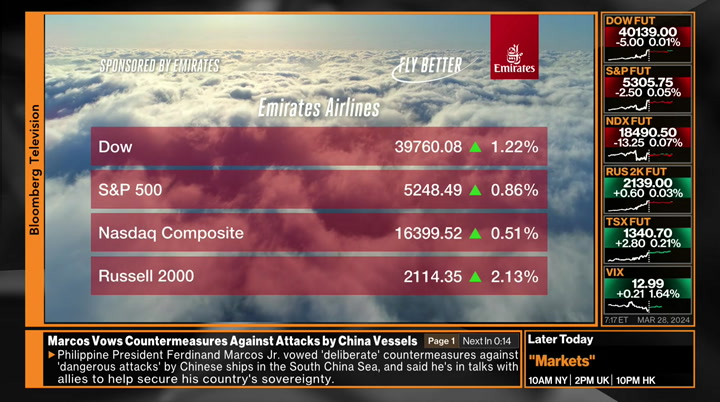

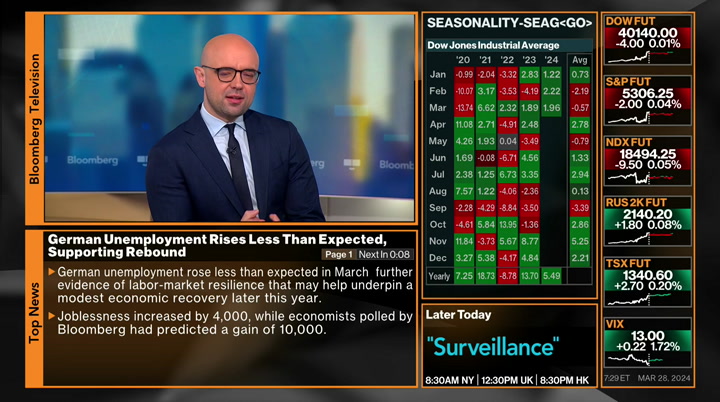

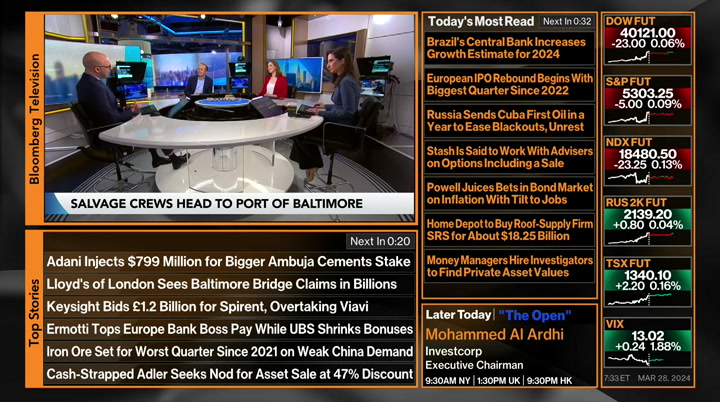

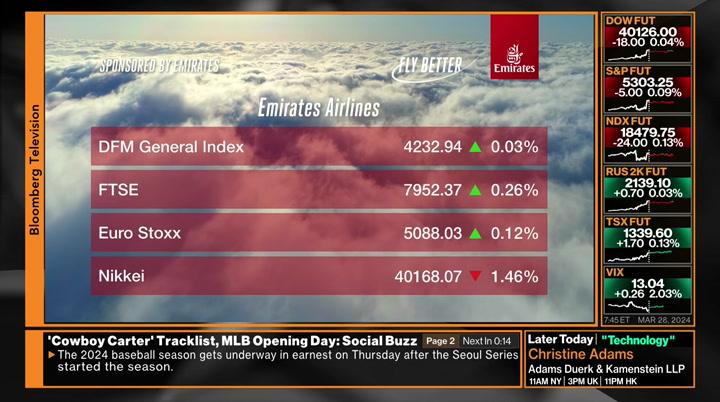

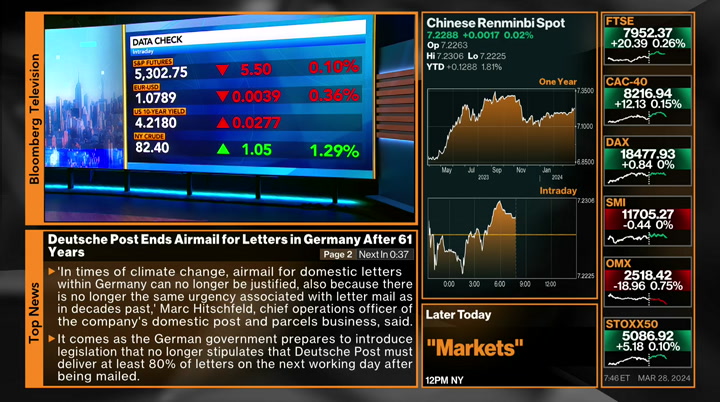

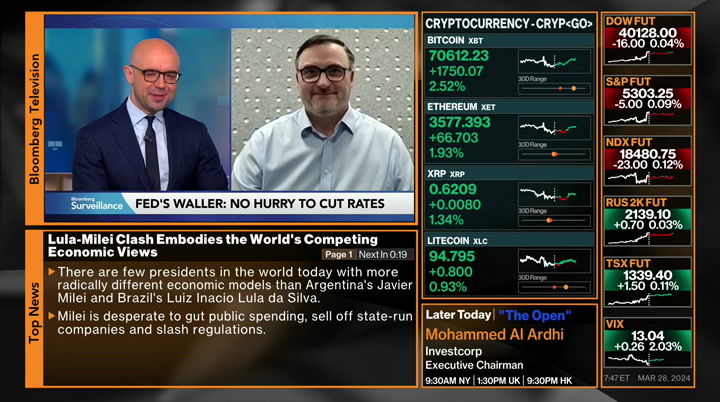

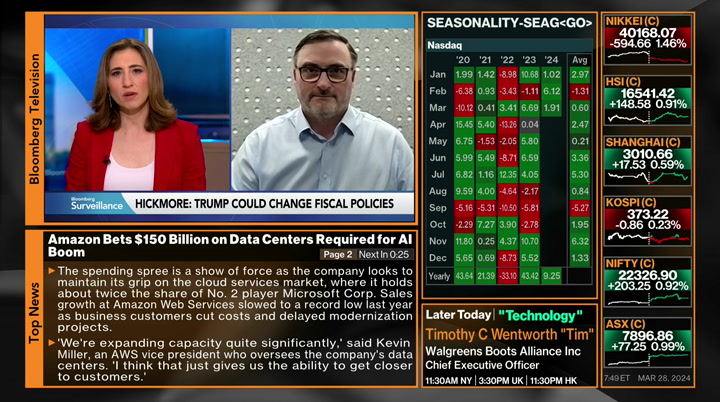

sticky. >> that changes communication and the rate path. >> this is "bloomberg surveillance" with jonathan ferro, lisa abramowicz, and annmarie hordern. jonathan: this is bloomberg surveillance. directly market pulling back a touch on the s&p 500. wrapping up q1, a decent month of gains. by 10% on is the 500. at least you get some consistency. the title of his speech, "what is the rush." that latest speech, "there is still no rush." sometimes they make it easy for us, you don't even have to read the speech. lisa: which is maybe why people are not reacting more than you expect. stop expecting all of these rate cuts because i don't like i saw and it was it is inflation data, we might have to push back the rate cuts. jonathan: i like the question,

6:02 am

what is the biggest risk, holding too long, cutting too soon? he said for strength of the economy and the get, the risk of waiting longer to year's policy is small and significantly lower than acting too soon. the question i have got, does that argument win out everyone else on the fomc? lisa: if you look at the market, the answer is maybe. people aren't buying wholesale into chris wallace being the mainstay of fed governors. when you look at the odds of a march rate cut, you are looking at 55%. not is in change. -- not a significant change. is there a rush for some of the others who we are hearing from tomorrow? jonathan: there is a rush to agreed targets on is a b 500. we get another one overnight. lifting the year end price target to 5300 to 5150.

6:03 am

we have seen this from a series of banks. annmarie: she is talking about spring cleaning, when she wants to lift her s&p 500 forecast. she is that in the press target. jp morgan, they are noting their clients not to be stuck on the wrong side because there is a pullback. we do not want to be stuck on the wrong side yet people continue to that upgrades. lisa: she went through her forecast, lifted from 5000 in november, it was 5150. it is like me to do this because we have moved beyond where we are which shows you what a surprise that has been on so many levels in terms of the strength in the continuation. when you find someone bearish, they are apologetic and subconscious. jonathan: the rally has changed and split it up three and two.

6:04 am

a move of something my 25 cents since the end of october. -- of something like 25% since the end of october. last three months, the two year yield has risen by 40 basis points. the rabbit was all about pressing and a rate cuts from the federal reserve's second half was about pressing out because from the federal reserve because the data was better. this has been two different stories even though it has been quite consistent. lisa: it is broadening out. you can see the s&p is up to percent, the nasdaq up less than that. you can see divergence within the magnificent seven. the nikkei is up 20% so far in the quarter it is as if this is not the same monolith as three months ago. it is the new type of bull market are expecting can broaden without the insecurity chris wallace is raising which is what if this is sticky and we cannot cut it at all? jonathan: public service

6:05 am

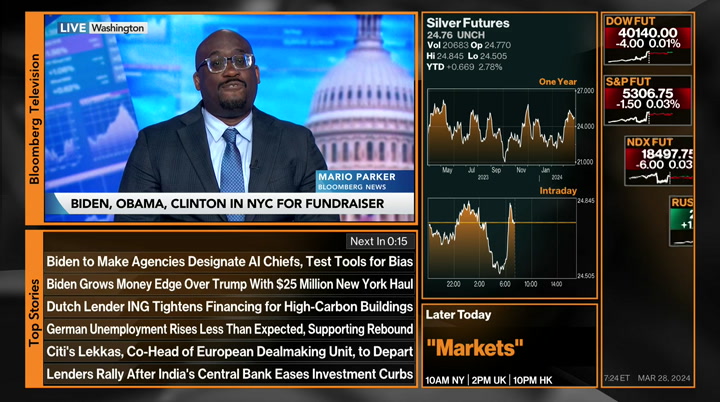

announcement, if you are in new york city come to for a three-day weekend. don't get too excited. there might be a lot of traffic. we are going to get three president tsai the same pace in midtown manhattan. obama, clinton, and biden trying to raise 25 million u.s. dollars. annmarie: president biden out front when it comes to fundraising, crushing former and his war chest is going to be adding to that. he is going to be joined by barack obama and bill clinton to try to bring in more campaign donations. the former president is also going to be in new york. there is going to be a split screen between what is going on with these candidates. jonathan: these are the kinds of things that get lisa very excited. lisa: get out of town. that sounds dreadful. jonathan: equity futures on the s&p 500 act 0.1%. no big losses on the screen,

6:06 am

some big gains over the last five months. in the bond market, yields could be higher by three basis points. on the 10 year, 4.22. dollar strength started to build. the euro 1.0776. this morning -- lisa: is 1.52, the way it gets there and the drift, these other the levels people are talking about when people did not buy the verbal intervention they had yesterday. this is a show me the money story. does the bank of japan step up or will they be this? jonathan: just a tiny bit of weakness. we catch up with larry adam of raymond james as the is me 500 kids ate -- it's a record--- hits a record high.

6:07 am

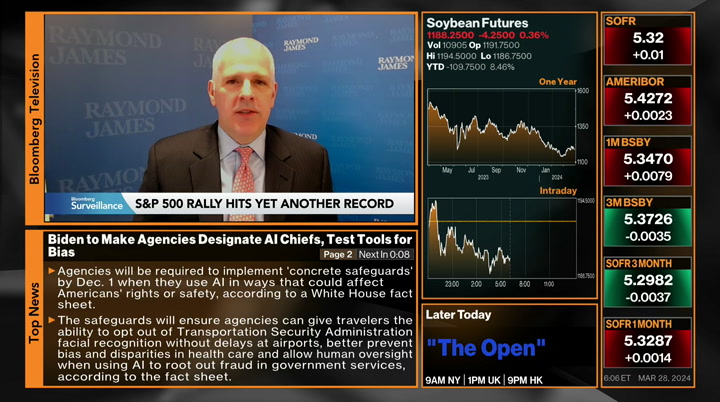

fed governor while pushes back on rate cuts. we be of their top story, is a b 500 hitting another record high as investors looked around at the quarter. larry adam singh at the rally has room to run. we believe the eckley momentum is likely to continue because we are in the early stages of this market. larry joins us now. i think we have to repeat the conversation because you are repeating the effort. why do you think we are in the early stages of a bull market when some people say we are going -- we are late cycle and this is going to end soon? larry: i look at the economy and i think we will be able to revert a recession. if you get the magnitude of what has happened, is probably the biggest bull market we have had. you look at the average duration, usually they last about 5.5 years. we are only 1.5 years into this market so we have room to run.

6:08 am

i would say i am more cautious in the near-term. jonathan: we mentioned the relationship or lack thereof of the bond markets. i want to talk about valuations. i was going back over noland road's -- my old notes. we were talking about a price to perfection and we had a bunch of notes saying we were pressed to perfection. we still get guests coming on the program saying we are priced for perfection. we have been priced for perfection 25 basis points ago. can you tell me what we are pressed for. larry: i think we are pressed for perfection but that is because earnings have continued to move higher. we have seen any upward revision to earnings and that is what has allowed the markets to move higher earnings right now, press valuations, we are pretty expensive. we are in the top decile when it

6:09 am

comes to pe violations. if you dig out the covid time period, it is probably the most expensive we have been. that is why i am more cautious as visit you today. lisa: forgive me for being confused. it is the beginning of the bull market but you are cautious and trying to sit on your hands? which is it? larry: you guys mentioned at the beginning of this section, the market has been up 27% since the lows of october. usually you see that type of performance coming out of a recession. that being said, usually you have three to triple docs in a given year. we have not had one in six months so we are double the time period you get a pullback. once we get that pullback, you see the equity markets pullback to the 4800 to 5000 level, that will set up a nice run. when i look at the fundamentals, i don't see earnings going

6:10 am

lower. when i look at this economy, as long as that stays strong, that will propel those earnings. i am not concerned about the fed cutting rates. i think it is more important, what is the impact on the economy and as long as the economy remains strong, those earnings will be there. lisa: are you saying if the fed keeps rates where they are for the remainder of this year, the market could hang in there and remain incredibly attractive because there is enough economic strength that that is not a restrictive rate? larry: if the economy were to continue to do better than what people think, that is a potential scenario. our scenario is that the fed doesn't start to cut in june, it will take insurance cuts to make sure it increases the lead would this is a soft landing -- the likelihood this is a soft landing. you will see a soft landing in the second to third order but not enough to take us to a

6:11 am

recession, just a mild slowdown to set up for an acceleration of growth. jonathan: what we have seen through march is a performance on energy, banks, relative to information technology on the s&p 500. tech has not been dominant. would you extrapolate that given the recovery of seen the second half of this year? larry: once we get back into earnings season, you will see those companies deliver on the earnings side. if you go back the last 10 years, those companies tend to outperform burning expectations by 7%. we continue to see those revisions moving higher. we do like technology. i do like health care and the industrial sector because one of the things we believe happened here is we are in the process of those manufacturing indices that have been coming out. historically when you hit, industrials tend to outperform. lisa: a lot of people would

6:12 am

agree with you. talk about how expensive the stock market is and valuations making them queasy. do you hold more cash and wait for a drawdown? do you basically hang in there and say long-term is good, short term we can reallocate? how do you handle near-term pessimism and long-term optimism? larry: you give the holdings you have in the equity market -- keep the holdings you have in the equity markets. with a 5% plus rate in money markets, there has been no rush to put them to work. but if we get a pullback closer to the 5000 level, that sense of a reasonable opportunity for someone to has a long-term horizon for this equity market. jonathan: the elusive did -- dip everyone wants to buy. the elusive dip because we have not had one for five months. lisa: exactly.

6:13 am

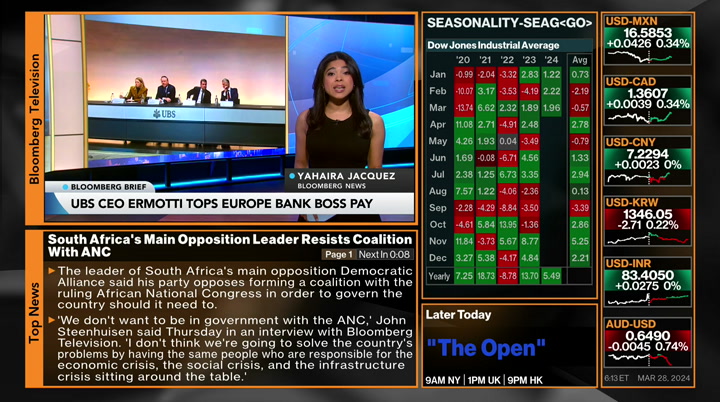

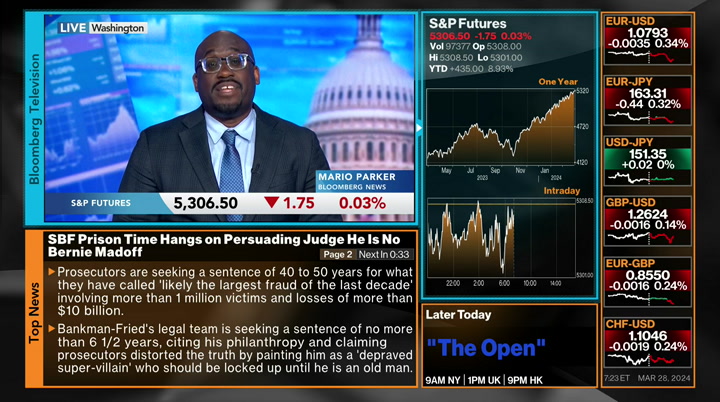

which is the reason i wonder why people handle this thought. valuations make them feel sick. at the same time it is hard to not by when you see a lot of gray clouds. if you are not worried about the bogeyman coming out of the corner, what is going to cause that a drawdown? jonathan: everything everyone was think about valuations, same story. we kept repeating the same line. lisa: which is the reason momentum is a hard trader to bet against. we keep hearing from so many people. maybe we are not there. jonathan: matt miskin is going to a in on that point -- going to weigh in on that point. we are down .006% on the s&p. here is your bloomberg brief. yahaira: sam bankman-fried will be -- over his collapse of ftx. he was convicted in november over fraud and conspiracy with a

6:14 am

jury finding he illegally used money from depositors to cover personal expenses including the purchase of luxury property. prosecutors recommending a prison sentence of 40 to 50 years. is him and friends urging leniency saying ftx investors have largely recovered their funds. ups cut its bonus pool last year by 14% after a tough year for traders and dealmakers. a ceo ranks as the best paid european boss. sergio ermotti received millions of dollars in compensation for his first nine months. he was brought back as ceo in april to see the rescue of credit suisse. record annual profit of $27.8 billion, largely driven by windfalls from the takeover. major league baseball owners voted to approve david rubenstein as the new controlling owner of the baltimore orioles.

6:15 am

the franchise has been valued at -- with the owner of the carlyle group taking a 40% stake with any option to buy the rest of the team when peter angelos died. he passed on saturday but david rubenstein has not yet spoken to the family about purchasing the rest of the team out of respect. jonathan: very cool. it is opening-day tonight. just on time. lisa: and number of teams are doing their opening day in korea which highlights the increasing patient -- -- asian -- jonathan: in the u.k. as well. lisa: which is what people think los angeles gets good players because they have a good times on. jonathan: do support the orioles not? yankees over here and mess over there. are we going to do the game? the mets-yankees later this year. possible intervention from the

6:16 am

boj. >> when you have a low volatility world that we do in fx, you have got another potential funder. jonathan: that conversation coming up next. live from new york city, good morning. ♪ starting a business is never easy, but starting it eight months pregnant... that's a different story. with the chase ink card, we got up and running in no time. earn unlimited 1.5% cash back on every purchase

6:18 am

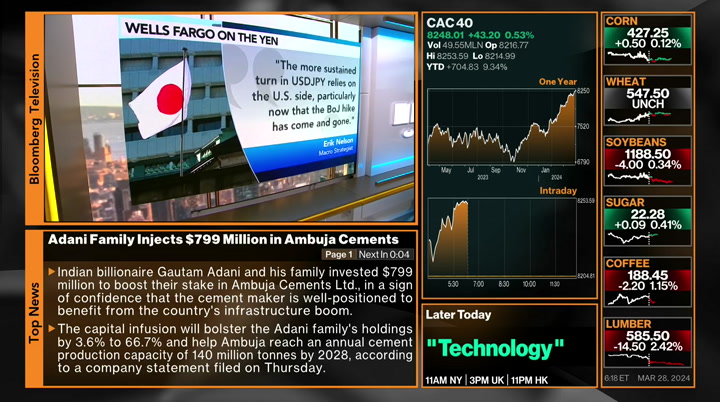

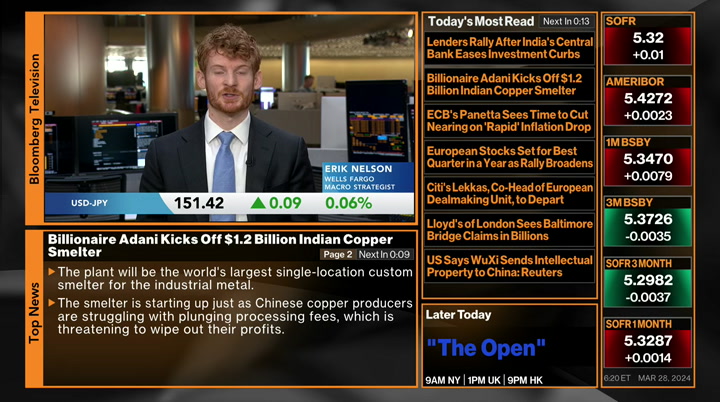

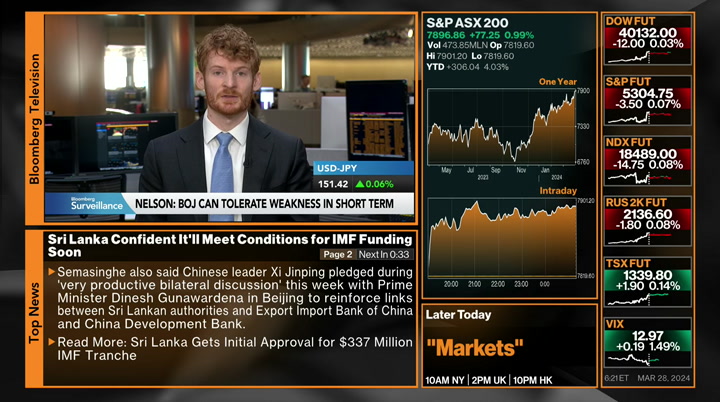

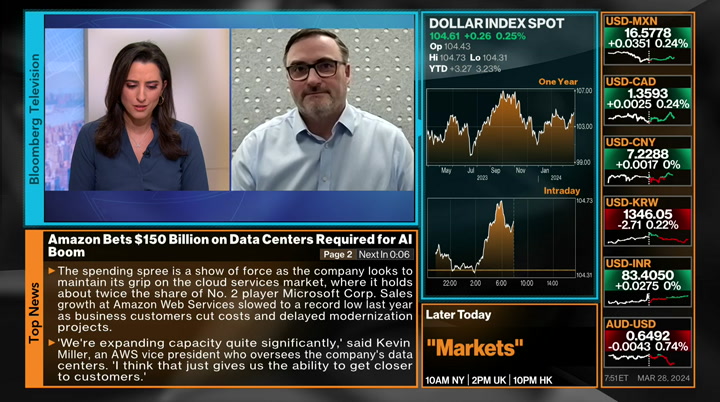

jonathan: closing out the quarter, equity satriani session of big time. up something like 25%. equities negative by zero .06%. under surveillance this morning, trades design, possible intervention from the boj. >> they laid the groundwork and terms of how to think about their policy when they hiked to

6:19 am

zero. the rate differentials remain fairly robust. when you have a low volatility world that we do in fx, you have got another potential funder. they have taken out that a gap from the perspective of if they actually approach policy. jonathan: the yen is steady after reaching its biggest level in 34 years. traders eyeing 152 which would prompt intervention. the more sustained dollar have been in relies on the u.s. side. the boj hike has come and gone. eric nelson joins us. are you saying that words are not enough? erik: that is exactly right. just because we have this intervention rent and we are seeing some shift in leadership on the funding currency side with swiss franc coming to the forefront, it doesn't mean you should i the yen rush you should

6:20 am

buy the yen -- you should buy the yen. we should turn toward my depressing and more rate cuts. the market is moving the opposite direction with regard to the fed. lisa: when you look at the implications, already saying that our path he gets to do real intervention at 152 and they would accept 152 or 153 as long as it is controlled? erik: first it is not just about levels, is also about volatility. if you look at realized volatility, how much the currency has moved intraday over the past few weeks, dollar-yet has been subdued. if we break through 152 and we get to 155 in a couple of days, i suspect they will intervene. they will put their money where their mouth is. if we move gradually, we don't have to do that. it is not just about what level we get to. lisa: what is the thinking in terms of why it is okay to have

6:21 am

this weakness? they don't care about the important inflation previously were talking about -- people previously were talking about? erik: i would not say they don't care, the domestic icebreakers are well behaved. a lot of strong which numbers from the annual wage results. wage growth in japan is around 1.5% to 2%. they are 02 gate -- they are okay to tolerate weakness here in the short-term. what they are worried about is the yen strengthening too much on the back of his normalization. they are happy with the recent yen section given the magnitude of change. they are happy to moderate gradual weakness as long as it is now underway with him. annmarie: what is the base case of what that intervention actually looks like? erik: this is an important

6:22 am

detail. in terms of the movement in dollar-and, 2020 we had two big periods of doj intervention. we're looking at four to five big figure moves in dollar-yen. if we get to 154 or 155, you could break back low below 150. the question we get all of the time is the mechanism. are they selling u.s. treasuries? we have done work that shows we don't sell treasuries and advances intervention a lot of times they are selling cash on hand and using proceeds to replenish their cash holdings. it is important in terms of how it affects the u.s. and global bond market. jonathan: let's talk about the u.s. side. did talk about the dollar side of the trade and the importance. so many people are bullish on the u.s.. exceptionalism. i want to understand whether

6:23 am

there is greater scope for positive surprises since that appears to be a high bar in the u.s. erik: i hear a lot of clients that tell me the u.s. economy is booming. i do not think that is necessarily true. it has done better than anyone has expected given real rates. the problem is it is not slowing as much as the fed or others expected and that is what is hard for the bond market to digest. if we look to next friday jobs report, you don't have to have a 3000 number on jobs. the market is going to have a hard time rallying significantly on the number, the bond market. that is going to be a challenge for dollar-yen. no one wants to get a short the dollar right now. we are probably late in the global cycle.

6:24 am

there are some risks on the horizon so we are recommending in the g10 space being long dollars over the next three to six months. jonathan: including against the euro? erik: yes. historically, this low volatility regime we are stuck in right now tends to be a good dating and again her for three to six months out broad dollar strength. i think the euro is vulnerable especially as u.s. election risks come to light. the trump team has been critical of europe. there are risks building that could be dollar positive. jonathan: eric nelson there at wells fargo looking for a dollar that is stronger. lisa: the fact that he said we are they tentatively will cycle and basically you get dollar strength as we are late in the cycle and then you have larry earlier saying we are early cycle.

6:25 am

if your head is spinning, welcome. jonathan: governor walter alluding to you might get midcycle rate cut judgments. it does not sound like end of cycle stuff on the fomc either. lisa: on this panel essay were we. one person set up early cycle, one said late, one said what even is a cycle? maybe it is a bifurcated thing. everyone is a little existential. how do you benchmark a time when we have rolling cycles? jonathan: let's talk about the boj. to difficult situation they are in. i was talking about 2011 -- i was thinking about 2011. what do you notice the policy priority of a central bank, is hard to find that. 2014, ecb was fed up with having a strong euro. they came out with negative rates. it was hard to fight because the

6:26 am

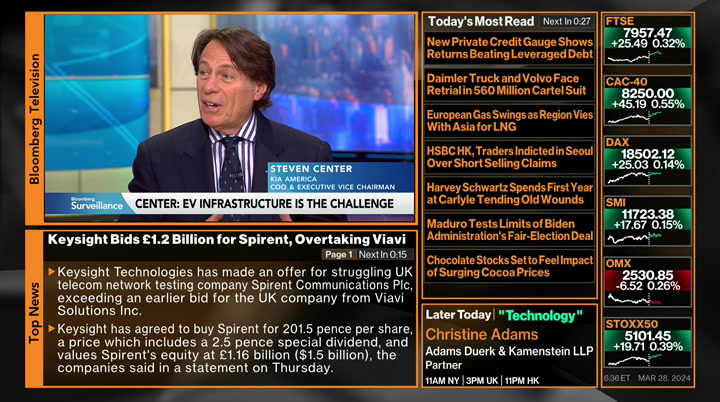

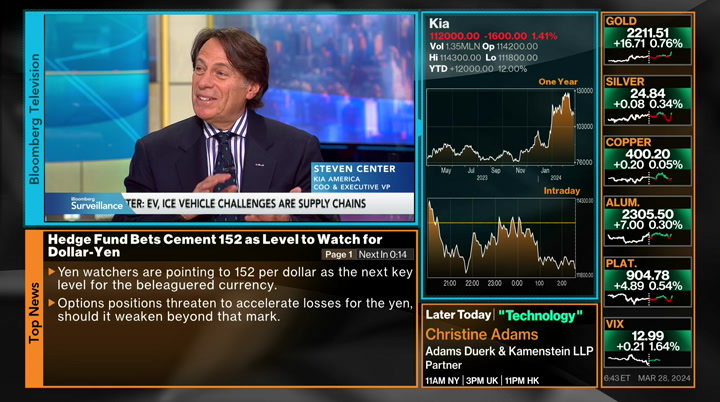

policy preference was to do something about it. i don't think we can say that the japanese policy preference is to do something about dollar-yen. there is a much bigger story. lisa: eric nelson said they are happy with the section. they don't mind the beginning of the yen because it allows ongoing reflation they have been looking for. this is a new way of looking at it. not only are they not committed, they like what they are seeing. jonathan: that could change. that is just where we are right now. coming up, steven center of kia motors. equity futures on his be 500 to close out the month of march, down by 0.04%. from new york, this is bloomberg. ♪

6:30 am

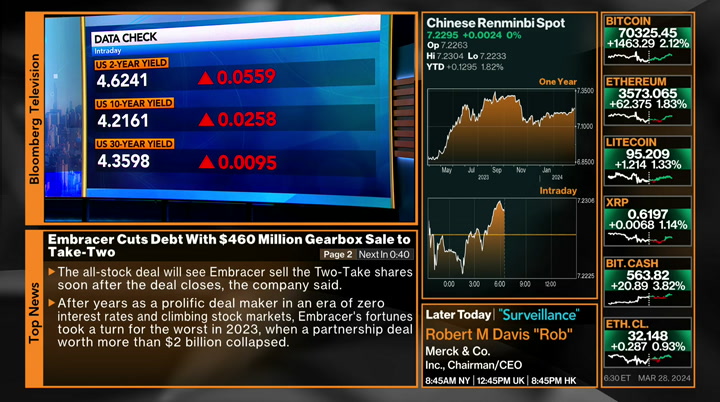

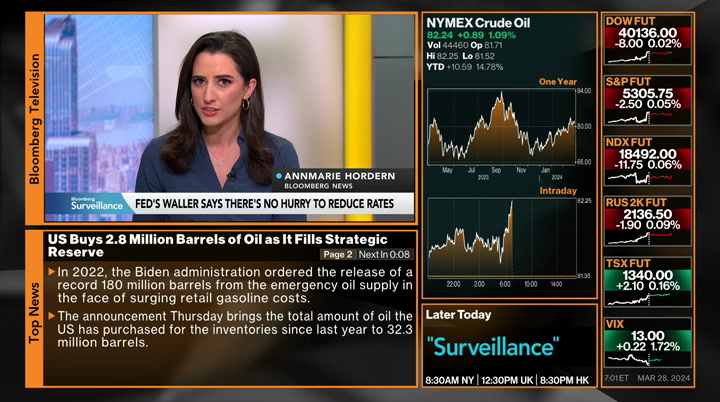

jonathan: let's check out the price action together, equity futures on the s&p 500 slammed the negative with the emphasis on slightly. down by .03%. more -- farmworker truck you can think about where we have been. yesterday the 21st record high of the so far. we have had five months of gains. since the end of october, stocks are higher by 25%. lisa: even though bonds are down, even though we have seen

6:31 am

with and prices come down. with this expectation you are not going to get rate cuts. that is the conundrum. it could stymie a rally. jonathan: bonds down, yields up. the bond market, tenure, two your, 30 year. the two year has risen by close to 40 basis points come up by another six basis points this morning. four point -- 4.6241. we rallied over the previous two months to close out last year with much lower yields and we are trying to work out what he relationship is between the bond market and stocks given that people but when we priced out rate cuts stocks would be heading south. lisa: ask six people, you get six answers. my take is it doesn't matter, this is the latest zeitgeist. it is a if they cut once or three times this year as long as they cut a little bit. if they don't cut at all, it

6:32 am

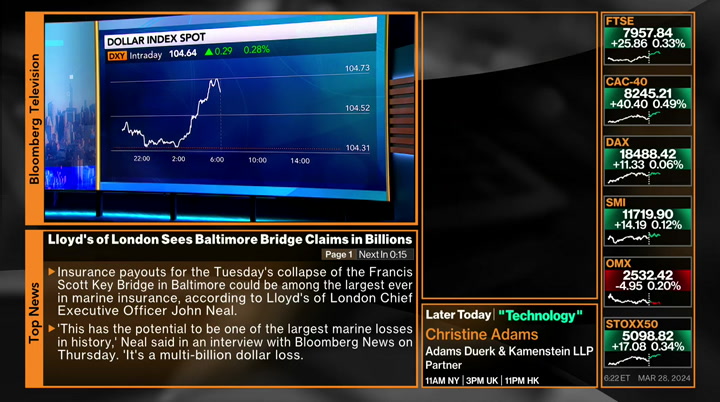

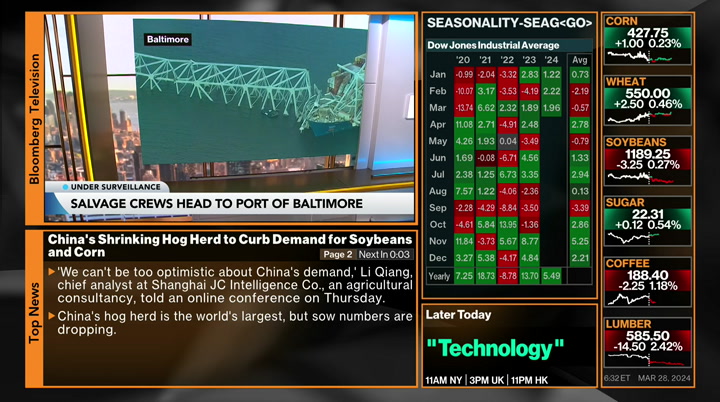

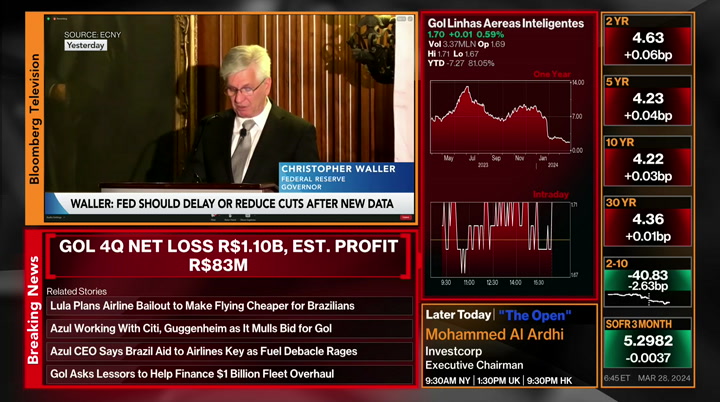

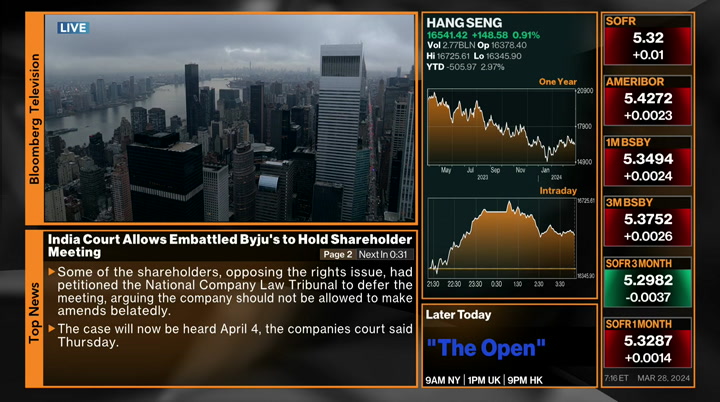

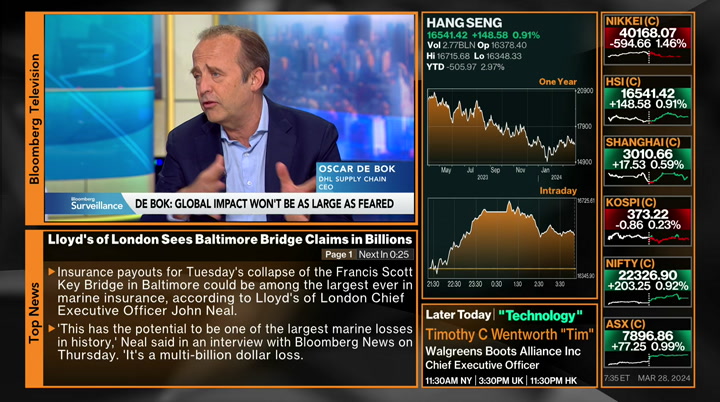

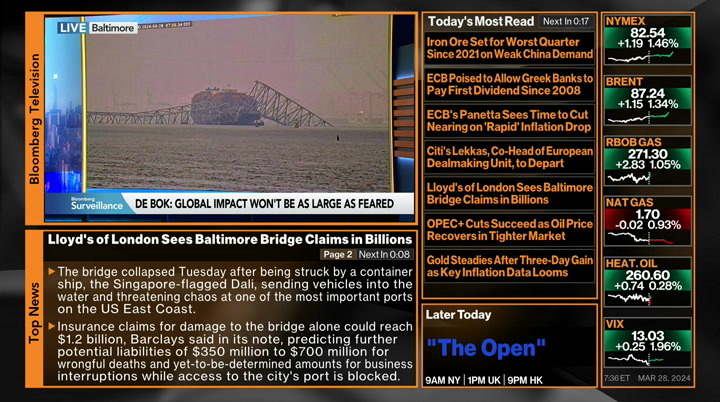

becomes a potential risk. that is the message we have gotten from a lot of people. i am butchering it. jonathan: they are not hiking and it is okay for now. pce comes tomorrow. chairman powell after that. the euro bringing in touch. the dollar is stronger, the euro weaker. 1.0788. dollar-yen, 151. lisa: people are saying is that the line and it is and? it doesn't really matter if it gets to 152 as long as it is not rapid. a slow controlled climb is fine. jonathan: it's got to 157 yesterday and they just talked about it. a salvage firm is headed to the port of baltimore to remain -- to collect the -- there is no,

6:33 am

as to when normal port operations will resume. it facing as much as $3 billion in claims. lloyd's of london is the most exposed. this is what we talked about yesterday, where is the liability and where does it sit? annmarie: what we are from officials and janet yellen, there is going to be some ability on this companies -- on the insurance companies. that gap or waiting for this paperwork to go through, this city federal government is to step in. if other people say this could just be the start of how much this will cost. jonathan: it takes time to get money. lisa: i was reading by the excavation effort and how you get the material out and begin to understand what the morning is going to look like for the new bridge. it is an intense process.

6:34 am

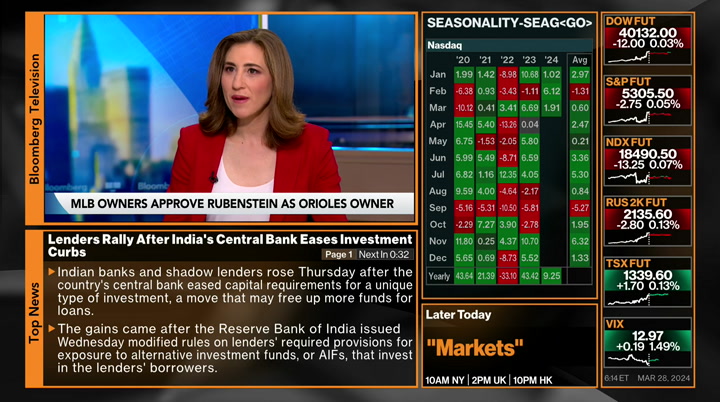

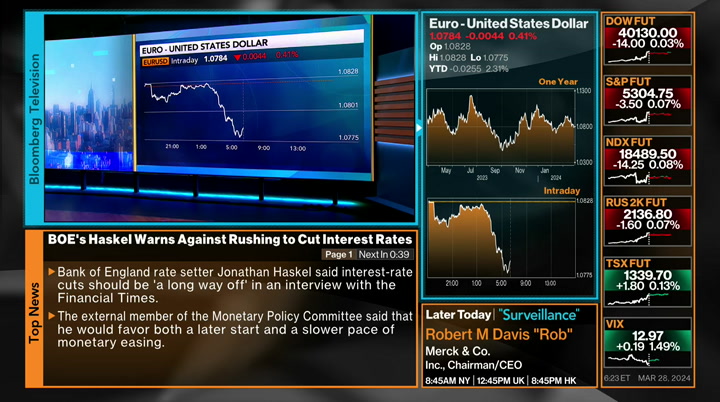

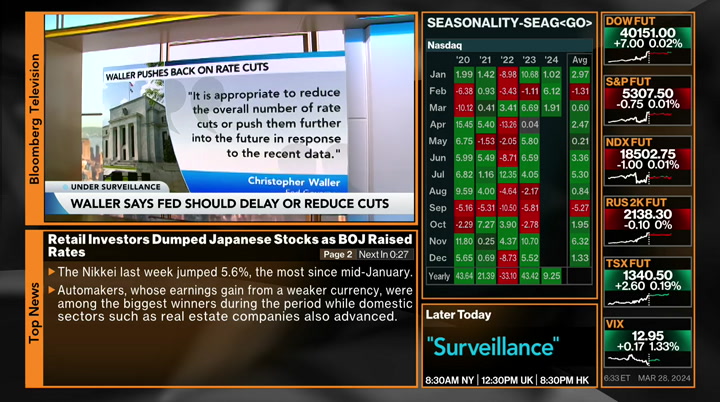

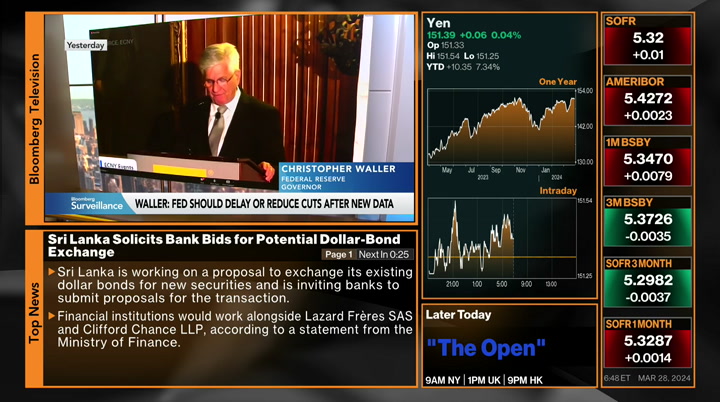

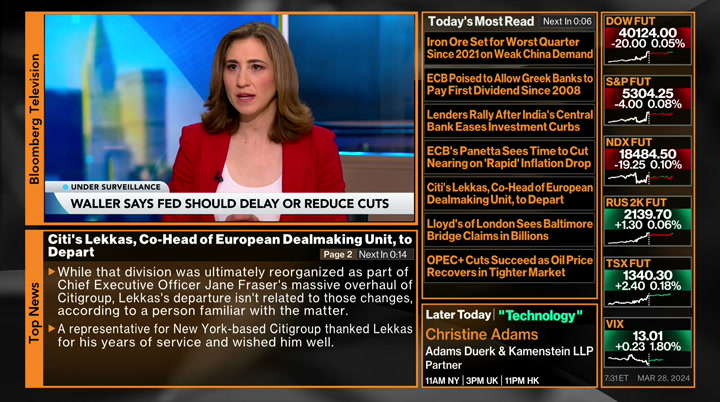

excavators come in that have expense with this. jonathan: a 1000 foot boat stuck in a bridge. that can take a long time, weeks, maybe months. lisa: there are 56 containers with hazardous material. they have to get it out without spilling anything and do so while preserving an effort that could lead to faster construction. jonathan: a massive effort underway. let's turn to our next story. fed governor walz are looking to reduce the number of rate cuts or push them out. saying "i see economic output showing continued strength while progress in reducing inflation has slowed. i see no rush in taking the step two is monetary policy. we need to see a couple of months of better envision data." no rush, that is his tagline over the last few months. lisa: that is interesting, they said lens. -- next headlines. it is said off tomorrow when

6:35 am

chair powell will be speaking. expect bigger response in markets. people can shrug off chris waller as a hawk. jonathan: it would be nice to hear from chairman powell, markets closed, just take it in, have a few days and then come back monday. lisa: is that what you are doing tomorrow? jonathan: of course. mike mckee out -- mike mckee is going to break down pce for me. i will be listing to that. let's talk about the tension between china and the u.s. and a sprinkle of ev. janet yellen slimming china's use of industry to boost subsidies. seeing u.s. manufacturing is facing pressure from cheap was flooding the market. comments ranging from green energy products to electric pickles. janet yellen saying this will be a key issue in her next trip to china. steven center drugs is now. -- joins us now.

6:36 am

you have the ev's at kia, can we talk about how they are selling? stephen -- steven: there seven well, we would like to sell more of them. there has been a lot of expectation about the rate of transition and that is unknown. consumers are buying the car, enjoying the car. the infrastructure is a challenge. the whole industry has received the business from the early adopters. now you're getting into people that really need the car. the thing about range anxiety is true. it is more about charging excited because the cars go 300 miles and very few people drive 300 miles at a time. we are very excited. ev nine has won a lot of awards. it has proven what you can do with cars. a three row suv. jonathan: what do the ships

6:37 am

telling you they need right now, where consumer demand is and how you meet that demand? steven: you talk to dealers, their first thing is discounts. that is not selling from shrink. we need better infrastructure and that is where all of this is failing. you can regulate what we build, you cannot regulate what people by. the big projects like infrastructure that in the beginning our cash out and then the returns over a period of time, that is like building highways and that is what the government should be and they have blown it on that. lisa: when i was buying a car, it was not range excited or charging anxiety, it was resale value anxiety, the fact that it was probably going to plunge if i got any ev because it is not clear with an eight year battery lifespan. how do you address that? these cars are not as valuable when you resell them and there

6:38 am

could be new technologies that come down the pike in that time. steven: absolutely. when you are buying electric cars, they are more like tech products than normal cars. perhaps the ownership method is going to change. you may lease the car. you may come back at the end and get a complete refitting. and then there will be a second lease end recondition the battery. there is a lot of change coming in terms of how you do things. it might be you don't own them. you don't own a car when you get, you only on the left of the car. lisa: it raises this question if policymakers have gotten it wrong. it basically carmakers were pushed into manufacturing vehicles where there wasn't demand yet and it wasn't clear that with the right pathway where there could have been better ways to get to a more efficient future. is that accurate? steven: absolutely.

6:39 am

we are being told what to make specifically. if you talk to emissions designers and engineers, there are many things they can do to clean up the cars. there are different technologies. batteries is one, fuel cells. hydrogen fuel cells are wonderful. they are silent. the question is where you get the hydrogen? that infrastructure is eve thomas mature than the battery charging infrastructure. i chill everyone i can find in the government you need any oppenheimer moment -- need any oppenheimer moment. you need someone to fill the crisis and diminish the change. lisa: -- annmarie: the epa, many people say this is a mandate. the strongest pollution standards we have seen.

6:40 am

you are saying they got it backwards. steven: there is a lot wrong with regulation. you have three different groups regulating the auto industry. we have knit so. you have the epa for exhaust gases. and then you have california's doing from the pack. they are requiring electric vehicles. there are other states that jump on that rule and they are not doing anything about infrastructure. the challenge you have is too many sets of conflicting rules. in the case of electric view was -- electric vehicles, the point is to reduce co2. co2 is not a local problem. when you fly over the country, you don't see the lines on the ground. it is a global problem. california is a big ev market. number three and five are texas and florida.

6:41 am

my attitude is let people buy them where they want to buy them and let's get the job done. i tell automakers there is a present of ev's you have to sell for the whole country. don't create these silos, that is killing the industry and it is impossible to manage. lisa: the biden administration has been happy with the efficient reduction act. how concerned are you about that? steven: someone asked me what is the biggest threat i see in this business and i said it is an existential threat. they say is in china? no, that is competition. it is government policy. we are making decisions that last 30 or 40 years when you build factories that establish supply chains. to have the government policy change from on and off, on and off, it is nuts. jonathan: can we talk about the ev plant in georgia? can you tell me whether that is

6:42 am

going to be dedicated to battery pack vehicles are not? steven: that is a great question. the original concept is ev's and it also includes a battery plant. we went to the factory -- you want the heavy components near the factory. we want that factory morning. he did. this might be that we build other cars there. we have another factory in west georgia. we build the telluride and sorrento there. we are building ev nine there. most of electric vehicles are the sim's internal combustion come at one point it goes this way or that way. we are building ev nine, we are going to introduce it later this year. it might be that we are going to balance capacity with other products. jonathan: how easy is it to do that?

6:43 am

i have treasure get some information and have struggled. toggle between hybrids, ev's, and internal combustion vehicles. how easy is it to toggle between the three. jonathan: hybrid -- steven: hybrid vehicle is not that different. it has a fuel tank and an electric motor and a smaller battery pack. ev is a different beast because it is driven by electric motors at the wheels. at some point when you are building the car, it is either bored as any ev or internal combustion. at some point you really go this way or that way. the biggest challenge is the supply chain because you have different parts. we have different motors coming in and battery packs. inside the factory you are either jacking up engines or checking battery packs. not that exciting. lisa: when you talk about the supply chain, you don't worry

6:44 am

about china. that is competition. do you think the gating offer different auto industries about the country is problematic for their industry even if it might benefit you in the short run in terms of stricken competition -- restricting competition? steven: you don't want to restrict competition because it breeds laziness and weakness. competition is a good thing. you don't like it when someone can be you and often you get beaten because the difference is between the nations. you just have to get better. jonathan: this was one of the most revealing conversations i have had about automakers in a long time. i appreciate the transparency. policymakers have put you in a complicated case and we appreciate the time. steven: my pleasure. jonathan: steven center there. equities unchanged on s&p. here is your bloomberg brief with yahaira.

6:45 am

yahaira: joe lieberman has died. he represented connecticut in descendant and was -- in the senate and was al gore's running partner in 2000. he moved from democrat to centrist independent come supporting republican efforts like in invasion of iraq. lieberman was 82. discover ceo is leaving the credit card company to lead ally financial. he will be replaced by michael sheppard. he was not expected to be at the firm long-term. capital one agrees to buy discover in a 35 bullet dollars deal. -- $35 billion deal. as an abiding is that you face -- to raise 35 many dollars in a day campaigning in new york city. he is raising money alongside obama and resident quentin.

6:46 am

it is to expand president biden's cash lead over donald trump. for showing alongside two former presidents giving biden an institutional backing that trump lacks a due to his estrangement with big gop names. jonathan: the only thing i can think of is traffic. fed governor waller in no rush. >> in my view, it is appropriate to reduce the overall number of rate cuts or push them further into the future in response to the recent data. jonathan: that next. live from new york, this is bloomberg. ♪

6:47 am

6:48 am

people were showing up left and right. and so did our business needs the chase ink card made it easy. when you go for something big like this, your kids see that. and they believe they can do the same. earn unlimited 1.5% cash back on every purchase with the chase ink business unlimited card. make more of what's yours. billy's not just running a small goat grazing business he's also the chief marketing officer. and when he needs to round up some new customers constant contact makes it easy. helping him craft the perfect message like a marketing genius so his email stands out. constant contact delivers all the tools you need to help your business grow. if billy can do it so can you. get started today at constantcontact.com. helping the small stand tall. jonathan: inching back on the

6:49 am

s&p 500, down .5% and yields bleeding higher come up two or three basis points. crude higher by .29%. under surveillance this morning, fed governor while they're in no rush. >> the economic output and labor market showing continued strength while progress in reducing inflation has slung. -- slown. i see no point in reducing -- 4% further into the future. jonathan: the preferred metric, pce, due tomorrow. another hot print calling for the raised increase of the year.

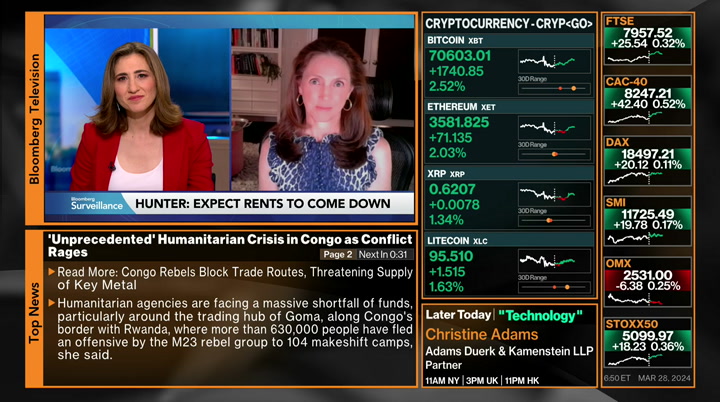

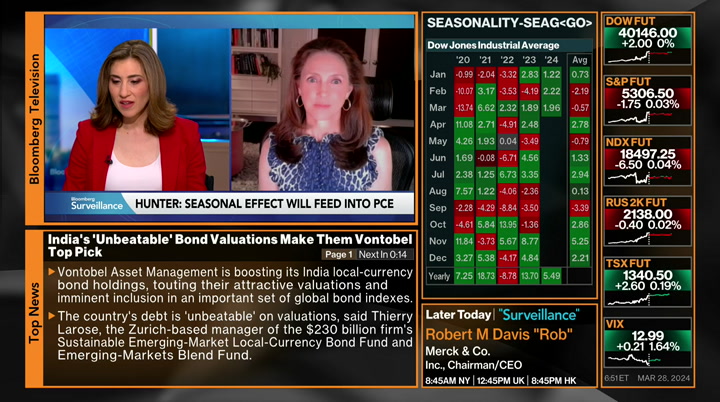

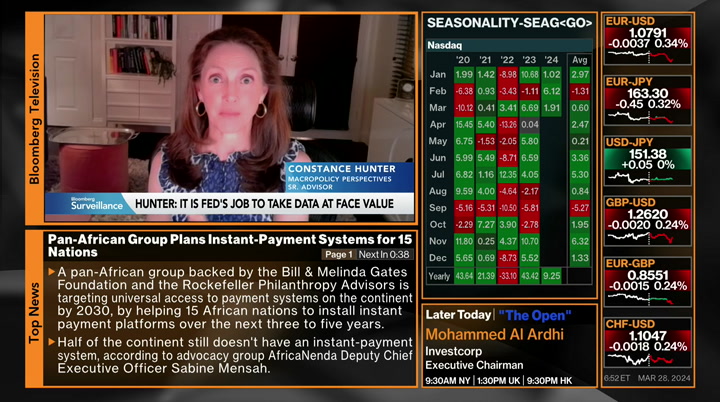

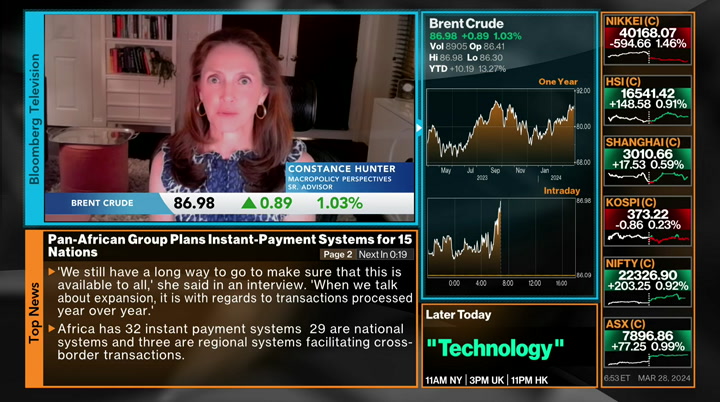

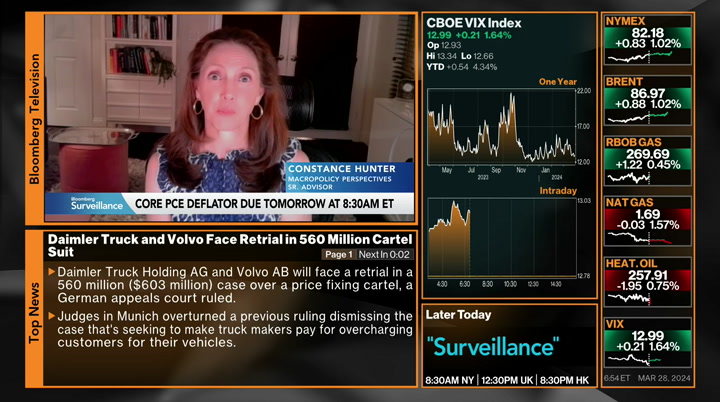

6:50 am

macropolicy for -- but expecting continued moves in the right direction on monthly data that should give the fed confidence to cut in june. constance hunter joins us now. let's start with the data tomorrow morning. we have had avi, cpi, how do those form what we get tomorrow morning. constance: pc is broader, but the seasonal effect we saw in january and continuing in february will feed into pce. on the good news front, we are expecting it to funding come down i know this is like waiting for the goal -- waiting for ga dot. we are befitting their prices to be soft and that the grill question comes in sources like

6:51 am

waiting for insurance. if you think about auto insurance, it was influenced by the rise in vehicles and prices of labor. all of that has moderated and we are expecting that to feed through into vehicle insurance. lisa: you said you think this will give the fed confidence to cut in june. we heard him saying yesterday that is appropriate to reduce the number of rate cuts abortion into the future in response to the recent data. constance: a few things on that. we don't expect tomorrow's dated to give them confidence. we expect data forthcoming between now and june to give them confidence. is the fed's job to take the data pretty much at face value we saw powell speak about this is not actors. they need to be cautious and

6:52 am

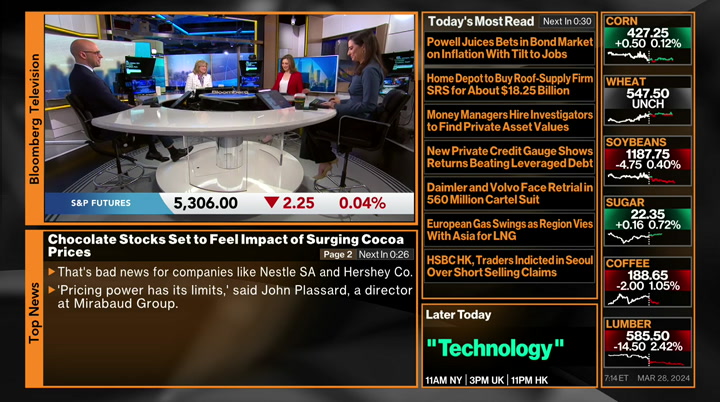

prudent in regards to that. i think waller was laying out the case for that last evening. on the other hand, the fed is data dependent. at the data comes in, will cause them to inform what actions that actually take. lisa: are you surprised we have not seen that weakness yet? a lot of people expected to see the disinflation in a much more aggressive way. we are now seeing inflation in commodities across the board. goods inflation seems to be picking back up and people are worried about the housing price increase. does that give you pause that the data will weaken by jim by june -- by june. constance: commodity prices leak into cpi. there are some commodities, if you look at cocoa and copper that have been going out.

6:53 am

if you look at the broad basket, not so much. if we consider rent, we have been waiting for those. we were expecting those. again, that beginning of the year data can be a little lumpy. we saw this last year. with regard to housing prices, let's remember to be elected aggregate of the two components that make up housing cost and housing price inflation. it is aggregates the consumption portion and the investment portion. those house prices that are going up in the marketplace are not what gets fed into cpi and pce. from the perspective of the fed, lowering rates would increase housing supply at the margin which would have numbered pressure on prices. annmarie: can we sit on commodities? jp morgan upping their target

6:54 am

for oil to hit $100 a barrel. how much of a headache is that given that oil has a read through across the space when it comes to other products and goods? constance: if we look at will prices on any metric on a real basis, remember all of these commodities quoted nominally, they have not increased that much. they also not decreased. that should have also not decreased. i will feed. you prices the question is how quickly we get to $100 -- the question is how quickly we get to $100. if it is a swift and sustained, that is a different story. annmarie: if it is this summer and the markets expecting june, does that mean the fed may have to distance themselves again? constance: we are casting oil

6:55 am

prices is a tricky thing to do and it is we get to 100. gasoline prices would cut demand for other goods and services. 70 people need to use their cars to get to work and we have a predominant internal combustion engine fleet. if your previous guest is in them to go by, that will be slowly going away -- if your previous guest is anything to go by, that will be slowly going away. i don't think it is going to be the primary thing we're looking at. if we are moving in the right direction, pc" pce, the -- core pce is not going to change the trajectory for the oil market. jonathan: thank you. going into pce data, constance hunter there following that speech from governor walz or. lisa: is difficult to understand agitate data at face value -- to her stand how to take data at face value.

6:56 am

-- do you take it at face value when you take into valuation? you know certain areas are going to disinflation over the next couple of months. this is such a fraught moment. who do you pay attention to in the fed. are they going up on ideology more than data dependency? jonathan: do you think the hawks might trade earlier cuts? you think that is the compromise? lisa: is like a poker table? i will give you a cut and raise you know more. jonathan: i don't think the -- wants to dissent. if you get that cut, that is one way of getting to an agreement. we can go earlier but ultimately it is going to mean fewer. lisa: profile bostick talks about how he only wants one cut and he said we can be one and done for a while. jonathan: we will see with that conversation heads. jenny johnson -- louk evermore.

6:57 am

6:58 am

the all new godaddy airo helps you get your business online in minutes with the power of ai... ...with a perfect name, a great logo, and a beautiful website. just start with a domain, a few clicks, and you're in business. make now the future at godaddy.com/airo when i was your age, we never had anything like this. and yowhat? wifi?iness. wifi that works all over the house, even the basement. the basement. so i can finally throw that party... and invite shannon barnes. dream do come true.

6:59 am

xfinity gives you reliable wifi with wall-to-wall coverage on all your devices, even when everyone is online. maybe we'll even get married one day. i wonder what i will be doing? probably still living here with mom and dad. fast reliable speeds right where you need them. that's wall-to-wall wifi on the xfinity 10g network.

7:00 am

7:01 am

>> this is "bloomberg surveillance" with jonathan ferro, this abramowitz, and anne-marie turned -- is of rum with scum and annmarie hordern -- lisa abramowicz, and and reorder. -- and annmarie hordern. jonathan: we're looking at a third month of gains on the s&p 500. lisa: people have been asking for a broadening out, you got it. you are still seeing the magnificent seven crushing it up. you are seeing other areas, particularly in industrials and energy pick up some of this lack. jonathan: governor walz or -- governor walter at a speech in new york got -- owner waller at a speech in new york saying no rush that sums up everything about his position. lisa: and it tells you about how people read things they want to read. no rush means they cut in june and we will see if they cut again. other people are saying maybe he

7:02 am

is saying they don't cut at all this year. we hear a fed speech, we get economic data, and people take it and fitted to it is as they had earlier in the year. jonathan: core inflation data tomorrow morning. reflecting on inflation data we have already had. recent inflation updates, disappointing. the conclusion, delay or reduce the number of cuts in 2024. annmarie: there when they get to talk about was softness on retail sales but he says it is not evidence of a slowdown. he says that evidence is too sparse. he brought up a great point, this started with raphael bostic saying maybe it is going to be one and done. i like what greg valliere said. he said of course we believe that officials when they say political considerations that affect their policies, but initial rate cuts on september 18 and 18th could be up. jonathan: let's say you're only going to go once. maybe it would make sense if you would avoid the election period

7:03 am

altogether. lisa: you have come up with this this is that the fed is like a poker table trying to negotiate rate cuts and the timing and what they are consolidating around is they have the hawks saying we are going to cut once. june is a good time and that we are not going to cut again. we will give you your dovishness but to caucasian is later -- but take your hawkishness later. jonathan: i'm going off of what burner waller said which is that the grand compromise is either fewer or later. if they go earlier, you might end up with fewer. it might make sense to shift towards two. i have no idea where the economic it is going to be between here and then. i listen to commentators, the visuals on the fomc. that to be the direction of travel. lisa: if that is the case, should the two yearly higher? is that mean the neutral rate is substantially higher than it has

7:04 am

been? does that reset expectations anymore material away? jonathan: yields have been shifting higher at the front end of the curve. equities at the moment, no drama. changed on this and be 500, negative by .04%. that is the story of the first quarter, how well this equity market has stood up to yields repricing higher and pricing out rate cuts, not pricing them in. lisa: yields are rising because of strength that is the good kind of rising. when does it become the bad type of rising? there'll of these levels. -- there are all of these levels. if the narrative is strong enough, it can persist longer than they did that can continue to go with it. jonathan: markets to market committee commentary. it has been list -- different than the last two months. .

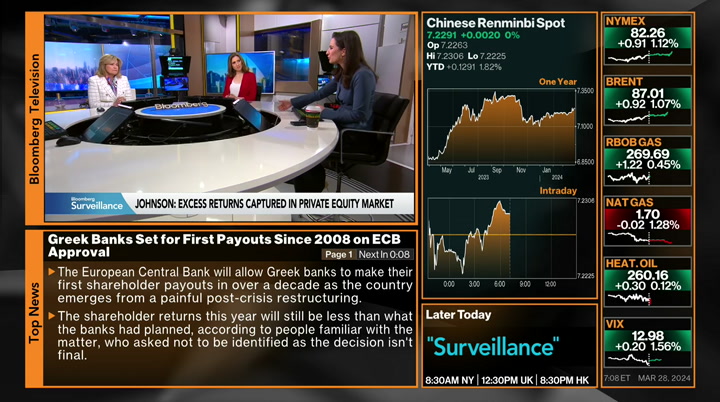

7:05 am

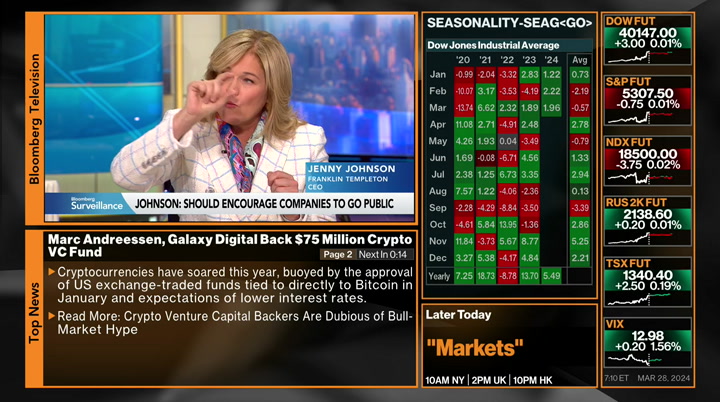

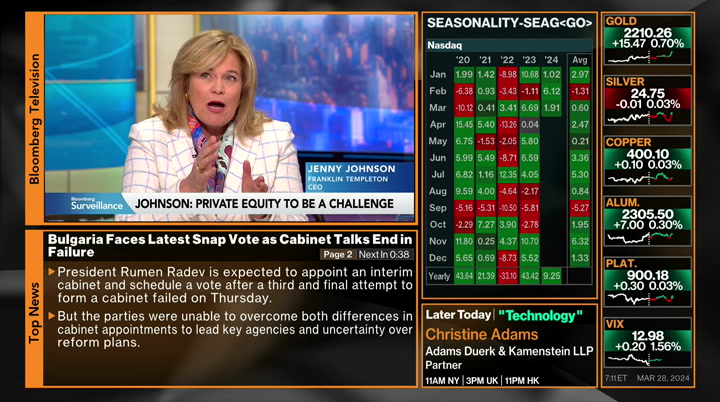

coming up, jenny johnson, the ceo of franklin templeton. janet yellen sound the alarm on china and oscar de bok on the dhl supply chain. rubbing a big quarter that public a year. stocks posting any all-time high. . jenny johnson of franklin templeton seeing this, we see a dovish but pragmatic federal reserve. rate might not appear as soon would be as deep as they are projecting. jenny is with us around the table. i want to start with this big picture stuff. how do you and the team think about investing over the next 10 years compared to investing over the previous decade? jenny: i think it is very different. this is where it feels good to be an active manager because you have come off of a decade where money was free. the abe's place to go is the equity markets.

7:06 am

when you do that, you have a moment to -- a momentum market. if you are lucky enough, you could qualify for the private market and you have excess returns there. now it is tougher. listening to the two of you on the politics of where the fed is going to go, which is the reason why i would say the best thing to do is to ignore the politics of the election and look at the data. i think if you look at the data, i believe it is probably september that first rate cuts. maybe not a 75 people think. there are still wellpoint for jobs for every person looking for a job. wages are in sync. we saw the story with stocks projecting on earnings because consumers are strong. this next decade is going to be

7:07 am

all about risk-adjusted asset management. jonathan: you think they should ignore the politics. can you personally ignore the politics? jenny: if you are the fed, the best thing in the end, you can never defend yourself if you have allowed politics to infiltrate your thinking. the best thing is to look at the data and standby that. the matter what, they are going to get criticized on the timing. take out the politics in your decision-making process. lisa: as an investor, politics has a legitimate influence on markets, especially right now with industrial policy. people say that is the beginning. we have to revise our economy is held up by nuts and bolts as much as by the pickles on your phone. how much is that changing her thesis in terms of how you invest, the asset, and where you

7:08 am

are directing money? jenny: we have done acquisitions in the private markets. the change from public markets to rabid markets is directly related to political policies. just take private credit. banks are not lending in the way they used to lend. people say look at this growth of private credit but it has shifted from the bank balance sheets to the private markets. that is a direct reaction to the capital requirements imposed on banks. we have managed to $78 billion in private credit. only 10% of direct loans have come to the banks. the rest go the private markets. you look at the private equity market, it is tough to be a public company. you see ceos who have the choice to wait longer, waiting longer to go public. all of those excess returns are being captured in private equity market.

7:09 am

that is a bit of politics that has become imposed on public companies. the average investor needs -- they invest in mutual funds and etf's. those are only investable in the public markets. we should encourage and create opportunities for companies to go public versus creating inadvertent where we are attacking public companies. annmarie: a key executive was saying it is hard to plan 30 to 40 years out when regulation is cost of the on and off. john is asking about 10 years off -- 10 years out. how do you look four years out, especially with a change of a president in november? jenny: i think we probably do look four years out. anything is to not be a day trader where you are looking up and down. we are longer-term -- longer-term investors so they thesis will be anywhere from three to 10 depending on what company they are standing. he was talking about eeev market

7:10 am

and all of the -- the ev market technology politics behind that, you are going to be focused about the policy that comes in. it was quite on banks for a while -- quiet on banks for a while until silicon valley bank. then more regulation. you try to understand how quickly politics are going to impact the investment. jonathan: you were talking about money shifting toward private markets, you have received 10 strategic investments and acquisitions. how did a couple of initiates of capital in u.s. capitol markets -- how do they complement shifts of i u.s. capitol markets? jenny: i talk about this shifted the private market. right now private equity is going to be a challenge. with interest rates up, private equity firms have excelled when cash was free, it was hard to not do well. we bought secondary private equity and it is a great place

7:11 am

to be if you want exposure. in the private markets, there is a shift towards capital. the other thing is the massive advances in technology are so that you can have customized portfolios in a way we have never been able to do. we have an ai application where a financial advisor can customize a client's portfolios based on their individual goals. it's dynamically shifts based on the timeframe and the risk of that particular goal. that kind of customization and tax optimizing is going to be a real win to investors. lisa: you talk about ai technology and for strategic ships or acquisitions, are there more to come? this is the best way to access new markets and new expertise? jenny: it is important for -- it

7:12 am

is difficult to grow organically in new areas. our alternative investments in real estate, private credit, and secondary ee. the second area we think there is a good opportunity is in infrastructure. that would be the last two feel about that product gap. our acquisition of putnam investments brought traditional capabilities into retirement and insurance which is an important channel for us. we are looking for those things that look to fill gaps. we have the broadest give abilities of any asset manager. we don't need to do any acquisitions. now it is about finding ways and we recently had our private credit manager say it was great, franklin bought us in 2018. you helped us with tribute, but now because of ai and the cost

7:13 am

of data and the expertise required there, we realize we would not be able to do that on our own. being part of a $1.6 trillion platform that can invest in these is any advantage. -- an advantage. lisa: some people are wondering if the biggest players in the space habit is proportionate advantage because they have economies of scale. they have that scope updated to use for the machine running programs. do you think this is how it is, boutique managers have to partner with dr. firms in order to survive -- with bigger firms in order to survive? jenny: you and to narrow the asset managers they work with. you have to do due diligence on a small manager is a large manager -- as a large manager. not only is the cost of external data expensive but your ability to train your own ai models by

7:14 am

having more data in-house is an advantage. for us having it in different parts of the capital stack is a great opportunity. that is where it becomes an important advantage of size. things like blockchain, i'm a big believer there is going to be new types of products introduced because of this technology. we have a tokenized money market fund that launched in 2020. for us it is going to be interesting although on objects -- interesting follow-on objects. we are probably not going to be earning on this for 10 plus years. you have to get that knowledge today. that is hard for a small manager to spend their time in r&d. jonathan: can you tell us the secret sauce to brackets for march madness? he won the men's bracket in 2021, tied for third place last year. why are you so good at this?

7:15 am

jenny: just like active management comes down to a great team, i have a great team who gives me great advice. [laughter] lisa: how big is the team? you have four people doing brackets? jenny: i would say there are five core people that help fill that out and i'm sure they get advice from others. jonathan: i am dreadful at this. jenny johnson, the ceo of franklin templeton. here is your bloomberg brief. yahaira: sam bankman-fried will be sentenced over his role in between to 22 collapse of ftx. there should be 2022 collapse of ftx. he was convicted of fraud and conspiracy with the jury finding helical used money from depositors to cover personal

7:16 am

expenses like the purchase of luxury property. . prosecutors recommending a prison sentence of 40 to 50 years. his family and friends urging leniency saying ftx investors have largely recovered their funds. the ecb will allow greek banks to make their first shareholder payouts in more than a decade. the last time a greek bank made it evident was in 2008 ahead of the global financial crisis and before the country's debt crisis started. the bank payouts expected to come after greek banks reduce their nonperforming loans and increased financial strength. towns across america are preparing for an economic windfall with the solar eclipse expected to pass across the country. the last eclipse in 2017 was limited for some states with south carolina's tourism department meeting and impact from 1.6 million people traveling to see the eclipse.

7:17 am

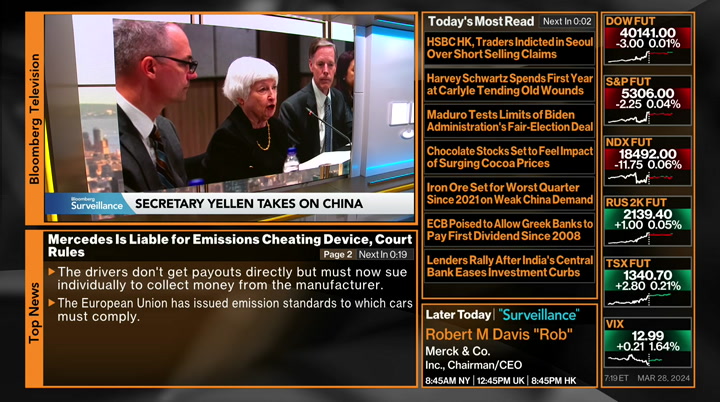

rochester, new york is one city on the path with officials anticipating 500,000 people will visit with hopes of seeing it. jonathan: secretary janet yellen taking on china. >> we have reached overcapacity with previous discussions with china and i plan to make it a key issue in discussions during my next trip there. jonathan: that conversation up next. good morning. ♪ welcome to ameriprise. i'm sam morrison. my brother max recommended you. so, my best friend sophie says you've been a huge help. at ameriprise financial, more than 9 out of 10 of our clients are likely to recommend us. our neighbors, the garcía's, love working with you.

7:18 am

because the advice we give is personalized, -hey, john reese, jr. -how's your father doing? to help reach your goals with confidence. my sister's told me so much about you. that's why it's more than advice worth listening to. it's advice worth talking about. ameriprise financial. okay y'all we got ten orders coming in... big orders! starting a business is never easy, but starting it eight months pregnant... that's a different story. i couldn't slow down. we were starting a business from the ground up. people were showing up left and right.

7:19 am

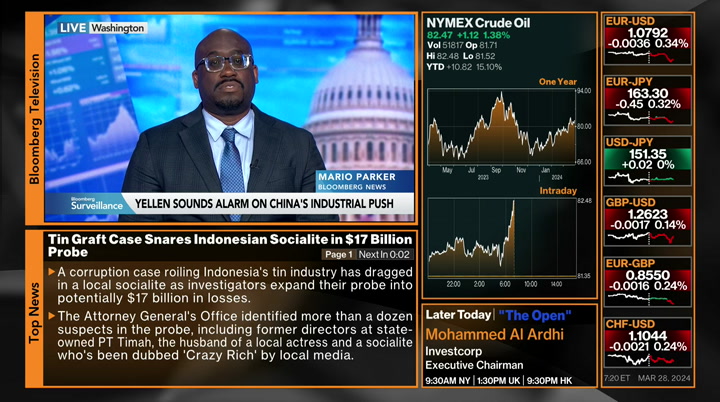

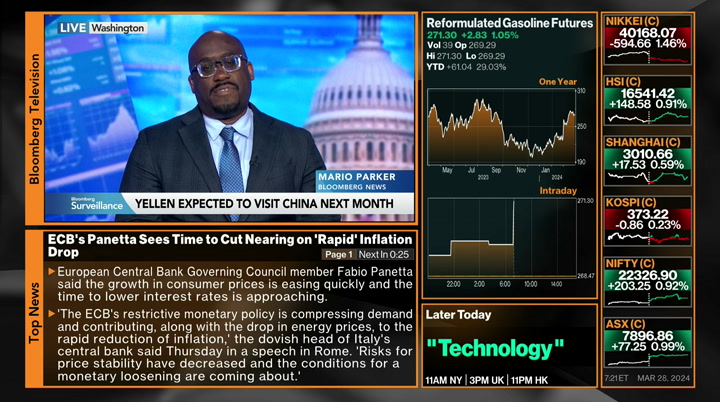

and so did our business needs the chase ink card made it easy. when you go for something big like this, your kids see that. and they believe they can do the same. earn unlimited 1.5% cash back on every purchase with the chase ink business unlimited card. make more of what's yours. jonathan: quiet start to the morning come equity futures negative by 0.04%. yields higher by two or three business points. 4.2161.

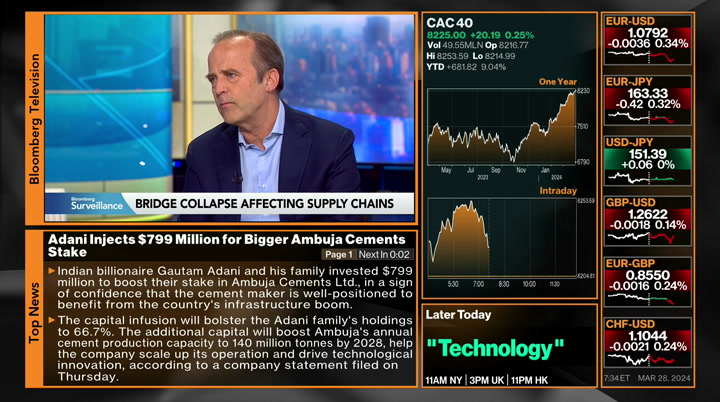

7:20 am

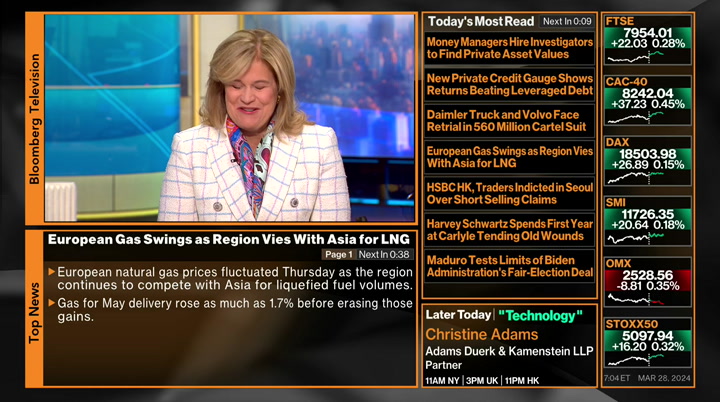

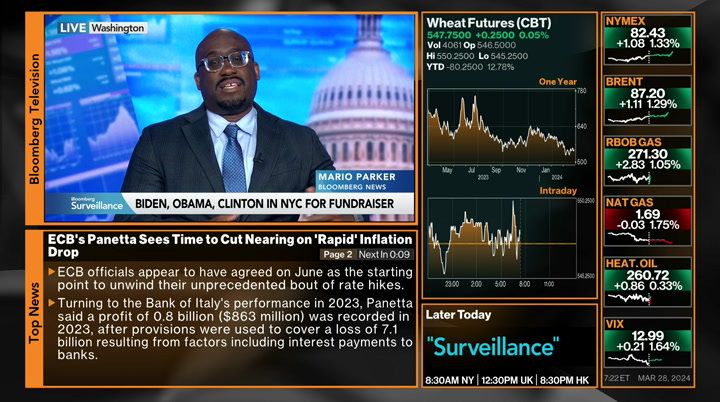

secretary yellen taking on china. >> china's overcapacity distorts global prices and production patterns and herds american firms -- hurts american firms and workers. we have reached overcapacity in previous discussions with china and i plan to make it a key issue in discussions during my next trip there. jonathan: janet yellen sending the alarm on industrial -- china's industrial push, putting it front and center of an expected visit in the future. china snapping back, going first in the last 24 hours with comments about the efficient reduction act. those comments are not unique. how much tension is there between the u.s., europe, and china on this front? mario: there is a lot of tension. the fact that you see janet yellen regularly on her visits

7:21 am

across the u.s. take aim at china and some of its economic disease. president biden has featured record about china -- frederick -- rhetoric about china and its unfair practices. tensions are high. it is very bipartisan in washington right now, even as acrimonious as the political -- annmarie: xi jinping met with business leaders and steve schwarzman said the feeling i got is they are very open to attracting foreign capital. is there any lane you can see but this upcoming trip that we could get something positive coming out of this relationship between washington and beijing? mario: one of the things janet

7:22 am

yellen has tried to do is tight rope. while we say she has had workers language towards china -- she has had more terse language towards china, she has also welcomed healthy competition, it wants a healthy environment with china. a fair and competitive environment with china, and not to decouple from china. that is any understanding of how dependent the global economic landscape is on china. the u.s. is trying to make sure it is measuring some of that rhetoric. annmarie: i would like to change topics into what is happening in new york today. president biden is coming flecked by obama and clinton. we have any of panetta. there is everything to be gained by biden standing next to clinton and obama. how difficult is this between going to be when the former president is in new york to attend the funeral of a police officer that died while on duty?

7:23 am

mario: it is a sad situation, first of all. it is politics. this is an election year. on the one hand we have joe biden showing he has coalesced to the democratic party. donald trump has pointed to this fundraiser bided come obama, and clinton are doing in new york. it shows it has got under the skin of the former president. with him visiting or attending that funeral, it does essentially bolster his bona f ide on criminal justice, crime, etc. it was also liability given about true or five years ago and he was in office, he authored the first step act that allowed for the people who have been arrested to get back on the streets.

7:24 am

this has been a political liability he is trying to cover up. lisa: when it comes to the campaign -- annmarie: when it comes to the campaign, can you give us a sense of how far these two are part? mario: they could not be further apart. president biden has about three times as much cash as president trump. this event today which is a star-studded event is going to raise 25 minute dollars according to the campaign. that is $25 million according to the campaign. that is more than double that president raised in february. he is cash strapped. three days ago, former president trump was in a new york court room asking for reduced bond because he could not afford it. this key adversary, president biden has an embarrassment of riches. jonathan: it seems quite obvious, does bill clinton still

7:25 am

help people raise money? does that actually help them? mario: bill clinton does still help with the party raise money -- help the party raise money. you have a few tears in be party. joe biden is the oldest of the three men. there is the obama coalition he formed in 2008 and carried in 2012. there are still clinton democrats out there, more centrist democrats who remember those years or look back on those years fondly when he was in office from the economic and policy point of view. you have three tiers of the democratic already represented between biden, obama, and clinton. you need all three for november. jonathan: mario parker on that big fundraising effort that you're on this evening in new york city -- fundraising effort later on in new york city. lisa: if they raise money, that

7:26 am

is the bottom line. jonathan: a controversial figure in years gone by. not exactly the person you called to raise money. annmarie: there were a lot of whispers about people saying biden should step aside with this photo today. he is pretty much saying i have coalesced everyone in the democratic party. they are all backing me to be president. lisa: everyone who came before. not necessarily how the party is changing now. jonathan: so well said. lisa: thanks. let's move on. jonathan: ceo of dhl supply chain oscar de bok to discuss on their front. s&p futures on the dish equity futures obvious to me -- equity futures on the s&p 500 unchanged. this is bloomberg. ♪

7:28 am

her uncle's unhappy. i'm sensing an underlying issue. it's t-mobile. it started when we tried to get him under a new plan. but they they unexpectedly unraveled their “price lock” guarantee. which has made him, a bit... unruly. you called yourself the “un-carrier”. you sing about “price lock” on those commercials. “the price lock, the price lock...” so, if you could change the price, change the name! it's not a lock, i know a lock. so how can we undo the damage? we could all unsubscribe and switch to xfinity. their connection is unreal. and we could all un-experience this whole session. okay, that's uncalled for.

7:30 am

jonathan: it is a sleepy start to thursday morning. good morning to you. equity futures unchanged on the s&p. on the nasdaq, too. it's a fifth you know the numbers, from the end of october, a move of 25%. quite a rally in the bond market. a very different story compared to the back end of last year. lease up, five basis points this

7:31 am

morning. lisa: are you not entertained? bonds have not necessarily done so well, a loss year to date in a total return level, but people have just moved on, saying that we enjoy the gains. jonathan: listen up, russell crowe. i have been entertained. [laughter] lisa: you sounded like you weren't. just saying, you know? another record high? jonathan: just a foreign-exchange. that's entertaining enough for you. 100 and 51.47, unchanged on -- 100 and 57 -- 151 this morning. unchanged. rate cuts, recent inflation data called disappointing by one of the fed governors, saying he wants to see more data before cutting. comments coming ahead of the preferred gauge and comments from chairman powell later that

7:32 am

day. "i like waller, but i like powell more, and he might be sharing it publicly now, but this leads me to believe that waller already made the case around the table, we know how the powell press conference went in the meeting, more weight." lisa: it doesn't change anything, he's a known hawk. to me that's the point. we can get the gut check tomorrow. if powell changed his tone, he's got nothing to say when everyone else's home. jonathan: big chance. coming in to join mike mckee and break down the data? lisa: i haven't got the call. don't call me. jonathan: you don't want that call. [laughter] shares of the iphone maker, at a record high as their ai service overshadows concerns of a sluggish recovery. gaining more than 50%, sales out of china, for the apple iphone,

7:33 am

and down double digits year today. starting the year with stocks rallying, i'm not sure you would have seen apple so down at the beginning of the year. lisa: it's been a downpour. there are regulatory concerns on both sides of the atlantic and concerns in china. how do you compete with huawei when it is a cheaper model? they are trying to wave the flag, we found it interesting. the company seemed to be about ai hype, but j.p. morgan said that their ai exposure remains 10% this year compared to 20% for competitors. it just seems to be the ai hype with apple. i was looking at their partners and instead of apple being exciting, it was hewlett-packard. they are the big order flow from on high. jonathan: stock is down 10% on apple today. talking about the difficulties,

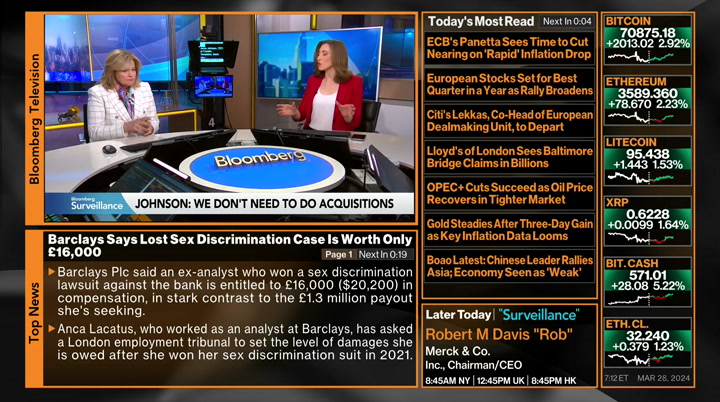

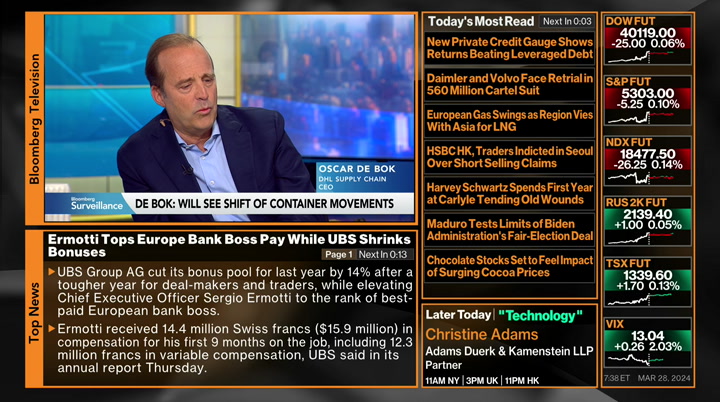

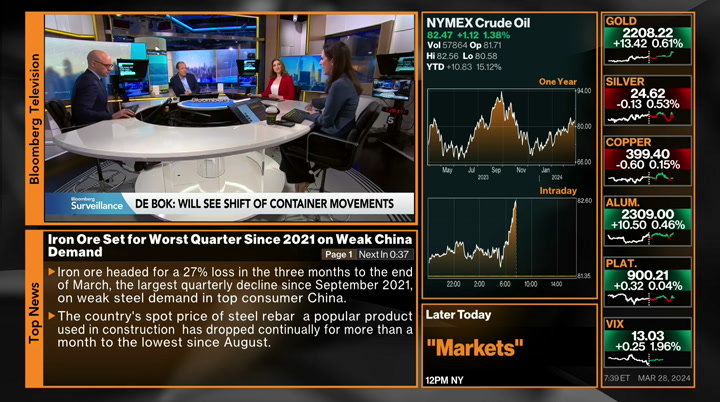

7:34 am

with international trade details are emerging on the scale of the rebuild after the collapse of the francis scott key in baltimore. could cause $2 billion, insurance facing claims of $3 billion for the cargo on the ship. according to analysts, one detail that is unknown is how long it will take to reopen the baltimore port and how it could affect supply chains on the eastern seaboard. joining us around the table for insight, the ceo of the dhl supply chain, oscar de bok. oscar: pleasure to be here. jonathan: how far down the supply chain are you expecting consequences for fallout this week? oscar: the main impact of this one is more in the automotive. less on the container part. of course, there is a container element in their. we have to manage that at the moment, but if you see one thing, and we discussed this earlier, if there is a common

7:35 am

theme in supply chain management , it's the ability to fast respond, the agility to fast changes into how supply chains organize. that is what you see here as well. a shift in container movements from these ports to other ports. the impact to the port itself is dramatic, the event itself is tragic, but the overall impact on the global supply chain and u.s. supply chain will not be as large as you would fear. jonathan: you mentioned you had containers on the ship. can you walk us through how those communications and conversations go? oscar: i've not been directly involved in that, but it is a few containers -- not compared to the number we have their -- but we have to make sure how to get them released and find alternative routes for them. make sure that the customers receive the products in there. alternative plans, alternative

7:36 am

products. keep the supply chain running. our last interview with bloomberg, there is always something around the corner with supply chains. you just never know what it is. i could not have guessed that we would be talking about this event. one of the main things that you see is our customers and ourselves, everyone working around supply chain and other parts with customers is now far more acute for having to respond to decision-making. making sure that you have the alternatives and find those alternative solutions for managing the supply chain. this is one of those events. lisa: raising the question of how much you have to create redundancies inherent in your supply chains and in your system in order to be flexible to handle, say, a two hour delay because you have to go a different route around baltimore

7:37 am

, disasters if traveling with kids, but you have to manage it time. oscar: in the past, more than four years ago, it was all about having the most efficient and cost-effective supply chain. what you now start to see is that it's far more about the resiliency of supply chains, to make sure that they are organized in such a way that you can respond to these things. they two hour delay could be dramatic. if you make sure to build the supply chain in such a way that you can respond to it, it really helps and that is something that you see happening at the moment. rather than say the minor costs being the main thing, it's making sure that the supply chain keeps running. many of our customers have realized that supply chain is about availability and making sure that you can continue to serve customers rather than having minimal levels of costs. lisa: does this make the just-in-time promise that so

7:38 am

many were trying to offer less of a desirability? or is it more the resiliency and the ability to be flexible? oscar: it's the exact availability of products becoming the priority over just in time. we have all learned that the costs of pressure on the supply chain because of an event is higher than having a lower or higher stock level. obviously, with today's interests, stock levels have become more relevant. the whole element of that analytics, converting it into ai comes in as well to make sure that the planned supply chain in real time is better and better on the use of data, historical data. a lot of it helped us to learn how to respond to things. lisa: secretary buttigieg talked about this yesterday, there is

7:39 am

no air traffic controller when it comes to the just six of shipping. how can technology change that to make it more transparent? oscar: with port control, there actually is traffic control. connection between the ports. in shipping, it's more advanced than it makes it seem. some of the elements that you can see in the event as well is having to be able to respond fast to avoid even more dramatic events because of good communication. but you are right, the use of data is fast evolving. one of the things that you see in general in the logistics sector is the amount of investments going into the sector compared to four years ago is exponentially more. meaning there is not -- meaning the innovation in the sector is exponentially more. you see that in data, with what

7:40 am

we can do with data and analytics. you see it in robotic solutions and other innovations. you see a fast involvement. internally i would say that if you look at the last four years, the speed of innovation in the logistics sector compared to the years before is mind-boggling. so, that is actually -- it helps us to further increase in improve, compared to the airline industry. lisa: when you look at the communication between the government, pete booted judge remaining chipper with supply partners, how has that been between the public and private? oscar: the collaboration between public and private, well if you take for instance the example between ports, which in some cases are private, in some cases a mix of both, there is a good direction, but if you look at the speed with which it involved on the business side -- for

7:41 am

instance, now the interactions with companies are far more on sea level then before, where it would have been to levels down. ceos and cfos see the importance of being close on what's happening with supply chains. it changes the profitability, the market share, the growth. gradually, governments need to make the same step to make sure and understand how important it is for the success of the economy to really be close to the infrastructure, not only for hardware but software. those investments need to come from there as well. jonathan: you talk about building resistance. -- resilience. things feel fragile in the more -- last few years. from your perspective does it feel more fragile since pandemic? oscar: the capability to respond to the unexpected has evolved enormous sleep.

7:42 am

the only problem is that the unexpected happens more than in the past. i think it has improved a lot. that is because a bigger investments, the view of necessity of having those capabilities. on the other hand, the number of events is evolving faster in the development of the sector. i must say, talking about dhl, the market in general, and our customers, the ability of responding to things has evolved enormously. lisa: does that mean that you can charge more and that shipping will costs more because building resilience is expensive? oscar: charging more and costing more are two different things. the professionalization of the sector has evolved, the value it brings has evolved. it might be that there is a higher price to pay, but the benefit might also be higher.

7:43 am

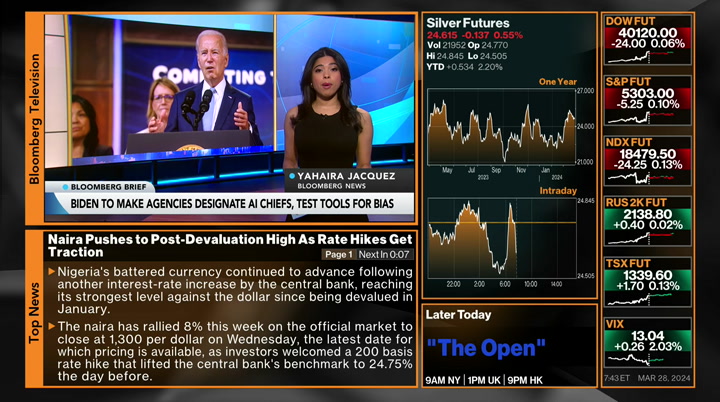

it might not mean higher costs because efficiency might be proof as well. jonathan: oscar de bok, good to see you. thank you for the update. equities are negative on the s&p . for an update on stories elsewhere this morning, here's yahaira. >> the ceo of the best european bank, bank boss, sergio ermotti received compensation for his first nine months in the role, brought back in april of last year to oversee the rescue of credit suisse. ubs had a record profit, largely driven by windfalls from the takeover. president biden is set to raise $25 million in a single day as he campaigns across new york city, raising money alongside barack obama and bill clinton at

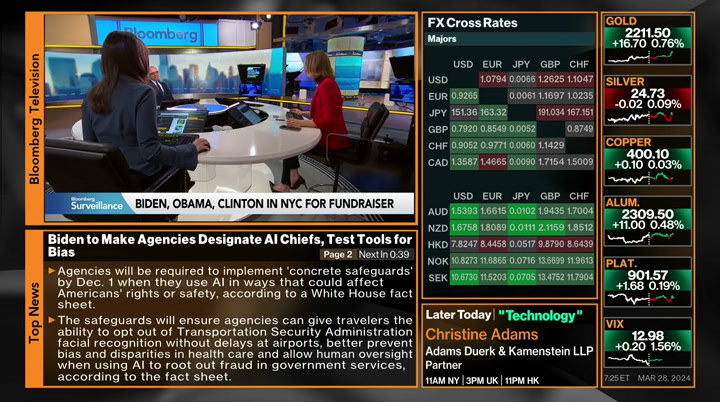

7:44 am

a radio city music hall event. the effort is designed to expand his already large cash lead over donald trump. showing up alongside former presidents giving him an institutional lacking that trump lacks because of estrangement the gop names. the white house will require federal agencies to test ai tools for potential risks and designate officials for oversight. the office of management and budget issuing a governmentwide policy pushing federal agencies to implement safeguards by the first. including protections against privacy violations, discrimination, and more, including giving travelers the ability to opt out of tsa facial recognition and allowing human oversight when using ai to root out fraud in government services. jonathan: up next on this program, governor waller with one message. >> there's no rush to cut

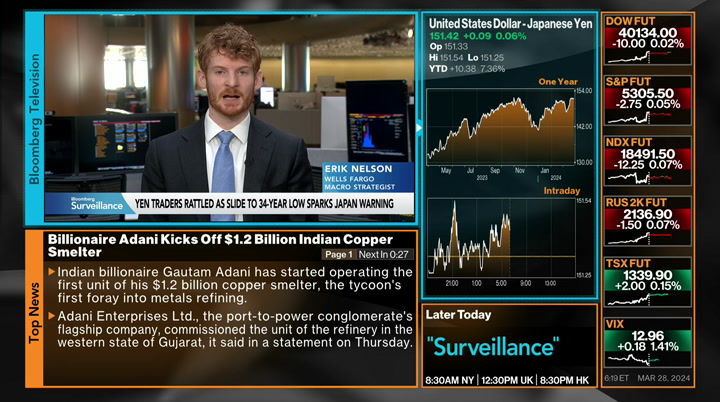

7:45 am

7:47 am

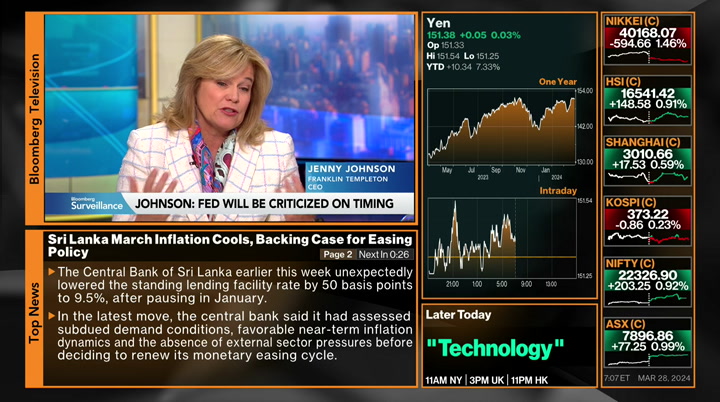

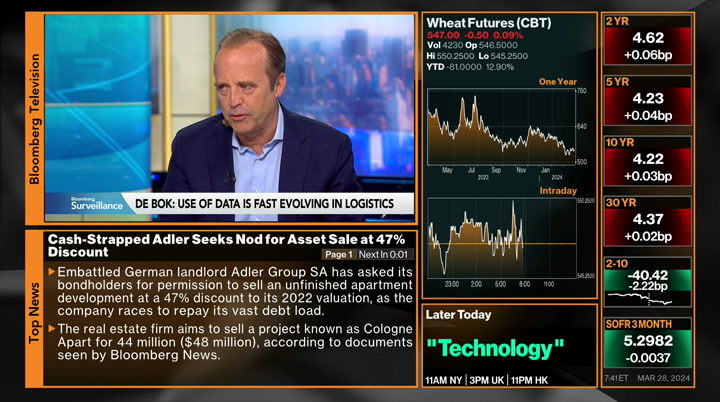

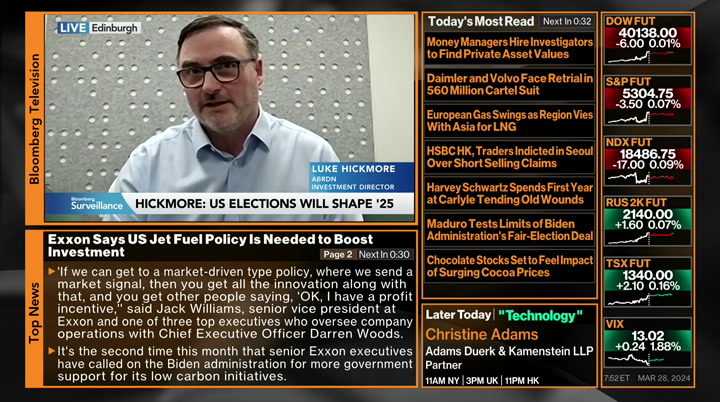

jonathan: slightly negative, lower, down by .1%, -- 0.1%. 10-year, 400 and 21. -- 4.21 80. under surveillance this morning, governor waller with one message. >> no rush to begin cutting interest rates. no rush to cut the policy rate. no rush in taking the step two easing monetary policy. in my view it's appropriate to reduce the overall number of

7:48 am

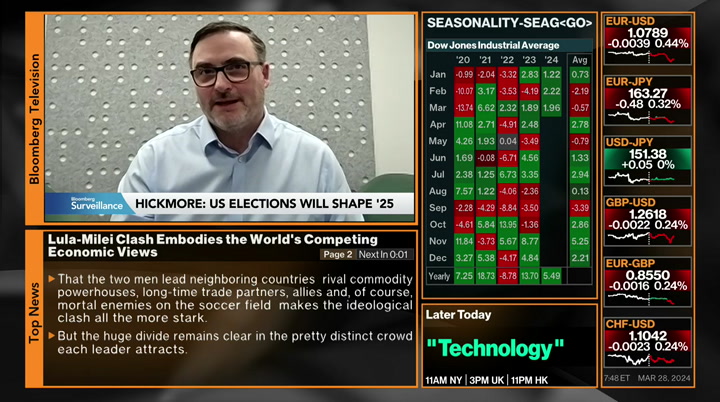

rate cuts or push them for further into the future in response to recent data. jonathan: traders are looking ahead to the core pce data tomorrow. comments from chair powell a few hours later. for clues on this, "waller is ignore and move up, more hawkish after the fed pivot. we are pensive in june and september, waiting for the lecture. then it depends on the politics. luke joins us for more. skipping to the end bit, good to catch up with you, wait for the politics -- what did you mean by that? luke: there is a lot going on at the end of the year, isn't there? the outcome of the u.s. election will shape the whole of 2025, plus the end of this year as well. if we get donald trump coming into the white house, it chases -- changes the outlook

7:49 am

significantly. it could lead to tariffs. it's a whole raft of negatives that his team has been talking about that couldn't -- could change inflation as well, regarding monetary policy. jonathan: can they change the outlook and policy thinking back? 2016, we knew that there would be a push for tax cuts in 2017. we knew that that was on the table. fed officials were asked about that all the time. they couldn't change the outlook. can they act ahead of time? luke: this is why i think we get the cuts before the election. the 27th is the review point, where they think run. what's he going to do in his first hundred days? what's the outcome going to be? we are going into this with a 6.5% sequel ready. markets are going to be very,

7:50 am

very curious about what happens with that. the fed, let's be honest, december afterwards, it's hard to say it's a free outlook for this year. lisa: how close are we to proposals with whichever candidate wins that has to deal with more tariffs, fewer taxes, more protectionism more broadly? how much does that lead to a bigger disruption than some people are understanding in terms of inflation expectation and a potential fed response? luke: these are absolutely the key points. is there a real risk of a trust moment? possibly. just have to remember that this is the world's reserve currency. biggest deadline in every single shape and form. biggest economy in the world.

7:51 am

all of that mitigates the risk, but it doesn't mean the market is going to blindly fund the federal government. into a 7, 7 .5, 8.5 fiscal deficit. but in time they will let them come out and say that this is what we are going to do. clearly we've been hearing a lot of news about a better team behind donald trump in terms of getting the message straight and clear. i think we will probably avoid it, but the risks have got to be right as we get closer and closer. lisa: we have been talking a lot about politics, but everyone we talked to says it's too early to make a bet around it just yet. is there some concern about this outcome into why the dollar isn't stronger in terms of the divergence of economic data? luke: it absolutely has to be. for the last six months that

7:52 am

would be a natural point for a weaker dollar where we've seen the dollar strengthening up this year quite a lot. so yeah, it's not yet playing out as much in terms of currencies, but perhaps you are starting to see some of it cut through. i think separating it from risk assets remains difficult. lisa: picking up the point that you said, they need to wait to see the policies of the election , but they will be cutting twice before. do you think they need to wait to see the policies, or are they waiting because they don't want to look what occult and in that sense it makes them look a little and not eta dependent? luke: the entire debate on how political the fed is is a little bit beyond me, but i think for me pure fiscal monetary perspective, tight fiscal

7:53 am

conditions are likely to be going into the summer and i think they need to cut before they risk staying high for too long and actually hurting what has been a remarkably active economy in a soft landing environment like we are in. jay powell made it clear in his recent speeches, it's why we are leaning on june for the first rate cut problem. the september 1 is possibly things being weaker with inflation coming down a long way. deploying the markets next week, there are early signs of weakness there. that could lean on the september cut as well. it's tight to get three in, but why would you not wait? jonathan: getting that super summer. looking at the comment we got this week from andrew boyce, talking about where to take duration risk, beyond the united states in terms of treasuries,

7:54 am

he was more convinced by the broader supply risk as well in the united states. are those views that you share? luke: he's been doing german government bonds for the last five months. the sticky inflation is getting a challenge over the next few months. we could hit 1.5% inflation before the bank cuts rates in june. probably around the five-year area with a five year investment on the bond markets in the last year and a half, that's my sweet spot. jonathan: luke, wonderful to hear from you. it's been too long, mate. luke hickmore, didn't get to japan, so let me turn to these comments. we talk about the priorities in japan and what we have said over

7:55 am

the last couple of days is the policy priority is not the currency. it's a much bigger picture, a multi-decade effort to set expectations higher and they don't want to undo it anytime soon. the japanese prime minister moments ago, "we have a historic chance to beat deflation." that's the priority. lisa: and that's the reason people are not buying but this is a japanese authority that materially wants to support the yen, because right now they will tolerate that in order to defeat decades of deflation. that's the reason why their message is falling on deaf ears. jonathan: yesterday, the yen fell really close to 152. prompting aggressive intervention. getting the policy to follow through in an aggressive fashion towards 100. rate hikes, absent something happening on the others of the currency pair, which is why we have wells fargo with us this

7:56 am

morning, dollar-yen could come back down, but it depends on what happens with the u.s. dollar. lisa: and that's the reason why people are willing to push back. people had understood the conviction behind. here, people don't believe the conviction because of comments like we just heard from the japanese prime minister. jonathan: historic chance to beat deflation? in the next hour we will catch up with david, our guest from pimco, and robert davis at merck. mark, quite a year so far in the stock market. lisa: they just came out with a drug that has to deal with an esoteric blood sickness. also want to hear about their other developments. jonathan: a different focus. lisa: yes, how do you get into this world that has already been established in a unique way that has financial benefits? jonathan: that conversation, about one hour away. this is delivered.

7:57 am

♪ okay y'all we got ten orders coming in... big orders! starting a business is never easy, but starting it eight months pregnant... that's a different story. i couldn't slow down. we were starting a business from the ground up. people were showing up left and right. and so did our business needs the chase ink card made it easy. when you go for something big like this, your kids see that. and they believe they can do the same. earn unlimited 1.5% cash back on every purchase with the chase ink business unlimited card. make more of what's yours. is personalized based on your goals, whatever they may be. all that planning has paid off. looks like you can make this work.

7:58 am